lorozco3D/iStock via Getty Images

The recent release of Federal Reserve minutes gave investors a reason to reevaluate the pace of future Fed tightening. The minutes lead investors to believe the Fed might raise rates in the first half of this year and maybe as soon as March and the January 25-26 Fed meeting likely sheds more light on future rate hikes. Quantitative Tightening (QT), or the reduction in the Fed’s balance sheet, may occur soon after rates move higher too. This earlier increase in rates comes on the back of higher inflationary pressures and what seems like a tight labor market.

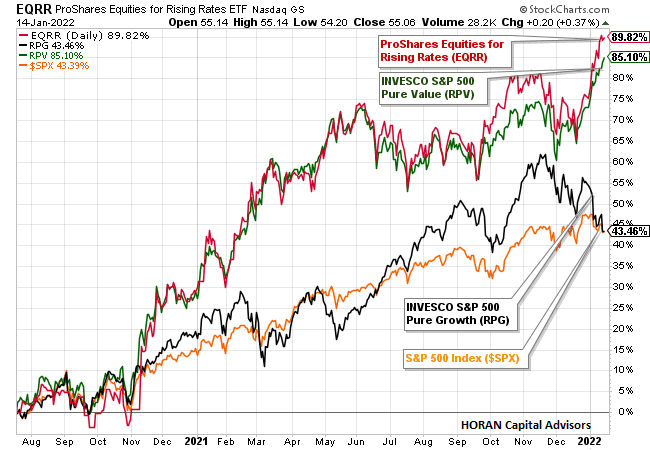

This move higher in inflation has led to better performance in stocks that would benefit from higher inflation. The ProShares Equities for Rising Rates ETF (EQRR) has performed as expected in this higher interest rate environment. Investors should know though, this ETF is concentrated in mostly five sectors. As of the end of November 2021, the three largest sectors, Financials, Energy, and Materials, account for almost 80% of the weighting in the ETF. As the below chart shows, since mid-July of 2020, the EQRR index has outperformed the S&P 500 Index, 89.82% versus 43.39%. Has the performance of this index already discounted those equities’ benefits from an inflationary spike? Also evident on the chart is Pure Value’s outperformance relative to Pure Growth’s, 85.10% versus 43.46%.

Stock Charts

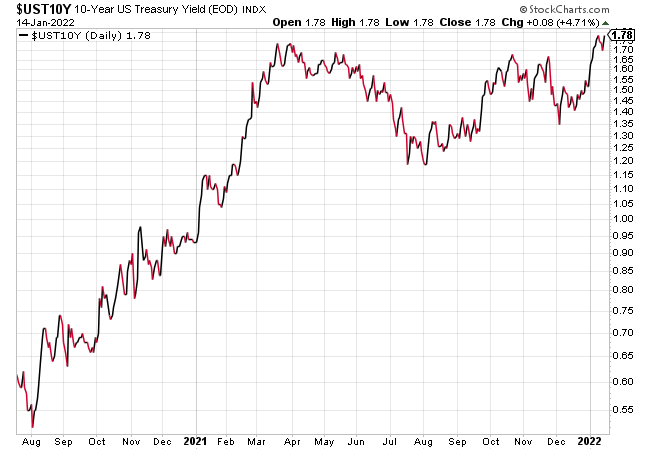

The favorable performance for stocks that benefit from higher interest rates has taken place at about the same time market interest rates have actually moved higher. Over this same time period, the yield on the 10-Year U.S. Treasury has increased from about .50% to 1.78% as seen below. The higher move in market interest rates has pressured bond or fixed income returns.

Stock Charts

Higher prices, pressure on “real” wages, and already satisfying pent-up demand may be an indicator of a lessening of inflationary pressure. As Nancy Lazar of Cornerstone Macro recently noted:

Real retail sales — units — have been declining for almost a year, as pulled-forward demand dissipates. Basically, consumers bought 3-years worth of stuff in a year (e.g., computers, TVs, household appliances, sports equipment, etc.), and with the pandemic transitioning to an endemic, consumers are shifting from spending on stuff to spending on services, just as income slows sharply, back to trend. Indeed, investors are anticipating this, as reflected in hotel stocks recently outperforming.”

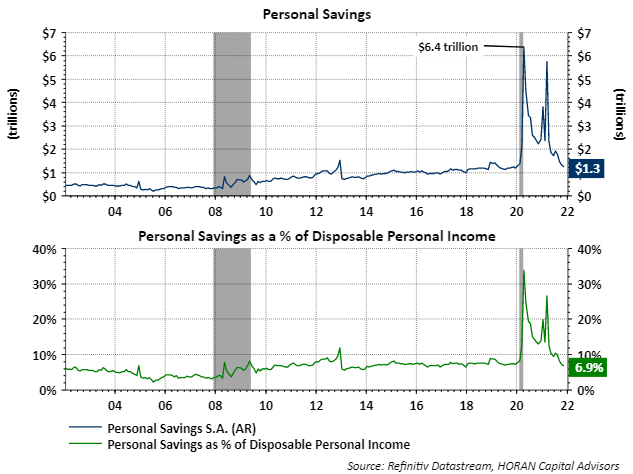

This pull forward in demand/elevated spending can be seen in the decline in the build-up in savings. Personal savings rose to $6.4 trillion at the peak of the pandemic and are now back to a more normal $1.3 trillion.

Refinitiv Datastream, HORAN Capital Advisors

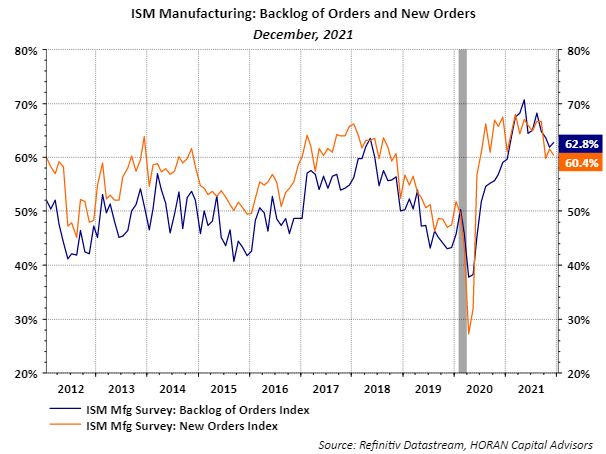

As desired by the Fed, interest rates are most likely moving higher and off the near-zero level in place today. And fiscal and monetary stimulus needs to be reined in, but the question remains how strong is the economy and will higher rates tip the economy into recession. We believe economic growth is not red hot and the satisfying pent-up demand resulting from the pandemic shutdown is slowing. Economic growth likely moderates as the year progresses with near-term volatility due to the uncertainty that is generally associated with midterm election years and the Fed’s move higher in interest rates. On balance, businesses continue to see favorable business prospects. The below chart shows the ISM Manufacturing Indices for the backlog of orders and new orders. Both are at high levels but coming down to more historical levels. At the end of the day, we believe inflationary pressure subsides from its current high level.

Refinitiv Datastream, HORAN Capital Advisors

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment