Ethan Miller

Day after day, Intel (NASDAQ:NASDAQ:INTC) continues to cut expectations leading to less shareholder value. The latest news has the long expected Mobileye IPO coming out at a much lower valuation leading to less funds raised by the chip giant. My investment thesis remains Bearish on the stock.

IPO Cut

Back when the chip market was hot at the end of 2021, CEO Pat Gelsinger promoted the idea of a Mobileye IPO with a $50 billion valuation. The number never made sense considering the current revenue stream of the driver assistance technology firm, but the stock market bought into the news quickly sending Intel up to $52.

Now, Bloomberg reports the company is looking at a valuation of only $30 billion for a 40% cut to the target price. Intel might even delay the IPO due to ongoing market weakness in the semi. sector with Nvidia (NVDA) hitting a new 52-week low on September 13.

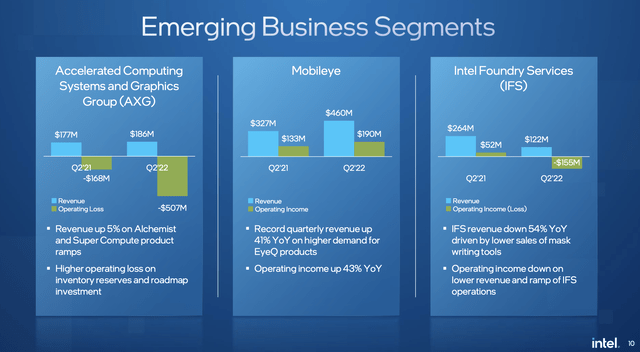

The major problem here is that the valuation still doesn’t add up. For Q2’22, Mobileye reported revenues of only $460 million. Sure, revenues were up 41% YoY, but some of the previous revenues were depressed due to the chip supply issue in the automotive manufacturing sector.

Source: Intel Q2’22 presentation

Mobileye is only running at a $1.8 billion annual run rate, yet the stock is still supposedly worth $30 billion after a market sell off. One is hard pressed to find a chip company still trading at this valuation.

