gremlin

We are recommending a Hold rating on the shares of Air Lease Corporation (NYSE:AL) and a price target of $37 per share, approximately equal to 9 times forecast adjusted 2023 earnings per share. The company delivered decent third-quarter results and continues to benefit from its strong balance sheet and low cost of debt. However, there are some potential challenges on the horizon that may limit the company’s ability to meaningfully boost shares in the coming years.

We are also initiating a Buy rating on the shares of Air Lease Corporation’s 6.150% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series A (NYSE:AL.PA), with a price target of $25 per share, which is equal to its Liquidation Preference. The company has consistently paid dividends on all three classes of preferred stock since they were issued. Air Lease preferred stock provides an attractive income stream, and unlike many preferred stocks which are fixed-rate in nature, switches to a floating rate from March 15, 2024. The limited duration resulting from the floating-rate feature and rising rate environment should provide solid support for shares. The stock has a current yield of 6.8% with potential for upside once the floating rate period comes into effect.

Company and industry overview

Commercial aircraft leasing could be described as a growing business within the growing global aircraft fleet. Both Airbus (OTCPK:EADSF) and Boeing (BA) forecast the need for approximately 40,000 new aircraft over the next twenty years with a combined value of approximately $7 trillion. In addition, there is a subset of transactions involving the trading of used aircraft that continues to grow as lessors compete for sale-and-leasebacks and new sources of capital enter the aircraft leasing business. There is a clear need for funding for airlines to take equipment in what is a capital-intensive business, and lessors like Air Lease are relied upon by more and more airlines each year to assist their customers in meeting their financing needs.

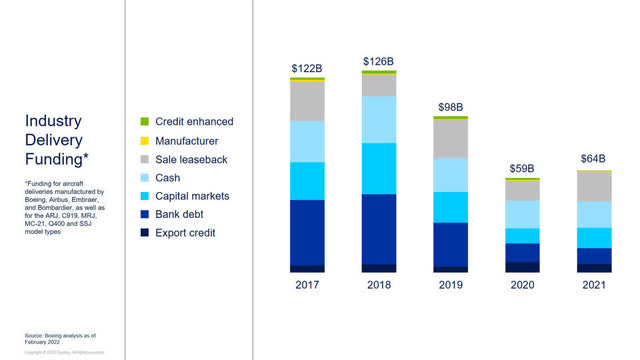

The aggregate level of financing decreased during the onset of COVID-19 but is likely to ramp up again in coming years as the market normalizes and airlines and lessors take delivery of orders that were deferred during the pandemic.

Source: Boeing Capital Corporation

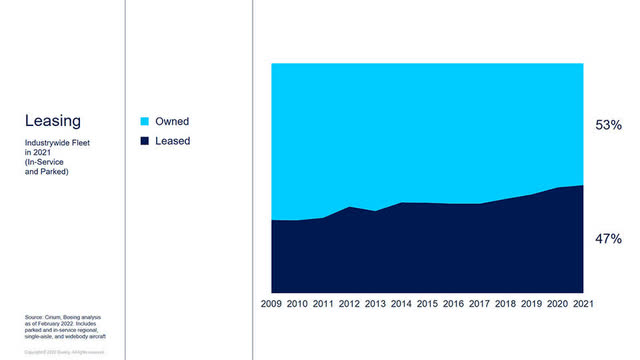

Some of these lessors were instrumental in providing airlines with large amounts of critical financing to help weather the pandemic. Due to the impact of COVID-19, among other things, there is some likelihood that leasing’s share of the global fleet may continue to increase well beyond 50% as airlines opt for the full financing and flexibility that leasing provides.

