piranka

Investment thesis

What Informatica Inc. (NYSE:INFA) basically does is provide a means for their customers to efficiently manage their data without having to waste too much time while doing so. Their platform is cloud-based, and they have an AI engine called Claire that makes the whole process speedy yet meticulous. A lot of companies nowadays are having problems managing their data. In light of this, INFA provides a new and better means to carry out this process. They have partnered up with strong players in the industry, and this puts them in an advantageous position. Also, their platform is designed in such a way that it can be easily used by every employee in an organization and improve the work in the company, generally.

However, I believe INFA is fairly valued today and investors should wait to deploy capital when valuation gets cheaper.

Business overview

INFA has developed a new means for businesses to correctly monitor the place where their data settles, have an in-depth knowledge of the kind of connection that prevails in their various data depositories, and also know who can get a hold of the data and how the data is being used. All of these functions are carried out on an enterprise level. INFA’s cloud-native platform continuously examines their customers’ data in order to create a rich and thoroughly scrutinized metaverse, as well as to create and control a metadata system of record that serves as the primary source of truth about their data. As such, their AI engine, CLAIRE, is able to assist customers by helping them have access to their data more quickly, give contextual suggestions on data connections, reveal novel observations about their business, and computerize duties that were formerly manual.

Several challenges faced by companies to properly manage data

In the present era of relentless pursuit of digital transformation ideas to rework businesses, data is one of the most crucial and irreplaceable competitive assets that companies possess. The world’s population, software, and hardware collectively generate enormous data sets. In order to transform into data-driven enterprises, organizations are looking into methods of consolidating data across their many IT applications, systems, and environments. Better insights across the board, enhanced customer service, mechanized supply chains, and consistent, secure, and governed data access for all employees can be achieved by understanding and combining these data assets and migrating the workload to the cloud.

To make matters worse, the proliferation of mobile, social, and IoT data, combined with the growth of cloud computing, low-cost data storage, and the expansion of applications that create and access data, is leading to a data explosion in terms of volume, variety, and velocity. While it is now possible to generate deeper business insights and pursue untapped market niches thanks to the influx of fresh data, this plethora of information, however, is beyond the capacity of managing organizations to manage, aggregate, and standardize.

Further, as more businesses take advantage of cloud-based services, more data is generated and stored in various SaaS applications and storage places. The crucial thing to note here is that data is stored in a variety of formats across different data repositories, making it challenging to aggregate it into a consistent, long-lasting, and useful whole. The difficulty in integrating data from various sources within an organization in order to gain a fresh understanding and support strategic decision making is exacerbated by the ongoing fragmentation (i.e., where the data are stored).

In reality, the purpose of data management software is to give businesses complete command over their data at all points in its existence. In order to achieve this goal, it is necessary to have access to data from multiple sources, standardize data across formats, filter data for quality, join data to destinations, govern data access, secure data from all breaches, and create a single source of truth for data. However, businesses are still employing older methods of data management for strategic and one-off use cases, despite the fact that these methods only address a subset of the full data management lifecycle. If businesses truly become data-driven, the data strategies they use to support their digital transformation initiatives will be severely constrained by their reliance on legacy approaches. There are a number of significant problems with the existing solutions, including:

- Many traditional methods of data management have inherent flexibility, scalability, and extensibility because they were not designed specifically for the introduction of cloud-based workloads. These products, which are usually server-based, may only be able to manage a subset of the total data and may necessitate additional resources in order to prevent issues with the user experience, such as latency and unpredictable price spikes. The inflexibility and incompatibility of the non-native cloud approach usually result in the loss of expertise, the accumulation of unnecessary data, and the slowing of innovation.

- Legacy data management methods were made for a few types of structured data that usually come from internal business systems. This can make it hard to capture, control, organize, group, and govern semi-structured and unstructured data that is constantly coming in from connected devices, apps, and social media. When dealing with the massive amounts of disparate, unstructured data being generated by a diverse set of users all over the world, businesses have a hard time scaling their data management initiatives. Many of these methods can only help with analytical frameworks. They aren’t good enough to handle the use and streaming of data at high speeds from devices that are connected to each other.

- In most cases, the methods used to manage data in the past were simply band-aids designed to fix specific problems. Typically, enterprises do not integrate these methods into their overarching end-to-end data management strategy. For instance, while some current products can standardize various data types, they may fall short in providing the necessary governance and security for organizations to deal with the quality of their data as it currently stands.

