MoMo Productions

The Invesco Senior Loan ETF (NYSEARCA:BKLN) is an index ETF investing in senior secured variable rate loans from non-investment grade corporations. BKLN’s holdings are almost all variable rate loans, which see higher interest rate payments and stable asset prices when rates rise. As such, BKLN tends to outperform other bond indexes when rates are rising, as has been the case YTD.

BKLN is a reasonable investment opportunity, especially in a rising rates environment, but there are several similar CEFs with higher yields, discounts, and overall value propositions. These include the BlackRock Floating Rate Income Strategies Fund (FRA) and the Invesco Senior Income Trust (VVR). In my opinion, and under current market conditions, these CEFs are stronger investment opportunities compared to BKLN. As such, I would not be investing in BKLN at the present time.

Variable Rate Bonds versus Fixed-Rate Bonds – Analysis and Comparison

BKLN invests in variable rate bonds, while most bond funds invest in fixed-rate bonds. There are significant differences between these two sub-asset classes, differences which are material to the fund’s performance, characteristics, and investment thesis. As such, let’s start with a quick comparison between these, before taking a look at the fund itself.

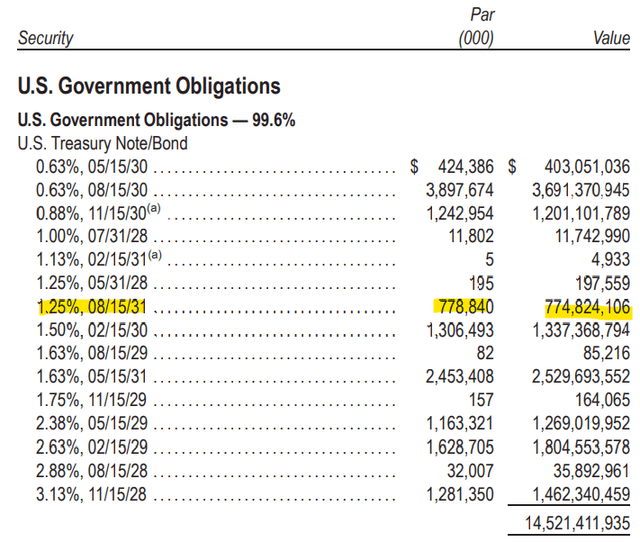

Fixed-rate bonds pay a fixed interest rate payment throughout their tenure. Market conditions may change, but the interest rate on the bonds remains the same. Most bond funds focus on fixed-rate bonds, as these tend to be the most common type of bond. As an example, the iShares 7-10 Year Treasury Bond ETF (IEF), the largest, most well-known treasury index ETF, exclusively invests in fixed-rate bonds / treasuries. Let’s have a quick look at one of the fund’s underlying bonds. The data below is for 3Q2021.

BKLN 2021 Annual Report

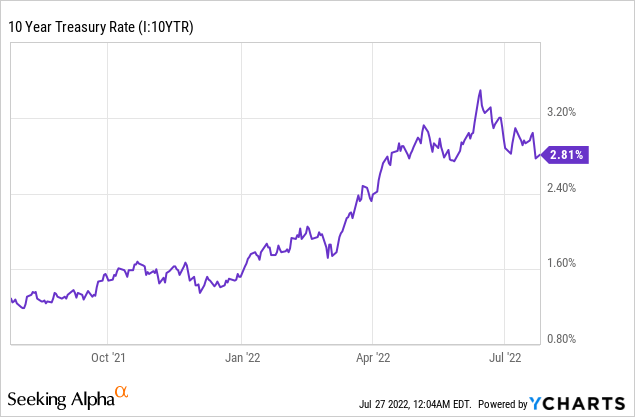

The marked bond above can be described as follows. IEF loaned $778,840,000 to the government at a 1.25% interest rate with a maturity date of 8/15/31. IEF’s bond will be repaid in full at maturity but, if the need arises, the fund could sell said bond in the open market whenever it wants. The market price of said bond could materially differ from the original investment, depending on economic and industry conditions. Conditions have materially changed since, as higher inflation rates and tighter monetary policy have led to increased interest rates across the boards. 10Y treasury rates, the benchmark treasury rate, and the closest analogue to this specific bond, have jumped from 1.25% to 2.80% these past few months.

