Mohammed Haneefa Nizamudeen

Shares of up-and-coming ADC player ImmunoGen (NASDAQ:IMGN) are down 11% over the past 5 years. Despite achieving FDA approval for lead drug candidate mirvetuximab (Elahere) recently, shares have lost a third of their value over the course of 2022.

My interest in the name stems from a variety of reasons, including from a top down perspective (accelerating clinical momentum in the antibody drug conjugate space) as well as company-specific factors (achieving approval for indication of high unmet need, platinum-resistant ovarian cancer). Situations where progress is being made on BOTH commercial as well as clinical trial front can be quite lucrative IF investors enter at the opportune time. A key caveat here in terms of derisking is that I prefer situations where the evidence is clearly in our favor (sales growth and multiple data wins).

Having shared initial thoughts above, let’s dig deeper to determine whether ImmunoGen has sufficient upside potential in the near to medium term to be considered for the Core Biotech portfolio.

Chart

FinViz

Figure 1: IMGN weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares hitting a high above $10 near the peak of the biotech bubble in early 2021. From there, they’ve bounced around in the $4 to $7 range with recent weakness perhaps a bit surprising considering Elahere just received accelerated approval in a significant subset of patients with gynecological cancers. My initial take is on the cautious side, as in general for such companies (just making the transition from clinical to commercial stage) I typically suggest waiting on the sidelines until we see signs of sales growth out of the gate.

Overview

Founded in 1981 with headquarters in Massachusetts (106 employees), ImmunoGen currently sports enterprise value of ~$900M and estimated year-end cash position of $$230M providing them operational runway into 2024.

Q3 filing showed 253 million basic and diluted weighted-average common shares outstanding (up almost 25% from 204.8M for the same quarter in 2021). I don’t like that history of outsized dilution, though I realize it can be necessary in a difficult funding environment for smaller biotech companies.

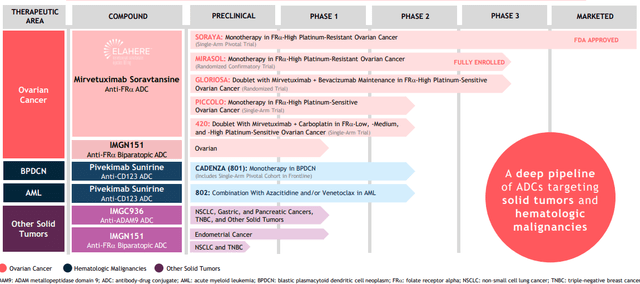

ImmunoGen is focused on developing next generation antibody-drug conjugates (ADCs) with enhanced anti-tumor activity and favorable tolerability profiles, the latter having been a hang-up for several predecessor programs in this space. Pipeline consists of multiple drug candidates addressing both solid tumors and hematologic malignancies.

Corporate Slides

Figure 2: Pipeline (Source: corporate presentation)

