Chesky_W

Over the past year, Aeva Technologies, Inc. (NYSE:NYSE:AEVA) has lost⁓ 71% and is currently trading 73% below its 52-week high of $10.75. The company has been struggling with earnings and has made no significant profit since its inception back in 2017. As of Q2 2022, AEVA reported total revenue of $1.49 million, beating analysts’ estimates by $203,000. It is yet to be seen if the company will achieve the milestone it has claimed with its next-generation 4D LiDAR Technology. LiDAR, as will be discussed in this article, is a method of measuring distance (from a car or any other moving system) by shooting lasers and analyzing the time of return.

Thesis

Aeva believes that its collaboration with SICK AG (a German-based sensor producer) will help bring its Frequency Modulated Continuous Wave (FMCW) 4D LiDAR to various industrial sensing applications beginning with Aeries II. The company explained in its Q2 earnings report that it was already seeing stronger traction in the market after the commercial launch of the Aeries II. However, the adoption and implementation of LiDAR technology are still facing major challenges such as high cost and environmental headwinds.

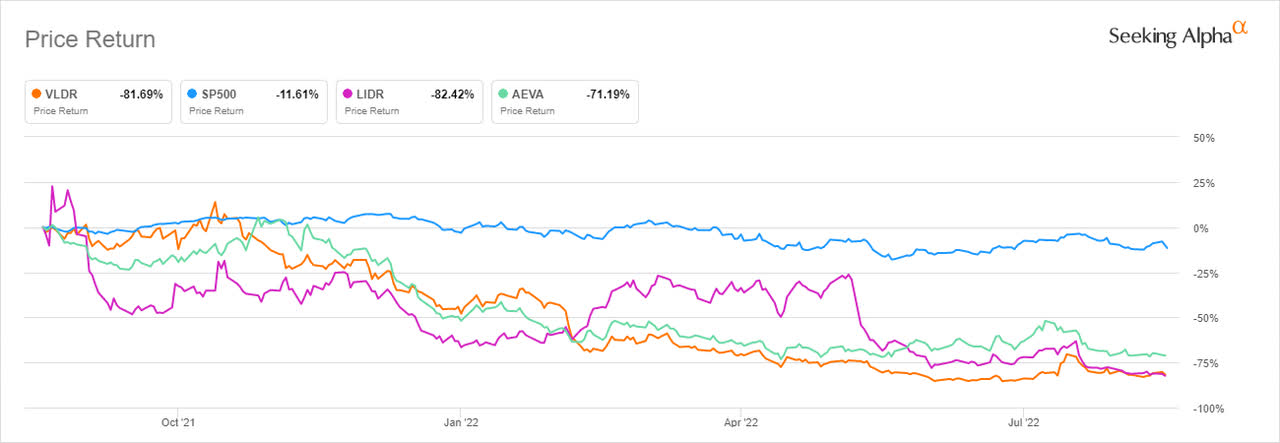

Intelligent sensor solutions companies have had a dodgy run over the past year, with the adaption of sensor-based operating systems still a problem in the U.S. The decline as described earlier was not just faced by Aeva but other sensor companies as well.

Seeking Alpha

Velodyne Lidar (VLDR) was down 81.69% while AEyE, Inc declined 71.14% over the past year against the S&P 500, which also inched lower by 11.61%.

Recap of Aeries II and its developmental progress

The Aeries II – dubbed the next wave of autonomy – is a 4D LiDAR sensor built to detect the fourth dimension of instantaneous velocity. It is expected to leverage Aeva’s unique FMCW technology and also the world’s first LiDAR-on-chip module design.

Sick AG, a producer, and distributor of sensor solutions for industrial automation solutions in the U.S, has a lot to benefit from its collaboration with Aeva. First off, the FMCW technology is the sole preserve of Aeva. This technology includes the detection of instant velocity systems and long-range performance. Speaking during the announcement of the collaboration, Dr. Niels Syassen, Member of SICK’s Technology and Digitization Executive Board, stated:

We are convinced that their unique approach to FMCW technology, which includes instant velocity detection and long-range performance, will provide new opportunities for us and our customers in a variety of industrial sensing applications where the traditional time of flight LiDAR technologies are challenged.”