Source: Boeing Capital Corporation

Air Lease is one of the largest lessors of commercial aircraft, with a fleet of nearly 500 owned and managed commercial aircraft on lease to airlines worldwide along with 412 orders of commercial aircraft. It is helmed by two industry veterans in Steven Udvar-Hazy and John Plueger, both of whom were instrumental in the creation and growth of the aircraft leasing industry itself. Udvar-Hazy cofounded the company that became International Lease Finance Corporation (ILFC), building it into an industry leader and selling it to AIG in 1990. The company further expanded over the next two decades under AIG’s ownership. Both Hazy and Plueger left ILFC when AIG’s struggles hamstrung the business in order to start Air Lease with private equity backing, bringing along other members of ILFC management to the new enterprise. They have longstanding relationships with the OEMs and airlines worldwide and have grown Air Lease from a startup just over a decade ago into one of the largest global lessors.

Air Lease financials and projections

Air Lease reported earnings of $0.90 per share in the third quarter. They also announced an 8.1% increase in their quarterly dividend to $0.20 per share, which represents the tenth increase and fortieth dividend paid by the company since inception, which implies a yield on its common stock of 2.3% at current levels. Our forecast for 2023-2025 can be found below:

| 2022E | 2023F | 2024F | 2025F | |

| GAAP EPS | $4.10 – $4.20 | $4.00 – $4.50 | $4.00 – $4.50 | $4.00 – $4.50 |

| Book Value per Share | $58 – $59 | $63 – $64 | $67 – $68 | $71 – $72 |

Source: Author’s own calculations; 2022 results are adjusted to back out the write-off of the Russian fleet.

This implies that shares are currently trading at approximately 55% of 2023 book value and approximately 8.5 times EPS. While we believe our forecast of future earnings and book value is not an aggressive one, we believe Air Lease may contend with some issues as it continues to grow its fleet:

Concerns on rising interest rates and new customers

Firstly, similar to our prior analysis of AerCap Holdings (AER), we assume incremental debt issuance through 2024 taking place at current market rates while lease yields remain relatively steady. Air Lease’s debt cost is a bit less than some of its competitors, as it is rated BBB by both S&P and Fitch, in line or better than peers like AerCap, Aircastle and Aviation Capital Group, but below SMBC Aviation Capital and Bank of China Aviation. This investment-grade rating is beneficial but is not enough to prevent a likely material rise in the company’s cost of debt over the next few years. The company may choose to tap its attractively priced revolving credit facility in order to mitigate this risk; however, they would need to consider whether to hedge the interest rate risk. The company should benefit from a rise in lease rates of new delivery aircraft, many of which will arrive over the next few years, but the amount of this increase is still to be determined. Air Lease’s massive orderbook and the nuances of operating lease accounting will at a minimum delay the time for increased portfolio yields to materialize.

Asset sales impacted by market conditions

Air Lease has utilized two third-party joint ventures, Blackbird and Thunderbolt, as a means to dispose of a large and diverse volume of aircraft, with a focus on slightly older assets as well as those with relatively shorter remaining lease terms than its owned fleet. We estimate that Air Lease has sold well in excess of $3 billion of aircraft through these programs, an amount which we estimate comprises somewhere between 60% and 70% of overall asset sales since the ventures were launched. The fact that the securitization market remains largely dormant and costs of financing have likely risen materially will likely hinder both the volume and profitability of aircraft sales. In addition, Air Lease retained a management role in those ventures and also earned fee income for managing the portfolios. This contrasts with typical trade sales which do not usually come with any such arrangement. We assume between $1-1.5 billion in sales per year and a sale margin of 8-10%, but this may prove to be optimistic in light of the above. The inability to funnel aircraft to these vehicles could also have the impact of weighing on some of Air Lease’s portfolio metrics such as fleet age and average remaining lease term as well as increasing expenses incurred from the maintenance and transition of these aircraft as they age. On the plus side, management indicated that they had approximately $700 million of sales pipeline for the first half of 2023, a welcome development that hopefully means the company is actively diversifying its trading partners.

