Alex Wong

Inflation acts as a gigantic corporate tapeworm – Warren Buffett

Written by Sam Kovacs

Introduction

Want to play a game?

It’s called “when does inflation peak?”

Turns out, nearly everyone sucks at that game. They all thought it had peaked in April, then got a shock. Then it was supposed to have peaked in May, once again commentators took a hit.

The latest inflation reading came in at 9.1%. That means that life costs 9.1% more than it did last year. Of course, the CPI isn’t a perfect measure, and depending on your lifestyle, the inflation you suffer could be more or less than the headline rate.

But still, unless your earnings and net worth have gone up by 10% or more this year, then you are poorer than you were last year. And most of us are NOT up 10% this year.

Think about that for a minute. If you’re an entrepreneur, maybe you’ve found ways to grow your business enough to offset inflation, or you’ve been able to pass on costs to customers. If you’re an employee, maybe you’ve managed to negotiate a pay rise to offset inflation.

But what if you’re a retiree living off of the income of your portfolio?

You most likely can’t just pick up the phone and ask the board to increase the dividend by 10%.

That means you’re left with picking stocks that will increase their dividends at rates that outpace inflation.

Growth heals everything, when it comes to capitalism, and inflation is no exception. To grow a company can either increase price or volume, and to a less extent decrease costs.

But just growing isn’t enough. You need growth that is faster than inflation.

In this article I’ll cover two stocks that fit the bill perfectly, and 2 which do not.

Strong Buy #1: American Tower Corporation

I’ve been touting American Tower Corporation (AMT) as an inflation proof investment idea to the members of the Dividend Freedom Tribe for over a year.

It just has such a great business model, which has an incredible growth backdrop in upcoming years.

The company owns over 220,000 cell tower assets around the world. With the continued implementation of 4G in developing nations and 5G in developed nations, both organic growth from existing customers and the construction and acquisition of new sites should continue to fuel AMT’s operations in years to come.

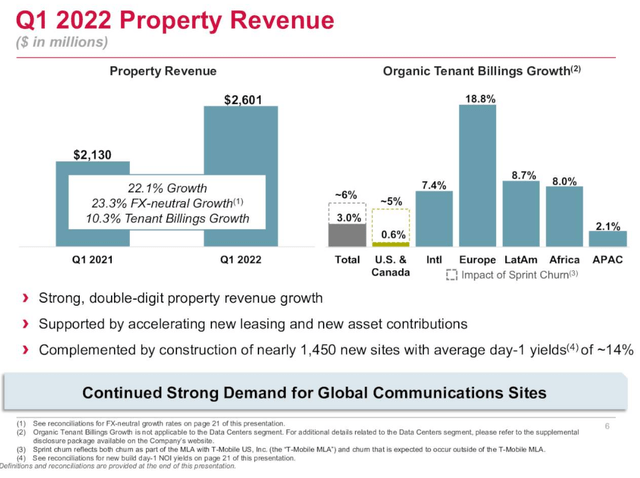

In the first quarter of 2022, property revenue increased by 22.1%.

The company is on track to grow revenue by 14% over the course of the year.

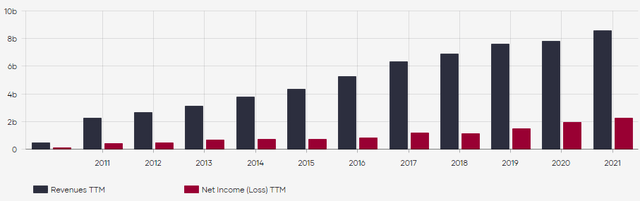

This continues a long lasting streak of impressive growth.

Dividend Freedom Tribe: AMT revenues / earnings

Since AMT is a real estate investment trust (“REIT”), although an unusual specialty one. Growth in earnings will always flow through to growth in dividends, as the REIT structure forces companies to pay out the vast majority of earnings.

