SimonSkafar

As investors are increasingly worried about the broader economic outlook in 2023, markets with acyclical or counter-cyclical characteristics are more in favor. Agriculture and construction would be candidates to consider as part of that theme, and the shares of Deere (DE), Lindsay (NYSE:LNN), and Valmont (VMI) have been rather strong over the past year at a time when industrials as a group have lost about 15% of their value.

Higher rates are a risk, but farmer incomes and budgets are strong here of late, and irrigation equipment doesn’t seem to have the same bottlenecks that other agriculture equipment has. Moreover, Lindsay offers good leverage to increasing activity on the road construction/repair side – a trend that should be countercyclical for a couple of years. At the same time, though, I do have concerns about Lindsay’s weak historical FCF generation and lack of sustainable margin leverage. I do like the macro backdrop here, but I’d view this more as a trade than a core holding given valuation concerns.

A Good Close To The Fiscal Year

Lindsay leveraged strong demand trends and improving supply chain conditions to produce a strong end to the 2022 fiscal year.

Revenue rose 24% as reported, good for a 6% beat relative to sell-side expectations. Although International Irrigation sales declined 2% on the impact of forex (around 5%) and a tougher year-ago comp on a large order, North American sales rose 50%, driving overall Irrigation up 20%. Infrastructure sales were up 40% on improving state/municipal infrastructure activity (roadbuilding and so on).

Gross margin improved almost eight points from the year-ago level to 30%, and some of the supply/input cost pressures do seem to be easing for the company. Operating income rose almost 200%, with margin up 850bp to 14.6% while segment income grew 118% and margin improved more than eight points to 18.8%. By segment, Irrigation profits rose 129% (margin up 770bp to 16.1%) while Infrastructure profits rose almost 100% (margin up 830bp to 28.8%).

Backlog did decline 35% year over year, with Irrigation down and Infrastructure up (no other details were offered), and the year-ago irrigation order from Egypt could explain at least some of that given the size of the order ($17M) relative to the size of the company’s overall backlog (a bit under $100M).

Trends: Good

Look at FY’23 and beyond, there are certainly some positives working in Lindsay’s favor.

Soy futures prices are about 10% above year-ago levels now while corn prices are about 19% higher. A recent USDA World Ag Supply & Demand Estimates (WASDE) report showed lower stocks-to-use estimates for both corn (8.3% versus 9.2% last year) and soybeans (4.5% versus 6.1% last year), and I would describe the overall environment for corn and soybeans as still quite favorable for U.S. farmers. The USDA has also estimated that net farm income should be up about 5% this year, reaching the highest level in over a decade.

On top of that, many growing regions continue to see drought conditions (sometimes severe), making dryland farming even more challenging. The center pivot-style irrigation that Lindsay specializes in is still underpenetrated around the world, as is irrigation in general. Given the need to feed more people using less land and less inputs (water, chemicals, etc.), I don’t see many good arguments against the broader adoption of mechanical irrigation in the years to come, as well as the increased use of smart/precision systems (like Lindsay’s FieldNET system) to maximize yields and minimize water waste.

Lindsay is also leveraged to positive trends in its Infrastructure business. The Infrastructure Investment and Jobs Act (or IIJA) will help rejuvenate road and bridge projects across the U.S., and Lindsay should benefit from the sale of various barrier, safety, and marking products. I also see good demand trends for the company’s Road Zipper moveable barrier system, as more municipalities look to improve traffic flows on roads where expansion/widening isn’t a viable option. Last and not least, there’s an IoT/labor angle here as well, with the company’s Road Connect product line offering remote roadside monitoring to help automate maintenance and repair tasks.

Last and less quantifiable, Lindsay is leveraged to positive sentiment trends. Water is a perpetually popular theme with investors, and while that doesn’t mean that water infrastructure stocks are perpetually immune to financial performance or valuation concerns, the fact remains it’s a popular theme. Likewise, I do believe that agriculture and road/infrastructure-based construction are markets that could outperform the broader industrial space over the next 6-24 months, giving Lindsay some counter-cyclical appeal.