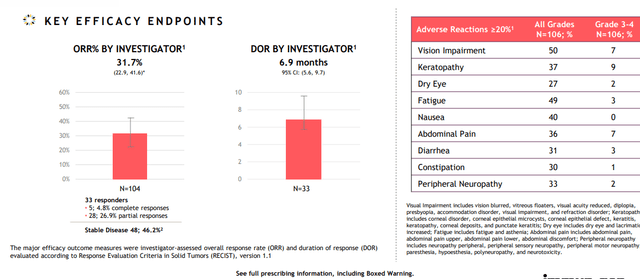

Lead candidate mirvetuximab soravtansine is a first-in-class ADC targeting folate receptor alpha (FRα), a cell-surface protein over-expressed in several epithelial tumors including ovarian, endometrial and non-small cell lung cancers. It was recently approved under the name Elahere for the treatment of patients with folate receptor alpha-positive, platinum-resistant gynecological cancers (epithelial ovarian, fallopian tube and primary peritoneal) who have undergone one to three prior systemic treatment regimens. This approval came as a result of the SORAYA single arm trial in patients whose tumors express high levels of FRα (specifically, those who were treated with up to 3 prior regimens one of which included bevacizumab). Primary endpoint of ORR was 31.7% including 5 complete responders, with responses observed regardless of prior PARP inhibitor or number of prior lines of therapy. Median duration of response (DOR) came in higher than I expected at 6.9 months. While the company calls the drug “well-tolerated” in over 700 patients treated with mirvetuximab, I think that’s a matter of perspective as treatment-related adverse events led to dose reductions in 19% of patients and dose delays in 32% of patients. To be fair, discontinuation rate was rather low (for an ADC) at 7% of patients. Most common treatment-related AEs included blurred vision (41% all grades, 6% Grade 3), keratopathy (35% all grades, 9% grade 3) and nausea.

Corporate Slides

Figure 3: SORAYA results supporting accelerated approval (Source: corporate presentation)

The MIRASOL randomized phase 3 study is ongoing and if results are positive, that would likely lead to full approval in the above setting (devil’s advocate case is that negative data would result in Elahere being pulled off the market).

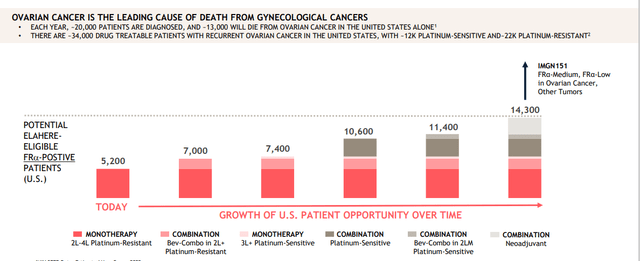

Beyond FRα-high, platinum resistant ovarian cancer in patients with 1+ prior lines of therapy, the chosen strategy is to move forward with expansion studies to position mirvetuximab as the combination agent of choice in ovarian cancer. To that end, PICCOLO single arm monotherapy study is underway in later-line platinum sensitive patients. Promising data has also been generated in recurrent platinum-sensitive disease with carboplatin combination with supportive investigator-sponsored trials (ISTs) underway in the neoadjuvant setting and in a randomized study comparing the combo to standard of care in patients with recurrent platinum-sensitive disease. Immunogen also plans to initiate a company-sponsored phase 2 study of the combo in patients with FRα low, medium and high patients with platinum-sensitive disease. Additionally, mature data from phase 1b FORWARD II study of mirvetuximab plus Avastin in recurrent ovarian cancer was the subject of oral presentation at ASCO in 2021, showing 64% ORR, 11.8-month median DOR and 10.6-month median PFS (progression free survival). Management believes such data sets could support compendia listing for this combination in close proximity to initial monotherapy approval. They’ve also aligned with the FDA on GLORIOSA phase 3 study design for mirvetuximab bevacizumab combo in maintenance setting of FRα-high recurrent platinum-sensitive disease.

Corporate Slides

Figure 4: Ovarian cancer opportunity is significant in aggregate across multiple indications and treatment settings (Source: corporate presentation)

Moving on to CD123-targeting IMGN632 otherwise known as pivekimab sunirine, I remember this candidate as prior it was the subject of 2017 collaboration with Jazz Pharmaceuticals (JAZZ) who then decided in 2020 to opt out. For what it’s worth, initial deal terms included $75M upfront payment and ImmunoGen’s right to co-commercialize in the US. Again, pivekimab is now a wholly-owned asset and is being developed in studies for patients with blastic plasmacytoid dendritic cell neoplasm (BPDCN) and acute myeloid leukemia (AML).