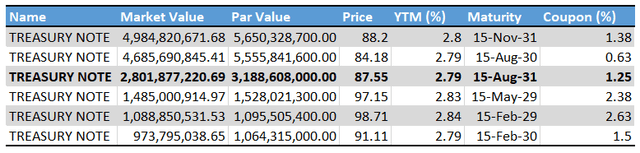

Importantly, the above is only for newly-issued treasuries. Older treasuries maintain their lower interest rates, including IEF’s 1.25% treasury bond. As should be obvious, investor demand for a 1.25% old treasury bond is going to be quite low when there are newer issues yielding more than twice as much. Low investor demand directly leads to lower prices, with this specific bond’s price declining by about 12%. The following table is for 3Q2022, interest rates have slightly decreased since, but not materially so.

BKLN Corporate Website – Chart by author

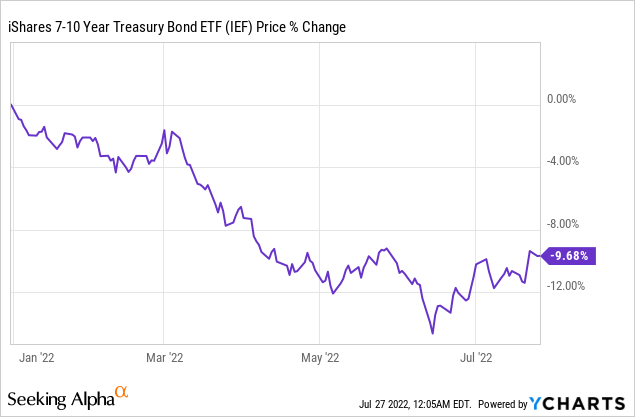

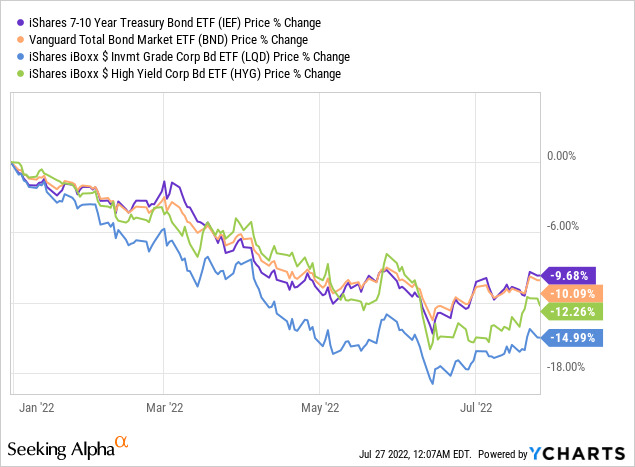

Lower bond prices mean capital losses for IEF and its shareholders, with the fund’s price declining by 9.7% YTD.

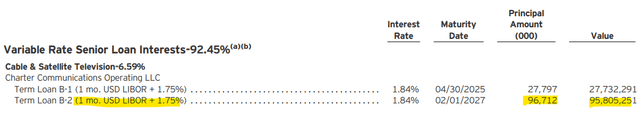

BKLN’s underlying holdings work somewhat differently from the above. BKLN focuses on senior secured loans which, due to market convention, overwhelmingly have variable rates. When market conditions change, the interest rate of these bonds changes too, which helps stabilize their price when market conditions are turbulent. As an example, let’s have a look at BKLN’s largest holding. Table below is for 3Q2021.

BKLN Annual Report 2021

The marked bond above can be described as follows. BKLN loaned $96,712,000 to Charter Communications (CHTR) at a rate of 1.75% plus 1M Libor, with a maturity date of 02/01/2027. 1M Libor is a benchmark interest rate which closely tracks the Federal Funds Rate, the interest rate set by the Federal Reserve. Federal Funds Rates were at close to 0% last year, 1M Libor was at 0.09%, so the bond yielded 1.84%.

With extremely few exceptions, if the Federal Reserve hikes rates by X%, 1M Libor goes up by X%. 1M Libor has gone up these past twelve months, closely tracking Federal Reserve hikes, as expected.

Bankrate.com

BKLN’s bond is tied to Libor, which is tied to the Federal Reserve rates, so as rates increase so does the interest rate paid by said bond. As per management data, said bond now pays an interest rate of 3.42%, an increase from one year ago, as expected. Higher interest rates help stabilize bond demand and prices. Prices for this specific bond have remained relatively stable, as expected. There have been some losses, mostly because it takes time for Federal Reserve hikes to reverberate across bond markets, and because the Fed has been slow to hike this cycle.

BKLN is a broad-based, diversified, senior secured / variable rate loan index ETF. The vast majority of its holdings have similar characteristics to the bond above, with all the benefits that entail.

