FatCamera/E+ via Getty Images

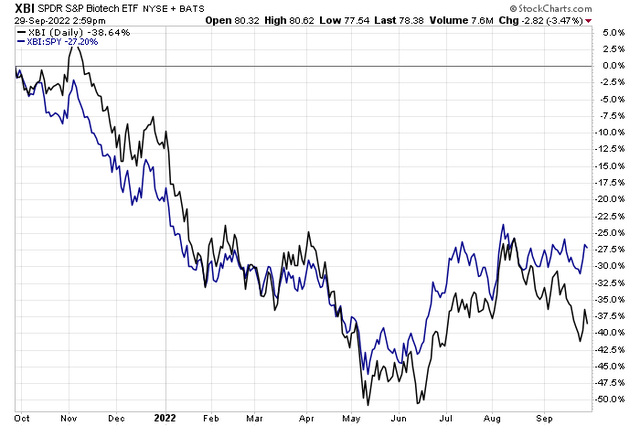

Biotech stocks were beaten down during the first several months of the year. The SPDR S&P Biotech ETF (XBI) was more than cut in half from this time a year ago to its May low, sharply underperforming the broad stock market. Since early May, though, risky biotech shares have managed to stage an absolute and relative rally.

Despite a sharp correction off its August peak, as XBI plummeted from $95 to under $80 today, the ETF has still returned more than 25% since its 2022 low. It’s also bullish that biotech equities bottomed ahead of the S&P 500. One SPX-listed stock features an optimistic earnings outlook with an intriguing chart setup.

Biotech Bounces Off Q2 Lows, Alpha vs. S&P 500 Since May

According to Bank of America Global Research, Incyte Corporation (NASDAQ:INCY) is a biotechnology company developing oral and topical treatments for oncology and dermatology indications. The company’s main asset is Jakafi for MF and PV. INCY’s Opzelura (ruxolitinib cream) was recently approved for the treatment of AD and impending vitiligo sNDA submission.

In addition, INCY has a broad early clinical oncology pipeline. There’s upside potential for INCY’s profits through its Jakafi revenue and late-stage dermatology program developments. Downside risks could include weaker than expected Jakafi and Opzelura revenue estimates as well as poor clinical trials.

The Delaware-based $15.1 billion market cap Biotechnology industry company within the Health Care sector trades at a near-market multiple of 15.7 times trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

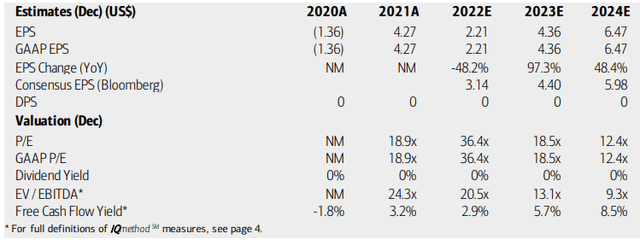

On valuation, BofA sees significant earnings upside potential through 2024 after a sharp dip this year. Moreover, the Bloomberg consensus forecast shows positive per-share profits in the years ahead, but not quite as sanguine as BofA. While no dividend is anticipated, its EV/EBITDA multiple is seen as dropping and free cash flow looks to be on the rise. Seeking Alpha rates its profitability with an A+ despite just a B- growth rating. It’s operating price-to-earning ratio should retreat if the share remains stable.

Incyte Earnings, Valuation, And Free Cash Flow Forecasts

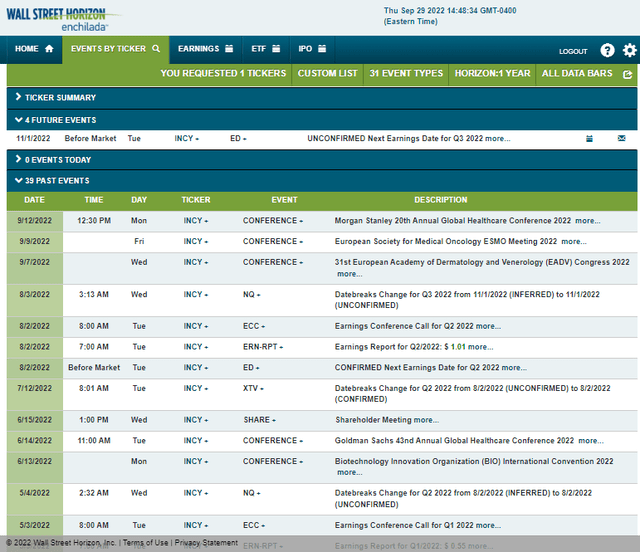

Looking ahead, Incyte has an unconfirmed earnings date of Tuesday, November 1 before market open according to corporate event data provider Wall Street Horizon. The calendar is light until then, however.

Corporate Event Calendar

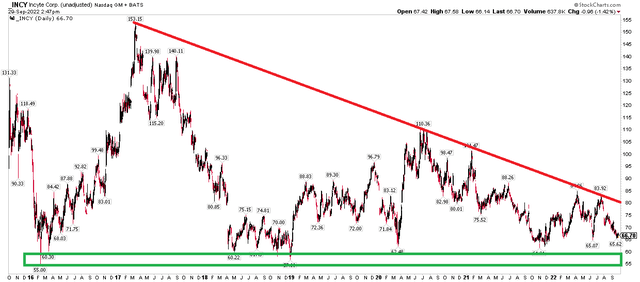

The Technical Take

INCY is nearing a key broad support zone from the mid-$50s to the low $60s. It looks like a good risk/reward setup to be long here with a stop under $55. On the upside watch for a bullish breakout above a downtrend resistance line dating back to its 2017 peak of $153. Sellers have come about each time it has attempted to move above that line. A breakout to about $85 would help support a longer-term bullish technical thesis.

Overall, I like the situation with the stock and price action currently.

INCY Shares Consolidation Near Support, Eyeing A Breakout

The Bottom Line

I like the growth and valuation scenario with Incyte right now. Strong earnings growth over the coming years is paired with a favorable risk/reward position on the chart. Being long here, but mindful of key levels mentioned is the play.

Be the first to comment