CD123 has traditionally been a troubled target for development given associated toxicities. BPDCN is an indication readers might recall as prior ROTY holding Stemline Therapeutics (STML) was bought out for up to $677M by Menarini Group to gain control of its drug Elzonris first approved for this indication. BPDCN is a rare blood cancer with annual incidence of just 500 to 1,000 patients in the US and pivekimab was granted Breakthrough Therapy designation back in 2021 for treatment of patients with relapsed or refractory disease. Based on FDA’s feedback, ongoing phase 2 CADENZA study includes a new cohort of up to 20 frontline BPDCN patients and prior poster highlighted 3 such patients who all achieved clinical complete response (CRC). Phase 1b/2 trial is evaluating pivekimab combo with azacytidine and venetoclax in patients with relapsed and frontline CD123-positive AML. Oral presentation at ASH 2021 showed 48% ORR with composite complete remission (CCR) rate of 30%. Interestingly, higher intensity cohorts showed higher response rates including 59% ORR and 38% CCR. FLT3 mutant subset (n=9) achieved better results with 89% ORR and 78% CCR rate. Importantly, there were no cases of tumor lysis syndrome, veno-occlusive disease, capillary leak, or cytokine release observed. Readers may recall that capillary leak syndrome was a key concern for Elzonris when it was approved in BPDCN. Still, safety profile here was far from benign with most common treatment emergent AEs of any grade seen in >20% of patients including febrile neutropenia, dyspnea, fatigue, hypophosphatemia, diarrhea, hypokalemia, nausea, vomiting, and pneumonia.

As for earlier stage assets, IMGC936 is being co-developed with MacroGenics (MGNX) and targets ADAM9, which is highly interesting considering its overexpression in a broad range of solid tumors and suspected role in tumor progression and metastasis. Initial data in 2023 could be a needle-moving catalyst, though devil’s advocate stance is that it will take expansion cohorts (if warranted) to truly tease out a meaningful signal of activity.

IMGN151 is the company’s next-generation anti-FRα candidate that could address a much broader patient population than mirvetuximab (patients with lower expression levels of FRα as well as other tumor types outside of ovarian cancer such as NSCLC). In February 2022, the FDA placed a clinical hold on their IND application pending CMC (chemistry, manufacturing and controls) information requests. Per Q3 report, follow submission of supplemental information to the FDA the company hopes to begin enrollment of phase 1 study.

Select Recent Developments

In February, ImmunoGen announced global, multi-year licensing agreement with Eli Lilly (LLY) granting them exclusive rights to research and develop ADCs directed to targets selected by Lilly based on ImmunoGen’s novel camptothecin technology. ImmunoGen received upfront payment of just $13M and also stands to receive up to $32.5M in exercise fees depending on number of targets licensed and up to $1.7B in total milestone payments plus tiered royalties. The objective of the camptothecin linker payload is to deliver wider therapeutic window with improved safety and efficacy.

In June ImmunoGen announced multi-year collaboration with Oxford BioTherapeutics to research novel, first-in-class ADCs utilizing proprietary linker-payload technology directed to novel targets via OBT’s OGAP discovery platform. Research and development efforts will be joint-funded, with OBC receiving upfront payment reflecting preclinical programs to be included in the collaboration. After antibodies generated by OBT have been coupled with linker-payload technology from ImmunoGen, each company will be able to select one or more development programs to advance on their own (the other being due milestone payments plus tiered royalties). Interestingly, OBT already has experience with ImmunoGen’s ADC platform and DM4 payload incorporated in its lead ADC program OBT076 currently in clinical trials as a monotherapy and in combination with checkpoint inhibitors in patients with advanced or refractory solid tumors, including gastric, bladder, ovarian, and lung cancer.

In November the company announced that SVP and Chief Commercial Officer Kristen Harrington-Smith is leaving the company to pursue a new opportunity closer to her home. Skeptics might not accept this explanation, suggesting such a departure in initial innings of drug launch could be a red flag. In the meantime, VP of Market Access Todd Talarico is serving as interim leader of commercial organization as search continues for a new permanent CCO.