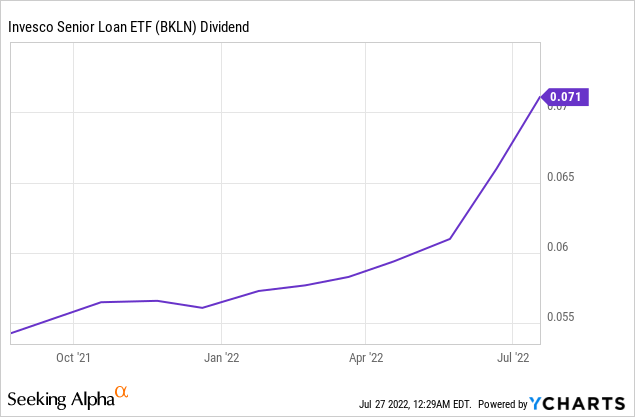

As BKLN’s holdings have variable rates, these increase when interest rates are rising, as they currently are. Higher interest rates means higher income for the fund, and higher dividends for shareholders, a significant benefit for the same. As shown in the example above, BKLN’s bonds have seen their interest rates increase these past few months, as expected.

On a more negative note, it takes a while for higher bond interest rate payments to translate into higher dividend payments. BKLN’s dividends have increased from $0.0541 to $0.0660 in the past twelve months, for a 22% increase. Dividends have increased, but interest rate hikes have been significantly greater than this. Due to this, the fund yields a relatively low 3.3%. On a more positive note, this means that dividends should continue to increase in the coming months, benefitting investors.

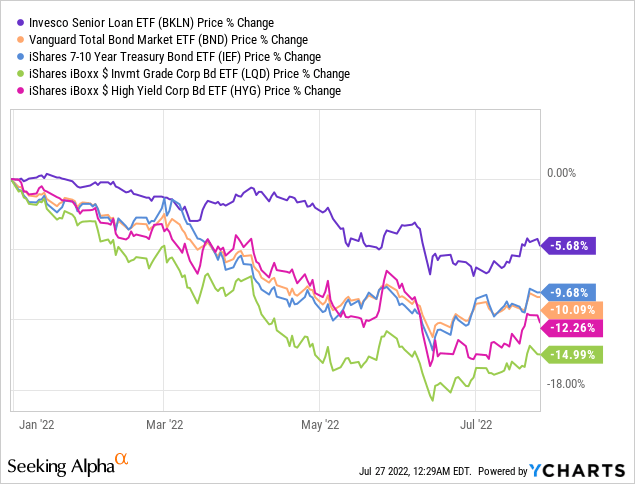

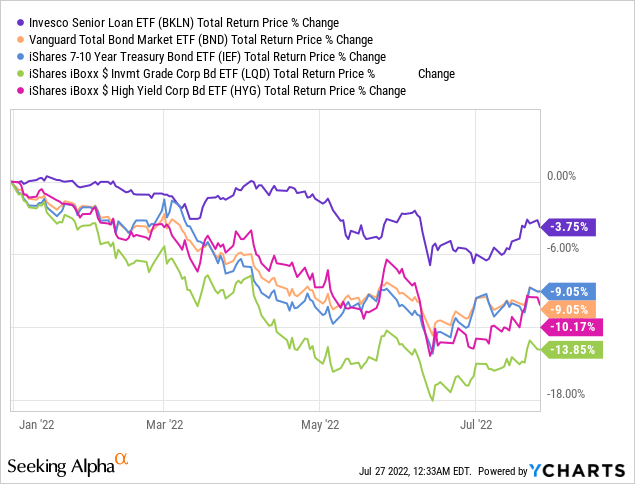

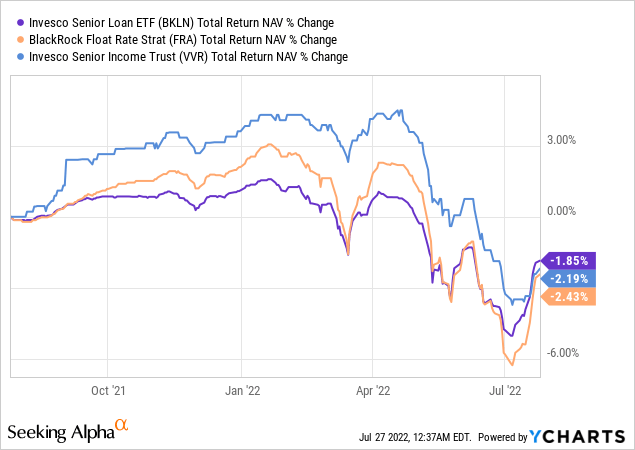

BKLN sees higher income and more stable share prices when interest rates rise, so the fund should outperform its peers when this happens. This has been the case YTD, as expected.

