gorodenkoff/iStock via Getty Images

A Quick Take On Qualys

Qualys, Inc. (NASDAQ:QLYS) recently reported its financial results on May 4, 2022, slightly beating revenue estimates and handily exceeding expected earnings.

The company provides a wide range of IT security software and related services to enterprises worldwide.

Given macroeconomic uncertainties and an apparently fully-valued stock valuation, I’m on Hold for QLYS in the near term.

Qualys Overview

Foster City, California-based Qualys was founded in 1999 to create an integrated platform that provides organizations with a holistic view of their IT applications for monitoring, security and compliance purposes.

The firm is headed by President and CEO, Sumedh Thakar, who has been with the firm since 2003 and was previously a software engineer at Intacct and Patni Companies.

The company’s primary offerings include:

-

Infrastructure security

-

Endpoint security

-

DevOps

-

Compliance

-

Web app security

The firm acquires customers through direct sales efforts for large customers as well as through a robust partner program including resellers, consultants, integration partners and managed service providers.

Qualys’s Market & Competition

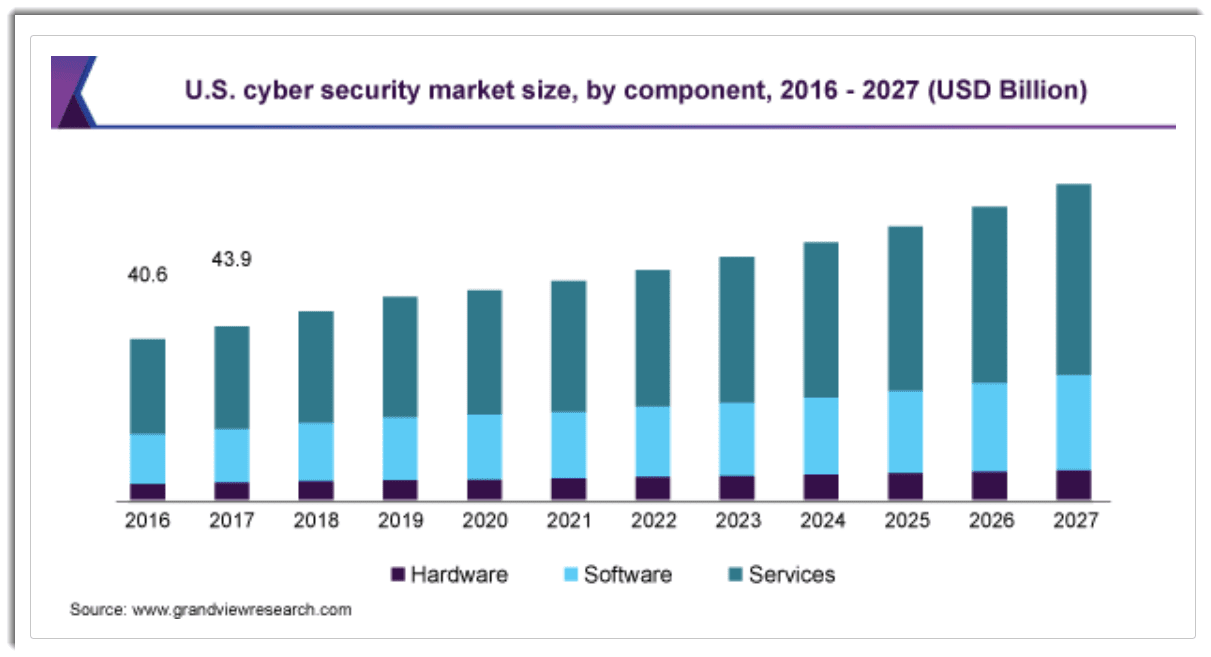

According to a 2020 market research report by Grand View Research, the global market for cybersecurity software and services was an estimated $157 billion in 2019 and is expected to exceed $300 billion by 2027.

This represents a forecast CAGR of 10.0% from 2020 to 2027.

The main drivers for this expected growth are constantly changing cyber threats against a backdrop of more complicated consumer and enterprise software requirements and infrastructures.

