4kodiak/iStock Unreleased via Getty Images

It is June all over again for stocks. And things may get worse than June, as the major indices reached their YTD lows last week backed by many layers of fear. Now, almost every day feels like going to the slaughterhouse. It is not far-fetched to say stocks have faced quadruple whammies over the last year or so. Inflation, War, Fed Policies, and Foreign policies have each taken the spotlight in sending stocks lower. So much that the last COVID-related selloff we recall happened in November of last year.

With fear comes panic. With panic come the opportunities for investors with these traits:

- Patience and Long-term view

- Enough capital or cash flow to survive market declines. By “survive” we mean the ability to at least retain your current standard of living. Even if that means the market going down another 50% from here.

- Belief in the underlying stock.

Amazon.com, Inc. (NASDAQ:AMZN) is one of the stocks that we believe in long term. We wrote this article back in June when the market was equally bad, suggesting investors sell puts at a price that was about 10% lower than the then-market price. By stroke of luck, Amazon has since outperformed the market handily, as Seeking Alpha has captured, as shown below. The point is not to tout such fleeting short-term “success” but rather to have the conviction to back a company you believe in through horrible market cycles.

Seekingalpha.com

In the interest of full disclosure, we did initiate a stock position in Amazon during this selloff. That is not to say we aren’t interested in increasing our exposure to Amazon at attractive prices. But what is attractive and how does one get it? What if you want to buy Amazon but at a lower price? Sure, you may use a limit order, but what if the stock never gets to that point? You remain out of the game entirely. That is where selling puts comes into the picture, where you collect a premium right away for your skin in the game.

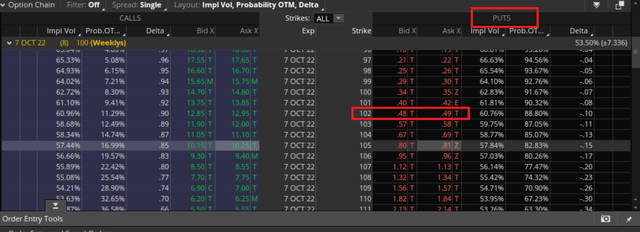

To keep things consistent with the previous article, let’s look at a strike price that is about 10% lower than the current market price. It is interesting to note that the option premium (as a percentage of the underlying cost-basis) right now is much lower than it was back in June. Let’s get into the details below.

Key data points

- Strike Price: $102

- Expiration Date: October 7th, 2022

- Premium: $0.48/share, for a total of $48.

In simple words, the put seller collects $48 to buy 100 shares of Amazon at $102 if the stock reaches $102 or below by October 7th, 2022. Bear in mind that time decay is in favor of the option seller, meaning as days go by, the option values declines.

What’s the expected return and possible outcomes?

Return: The premium collected ($48) for setting aside $10,200 represents just 0.47% for a little more than week. While any positive return in the current market is welcome, this is in stark contrast to the 1.25% return in June for comparable timeframe and strike price. How is that possible? On paper, things are at least a little worse, much worse now than in June. So, should the option seller not be paid a higher premium to undertake the risk of buying the underlying stock? The only logical answer we can come to is that the market does not believe the stock will go that low within the expiration date. That sounds like a positive affirmation to us.

Outcome #1: If Amazon stays above $102 by the expiration date, the option seller just retains mentioned above. The option seller will not be obligated to buy the shares.

Outcome #2: If Amazon goes below $102 by the expiration date, the option seller will be forced to buy 100 shares at $102, irrespective of where the stock trades at that time. Keeping the premium netted in mind, the average cost in this case will be $101.52 ($102 minus $0.48).

Outcome #3: As an option seller, one can “buy to close” anytime instead of waiting till the expiration date. That may be appealing to those who have the time and patience to play short-dated options many times over. But we typically let the option expire before choosing another chain (or another stock).

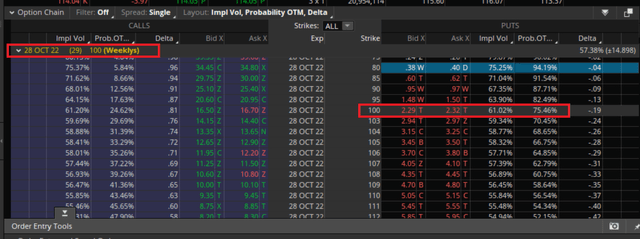

Many ways to skin the cat

The above chain was just one example. If you are looking for a higher return and a lower strike price, consider far-dated options like the one below. Our sweet spot has always been between a week and a month, as that give us enough time to react and at the same time does not tie up capital for too long.

In this example, the options seller agrees to buy 100 shares of Amazon at 100 should the stock reach that by October 28th, while collecting a premium of about $2.30 per share. A 2.3% return in a month for setting aside capital is something many would grab with both hands in the current market.

Be aware of your risks and choices

Once again, please bear in mind that if your primary interest is in getting premiums, selling puts during down-trending markets may not be the best strategy. If the market blood bath continues, your stock may reach the strike price before you blink. However, if your interest is in acquiring the stock should things fall further, this is a wise strategy. The added income through premium does not hurt either.

While AWS is flourishing, Amazon’s retail woes have been well documented. This article captures the essence of the company’s over-expansion during COVID. Amazon is also likely to face higher tax bills as a result of the new minimum tax signed by the President in August. Roughly ~$3B sounds like pocket change to a trillion dollar empire but everything adds up especially when things look depressing.

Conclusion

We were fully expecting the options premium for this exercise to be a lot higher (in terms of %) compared to June given how much shakier the market appears now. Granted, one sample is the worst anyone could go by, but this appears consistent at least within the Amazon chains we observed. The options market may be signaling that things are not as bad as feared, while yield is showing signs of topping.

Be aware of your risks, never go all in, stay invested in good companies and this too shall pass. Panic is not a strategy. Good luck.

Be the first to comment