Other Information

In November the company reported estimated year-end cash and equivalents of $230M to $240M. This contrasts poorly to operating expenses of $320M to $330M for the full year and revenues in the range of $80M to $90M. Management continues to suggest operational runway will last into 2024, but again I expect further dilution will be necessary in the near term.

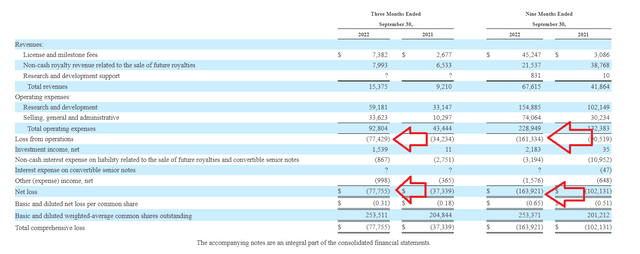

Total revenues for Q3 increased by ~50% to $15.4M driven by greater license and milestone fee revenue from Lilly and Novartis collaborations. Operating expenses for the quarter doubled to $92.8M, driven by increases in personnel and manufacturing costs related to US launch of mirvetuximab (also greater clinical trial costs). Net loss for the quarter more than doubled to $77.8M. Q3 cash position was down a third to $309M (from year end 2021 cash position of $478.8M).

10-Q filing

Figure 5: Increasing losses are concerning in context of dwindling cash pile (Source: 10-Q filing)

Again, putting the pieces together it’s clear that expenses are potentially getting out of control as the company ramps up spending on both commercial launch as well as clinical studies to expand label to new indications. Accumulated deficit since inception of $1.635 billion also reflects poorly on management’s stewardship of resources.

As for upcoming catalysts, it is interesting that for IMGC936 they aim to complete dose escalation and report initial data before year-end (expectations still on the low side given lack of clarity to date on this asset). Oral presentation at ASH in December will share data for the pivekimab combo with azacitidine and venetoclax in both relapsed and frontline unfit AML expansion cohorts (likewise not thinking this is a needle-mover). In early 2023, the company plans to submit data covering mirvetuximab monotherapy and bevacizumab combination regimens for potential inclusion in National Comprehensive Cancer Network (NCCN) Clinical Practice Guidelines (could lead to sales acceleration in coming years if accepted). MIRASOL top-line data is expected in early 2023 (would support full approval n FRα-high patients with PROC). To my eyes, none of these is a big needle-mover except IMGC936 which I see as a call option of sorts. Accelerating sales growth for Elahere, if and when it occurs, would then be the necessary catalyst for share price to rebound higher.

Moving on to nuggets from other presentations, here are a few from November’s conference call related to Elahere approval:

- Importantly, approved indication statement does not require prior treatment with Avastin (effectively doubles eligible patient population relative to SORAYA eligibility criteria). Elahere is the first FRα-targeting ADC approved in ovarian cancer. It’s also the first new drug approved specifically for platinum-resistant disease since 2014. Interestingly, this is the 3rd ADC approved using the company’s platform (following Roche’s Kadcyla and Sanofi’s Sarclisa).

- Market opportunity is highly concentrated with ~4300 physicians treating over 80% of ovarian cancer patients in the US. At launch they will focus initially on 400 physicians who treat ~1/3rd of patients. Initial market opportunity is in the platinum resistant setting where there 19,500 drug-treatable patients of whom 35% to 40% express high levels of FRα. 75% of these patients currently receive either single agent chemo or non-bevacizumab regimens. This equates to eligible patient population of ~5,200 patients. They have submitted to NCCN compendia listing approved indication as well as bevacizumab combination in platinum resistant setting (would add 1,800 FRα-high patients to the market opportunity). There is NOT an existing group of FRα-positive patients identified to initiate therapy on Day 1 of launch, so adoption will be driven in part by patient identification efforts (sounds like a slow launch is expected out of the gate). Average time to initiate Elahere is estimated to be 2 to 3 weeks from time of ordering FRα test to initial dosing with turnaround time of testing of 3 to 5 days. As for pricing, wholesale acquisition cost of 20mg vial will be $6,220. Most patients receive 3 to 4 vials per cycle resulting in price of $18,500 to $25,000 per cycle.