BKLN outperforms when interest rates are rising, as they currently are. The fund’s investment thesis is simple, clear, and strong, in my opinion at least. Although there is nothing inherently wrong with the fund, there are several stronger choices out there. Let’s have a look.

Quick Peer Comparison

BKLN is the largest, most popular senior loan ETF in the market today, but it has many peers. There are several ETFs with similar holdings and characteristics, including the SPDR Blackstone Senior Loan ETF (SRLN) and the First Trust Senior Loan Fund (FTSL). There are also several senior loan CEFs, including FRA and VVR.

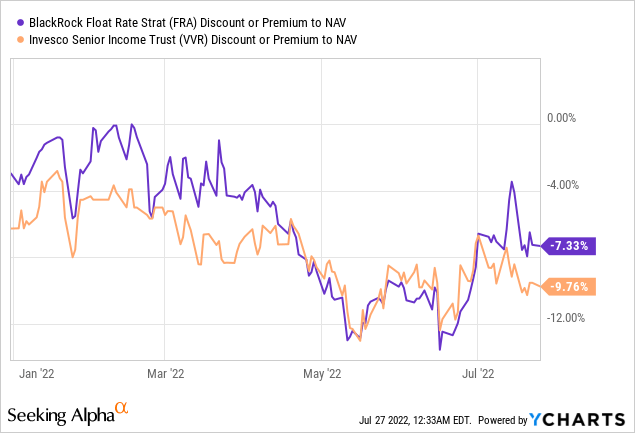

CEFs in particular are looking extremely attractive under current market conditions. Recent losses and weakening economic fundamentals have caused CEF discounts to widen, with these three CEFs trading with large double-digit discounts to NAV.

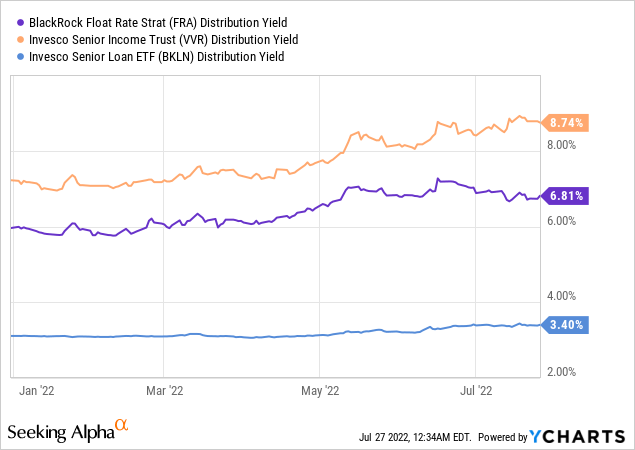

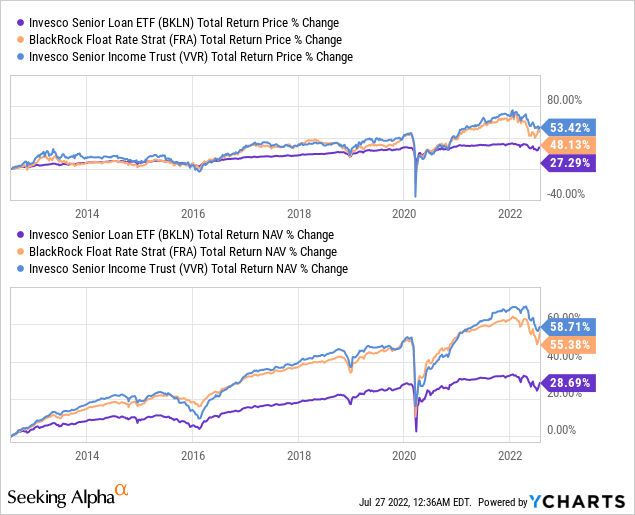

Higher distribution yields mean stronger long-term total shareholder returns, on both a NAV and price basis.

FRA and VVR have higher distribution yields, total shareholder returns, and discounts to NAV, relative to BKLN. Under these conditions, I see no reason to invest in BKLN over these two CEFs.

Conclusion

BKLN is an index ETF investing in senior secured variable rate loans from non-investment grade corporations. BKLN outperforms during a rising rates environment, making the fund a reasonable investment opportunity under current market conditions. Although there is nothing inherently wrong with the fund, there are several similar CEFs with higher yields, discounts, and overall value propositions. As such, I would not be investing in BKLN at the present time.

Be the first to comment