Chip Somodevilla

In an interesting move, Intel (NASDAQ:INTC) lined up some funding for new chip plants in Arizona. The move helps the free cash flow at the chip giant, but the funding comes at a cost. My investment thesis remains Bearish on Intel as the company focuses too much on maintaining the dividend, not solving the basic chip design and manufacturing issues.

Smart Capital

Intel keeps mentioning the use of “smart capital” in order to fund new chip plants. The company describes this as capital plans to increase the flexibility on this business and help efficiently accelerate and scale its manufacturing build-outs.

Mainly, the smart capital plan is another way of saying taking advantage of government incentives in the U.S. and Europe to build domestic manufacturing plants. In addition, the plan now includes investment partners in fabs along with the potential for future customer commitments via advance payments for IFS and the use of external foundries.

In general, a management team would be dumb to not utilize government incentives and other parts of the plan to improve the financial position of a company. In such regards, the chip company signed an agreement with Brookfield Infrastructure Partners (BIP) for a Semiconductor Co-Investment Program (SCIP).

Intel is funding 51% of the $30 billion expansion at the Ocotillo campus in Arizona while Brookfield is funding 49% of the total project cost. The transaction is still subject to close by the end of 2022 and Brookfield can decide to terminate the deal for a $250 million fee. Intel had originally announced a deal to spend $20 billion on two new Arizona fabs back in March 2021.

While Intel maintains majority ownership and operating control, the money from Brookfield isn’t free. The chip company didn’t provide a lot of details on the funding costs via an investor call other than suggesting the cost was more than the cost of debt at 4.4%, but lower than the cost of equity at 8.5%. The management team was unwilling to state the exact terms of the deal, but hinted that Brookfield will obtain a portion of the cash flows from the business based on an established rate of return, not 49% of the profits.

Intel primarily lists the benefit from the deal as the following:

- Adjusted FCF boost of $15 billion.

- Accretive to EPS during construction and ramp phase.

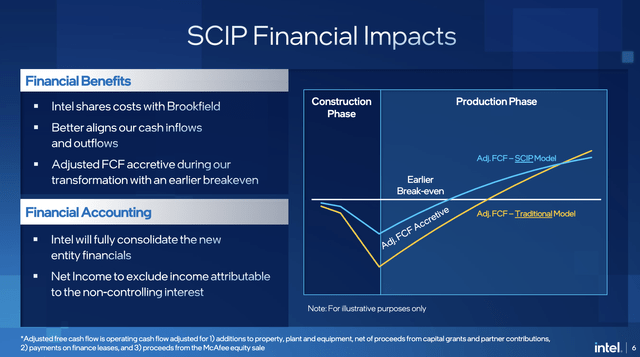

In essence, Intel saves $15 billion in upfront construction costs and apparently splits the losses with Brookfield in the initial ramp phase. The catch is that Intel apparently has to share the profits with Brookfield during the productive phase. The following slide from the SCIP presentation highlights how Intel will generate less free cash flow during the production phase of the fab.

Source: Intel SCIP presentation

The deal allows the chip giant to build more plants, but Intel has to pay Brookfield a return which at 6% amounts to $900 million. Note, too much of a guaranteed return for the investment program could lead to Brookfield obtaining the vast majority of the profits in a scenario where Intel fails to catchup with TSMC and the IFS business doesn’t gain momentum.

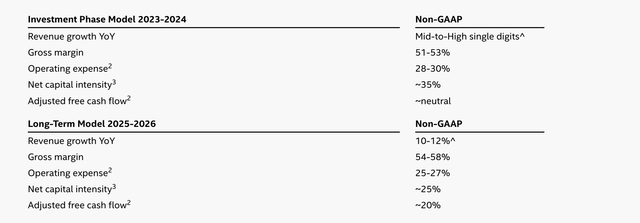

Back at the 2022 Investor Meeting, Intel had provided the below financial targets through 2026. The company has already slashed revenue targets in the near term, but this SCIP should help with the adjusted free cash flows in the short term while the long-term model will see a cut to cash flow margins with the payments to SCIP partners.

Source: Intel ’22 Investor Meeting

The best part of the deal is that Intel can compete better with TSMC on foundry scale and better have capacity for the IFS plan, but the company has to pay a high cost.

Saving The Dividend

The odd part of the announcement is that Intel suggests making this SCIP in order to save the dividend and hike it in future years. In essence, the chip giant is cutting future earnings potential in order to keep paying and hiking the existing dividends.

Nothing with the announcement suggests Intel is using the SCIP to match the investments of TSMC (TSM) in chip manufacturing capacity, Intel is just using the money to free up cash flow for the dividend.