Also, the transition of enterprise IT from on-premises to the cloud will create significant new opportunities for new services and capabilities.

Below is a chart showing the historical and projected U.S. cybersecurity market dynamics by component:

U.S. Cyber Security Market (Grand View Research)

(Source)

Major competitive or other industry participants include:

-

CrowdStrike

-

Rapid7

-

Tenable

-

VMware

-

McAfee

-

Symantec

-

Microsoft

-

Palo Alto Networks

-

Others

Qualys’s Recent Financial Performance

-

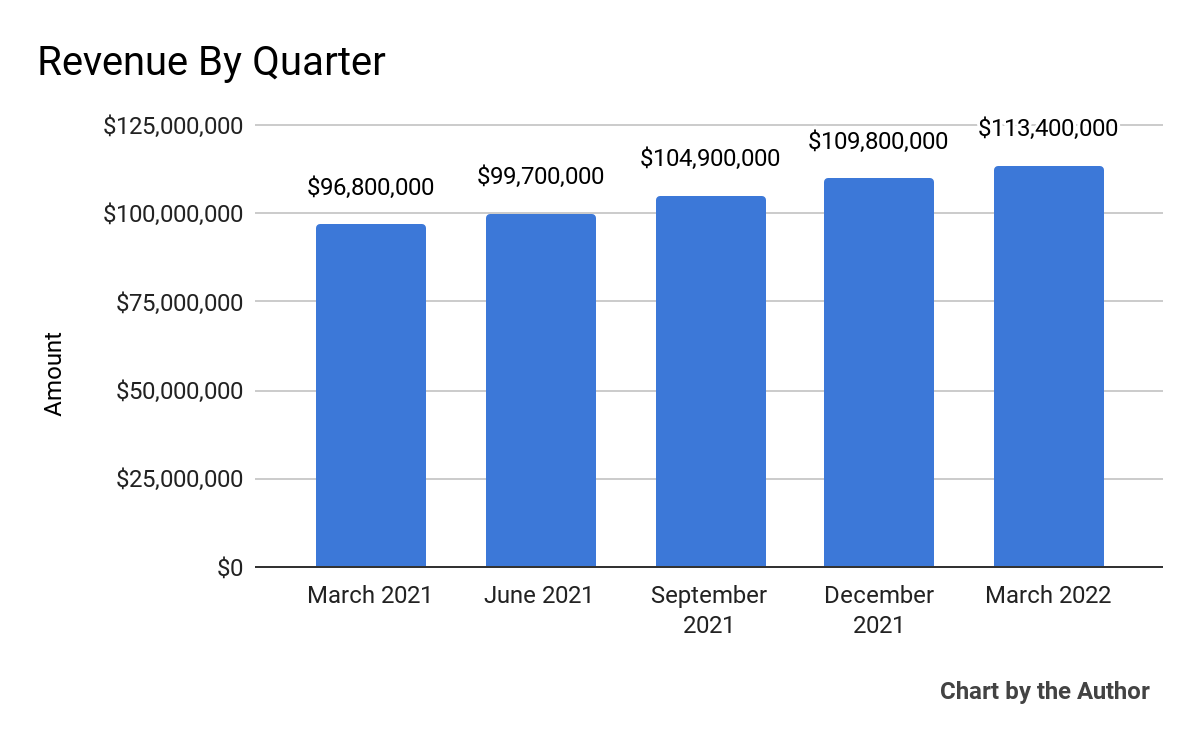

Total revenue by quarter has grown consistently over the past 5 quarter period:

5 Quarter Total Revenue (Seeking Alpha)

-

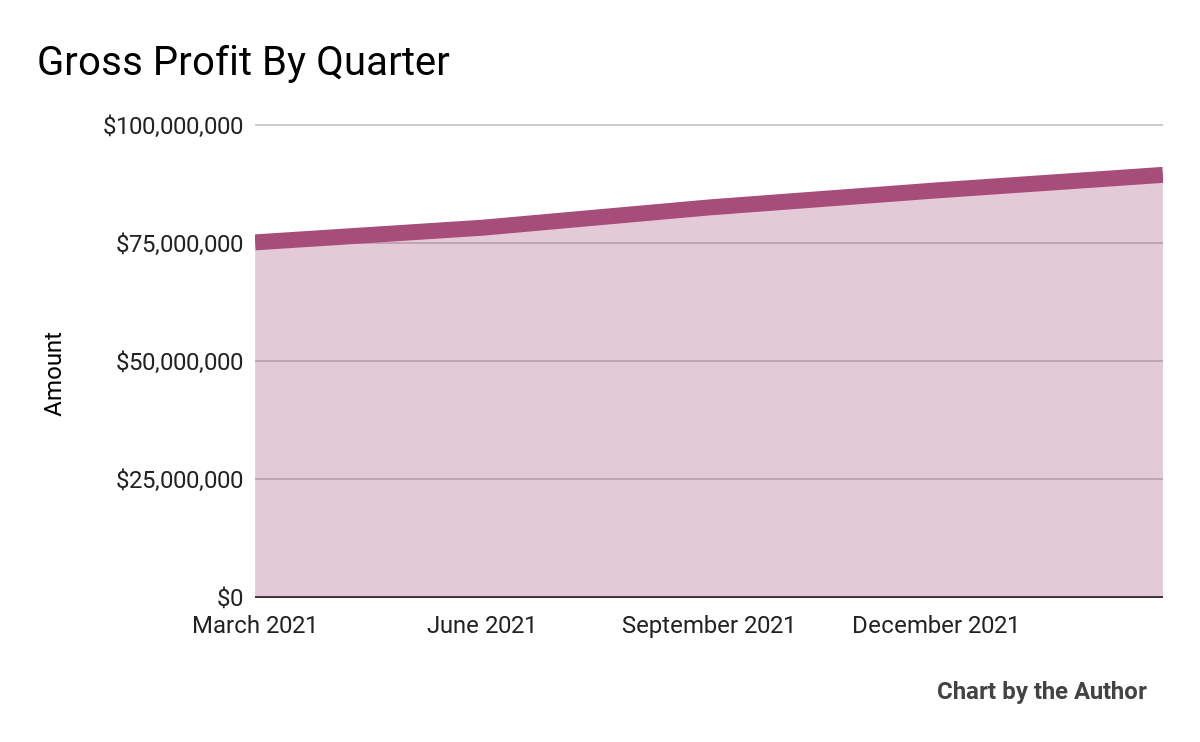

Gross profit by quarter has also grown steadily in recent quarters:

5 Quarter Gross Profit (Seeking Alpha)

-

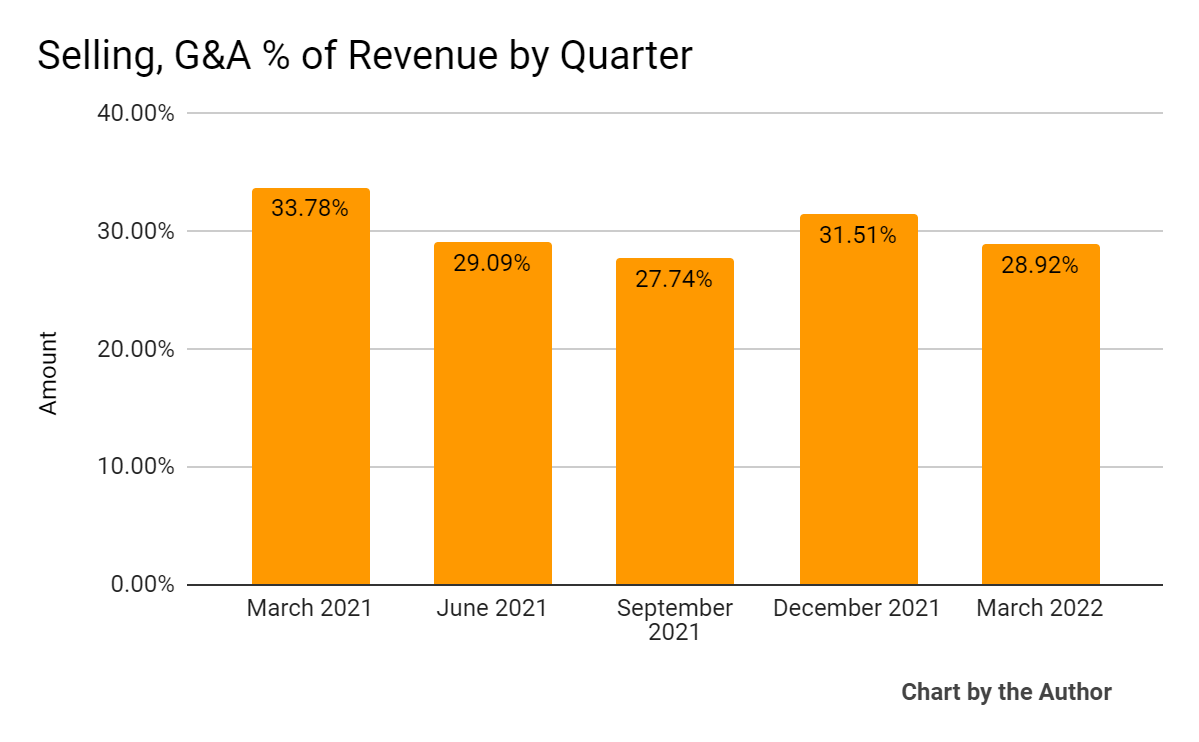

Selling, G&A expenses as a percentage of total revenue by quarter have trended downward slightly:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

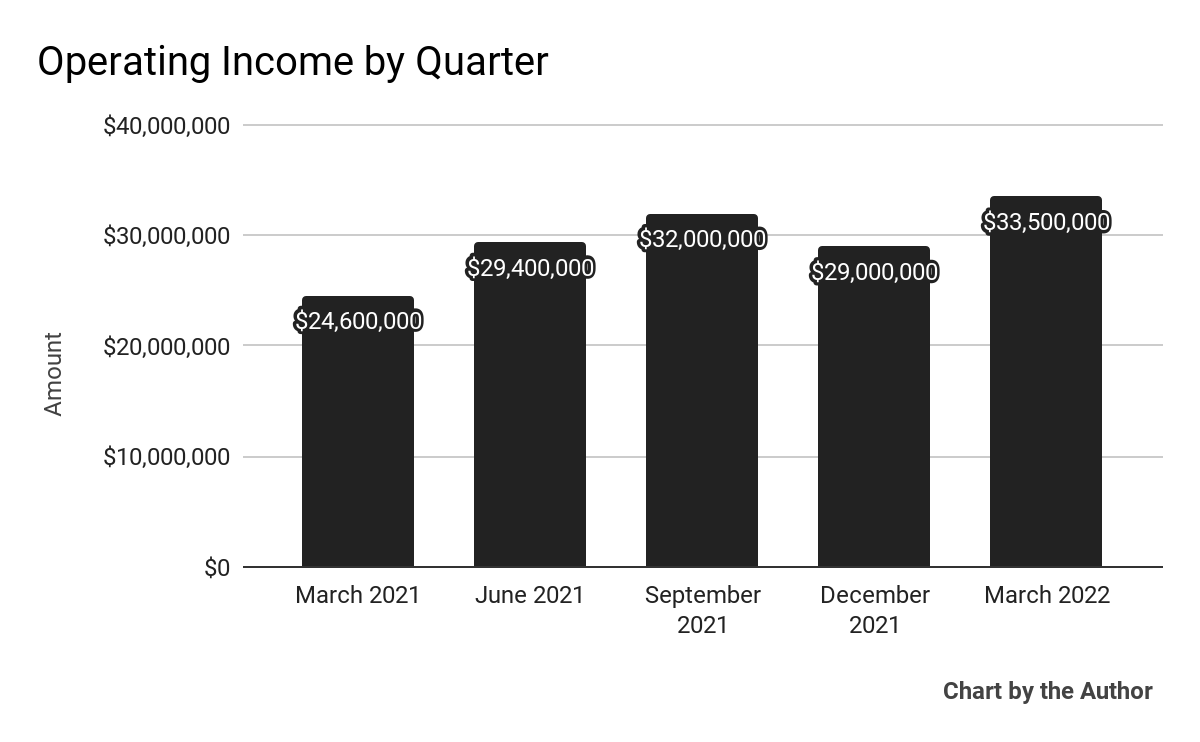

Operating income by quarter has trended upward in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

