kentoh/iStock via Getty Images

Beware the fury of a patient man.”― John Dryden

Today, we take a look at unusual small cap concern that happens to be located one hour south of me here in Delray Beach. An analysis is as follows.

Company Overview:

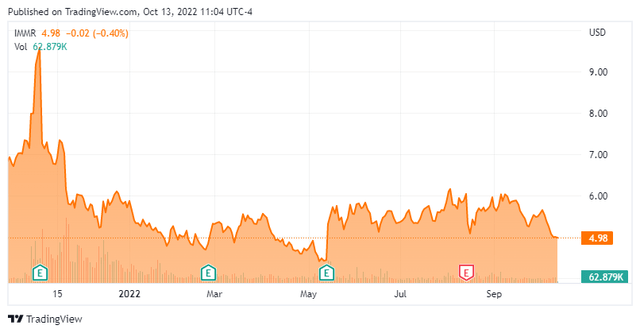

Immersion Corporation (NASDAQ:IMMR) is an Aventura, Florida-based developer of haptic technologies that allow people to use their sense of touch to engage with products (e.g., feeling the recoil of a gun in a video game). The company licenses these technologies primarily to the automotive, gaming, and mobile device markets with over three billion devices employing its technology. Immersion was founded in 1993 and went public in 1999, raising net proceeds of $48.3 million at $12 a share. Despite the ubiquitous nature of its technology, shares of IMMR trade for just under five bucks a share and sport an approximate market cap of $170 million.

Haptic Technologies

In many instances, the touchscreens, touch pads, and other interactive surfaces that people employ on a daily basis do not provide the feedback of a mechanical keyboard, a button, or switch. This lack of context and/or confirmation can lead to errors when interacting with a touch surface. Haptic technologies enhance these experiences by restoring tangible elements of confirmation and response. It injects a sense of realism into video games and enhances audio or visual communications. One example of this human-machine interface would be a laser range finder for golf that vibrates once the laser hits the flagstick and not something in the background.

Customers

Mobile Communications. The company’s largest end users of its technology are the top manufacturers of mobile devices in the world, including Samsung (OTCPK:SSNLF), Alphabet (GOOG, GOOGL), Sony (SONY), and Panasonic (OTCPK:PCRFY), as well as integrated circuit providers such as Awinic. Samsung is Immersion’s largest customer, although specifics as to the size of that relationship are not publicly available. In total, this customer base contributed FY21 revenue of ~$21 million, or ~60% of the $35.1 million total.

Gaming & Virtual Reality. Immersion licenses its patents to Sony and Nintendo (OTCPK:NTDOY) for use in their console gaming products, as well as the former for virtual reality. It also has licensing agreements with third-party peripheral manufacturers who provide the OEMs with steering wheels and joysticks. This vertical accounted for FY21 revenue of ~$7.4 million, or 21% of total. It should be noted that Immersion also has a relationship with Microsoft Corporation (MSFT), but due to its royalty-free, perpetual, and irrevocable license, any gain in the latter’s gaming market share will cause a decrease in the former’s revenue.

Automotive. The company also offers licenses to auto OEMs and third-party suppliers, such as ALPS Alpine, Continental (OTCPK:CTTAF), and Panasonic Automotive Systems, amongst others. These clients were responsible for FY21 revenue of ~$6.7 million, or 19% of total.

Because most mobile phone and gaming manufacturers are located overseas, Immersion generated 88% of its FY21 revenue ex-U.S., with ~80% from Asia.

Business Model

The company holds more than 1,200 issued or pending patents worldwide for its innovative haptic technology and licenses it to ~150 customers through fixed-fee license agreements and per-unit royalty contracts, as well as fees for support or other services. However, it now spends stunningly little on research and development ($4.2 million in FY21 and $864,000 in 1H22), having reduced the number of employees every year since YE15; thus indicating that it intends to live off its current patent portfolio. Owing to its licensing model, finite number of licensees, and insignificant R&D effort, Immersion currently employs 26 people on a full-time basis – 22 in the U.S. and Canada – down from 156 at YE15.