Limited return of capital to shareholders likely in near-term

Air Lease completed a $150 million share buyback this year which represented approximately 3% of common shares outstanding. As of the end of the third quarter, a new program has not been contemplated. While relatively insignificant, this is by far the company’s largest buyback since its founding. While the dividend is a nice attribute, Air Lease is in a difficult spot with respect to doing more to reward shareholders. The company’s stock has recently been trading at approximately 40% below its book value, its largest discount ever (excluding a few months during the height of the COVID-19 pandemic in 2020). Air Lease’s tremendous backlog of aircraft orders would force the company to employ some combination of a significant increase in aircraft sales or incurrence of debt in order to repurchase any sort of material amount of shares. This would be a welcome development, but goes against how management has operated the business thus far, so we will believe it when we see it. They may continue to emphasize the order book as a competitive strength but from a capital allocation perspective, buying aircraft over shares seems like a questionable strategy.

A more detailed walkthrough of my 2023-2025 projections can be found below:

| 2023 | 2024 | 2025 | |

| Revenues and other income | |||

| Total lease revenue | $ 2,546,281 | $ 2,959,630 | $ 3,340,439 |

| Net gain on sale of assets | 96,000 | 120,000 | 120,000 |

| Total Revenues and other income | 2,642,281 | 3,079,630 | 3,460,439 |

| Expenses | |||

| Depreciation and amortization | 1,097,998 | 1,259,115 | 1,412,289 |

| Amortization of debt discounts and issuance costs | 52,648 | 52,648 | 52,648 |

| Asset impairment | – | – | – |

| Interest expense | 644,808 | 873,247 | 1,071,173 |

| Selling, general and administrative expenses | 157,360 | 188,392 | 219,011 |

| Share-based comp | 23,056 | 23,056 | 23,056 |

| Total Expenses | 1,975,870 | 2,396,458 | 2,778,177 |

| Income (loss) before income taxes | 666,411 | 683,172 | 682,262 |

| Income tax (expense) benefit | (133,282) | (136,634) | (136,452) |

| Net income (loss) before preferred dividends | 533,129 | 546,538 | 545,810 |

| Preferred stock dividends | (41,700) | (41,700) | (41,700) |

| Net income (loss) | $ 491,429 | $ 504,838 | $ 504,110 |

| Diluted earnings per share | $ 4.42 | $ 4.54 | $ 4.54 |

| Weighted average shares outstanding—diluted | 111,090,133 | 111,090,133 | 111,090,133 |

| Book Value per Share (diluted) | $ 63.47 | $ 67.42 | $ 71.37 |

Source: Author’s own calculations

Revenue grows at a healthy clip over this time period given how much the fleet grows, and a 20% tax rate is utilized for all years. As mentioned above, SG&A should be monitored given upcoming lease expirations in 2022-2023 that feature several twin-aisle aircraft, including eight A330s (one of which, surprisingly, is an A330-900neo) and three 777-300ERs. Lease rates for these aircraft are likely to be weak, and costs to transition these aircraft to different operators can run into the tens of millions of dollars per aircraft. No asset impairments are assumed, though it would not be surprising if some of these lease expirations triggered impairment charges given the weakness in the market for certain aircraft types.

Competitive funding cost

The majority of Air Lease’s debt is fixed-rate and their average cost of debt was slightly below 3.0% at the end of the third quarter, an exceptionally low level. Their debt is predominantly unsecured and fixed rate, which should insulate them in the near-term from interest rate increases, in addition to indexing new aircraft lease rates to interest rate levels at delivery of those aircraft. Based on the amount of potential debt issuance required and the current rate environment, it is likely that the funding cost advantage that Air Lease enjoys over its rivals may reduce at least marginally in the coming quarters. They could look to encumber some assets as a way of diversifying funding sources and hopefully further reducing interest rates, but whether they pursue that remains to be seen. Part of Air Lease’s investment-grade rating stems from their lack of encumbered aircraft, so they are likely to engage the rating agencies to understand how any secured funding may impact their credit rating. They do not seem to have put in place any material interest rate derivative hedges in anticipation of future debt issuances, which may be prudent if they source secured debt or tap their revolving credit facility. They could also increase asset sales as a way to generate cash, and they have noted that the market for secondary aircraft sales is robust.