-

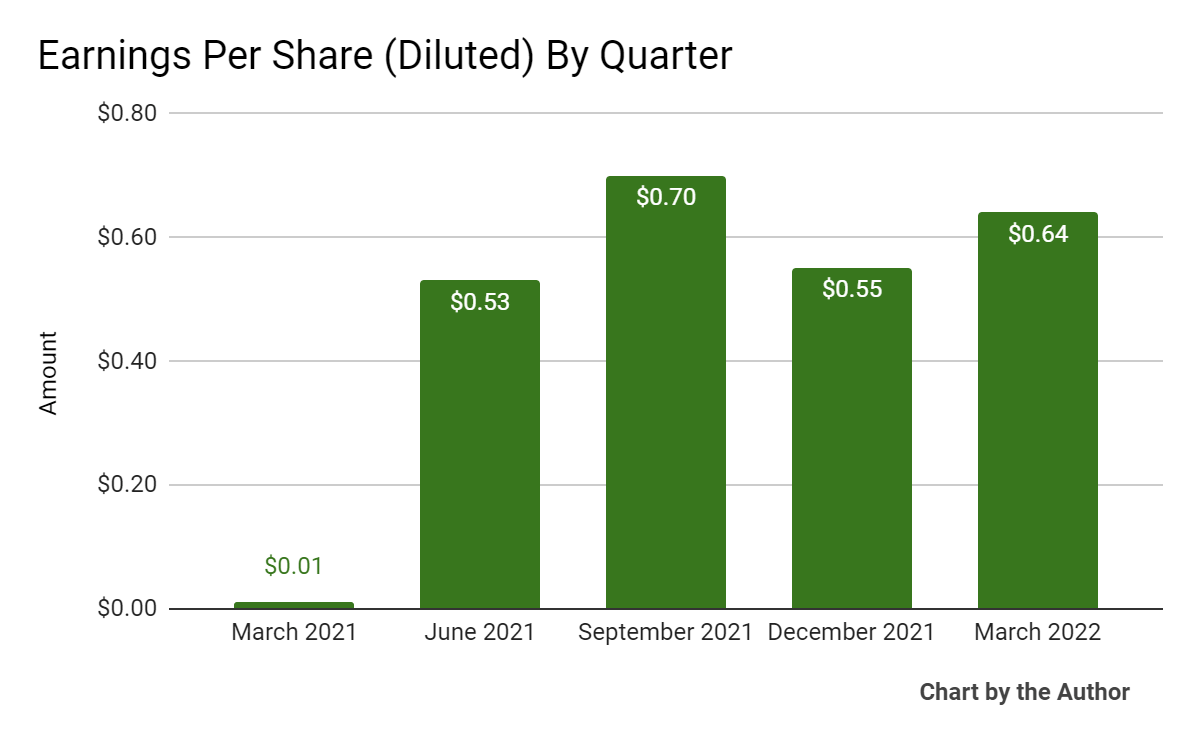

Earnings per share (Diluted) have been as follows:

5 Quarter Earnings Per Share (Seeking Alpha)

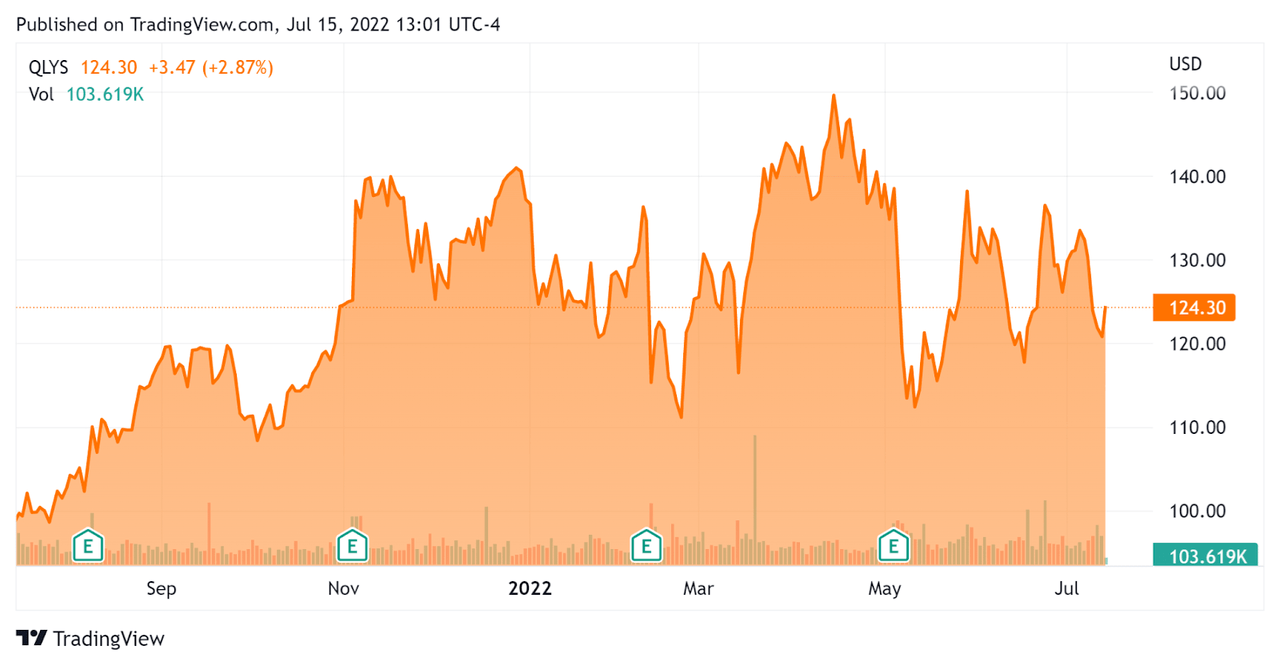

In the past 12 months, QLYS’s stock price has risen 26 percent vs. the U.S. S&P 500 Index’s drop of around 11.6 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Qualys

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$4,240,000,000 |

|

Market Capitalization |

$4,730,000,000 |

|

Enterprise Value/Sales (TTM) |

8.73 |

|

Price/Sales (TTM) |

11.01 |

|

Revenue Growth Rate (TTM) |

14.56% |

|

Operating Cash Flow (TTM) |

$221,800,000 |

|

CapEx Ratio |

8.60 |

|

Earnings Per Share (Fully Diluted) |

$2.42 |

(Source – Seeking Alpha)