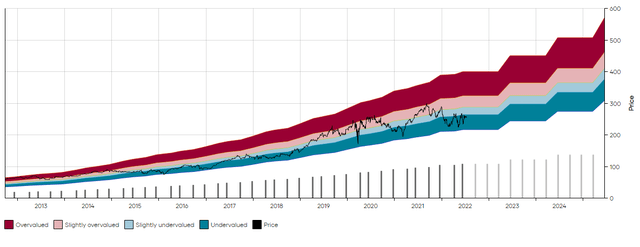

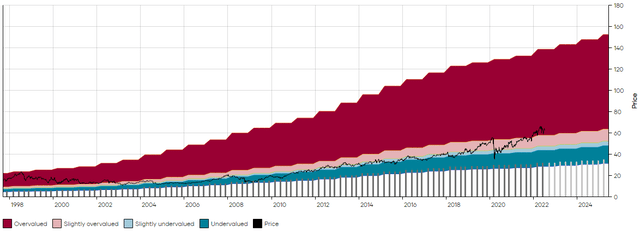

While AMT has grown at a 20% CAGR during the past 10 years, this has slowed to a 12%-13% CAGR over the past 2 years. You can tell from the reduction in the slope of the shaded areas on the MAD Chart below.

Dividend Freedom Tribe: AMT MAD Chart

This is acceptable. After all, the longer you grow at a very high rate, the harder it is to sustain that rate, as you’re growing from a higher base.

AMT continues to offer a fantastic double digit dividend growth rate, which I expect to be around 12%-14% for years to come.

This presents a beautiful income opportunity, and will ensure your income increases faster than inflation.

When a recession does hit, AMT should continue to fare well because of the recession resistant nature of the business model.

As management said when asked in a recent presentation:

We have had our tower portfolio kind of go through different macroeconomic cycles in the past, certainly through 2008, 2009 timeframe, also back in the early 2000s. And our assets performed exceptionally well during times of economic dislocation or disruption even into recessions or even a rising interest rates, we tend to do pretty well through those time periods.

The assets tend to follow technology cycles rather than economic cycles. So the 5G rollout will most likely not be disrupted by recessionary pressures.

AMT is thus the perfect stock to own. Increasing rates have pressured all REITs, but buying AMT now is just pure money in the bank.

Urgent Sell #1: Procter & Gamble

The Procter & Gamble Company (PG) has sustained this year’s tumble extremely well, coming down only 10% from its peak at the end of last year.

This can be easily understood by the fact that investors usually pile into defensive stocks when they think everything is going to go badly.

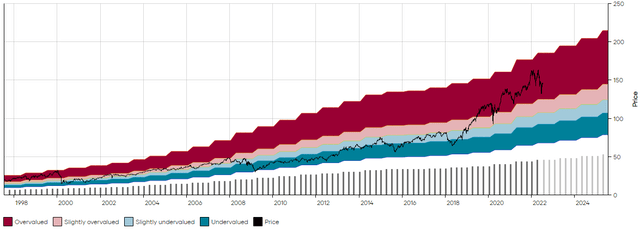

We have 42 years of dividend data for Procter and Gamble in our database. Since 1980, the only period during which PG was more expensive relative to its dividend was in the build up to the Dotcom Bubble.

Dividend Freedom Tribe: PG MAD Chart

Not only is PG dangerously priced relative to its dividend, but the business is being hit harder by inflation than it had imagined. When the CEO presented at Deutsche Bank last month, he said:

upstream labor and energy cost inflation hitting our suppliers and service providers, along with inflation in our own direct costs, are affecting us more this quarter and will have a larger impact next fiscal year.

Taken together, the headwinds this quarter are modestly higher than expected on both the top and bottom line.

This is why, while revenues increased by 10% YoY in the last quarter, operating income and EPS only increased 5%.

With inflationary pressures expected to be worse next year, it is unlikely that the company will increase its dividend by more than 5%-7% for the upcoming years.

This simply isn’t enough growth to compensate for the low 2.5% dividend yield.

By holding onto PG shares, investors not only face the erosion of the purchasing power of their dividends, but also capital losses when the price swings back to historical yields, which it always has done, and could do again within the next few years.

Strong Buy #2: Snap-on

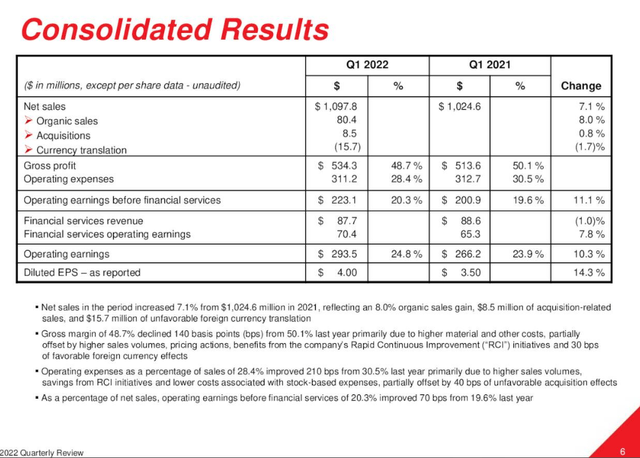

Snap-on Incorporated (SNA) is one of my favorite low yield high growth dividend stocks. Management have managed to keep growing the business at a fantastic rate for years, and have handsomely rewarded shareholders in the process.