Preferred stock income scenarios

The Series A preferred stock pays a quarterly dividend on March 15, June 15, September 15 and December 15 each year equivalent to 6.15% per year. The current discount of the shares to their Liquidation Preference translates to an approximately 6.8% annual dividend yield. Based on our forecasted net income for the company above, coverage of the $18 million Series A dividend should not be an issue.

Beginning on March 15, 2024, the fixed rate changes to a floating rate equal to 3.650% over three-month LIBOR, which based on current levels would imply a dividend yield of approximately 9.1% at cost. However, LIBOR is in the process of being phased out, and this may impact the dividend rate upon commencement of the floating rate period. The likely replacement for it should be three-month Term SOFR, which is currently approximately 4.2%, a bit below three-month LIBOR. The forward curve currently implies a three-month Term SOFR of 4.4-4.5% in March 2024 which would result in a yield at par of around 8% and a yield to cost of roughly 9% on the preferred stock at that time. Based on our projections, this dividend rate would be in excess of Air Lease’s return on equity, a less-than-ideal situation for common stockholders:

| 2023 | 2024 | 2025 | |

| Return on common equity | 7.1% | 6.9% | 6.5% |

Source: Author’s calculations.

This could motivate the company to redeem the perpetual preferred shares in March 2024, which would provide further upside to holders buying at today’s discount. This would result in a total return of around 20% over a 16-month period.

If the shares are not recalled, the long-term forward curve indicates that, assuming Term SOFR were to replace LIBOR, the dividend rate would be above the current fixed rate even though SOFR is projected to decline further from 2024 onward. This would provide a 7-8% yield at cost, and would reset every three months to market rate levels, which would make this preferred stock far less sensitive to changes in interest rates than many of its peers.

Risks to investment thesis

Economic recession

Air Lease has survived the distress caused by the COVID-19 pandemic, and the increase in “Other assets” is likely reflective of some of the deferral and restructuring agreements entered into during the most severe days of the pandemic. However, air travel is proving to be resilient and the rebound is in progress, notwithstanding the prospects for a recession in the near future. There remains pent-up demand for travel and the company has an investment-grade rating, unfettered capital markets access, nearly an entirely unencumbered fleet, a $7 billion mostly undrawn revolving credit facility in place and aircraft lease placements well established for 2023-2024.

Massive purchase commitments

Air Lease’s order pipeline dwarfs its competition. It has the largest orderbook with the manufacturers in absolute dollar value and its purchase obligations exceed the current carrying value of its portfolio. Below you can find a comparison of this relative to a select group of peers:

| Net Book Value | Backlog | Backlog / NBV | |

| Air Lease Corporation | $23,929 | $26,202 | 109.5% |

| SMBC Aviation Capital | $14,114 | $10,900 | 77.2% |

| Aviation Capital Group | $10,122 | $6,888 | 68.0% |

| AerCap Holdings | $56,494 | $24,000 | 42.5% |

| Bank of China Aviation | $21,921 | $9,300 | 42.4% |

| Aircastle | $6,494 | $748 | 11.5% |

Source: Company filings, author’s own calculations.

While Air Lease management highlights that 99% of 2023 deliveries and 58% of the entire orderbook is placed, the commitments so greatly exceed internally generated cash flows of the company and will naturally inhibit the company’s ability to return more cash to shareholders for the foreseeable future. A more detailed breakdown of placements is as follows:

| Year | Number Leased | Number of Aircraft | % |

| 2022 | 34 | 34 | 100% |

| 2023 | 77 | 78 | 99% |

| 2024 | 63 | 93 | 68% |

| 2025 | 41 | 73 | 56% |

| 2026 | 15 | 65 | 23% |

| Thereafter | 10 | 69 | 15% |

| Total | 240 | 412 | 58% |

While placement of the aircraft is important, what’s most important is whether this CapEx budget represents the best use of shareholder funds. In addition, some of the customers that Air Lease has committed new aircraft to, in particular new twin-aisle aircraft, are smaller airlines and startups that may be challenged to meet their leasing obligations over time, which could impact both revenues and expenses. Air Lease management appears to have already made its determination on its preferred path for capital allocation based on the above, but it would seem that there are better alternatives available.