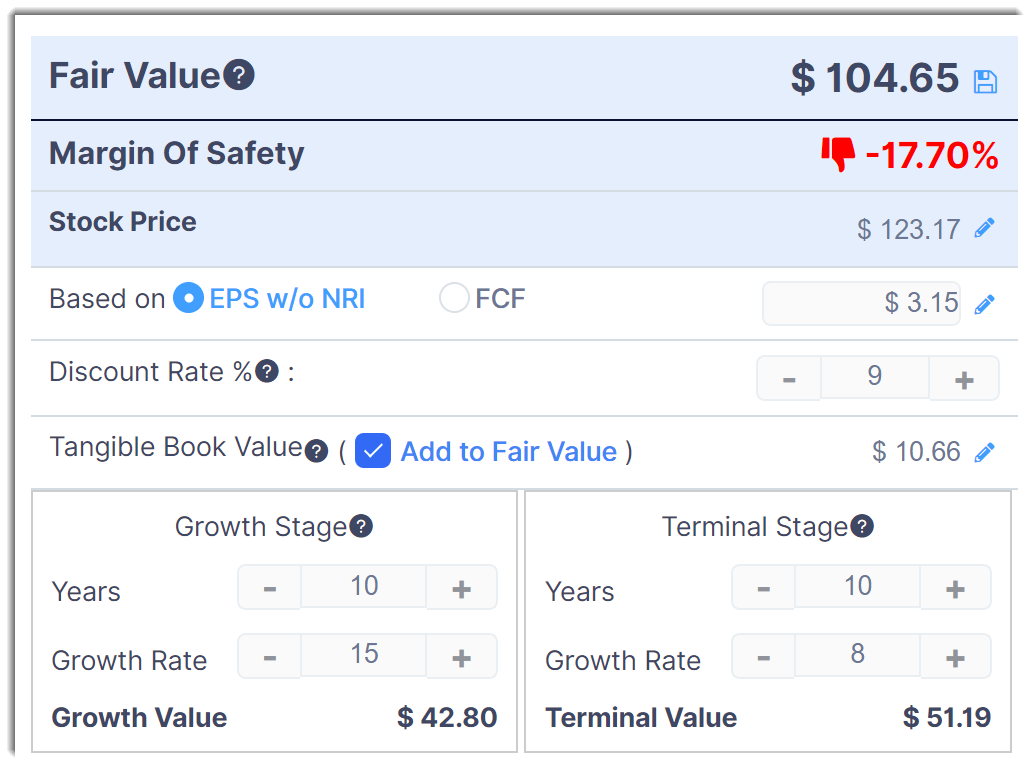

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

QLYS DCF Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $104.65 versus the current price of around $123, indicating they are potentially currently overvalued, with the given earnings, growth and discount rate assumptions of the DCF.

As a reference, relevant partial public comparables would be Rapid7 (RPD) or Tenable (TENB); shown below is a comparison of primary valuation metrics:

|

Metric |

Qualys |

Tenable |

Rapid7 |

|

Enterprise Value/Sales (TTM) |

8.73 |

8.69 |

8.05 |

|

Price/Sales (TTM) |

11.01 |

8.63 |

6.65 |

|

Operating Cash Flow (TTM) |

$221,800,000 |

$91,000,000 |

$43,730,000 |

|

Revenue Growth Rate |

14.6% |

25.3% |

32.4% |

(Source – Seeking Alpha)

A full comparison of the three companies’ various performance metrics may be viewed here.

Commentary On Qualys

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its integrated, single-agent product approach as organizations face increased threats such as ransomware and cyberwarfare.

CEO Thakar also noted that 40% of the company’s customer base has deployed its VMDR (Vulnerability Management, Detection and Response) system.

Customers that have deployed VMDR also have the ability to try out and subscribe to Qualys’ other application via only “a click of the button.”

Management also focused on its consolidated approach to providing a one-stop-shop for so many security needs as part of a multi-year trend by customers to reduce and simplify their IT vendor list.

As to its financial results, revenue grew by 17% year-over-year and the company’s sequential net dollar expansion rate was 110%, a material improvement from 103% in Q1 2021.

Average deal size continued to increase for both new and existing customers and calculated current billings grew 22%.

Free cash flow for Q1 was an impressive $71.4 million, leading the company board to authorize an additional $200 million increase to its share repurchase program.

Looking ahead, the firm intends to increase its Sales and Marketing spend to “support long-term growth in the business,” which will include adding headcount and accelerating its digital marketing efforts.

Management raised revenue guidance for the year to an expected 18% growth over 2021 and raised EPS guidance to a midpoint of $3.15.

Regarding valuation, the market is currently valuing QLYS at the high end versus competitors Tenable or Rapid7.

A DCF as shown above indicates the shares may be fully valued even at the raised EPS guidance for the rest of 2022.

The primary risk to the company’s outlook is a potential recession either already underway or occurring later in 2022, which may slow sales cycles and lower revenue growth estimates.

A possible upside catalyst is that any recession is shallow and may allow the firm to add headcount more easily and cost-effectively, improving net results accordingly.

While QLYS appears to be growing smartly, I’m cautious about the effects of a recession on its growth trajectory over the next 6 – 12 months.

Also, the stock’s current valuation isn’t cheap.

Given macroeconomic uncertainties and an apparently fully-valued stock valuation, I’m on Hold for QLYS in the near term.

Be the first to comment