Predictably, its revenue has flatlined between $30 million and $36 million every year since FY17, with the exception of FY18, when a settlement over patent infringement allegations with Apple Inc. (AAPL) was reached after two years of litigation, resulting in a one-time ~$76 million bump for Immersion.

Apple is one example of the company’s focus on protecting its patent portfolio by suing companies that employ its technology without a license. The end result of these efforts is typically a licensing agreement. Continuing with this approach, Immersion sued Meta Platforms, Inc. (META) in May 2022, accusing it of infringing on six patents covering haptic effects in its augmented reality and virtual reality (AR/VR) headsets. It has been dubbed a “patent troll” by detractors.

That said, Immersion signed a license agreement with ELAN Microelectronics without a lawsuit on August 2, 2022, providing it an entrée into laptop OEMs through the latter’s touch-screen technology. It also closed a multi-year renewal license with Google/FitBit in July 2022 after suing them for the initial license in 2017.

2Q22 Earnings

With potential further penetration of the AR/VR and an entrée into personal computing, the company reported a 2Q22 loss of $0.03 a share (non-GAAP) on revenue of $8.0 million versus a gain of $0.23 a share (non-GAAP) on revenue of $11.0 million. Management commentary was succinct, calling the quarter “productive,” citing the Meta Platforms lawsuit – which, if successful, would likely compel other AR/VR headset makers to set up a royalty agreement with Immersion – and two events (Google and ELAN) that occurred after the close of the quarter for its productivity.

Balance Sheet & Analyst Commentary:

The other part of Immersion’s business model appears to involve financial asset trading. The company cited market volatility for the $4.1 million decline in the marketable securities line of its balance sheet during 2Q22. It has fared better buying and selling its own stock, acquiring 1.22 million shares of IMMR at an average price of $4.90 in 1H22. The buyback come on the heels of the company selling 3.2 million shares at an average price of ~$7.25 a share net of commissions in FY21 after it repurchased 4.9 million shares at an average cost of $6.21 in FY20. Overall, its debt-free balance sheet held cash and marketable securities of $136.9 million on June 30, 2022.

Immersion’s relationship with the Street is quasi-nonexistent, as it does not participate in conference calls and (according to Colliers analyst Derek Soderberg) is disinterested in talking to Street analysts post-earnings. Not surprisingly, Mr. Soderberg downgraded the company’s stock from a buy to a hold back in November 2021. Craig Hallum still rates Immersion a buy but did lower its price target from $12 to $10 in June 2022. It expects the company to earn $0.48 a share on revenue of $31.8 million in FY22, followed by $0.53 a share on revenue of $33.8 million in FY23.

Chief Strategy Officer William Martin and Executive Chairman of the Board Eric Singer both rate Immersion a buy, based on their recent purchases. The former has bought 223,104 shares since mid-August, while the latter acquired 137,117 over the same period. Their average prices are in the mid-$5 area. It should be noted that William Martin sold 2.2 million shares at an average price slightly above $7 in November 2021.

Verdict:

The company earns the majority of its revenue from a patent portfolio that will eventually runoff – the number of patents it held dropped from ~1,600 to ~1,200 in the six months from YE21 to June 30, 2022 – and since it puts little effort into R&D, the only way to grow its revenue is to acquire additional patent rights in foreign countries – which lends itself to uncertainty – or hope new industries emerge (such as AR/VR) requiring its current portfolio of patents. That said, a successful outcome of the Meta Platforms litigation would certainly provide another significant revenue stream or a significant one-time bump. It trades at an EV/TTM EBIT ratio of 3.2, and net of cash, the stock trades at under 4 times FY22E earnings.

That said, Immersion seems – like its top line – destined to be range-bound at best. It’s a publicly traded company that employs a business model more suited for the private arena. The timing and outcome of the Meta Platforms case is anyone’s guess but will likely take a couple of years in the courts to resolve. With new revenue streams lumpy and somewhat unpredictable, we’ll take a pass on this licensing play.

Revenge is Always Sweet, it’s the Aftertaste that’s Bitter.“― Joshua Caleb

Be the first to comment