Igor Borisenko/iStock via Getty Images

ICD Offers Opportunities

Independence Contract Drilling (NYSE:ICD) will look to increase the share of advanced 300 Series (pad optimal superspec) rigs, which attract one of the highest dayrates in the industry and will lead to higher revenue per rig. The company plans to inflate operating margin by re-contracting and re-pricing rigs with existing and new customers. Rig utilization, too, should improve in 2022.

However, despite benefiting margin, focusing too much on shorter-term contracts can deny long-term cash flow stability, as evidenced by negative free cash flow in 2021. Its leverage is not high, and a debt refinancing in March will help fund additional rig reactivation programs. The stock is relatively undervalued versus its peers at this level. I think the current momentum and the stock’s relative valuation multiple placed it in an advantageous position for the investors to consider buying the stock for a robust return in the medium term.

Rig Strategy And Outlook

I discussed the company’s operations and its strategies in my previous article. While rig supply remains tight in the U.S. onshore due to years of underinvestment in anticipation of low demand, the sudden crude oil price rise has turned the situation. During Q4, the pricing momentum became more and more advantageous for ICD, as witnessed through the contract re-pricing. It re-contracted 11 rigs during Q4, four of which were placed with new customers. On average, the dayrate increased by 25%, touching 40% in some cases. So, the company revised its Q1 and Q2 guidance in 2022. The management anticipates at least one more price hike in FY2022, leading to further margin expansion. Also, during Q4, it could increase the number of rigs contracted to multi-rig customers in a couple of cases.

One of the principal drivers behind ICD’s expected price improvement is its potential supply of 300 Series rigs. The company currently has seven idle rigs in its marketed fleet. These rigs are rated highly in the industry and fetch one of the highest dayrates. In one of the recent contracts, the 300 Series rigs are expected to generate margins exceeding $10,000 per day on an all-in basis. As a result of the high rate, it will reduce paybacks on rig reactivation to less than one year. It estimates that the following three rigs would cost $3 million per reactivation. Investors may note that 65% of its rigs are in West Texas, and 35% are in Haynesville.

The U.S. onshore rig count increased 14% during Q1 2022 versus Q4 2021. The WTI crude oil price shot up by 33% in the past quarter. While the completed wells went up by 5%, the DUC (drilled by uncompleted) wells have contracted by 10% in Q1. So, the contract drilling industry saw boosted E&P activity, while the DUC well count decline signals a further supply shortage in the coming quarters.

Leading Metrics And Forecast

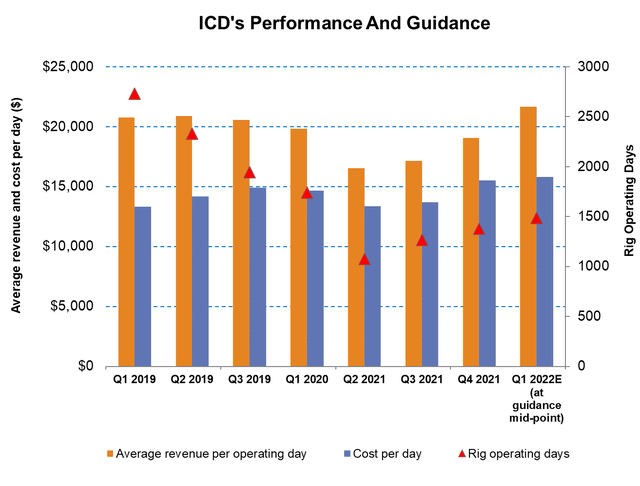

ICD’s Filings and Press Release

In Q1 2022, rig operating days can increase by 8% compared to Q4 2021. The average revenue per operating day can increase by 14%, while cost per day can go up marginally, leading to a 51% rise in average rig margin per operating day in Q1. Not only that, it expects utilization to increase sequentially by ~10%. In Q1 2022, the company expects to operate 16.5 active rigs,

By Q2 2022, the revenue growth can accelerate (20% to 23% growth from Q4) based on the contracts it has in place. Margin per day can nearly double from here. The drivers that would enable the company to gain traction are pad-to-pad re-prices and its ability to pass through the labor market cost inflation to its customers.

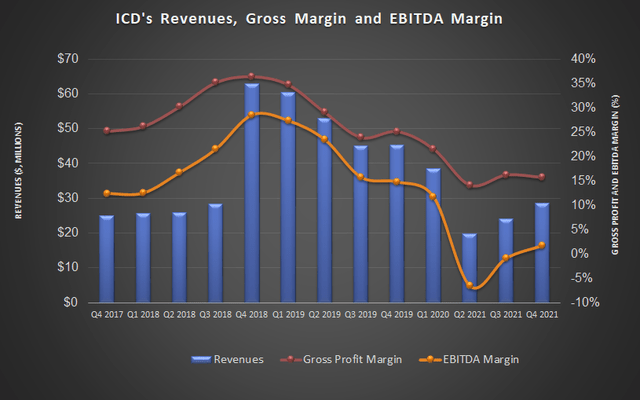

ICD’s management believes that the industry is in the early stages of a upcycle. Therefore, focusing on shorter-term contracts can lead to rapid margin improvement. It also expects to achieve margins exceeding pre-pandemic levels in the near term.