The perception of 4D LiDAR FMCW sensors is touted as superior to camera technologies and legacy 3D LiDAR sensors. Automated machinery using this technology will be able to perceive low and reflectivity targets within the same measurement without edge effects. This feature helps when moving machinery from an indoor to an outdoor facility. The main challenge here will be to ensure the transition takes in any changes in weather patterns.

Further, the application of Aeries II in the automotive industry market will be primarily expanded to the autonomous vehicle technology and the Advanced Assistance Systems (ADAS) market. The industrial automation and metrology markets are worth a combined $10 billion and the 4D LiDAR on chip FMCW technology seeks to capitalize on this value. But Aeva’s progress has been consolidated by its collaboration with the optical company Nikon Corporation (OTCPK:NINOF, OTCPK:NINOY).

Frequency Modulation vs. Amplitude Modulation

In Q2 2021, Nikon announced its cooperation with Aeva to bring micron-level measurement capabilities to its multi-billion industrial automation and metrology spaces. Among the companies served by Nikon include BMW (OTCPK:BMWYY, OTCPK:BYMOF), Stellantis (STLA), and top manufacturers of aerospace elements. As expected, Nikon will leverage Aeva’s 4D LiDAR-on-chip technology while Aeva will take advantage of Nikon’s laser radar technology.

Aeva’s deal with Nikon continues to open up avenues to pursue both photo and non-photo businesses. The company put a timeline of 2024 as the period when it hopes to begin the Aeries II production.

It is vital to point out that Aeva’s 4D LiDAR is an innovative technology that modulates the frequency, unlike the most common method today that involves modulation of amplitude. In practice, sensors that modulate amplitude use the pulse waves from a spinning laser array before calculating the time taken for the light to bounce back or pulse. This information is then used to obtain a (geographical) fix on the objects within the sensing field including other cars and pedestrians. Arguably, over 95% of the $1.1 billion LiDAR market is invested in amplitude modulating companies, the reason for the slow uptake of frequency modulation. Nikon’s Q2 2022 revenues hit $1.073 billion with gross profits at $491.7 million, indicating the strength of the photo/ film industry despite the high costs of revenue involved.

The new aspect that Aeva’s technology entails is that during frequency modulation LiDAR lasers do not pulse (unlike amplitude modulators). In retrospect, the 4D LiDAR transforms the minute frequency alterations into a continuous wave. This change allows the sensor to measure the Doppler Effect, with the LiDAR now immune from interference from sunlight or other sensors. Unlike the amplitude modulators, this sensor has a lower margin of error, especially as caused by drastic changes in weather such as lightning and sunlight. This innovation is needed to help Aeva expand into the huge industrial automation market.

4D LiDAR in the EV market space

In my view, I see the new LiDAR technology as an important facet in the manufacture of electric vehicles (“EV”)/ artificial intelligence (“AI”). The internet has been awash with the news of Apple (AAPL) releasing a new car into the market. Taking on the fact that Aeva’s founders are former Apple engineers, then this car will doubtless use all the help necessary from the 4D LiDAR sensors. Apple has a market capitalization of $2.53 trillion, making it a strong contender in the EV space in case it continues on with the launch.

At the moment, only Tesla (TSLA) among the self-driving car companies does not use LiDAR technology. Companies like Uber Technologies (UBER), Waymo by Google (GOOG, GOOGL), and Toyota Motor Corporation (TM, OTCPK:TOYOF) all use LiDAR technology. By utilizing the radars and cameras, Tesla is confident that its vehicles can identify the distance from objects. However, analysts believe that Tesla’s decision to avoid using the LiDAR system is due to costs. The cost of installing one LiDAR device in a car is approximately $10,000 (on the lower side). Added to the overall cost of the car, the entire price becomes significant. Google through its Waymo project has been able to reduce its pricing through mass production.

Earlier in 2022, a robust entry-level LiDAR system was also said to cost about $23,000 with the accompanying drone costing as high as $16,000. Other additional costs included accessories such as a base station, a GPS rover, and batteries among other drone elements costing an additional $10,000. Customers will also need to spend at least $2,000 on equipment. Factoring in insurance, it will also mean that the as $23,000 LiDAR system will attract an annual premium of $2,000. Such costs would mean the LiDAR system would go for as much as $50,000, such a prohibitive price.

To curtail this occurrence, Aeva has worked on shrinking the main components of the LiDAR self-driving car sensor to a single chip. This move is seen as essential in lowering the cost of the LiDAR sensors. Further, Aeva explained that it had inked a deal with the Autonomous Intelligent Driving unit of Audi-a company associated with Germany’s Volkswagen AG (OTCPK:VWAGY, OTCPK:VWAPY, OTCPK:VLKAF) in April 2022. The deal would see Audi develop its e-Tron fleet of vehicles using the LiDAR sensor. According to the report, the chip is said to be the size of a U.S. quarter. This move will enable Aeva to lower the sensor’s cost to less than $500 with the ability to perceive 300 meters (984 feet ahead).

Risks

Aeva will need to work hard to lower the cost of the 4D LiDAR sensor and maintain the same quality with the aggregate cost of the 3D LiDAR close to $50,000. Lowering the cost to $500 may seem almost impossible, but it is the best way to secure more customers.

The company’s production goal of Aeries II in 2024 may also mean a continued spell without significant earnings until that time. Still, we believe that the push to lower costs will hasten production considering Aeva is the single producer of this new LiDAR sensor in the entire world.

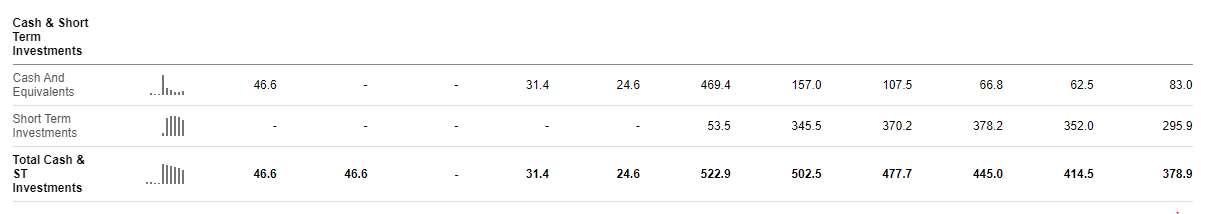

In the quarter ending on June 30, 2022, Aeva reported a 17.85% increase in its accumulated deficit at $231.1 million against $196.1 million incurred in Q1 2022. The decrease in earnings was also aggravated by an 8.6% reduction in cash and marketable securities to $378.9 million in Q2 2022 from a high of $414.5 million. Aeva’s cash balance has been plummeting since it hit a high of $522.9 million in Q1 2021.

Seeking Alpha

At the time, Aeva had diluted its total outstanding shares by more than 2,500% from 8.1 million shares in September 2020 to 211 million shares in December 2020. Also, the six months ending on June 30, 2022, further reduced its ending cash and equivalents balance by 47.10%- from $156.999 million (in the six months ending on June 30, 2021) to $83.048 million. This decrease is significant considering the company used up $57.971 million in operating activities at the time. It is, therefore, expected that Aeva will take up a loan facility to manage its dwindling cash balance and avoid further dilution this year.

Bottom Line

Aeva Technologies presents a formidable case with its Aeries II FMCW 4D LiDAR sensor technology designed for the automotive/ machine industry. It is the next-generation LiDAR technology that is yet to be adopted by big automation companies such as Tesla.

Aeva presents a disruptive design that will shift the balance in the market although it still faces a challenge of costs and liquidity. Aeva has promised to consider to scale production when it begins in 2024. However, I feel that the company needs to lower this lead time since it has no significant revenues. Delays in mass production may scare away investors.

In the end, the company will have more opportunities in both the photo and non-photo business deals needed to raise revenue. For these reasons, we recommend a hold rating for Aeva stock.

Be the first to comment