Brian Koellish

Boating can be a fantastic way to spend your time if you like to relax and have the money necessary to afford one. However, given recent economic concerns, we have seen some pessimism built up around some of the companies in this space. One great example of this can be seen by looking at MasterCraft Boat Holdings (NASDAQ:NASDAQ:MCFT). This particular enterprise operates as a manufacturer of recreational power boats, with some costing as little as $30,000 and others exceeding $900,000. Recent financial performance achieved by the company has been impressive and the company is undergoing an interesting change. Even though management is forecasting a decline in profitability for the 2023 fiscal year that has recently begun, shares are still trading at very cheap levels and warrant some upside potential moving forward. Because of this, I’ve decided to keep my ‘buy’ rating on the company for now.

Cruising along with MasterCraft Boat Holdings

Back in January of this year, I wrote an article that took a favorable view of MasterCraft Boat Holdings. In that article, I acknowledged that I was impressed by the company’s historical growth. The past few years had been rather impressive and the company has finally gotten to the point where it can generate attractive cash flows. I did also say that some of the increase in revenue and profitability was likely temporary, but I still maintained that shares were cheap enough to warrant a ‘buy’ rating, reflecting my belief that it would likely outperform the broader market for the foreseeable future. So far, this call of mine has not played out exactly as I would have guessed. While the S&P 500 is down by 6.9%, shares of MasterCraft Boat Holdings have generated a loss of 13.1%.

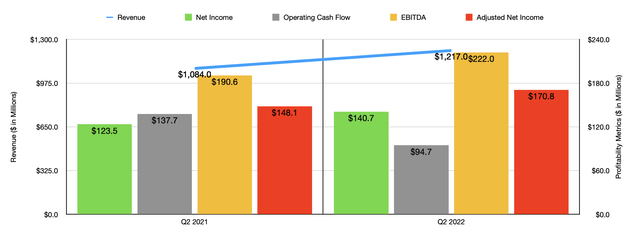

Based on this decline, you might initially think that there is some trouble brewing with the company. But that’s not exactly the case. To start with, let’s touch on how the firm finished its 2022 fiscal year. According to management, sales for the year came in at $707.9 million. This represents a sizable increase of 34.6% over the $525.8 million in revenue the firm generated in 2021. This increase came as the number of units the company sold rose from 7,197 to 8,217. Another driver was an increase in the average sales price of a boat. This number rose from $73,000 in 2021 to $86,000 in 2022. The average sales price of its key brand, MasterCraft, rose during this timeframe from $106,000 to $130,000.

With this rise in revenue, profitability followed suit. Net income for the company rose from $56.2 million in 2021 to $58.2 million in 2022. Although this increase is small, it is worth noting that if we look at adjusted net income, the picture is far better, with the metric climbing from $62.8 million to $84.6 million. Operating cash flow went from $68.5 million to $73.3 million. Meanwhile, EBITDA for the company also grew, jumping from $92.8 million in 2021 to $121.1 million in 2022.

When it comes to the 2023 fiscal year, things are going to be a little interesting. That’s because that year is not going to be exactly comparable with what prior years have looked like. This is because of management’s decision to sell off its NauticStar business to Iconic Marine Group at terms that were not disclosed to shareholders. Really the only thing we do know from this is that NauticStar has been a problem for the enterprise in recent years. While revenue in 2022 was $66.3 million, it generated an operating loss of $38.3 million for the year. That compares to the $2.7 million loss generated on $59.8 million in sales in 2021. Clearly, this should have a meaningful positive impact on the company’s bottom line. Having said that, we don’t see a great deal of evidence that this will come into play during the company’s 2023 fiscal year.

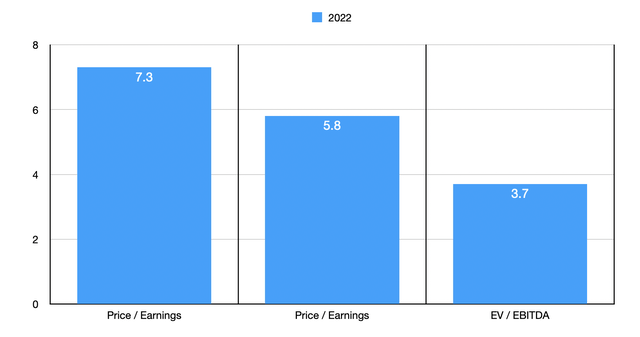

I say this because, according to management, profits for the company are forecasted to weaken slightly during the 2023 fiscal year. For instance, EBITDA for the firm should come in at between $105 million and $115 million. If we apply the same year-over-year decrease, using midpoint figures, to the firm’s operating cash flow, that metric should come in at around $66.6 million. At the same time, adjusted earnings per share should be between $3.89 and $4.31, translating with the company’s current share count to adjusted profitability of $76.4 million. if we were to value the company based on these figures, then shares should be trading at a forward price to earnings multiple of 7.3. The price to operating cash flow multiple would be 5.8. And the EV to EBITDA multiple would come in at just 3.7. This latter multiple is a bit uncertain because we don’t know how much cash the company generated from the sale. My calculation, because of the timing, does not include net debt reduction.

As part of this analysis, I also decided to compare the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low multiple of 4 to a high one of 11. In this scenario, two of the five companies were cheaper than MasterCraft Boat Holdings, while a third one was tied with it. Using the price to operating cash flow approach, the range was between 4.1 and 30.3. In this scenario, two of the five companies were cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range is between 2.2 and 7.6, with only one of the firms being cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow |

EV / EBITDA |

| MasterCraft Boat Holdings | 7.3 | 5.8 | 3.7 |

| OneWater Marine (ONEW) | 6.9 | 4.1 | 5.3 |

| MarineMax (HZO) | 4.0 | 4.6 | 2.2 |

| Malibu Boats (MBUU) | 7.3 | 7.0 | 4.9 |

| Brunswick Corporation (BC) | 9.3 | 15.2 | 7.0 |

| Marine Products Corp. (MPX) | 11.0 | 30.3 | 7.6 |

Takeaway

Although I understand that there is some pessimism around the near-term future for the boating industry, I also believe that the share price of a company like MasterCraft Boat Holdings is unbelievably low. It is true that the company looks to be closer to fair value when compared to similar businesses. But on the whole, it should offer some nice upside should things go right and limited downside should things go wrong. So while the past few months might have been painful for shareholders, I do still think a ‘buy’ rating on the company is appropriate at this time.

Be the first to comment