Longer-term rise in interest rates

Air Lease has locked in very attractive financing via its unsecured bonds and revolving credit facility. Therefore, the rise in interest rates is likely to be relatively less consequential given that new purchases should be indexed to interest rate levels, while the majority of its existing financings are not. Eventually they’ll have to raise more debt, but they may also look to swaps or caps in conjunction with drawing down their revolving credit facility as that margin on is likely to beat out any sort of bond or loan issuance given current market conditions. The preferred stock’s quarterly reset feature insulates it from this same risk.

Replacement interest rate uncertainty for preferred stock

While it seems likely that SOFR should replace LIBOR as it is doing in many other financing structures, there is no guarantee that this will take place. This could impact the dividend rate during the floating-rate period, and could reduce the level that might otherwise persist if SOFR were the Alternative Rate chosen to replace LIBOR.

Election not to pay preferred dividend for one or more periods

The preferred stock is non-cumulative in nature and dividends are discretionary, which means that, if the company does not make a payment in a given quarter for one reason or another, it is not obligated to make up that payment in future periods. That said, based on the level of net income forecast, there does not appear to be cause for concern for that to be an issue, at least for the foreseeable future.

Confiscation / requisition

This risk is unfortunately a looming one for all aircraft lessors following Russia’s seizure of billions worth of commercial aircraft, including over $800 million from Air Lease. Air Lease’s largest exposure is to China, at approximately 12% of book value and 17% of revenues, which it may wish to reduce. The geopolitical situation should be monitored closely, and Air Lease is likely to find receptive domestic buyers of equipment leased to Chinese airlines. Air Lease’s exposure to the Chinese market is over triple that of its former Russian exposure, and it is fair to say that loss of these assets, however remote, would result in a huge hit to the company’s shares. That said, a seizure of all equipment currently leased to Chinese airlines would eliminate approximately 44% of Air Lease’s book equity as of September 30, 2022 but would not impair any class of preferred stock.

Limited liquidity in preferred shares

There’s only $250 million in aggregate Liquidation Preference of the Series A Preferred Stock, and average daily volume is below 20,000 shares. This may result in limited ability to quickly trade out of shares and slightly wider bid-ask spreads. However, this investment should be looked at as a longer-term hold for the income it generates, with a bonus if and when the shares trade up above the Liquidation Preference (as they have in 2019 and 2021) or are redeemed at that level. Either way, this should reduce concerns about monetizing the shares in the near future.

Other considerations

As in our prior analysis on AerCap, we have assigned no value to claims related to aircraft and engines lost from the Russia-Ukraine conflict. Air Lease did surprisingly recover one 737 MAX from Russia in the prior quarter, but management was quick to note that the prospect of additional aircraft returns is highly unlikely, so they will go to their insurers alongside several of their leasing peers to hopefully recover their losses.

Conclusion

This is not an expensive business on a multiple of earnings or book value, though at the moment it lacks any significant catalysts to propel common shares. Air Lease should be able to benefit from favorable supply-demand dynamics, its market relationships, and the substantial capital needs of the commercial aircraft business as the global fleet grows over time. However, the tremendous commitment the company has made to new aircraft purchases will take time to move the needle. Further, this move has effectively consigned them to a path of tremendous annual capital expenditures when other avenues to create value would seem to be more attractive at the current time. Our forecasts suggest that generation of excess capital is still some ways off, and it would be encouraging to see a pivot to further aircraft sales and capital returns, especially in the event of share price weakness. A price target for the common stock of $37 seems appropriate, with potential upside to be achieved if operating performance exceeds our expectations, and/or if a tangible pivot in strategy is made towards capital returns to shareholders. On the other hand, the Series A preferred stock represents an interesting income-generating opportunity, with some potential upside to share price and limited interest rate risk. While appreciation potential is likely somewhat limited given the $25 Liquidation Preference and the ability for Air Lease to redeem shares at this level at any time from March 15, 2024, the shares should provide a reasonable source of income for a portfolio.

Be the first to comment