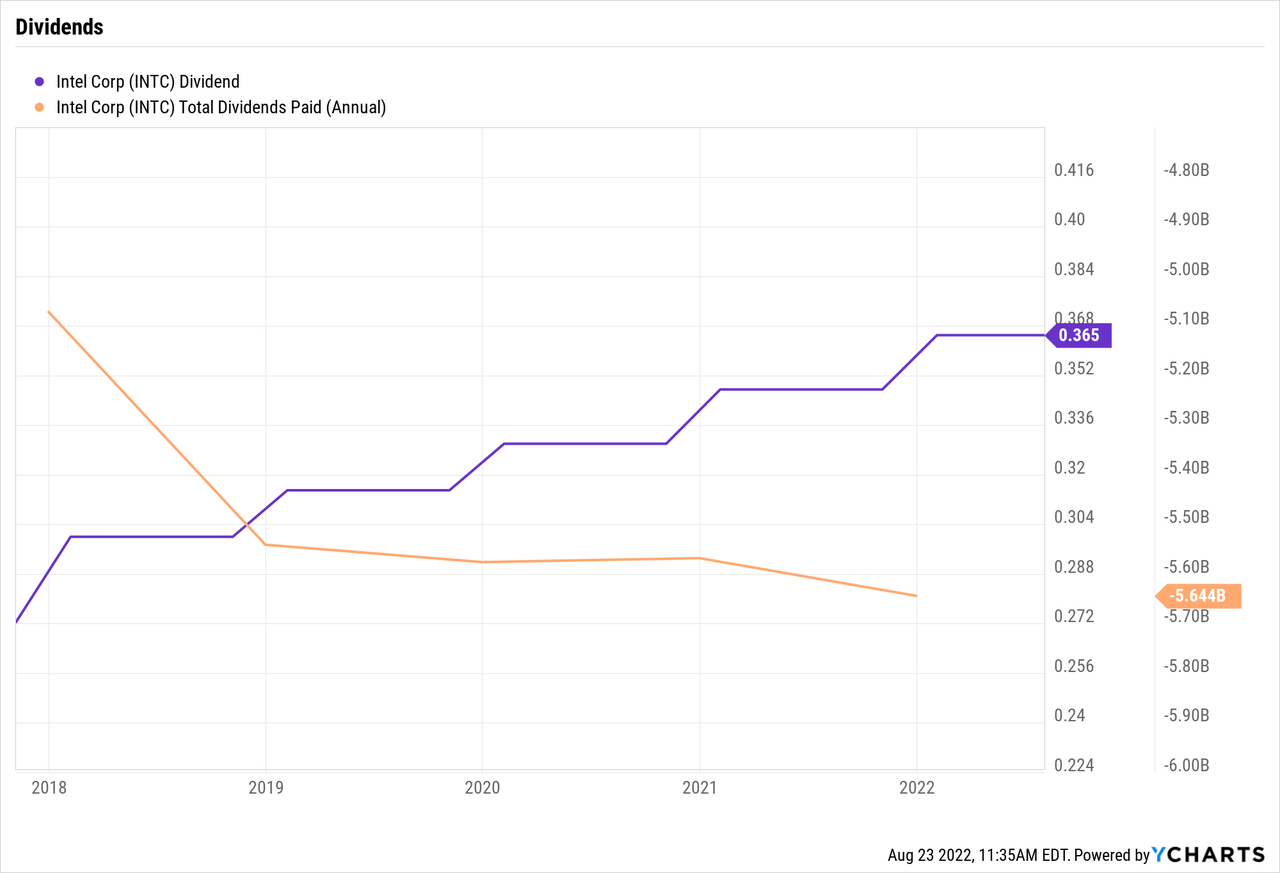

The company has slowly increased the dividend over the last few years with the quarterly payout now $0.365. Intel has a cash dividend payout of $1.5 billion quarterly with an annual cost of $6.0 billion on the $1.46 per share yearly dividend.

Intel will spend at least $12 billion on dividends by the time these two Arizona fabs come on line in 2024. Without the dividend payouts, the chip company wouldn’t need to undertake a co-investment partner to help fund chip foundries and share the profits.

Clearly, Intel investors like the dividend, but the company shouldn’t be trying to pay two masters. Either invest in the future, or send current profits to shareholders. A company trying to serve both masters makes no one happy.

Takeaway

The key investor takeaway is that the SCIP definitely helps Intel build all of the new fabs without the initial cash crunch. Ultimately, the devil will be in the details of the financial terms of the agreement. The chip giant will now have the cash to cover the dividend for the next few years, but the competitive position of Intel isn’t altered by an investment partnership. The company is now maintaining the dividend at the cost of additional profits.

Investors need to continue avoiding Intel until the company actually turns around the business and building new fabs doesn’t necessarily turnaround the business.

Be the first to comment