Sundry Photography/iStock Editorial via Getty Images

Thesis

We updated in our post-earnings article on Micron Technology, Inc. (NASDAQ:MU) that it was too early to turn bullish, even though we are not bearish. In addition, we are pleased to update investors that we observed MU has likely staged its medium-term bottom in July, despite its recent guidance revision.

Our analysis suggests that Micron’s estimates and valuation have likely been de-risked sufficiently for us to turn more positive. Even though Micron would continue to face the memory downturn through FQ1’23, the company’s long-term prospects remain intact. Coupled with the forward-discounting mechanism of the market, we are confident that MU’s July lows should hold robustly.

Therefore, we revise our rating on MU from Hold to Buy and urge investors to use the recent pullback to add more to their positions.

Micron’s Revised Guidance De-risked Its Valuation

Micron revised its guidance in early August, as the company observed a broad weakening of growth across most of its critical revenue segments, impacting auto, industrial, and data center (including cloud). Therefore, the company revised its guidance markedly downward and even guided toward negative free cash flow (FCF) for FQ1’23 (quarter ending November 2022).

However, the market’s reaction was surprisingly positive, as MU rode on the strong buying momentum seen in semi stocks in early August. Therefore, we are increasingly confident that its July lows should be supported resiliently, positioning MU well for a medium-term re-rating.

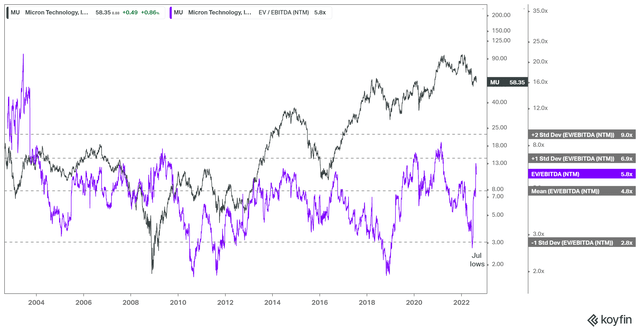

MU EV/NTM EBITDA valuation trend (koyfin)

As seen above, MU’s July lows corresponded to the one standard deviation zone below the 20Y mean of its NTM EBITDA multiples. Therefore, we are confident that the robust support seen in July is constructive for a sustained bottom for MU. Notwithstanding, the revised consensus estimates (bullish) on Micron’s adjusted EBITDA led to a surge in its NTM EBITDA multiples, as seen above. However, we urge investors not to be unduly concerned, as Micron should lap those weak quarters over time.

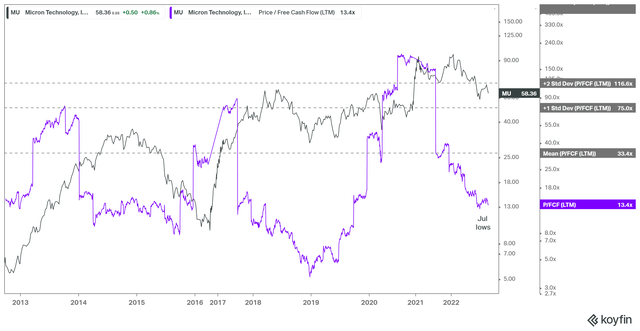

MU TTM FCF multiples valuation trend (koyfin)

Furthermore, our analysis of MU’s TTM FCF multiples suggests that it has moderated significantly. It last traded at a TTM FCF multiple of 13.4x, well below its 20Y mean of 33.4x. Therefore, we postulate that Micron’s price action has sufficiently de-risked the weakness that the company expects over the next few quarters.

Micron’s Operating Performance Should Recover From FQ3’23

Micron didn’t quantity the duration of the headwinds that it expected at a recent August conference. However, the company highlighted that FY22’s bit demand growth should come in well below its long-term trend, as CFO Mark Murphy articulated:

If we step back to the industry with this market backdrop, we now see calendar year ’22 bit demand growth to be below the long-term trend. We believe DRAM will be mid to high single digits growth. We believe NAND will be low- to mid-teens growth. That’s contrasting what we view as the long-term demand, DRAM, mid to high teens, and NAND about 28%. So substantially down off the long-term trend. (KeyBanc Capital Markets 23rd Annual Technology Leadership Forum)

However, we urge investors not to be unduly concerned. Instead, for cyclical semi plays like MU, investors should get excited when their operating profile is well below trend. Moving forward, as the semi downturn subsides, Micron’s operating performance should also normalize, helping lift its revenue and margins profile consequently.

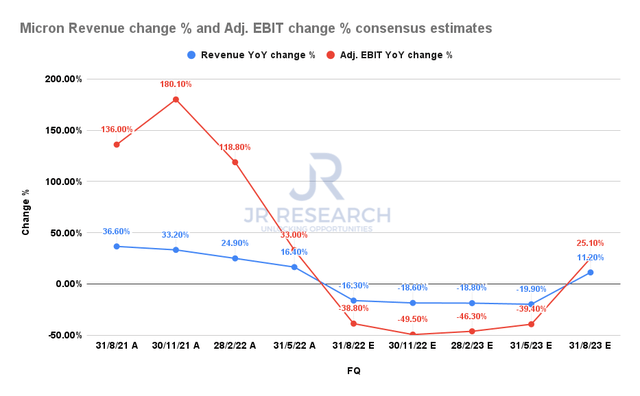

Micron revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (bullish) suggest that Micron’s malaise should bottom out by FQ2’23 before recovering markedly through FQ4’23. It’s also consistent with management’s confidence that its near-term headwinds are transitory. Furthermore, despite the semi downturn, the company is still building up its leading nodes inventory and investing. Therefore, we are confident that the company’s margins profile should normalize after this digestion period.

Is MU Stock A Buy, Sell, Or Hold?

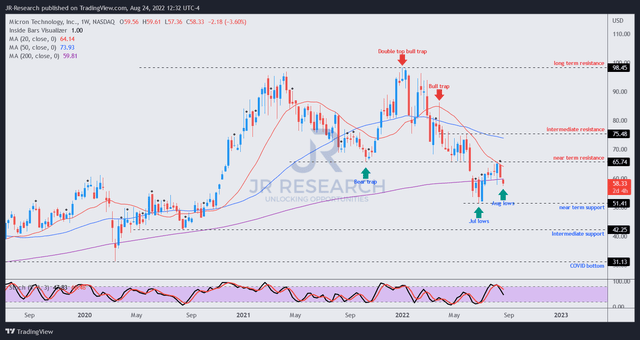

MU price chart (weekly) (TradingView)

We are confident that MU’s July lows should be underpinned robustly, in line with our assessment of a broad semi industry bottom.

Coupled with reasonable valuations, we posit that the recent pullback offers investors another opportunity to add exposure meaningfully as Micron navigates its near-term challenges.

Therefore, we revise our rating on MU from Hold to Buy.

Be the first to comment