Vendor-agnostic platform

INFA’s platform and products have advanced performance in any database, data source, or third-party application. They are using this approach as enterprises have now updated and revamped their infrastructures and moved lots of their workloads to the cloud. This completely contrasts to a lot of companies that have built their data management capabilities in such a way that they only work within their own products and platforms or have presented products that cannot control data in both on-premises and cloud environments. In a world where most companies are now adopting a multi-cloud, hybrid strategy and where data fragmentation is a major barrier to making sound decisions in an enterprise, INFA sure does have a major and continuous competitive advantage.

Addresses the needs of all types of users

INFA allows all major stakeholders in an organization to easily make use of their all-inclusive data management capabilities. Their products can be easily and quickly used in the organization, saving time for the users. There is also a user experience that they offer. This reduces the amount of technical skills that the user may require, and as a result, it effectively coordinates data within an organization’s employees while maintaining the expected functionality. This enables the universality of their platform, as every employee in the organization can further improve their performance in their work.

INFA enjoys strong network effect

Many of INFA’s benefits can be attributed to its strong network effects. More and more customers are using their platform, which means that the amount of metadata it controls is rapidly expanding. Because of this increase in metadata, CLAIRE is better able to understand complex data management tasks, and automation is progressing. For instance, when disparate customer datasets stored in various formats are combined, CLAIRE readily highlights inconsistencies and errors in the data.

As a result, the potential damage to a company’s bottom line from inaccurate information is mitigated thanks to the insights and automation provided by CLAIRE. It saves a ton of time by reducing the need to manually examine each data point in massive datasets. CLAIRE’s recommendation engine and automation will also naturally improve as it continues to process and analyze more business rules and data. I am confident that these factors will encourage more INFA customers, both current and prospective, to adopt the INFA platform and reap the benefits of using Informatica for their data management needs.

Strong partnerships with key players

From the onset, INFA has always proven itself to be a reliable partner, satisfying the needs of the most demanding enterprises. INFA’s relationship with these demanding enterprises only shows that they are able to meet the most complex needs of these enterprises. That alone gives them a competitive advantage over others.

Additionally, they have well-grounded relationships with three leading cloud hyperscalers. They are: AWS (AMZN), Microsoft (MSFT) Azure, and Google (GOOGL) Cloud Platform. These relationships enable their customers to deploy and use INFA on all of these cloud platforms. They sell their products on their marketplaces, and they strongly encourage the direct sales reps of the hyperscalers to share and distribute their products, for which they receive quota credit on the sale of their platform. They are also partners with Snowflake Inc. (SNOW) and Databricks. With all of these partnerships, INFA should always be one step ahead of the competition and will have the opportunity to market their platform to both new and existing customers.

Valuation

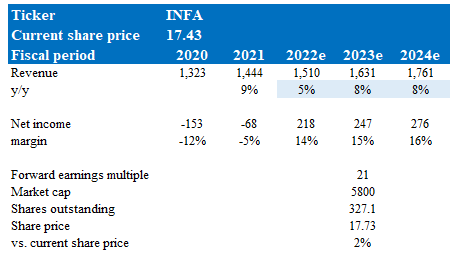

My model suggests that INFA is fairly valued today. My model values INFA on a forward earnings basis, as the business is generating profits. The model follows management’s FY22 guidance and high-single-digit growth (similar to historical growth rates), which I believe are achievable given INFA’s competitive advantages and a strong network effect.

INFA is trading at 21x forward earnings today, and I assumed it would trade in a similar range 1 year from now, as I do not expect any major events that would change this.

Based on these assumptions, I believe INFA’s stock is worth $17.73 in FY23.

Own estimates

Risks

Industry adoption rate may not grow fast

It’s possible that the market for cloud-based data management solutions has already reached the same level of maturity as the market for on-premise products. It might also not grow as much as it is expected to. Also, the acceptance might be stoic due to a number of reasons, like concerns about data security, privacy, cost, etcetera. A lot of customers have invested significant amounts of resources in conventional on-premise software solutions, and because of that, they might not be willing to move and start using cloud-based solutions.

Conclusion

I believe Informatica Inc. is an interesting and exciting company with a lot to look forward to. However, the market is not pricing it cheaply enough for me to deploy capital to invest in it. I would encourage readers and investors to hold back on investing and wait for a cheaper valuation.

Be the first to comment