Analyzing The Q4 Drivers

From Q3 2021 to Q2 2021, the company’s revenue per day increased by 11%, while cost per day increased by 13%. Higher labor costs and the year-end incentive compensation accruals led to a more-than anticipated cost hike.

As of December 31, the company’s drilling backlog was $16.1 million, significantly lower than in the past, on average. Lower backlog represents short-term pad-to-pad contracts, typically low versus long-term contracts. However, since most of the current backlog will expire by Q2, I think the company will benefit from dayrate momentum in an improving market.

The Current Financial State

In FY2021, ICD’s cash flow from operations (or CFO) deteriorated to -$9.5 million from a mildly positive CFO a year ago. Although year-over-year revenues increased (5% up), adverse changes in working capital led to a negative CFO. The company’s free cash flow (or FCF) also plunged into deeper negative territory in FY2021. It may draw down under the equity line of credit and draw down funds under the term loan facility to meet required non-operating expenditures.

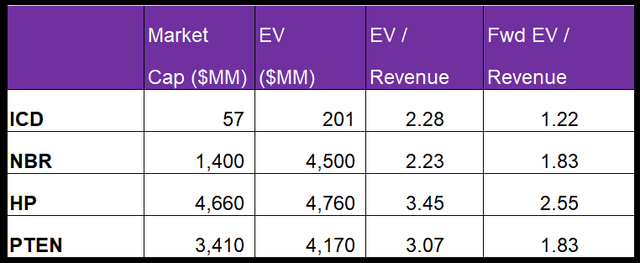

ICD’s debt-to-equity now stands at 0.75x, which is lower than the average for peers (NBR, HP, PTEN). Its liquidity stood at $27 million as of December 31, 2021. Investors may note that although $13 million in term loan will not be due before 2023, it will be classified as a current liability in Q3, which might circumvent the company’s ability to fund the ongoing rig reactivation program. However, in March, it refinanced its term loan by issuing $157.5 million of floating rate convertible notes. The proceeds will also be used to repay a previous merger (Sidewinder Drilling) and future rig reactivations.

What Does The Relative Valuation Imply?

ICD’s current EV/Revenue multiple (2.3x) to the forward EV/Revenue multiple contraction implies higher revenue in the next four quarters. The contraction is steeper than its peers’ (NBR, HP, and PTEN) average fall. This typically results in a significantly higher EV/Revenue multiple than peers. However, the stock’s current EV/Revenue multiple is lower than its peers. So, it can be relatively undervalued at the current level.

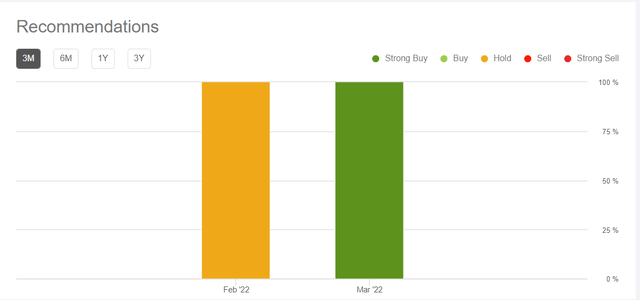

Target Price And Analyst Rating

According to data provided by Seeking Alpha, one sell-side analyst rated ICD a “Buy” (“Strong Buy”) in the last 90 days. None of the sell-side analysts rated it a “Hold” or “Sell.” The consensus target price is $7.00, which would reflect ~65% returns from the current market price.

What’s The Take On ICD?

In 2022, ICD is primarily looking forward to making a qualitative change in its operations rather than any big quantitative push. While the number of active operating rigs will increase marginally to cater to higher demand, the real push will come from increasing the share of more advanced 300 Series rigs and the associated higher revenue per rig. In some instances, the re-contracting and re-pricing of rigs with the advent of increased demand resulted in 25% to 40% higher dayrates. As a result, its topline and operating profit can increase substantially in 1H 2022. With forceful industry drivers and low relative valuation, the stock is due for a healthy return in the medium term.

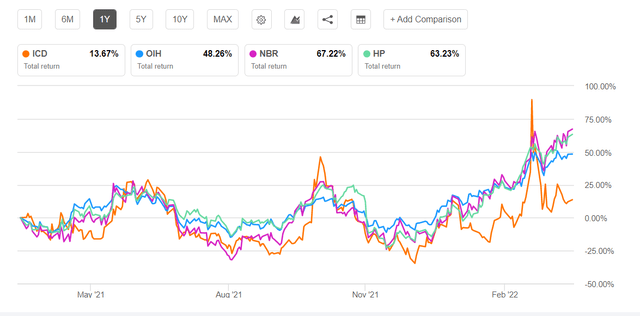

ICD’s growth story faces some mitigating factors. It suffers from a few operational weaknesses. The company’s drilling backlog was significantly lower than in the past. Dwindling cash flow is also a pressing concern. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, given the low relative valuation and current momentum as discussed above, the stock is a potential “buy”.

Be the first to comment