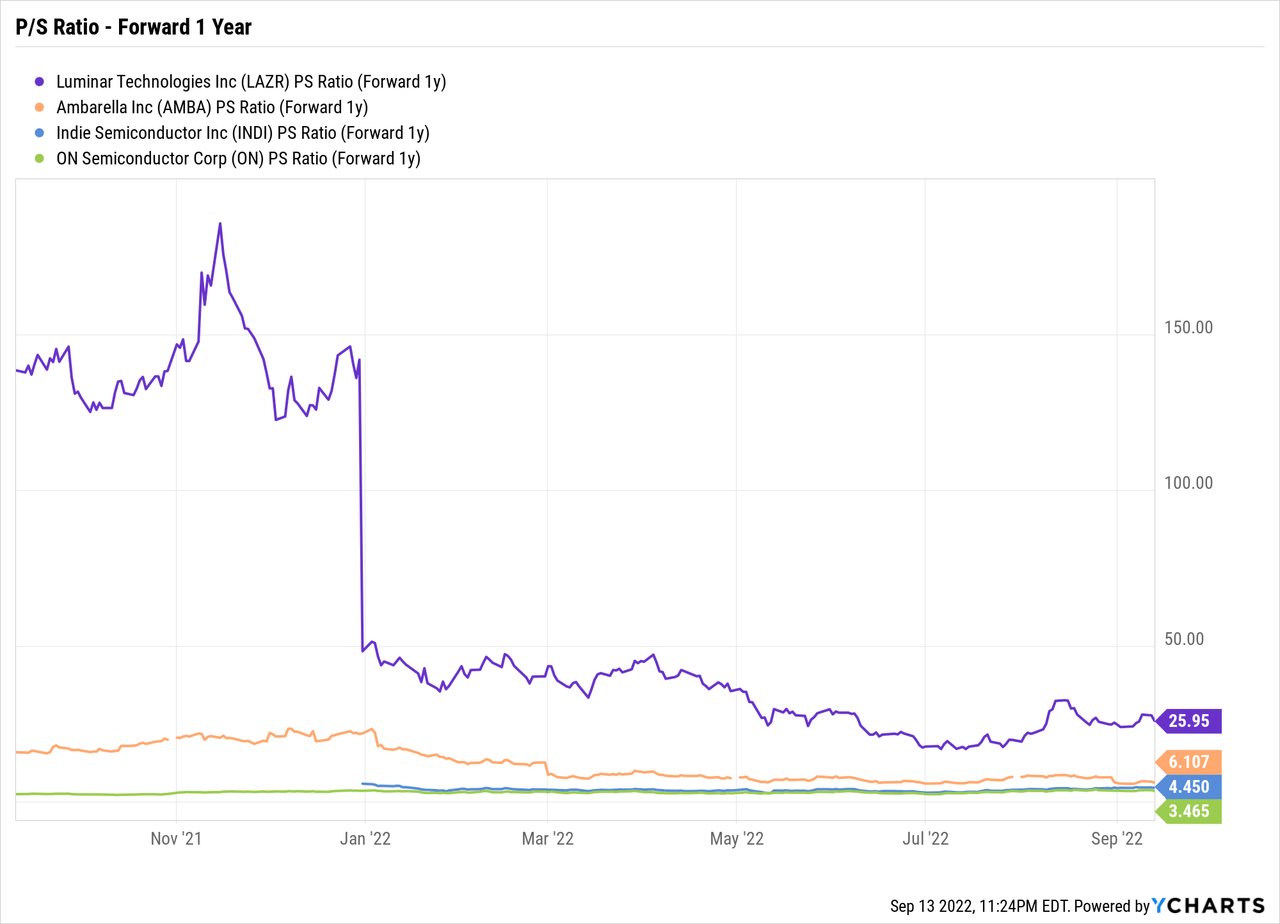

The company is currently using Lidars from Luminar Technologies (LAZR). The stock does trade at ~25x 2023 revenue targets of just over $120 million, but the Lidar business is forecast to surge in 2024 to over $350 million placing the stock valuation at less than 10x those sales.

Other semiconductor stocks focused on the auto tech sector trade at a fraction of the proposed valuation of Mobileye. ON Semiconductor (ON) trades down below 4x sales while Ambarella (AMBA) appears pricey at 6x sales despite a large backlog for their computer vision chips. Even the newly public indie Semiconductor (INDI) trades at only 5x sales with revenues growing 100% in the last quarter.

The only reason to pay a higher multiple for Mobileye is due to the better visibility from the high profile buyout by Intel several years ago at a market cap of $15 billion. The chip giant hasn’t made much of a return on the stock at the $30 billion valuation and one has to question whether CEO Pat Gelsinger isn’t promoting a higher valuation than reality to make the capital position and valuation of Intel overall appear more valuable.

A more reasonable multiple of 10x sales places an legitimate IPO price closer to $20 billion. Mobileye wouldn’t even be a buy at an initial trading value at this level.

Promising Technology

Just this last week, Mobileye announced Level 4 self driving technology reaching the U.S. The Mobileye Drive technology has been used in Germany for robotaxi service and the commercial version includes the following array of technology powered by EyeQ chips: a 360-degree suite of advanced sensing technology containing 11 cameras, 6 radars, 3 long-range lidars and 6 short-range lidars

Mobileye is a clear leader in the ADAS sector listing 120 million vehicles equipped with advanced driver assistance EyeQ chips from the company. A lot of questions exist on whether AVs will incorporate EyeQ chips with leaders in the sector such as Tesla (TSLA) developing internal full self-driving technology with a goal for approval by year end.

Assuming Mobileye can continue to grow content as the company moves from Level 1/2 driver assistance to Level 4/5 self-driving technology, the stock will have a strong growth curve from 2024 through the rest of the decade. The big question is why Intel would even want to unload a portion of the company in a weak market.

Clearly, the chip giant selling 10% to 20% of the company at a $50 billion valuation would provide $5 to $10 billion in capital to fund investment in fabs. Once the valuation dips below $30 billion, one has question the reasoning for unloading one of the faster growing divisions in the company. The capital raised on selling 10% of the stock quickly becomes immaterial to building fabs costing $10 billion each and Intel would be dumping the position at the worst possible spot, instead of waiting to sell on strength.

A very interesting aspect of selling a portion of Mobileye is the plan to use the proceeds to help build fabs for the Intel Foundry Services business which has historically been an utter failure. The chip giant reported Q2 IFS revenues of only $122 million, down over 50% from Q2’21. In essence, Intel is trading a booming auto tech business for an opportunity to resurrect a failed business.

Takeaway

The key investor takeaway is that Mobileye was another trap for Intel shareholders. The valuation was overrated from the beginning and will probably have to head lower before an IPO can occur.

Investors should continue to avoid Intel until the business actually hits rock bottom and a turn occurs. The company has a long road back that may never occur.

Be the first to comment