Trends: Bad

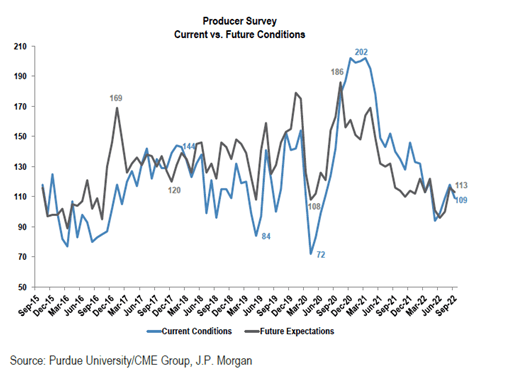

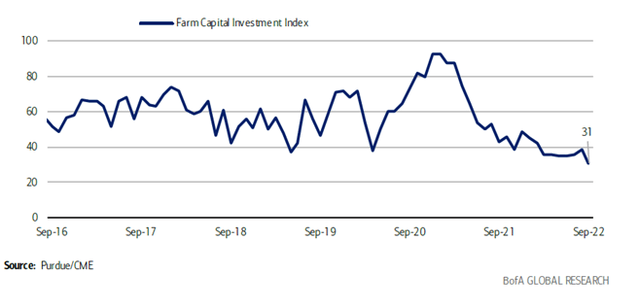

Although ag incomes and farmer balance sheets are in better shape than they’ve been in some time, that’s not translating into strong sentiment. The most recent Purdue-CME Group Ag Economy Barometer report showed a year-over-year decline in September (112 versus 124 last year), with the Capital Investment Index at a record low (31) as farmers are increasingly concerned about higher machinery costs and higher interest rates.

JPMorgan Bank of America Research

I also have concerns about the underlying financials here. While this is not an apples-to-apples comparison, Lindsay hasn’t closed the gap on Valmont in irrigation in any meaningful way over the last decade as far as market share goes. I’d also note that Lindsay’s trailing revenue growth rate is not that impressive – about 1% over the last decade after robust growth from 2002 to 2012 (mid-teens) – and the long-term average FCF margin is only around 4%. Likewise, operating margin and EBITDA margin have been choppy for a long time, with no real sustained upward trend.

Last and not least is valuation. Relative to discounted free cash flow and margin/return-driven EV/EBITDA, I don’t see Lindsay shares as cheap. It’s well worth noting that valuation does not stand in the way of share price performance in the short term, but I’ve seen too many theme stocks/sub-sectors melt down over the years to be entirely comfortable with a “ignore the valuation and just buy it” philosophy, even with stocks that are buoyed by attractive macro trends (like increased pressure on water supplies/utilization).

The Outlook

I do think that increased awareness of the importance of irrigation in improving farming yields, as well as the benefits of precision agriculture, can drive growth in the Irrigation business while the Infrastructure business leverages some nearer-term momentum in infrastructure spending. Longer term, I believe increased digitalization of agriculture (including FieldNET) can support better margins, as can increased sales/market penetration of the higher-margin Road Zipper systems.

Still, I think long-term revenue growth in excess of the mid-single digits (compound annualized) is a stretch, and I likewise think it’s hard to make a case for FCF margins exceeding the mid-to-high single digits on a sustained basis. That supports double-digit annualized FCF growth, but the share price already anticipates that. Likewise, today’s forward EV/EBITDA multiple (around 14x on my FY’23 estimate) already more than rewards the company for its likely margins, ROIC, and ROA in the coming years.

The Bottom Line

I don’t really like the valuation here, but I do think investors will be looking for names that can outperform against a backdrop of weakening PMI and weaker broad industrial performance. Agriculture and infrastructure construction are two markets that I think can buck the trend, and Lindsay is leveraged to both. Accordingly, I can understand the appeal of these shares as a theme/sentiment trade, but given what I see as an elevated valuation, it’s not a stock I’m in a rush to own.

Be the first to comment