- Guidance for cash runway includes spend for launch (most upfront building costs were incurred in 2022, now it’s a more steady state runway in 2023).

- Label calls for baseline eye exams and exams every other cycle up to 8 cycles (could be an obstacle to early growth as well). Tivdak (ADC from Seattle Genetics used in cervical cancer) has more stringent requirements with eye exam necessary before every course of treatment.

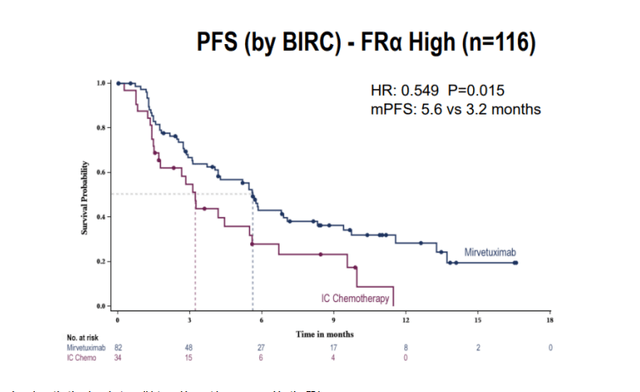

- As for what’s meaningful for upcoming data for mirvetuximab in MIRASOL, primary endpoint is PFS. It’s designed to detect hazard ratio of 0.7 (conservative compared to what they observed in FORWARD-I with hazard ratio of 0.6). FORWARD-1 control arm had mPFS of 3.2 months and FRα-high patients on mirvetuximab arm had mPFS of 5.6 months. Analyst playing devil’s advocate notes the difference is just 2 months. Management points to totality of benefit, separation of PFS curves and particularly tail of the curve which is a better reflection of benefit (see responses quickly, over 70% of patients have tumor shrinkage and even stable disease is meaningful in platinum resistant disease). They will have early overall survival data for MIRASOL (already showed strong trend favoring mirvetuximab over investigator’s choice chemotherapy in FORWARD I).

SGO Slides

Figure 6: PFS in FORWARD I for exploratory FRα-high subgroup (Source: SGO slides)

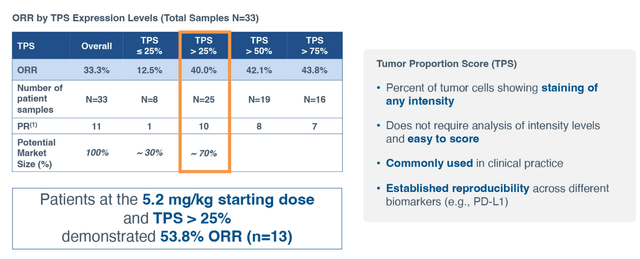

As for competition, two ADC companies also pursuing development in ovarian cancer that come to my mind are Sutro Biopharma (STRO) and Mersana Therapeutics (MRSN). Starting with Sutro’s FRα-targeting STRO-002, they plan to disclose study design for registration-enabling phase 2 trial in patients with ovarian cancer in the near term. Phase 1 data in heavily pretreated patients unenriched for FRα expression yielded a very respectable 33% ORR (by the strict RECIST v1.1). While ocular toxicities were not an issue, asymptomatic neutropenia was the leading TEAE resulting in treatment delay or dose reduction. As for differentiation versus mirvetuximab, Sutro’s management claims that STRO-002 would be able to treat a much broader patient population (TPS score above 25% would equate to nearly double the opportunity versus only FRα-high).

