hohl

Investment Thesis: I take a bullish view on Deutsche Post AG due to encouraging preliminary Q3 2022 results, along with the potential to outperform FedEx Corporation (FDX) across the e-commerce segment going forward.

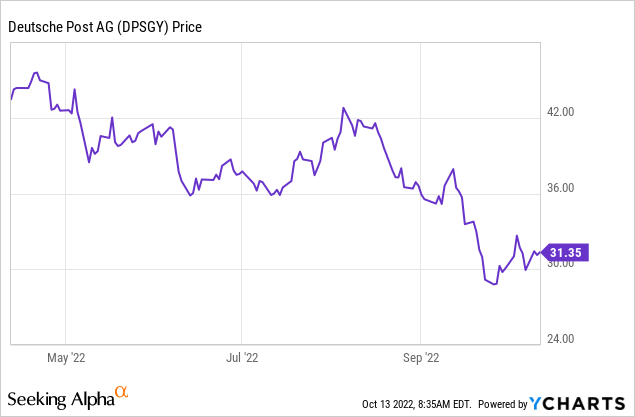

In a previous article back in July, I made the argument that the selloff we had seen in Deutsche Post AG (OTCPK:DPSGY) to date may have been overdone and that a rebound in upside for the stock could potentially be ahead.

However, the stock has continued to see a decline in the past three months:

ycharts.com

The purpose of this article is to reevaluate my previous assumptions for a rebound in upside, and assess if the stock could still be poised to recover from here.

Performance

Previously, I had remarked that while supply chain and inflationary issues were potentially of concern for Deutsche Post, revenue growth has continued to remain strong across the Express and Global Forwarding and Freight segments – which could be a catalyst for lifting the stock as a whole.

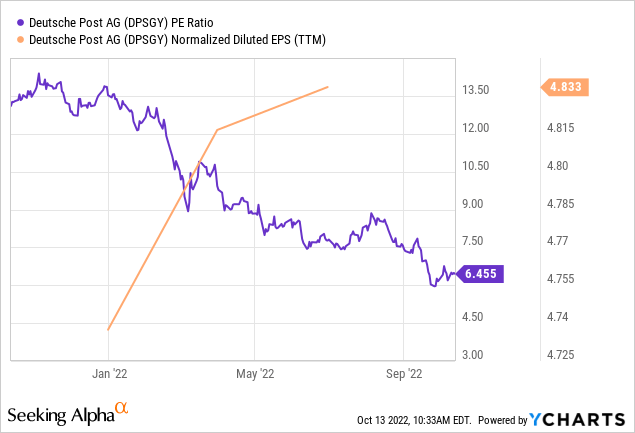

Moreover, I had also remarked that with Deutsche Post’s P/E ratio trading at a 10-year low along with earnings (on a normalized diluted basis) near a 10-year high – the stock could be trading at good value from an earnings standpoint and may see more upside from here.

While Q3 2022 results will be a significant telling point as to Deutsche Post’s trajectory from here – preliminary results report that Group EBIT is up by 15% to just over EUR 2 billion for the quarter, along with e-commerce B2C shipment volumes having recorded an improvement after having seen a decline for the first half of this year.

Specifically, the Express and Global Forwarding, Freight segments showed growth of just over 4% to EUR 1,010 million as compared to the same quarter in the previous year, along with growth of 57% for the Global Forwarding, Freight segment from EUR 372 million to EUR 585 million.

ycharts.com

From an earnings standpoint, we can see that the stock’s P/E ratio has continued to descend while we have continued to see a climb in earnings per share – indicating that the stock may still be trading at attractive value in this regard.

Looking Forward

Going forward, it is possible that in spite of strong indicated performance for Q3 2022, Deutsche Post could potentially see downside should broader market sentiment become more bearish in anticipation of a potential recession.

With that being said, with initial bottlenecks across air and ocean freight having shown signs of easing – there could be scope for the uptick in growth that we have seen across Express and Global Forwarding to continue.

Additionally, it will be quite interesting to see whether the company’s shipment volumes and overall earnings performance can continue to improve relative to competitor FedEx Corporation – who recently lowered their holiday volume forecasts along with a withdrawal of their full-year forecast after seeing first-quarter profit decline by more than 20%.

From this standpoint – should we see Deutsche Post start to outperform competitors such as FedEx – particularly across the e-commerce segment (as this segment has seen a decline for FedEx due to lower holiday package shipping demand), then this could be a significant catalyst for upside.

Of course, Deutsche Post is not immune to the current global macroeconomic risks, and it is possible that its own e-commerce volumes could come under pressure. With that being said, the overall indication so far is that the company has been seeing a recovery in shipping volumes thanks to a decrease in shipping bottlenecks – and this is quite an encouraging sign.

Conclusion

To conclude, Deutsche Post has seen encouraging preliminary results for Q3 2022. Particularly, should we see shipping volume demand start to outperform competitors such as FedEx Corporation in the coming months – then this could be a catalyst for upside.

For this reason, I take a bullish view on Deutsche Post at this time.

Be the first to comment