And throughout this challenging market, SNA has continued to perform fantastically.

When management presented their first quarter results, they stated:

At some level, we could summarize the environment by these are interesting times and the hits they just keep on coming. But despite the challenges, the quarters are pretty much playing out as we said they would.

The Snap-on team is prevailing against multiple axes of turbulence. Our markets are resilient, with their essential nature shining through, repair spending is up, tech numbers growing, wages rising, and the increasing complexity, electric vehicles, plug-in hybrids, improved internal combustion power plants and ADAS, it’s all driving demand.

During the first quarter, sales were up 7.1%, and operating earnings up 10.3%. EPS was up 14.3%, helped partially by the 1.5% of shares management has bought back in the trailing 12 months.

See the difference in trend with PG? while PG is still showing good top-line results, operating metrics are somewhat deteriorating because of unexpected inflation, whereas SNA is not seeing this. Of course, they are both in very different industries, I’m just underlying this.

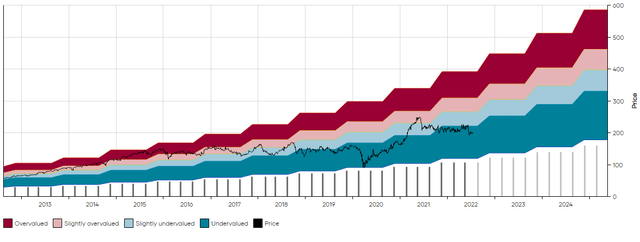

From a valuation point of view, SNA is cheaper than it has been for 80% of the past decade, boasting a nice 2.86% yield.

Dividend Freedom Tribe: SNA MAD Chart

A return to median values could see the stock run up all the way to $300 by the middle of next year.

Of course, this is subject to general market direction, which investors would be best served by ignoring in the short term. Over multiple years, the risk-reward of buying SNA at this price is very attractive.

Urgent Sell #2: Coca-Cola

How dare you buy the stock of a company which sells products which kill millions every year?

Just kidding, but given that I get that comment every time I write about tobacco stocks, I thought I’d slip it in when writing about The Coca-Cola Company (KO) given that obesity kills more people in the U.S. than tobacco.

Relative to its dividend, KO is currently more overvalued than it has been in 80% of the past 42 years.

I show the past 25 years below, as they show both the most extreme over and undervaluation for KO.

Dividend Freedom Tribe: KO MAD Chart 25y

Coca-Cola yields 2.8%, which is quite below its long term median yield of 3.7%.

We all suffer from recency bias, so it is easy to forget that it used to be customary for KO to yield much more. It has spent so much of the past 4 years yielding less than 3.2% that we have come to believe this is normal.

It isn’t, and the stability of the business, and recession proof nature of soda isn’t enough to justify it.

The core problem with KO isn’t inflationary hits, which while present, are more easily passed on to consumers, as soda turns out to be quite a recession proof commodity.

The problem is that the company’s dividend is usually around 90% of free cashflow.

The only way the company can grow the dividend sustainably, is by growing its operations, and given the existing cost pressures, the only way seems to be through top-line growth.

And management know top-line growth is their biggest challenge, and will continue to be, as they address this in every presentation they make.

Therefore, it is tough to imagine the dividend growing at much more than its long term historical rate of 5% per annum.

Which in years like this one, results in a decline in purchasing power.

KO’s price might stay resilient in the short term thanks to its businesses defensive nature, but over the course of the next few years, continuing to own the shares when they trade at this price is a bad idea.

One would be better off selling, and reallocating.

Conclusion

Hopefully the stocks covered in this article drives the following point back home: the only way to avoid the gigantic corporate tapeworm which inflation is, is to outpace it.

Companies which can do this will fare better in the next market cycle. Those which don’t won’t.

It’s as simple as that. Even more astonishing is the fact that companies which do have the ability to grow are trading at historically low prices, and those which are challenged are trading at historically high prices.

Be cautious in the current environment, and extremely picky with what you choose to buy. You want the combination of value, quality, and growth. You can forego momentum for a while, as not many stocks have positive momentum.

Be the first to comment