Sutro presentation

Figure 7: Exploratory analysis suggests TPS score above 25% is correlated with higher response to STRO-002 (Source: Sutro Biopharma presentation)

At Jefferies presentation in November, CEO Bill Newell commented negatively on Immunogen noting that they had to winnow their therapeutic window down and could dose effectively only at the 6 mg/kg dose. They also had to narrow their patient population down to only the highest expressors. STRO-002 was able to generate good responses in patients with lower expression levels at 4.3mg/kg and 5.2 mg/kg doses. Exploratory analysis showed that TPS score above 25% achieved much better response rates versus lower than 25%. Newell again notes that 54% ORR is much higher than Immunogen’s ORR in highest of the high expressors.

As for Mersana Therapeutics, I’ll be better able to gauge the extent of competition their NaPi2b-targeting ADC UpRi could pose after topline data is reported from the UPLIFT pivotal study in mid 2023 (also pursuing the approval in platinum-resistant ovarian cancer). If successful, BLA filing would follow 1H 24. The company is also aggressively moving forward with studies intended to support expansion into additional indications such as monotherapy maintenance following treatment with platinum doublets in recurrent platinum-sensitive ovarian cancer.

As for institutional investors of note, clustering here could be a green flag with Deerfield owning 6.7% stake, RA Capital maxed out at 9.99% stake and Adage Capital Partners with 5.25% stake to name a few. On the other hand, history of insider sales does not inspire confidence. President & CEO Mark Enyedy owns ~436,000 shares (significant skin in the game) while Chief Medical Officer Anna Berkenblit owns ~110,000 shares.

As for relevant leadership experience, President and CEO Mark Enyedy served prior as EVP Head of Corporate Development at Shire. CFO Susan Altschuller served prior as Head of Enterprise Finance at Alexion Pharmaceuticals. Chief Business Officer Stacy Coen served prior as VP Head of Rare Disease Business Development and Licensing at Genyzme. SVP Head of Market Access Mimi Huizinga served prior as SVP Head of US Oncology Medical at Novartis. A bit more credibility also comes from having current EVP & COO of Vertex Pharmaceuticals (VRTX) Stuart Arbuckle on the board of directors.

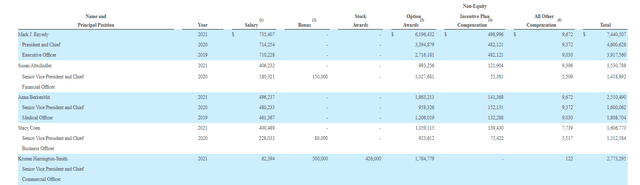

Moving on to executive compensation, cash portion of salary seems on the high side for CEO at over $735,000 as do option awards at over $6.1M (considering this small cap company is trying to conserve cash resources for launch expenditures not to mention studies to expand the label). On the other hand, cash portion of salary and level of option awards are more than reasonable for other members of the executive team.

Proxy Filing

Figure 8: Executive compensation table (Source: proxy filing)

Moving onto useful nuggets from members of the ROTY community, TwoJ stated the following on August 20th:

I have a full position in IMGN. They have a coherent strategy for mirvetuximab as a monotherapy in platinum resistant ovarian cancer with high levels of folate receptor and they are expanding into every possible niche in ovarian cancer with multiple read outs over the next two years as well as a pivotal read out for anti-CD123 ADC in frontline BPDCN this winter. RA Capital has a large position which led to my due diligence. I think commercialization of mirvextuximab will go well as most academic centers are familiar with the therapy and there aren’t any alternate therapies for ovarian cancer. They will also have first mover advantage in high folate ovarian cancer and are looking at all levels of folate expression in combination with platinum.

As for IP, Immunogen has robust intellectual property portfolio comprising nearly 1,500 issued patents and over 600 pending patent applications worldwide. The company’s tubulin-acting maytansinoid, DNA-alkylating IGN, and DNA-acting camptothecin cytotoxic payload agent technologies are considered to be key components of their overall patent strategy. They currently own 22 issued U.S. patents covering various embodiments of the maytansinoid technology including those with claims directed to certain maytansinoids, including DM4 and DM21, and methods of manufacturing of DM1, DM4, and DM21. Issued patents are expected to remain in force until up to 2038. With regard to IGN payload agents, they have 35 issued U.S. patents covering various aspects of their DNA-acting cytotoxic payload agents, which will expire at various times between 2030 and 2042. As for camptothecin agents, they have an issued U.S. patent covering various aspects of camptothecin cytotoxic payload agents, which expires in 2040. They also have 22 issued patents related to their linker technologies, including methods of making the linkers and antibody maytansinoid conjugates (expected to remain in force between 2023 and 2034). They also have 20 issued U.S. patents covering methods of assembling ADCs from their constituent antibody, linker, and cytotoxic payload agent moieties (to expire between 2026 and 2040).

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), it’s worth noting that Immunogen has a history of issuing pre-funded warrants to select institutional holders like it did in August 2021 selling pre-funded warrants to purchase 5.4M shares of common stock for $5.51 per share (to RA Capital Healthcare Fund) and following that in December’s public offering (to RA Capital and Redmile Group, pre-funded warrants to purchase up to 16M shares and 11.3M shares at $6.60/share, respectively).

Finally, looking at the story from a different angle, for the bear case the key concern could be a slow launch out of the gate (will take time for FRα testing to become more widely accepted). It’s also important to keep a close eye on competitor programs such as Sutro (could address a wider slice of the FRα market including lower expressors) and Mersana Therapeutics (pivotal readout for novel target NaPi2b expected next year).

Final Thoughts

To conclude, with market capitalization of $1.1B and EV of ~$900M, I appreciate that Immunogen has a first-mover opportunity with Elahere in an indication (platinum-resistant ovarian cancer) of high unmet need. Approval label on the whole appears broad, but again keep in mind the therapy will be initially limited to just FRα-high expressors. I remain skeptical of pivekimab’s ultimate market opportunity considering troublesome tolerability profile for CD123-targeted drugs not to mention small size of the BPDCN market. There’s high optionality in the pipeline with ADAM9-targeting IMGC936 and IMGN151 could address a much broader patient population in ovarian cancer as well as other tumor types with FRα expressors.

For readers who are interested in the story and have done their due diligence, IMGN is a Buy and I suggest initiating a pilot position in the near term. A prudent strategy could be to wait until MIRASOL confirmatory readout before adding more exposure and then rounding out one’s position only when there’s concrete proof that Elahere launch is going well (waiting until there’s accelerating sales growth).

From a Core Biotech perspective (emphasis on next 3 to 5 years), I like the ADC space and value proposition of Elahere in ovarian cancer as well as the company’s novel technologies. I would need to see accelerating sales growth before considering initial purchase and would also like to gain more visibility on the market potential of earlier-stage drug candidates such as ADAM9.

Key risks include additional dilution in the near to medium term, slow launch out of the gate (especially if it takes time for FRα testing to become more broadly utilized), increasing cash burn due to launch and expansion studies as well as competition from the likes of Sutro Biopharma and Mersana Therapeutics, to name a few. I didn’t even touch on MORAb-202 from Bristol Myers Squibb (BMY), which achieved 52% ORR in higher dose expansion cohort in Japanese PROC patients (efficacy irrespective of FRa levels, thanks Bio_clouseau). This candidate was originally obtained via 2021 deal with Eisai for $650M plus up to $2.45B in milestone payments and includes profit split in collaboration territories. A prior phase 1 study showed partial responses achieved in breast, endometrial and lung cancer in addition to ovarian cancer (hinting at broader utility).

OTHER LINKS OF INTEREST

Exploiting the folate receptor α in oncology

Safety and efficacy of MORAb-202 in patients (pts) with platinum-resistant ovarian cancer (PROC): Results from the expansion part of a phase 1 trial.

The pleiotropic roles of ADAM9 in the biology of solid tumors

Author’s Note: I greatly appreciate you taking the time to read my work and hope you find it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment