Ingo Dörenberg/iStock via Getty Images

Earnings of First Guaranty Bancshares, Inc. (NASDAQ:FGBI) will likely trend upwards this year on the back of continued loan growth. Strength in regional markets will likely drive the loan portfolio. On the other hand, the above-normal provisioning expense will likely restrain earnings growth. Meanwhile, the margin will likely remain somewhat stable for the remainder of the year. Overall, I’m expecting First Guaranty Bancshares to report earnings of $2.58 per share for 2022. Compared to my last report on the company, I have barely changed my earnings estimate. The year-end target price suggests a decent upside from the current market price. Based on the total expected return, I’m maintaining a buy rating on First Guaranty Bancshares.

Loan Growth to Start Slowing Down by the End of the Year

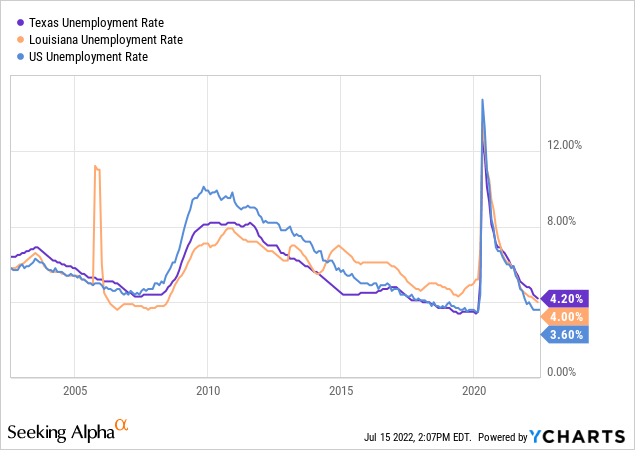

First Guaranty Bancshares reported robust loan growth of 3.4% in the first quarter of 2022, or 13.4% annualized. Strong job markets will ensure that loan growth remains at a decent level through the mid of 2022. First Guaranty Bancshares is based in Texas and Louisiana. Although both states have greater unemployment than the national average, their unemployment rates have improved significantly and are almost back to the 2018 level.

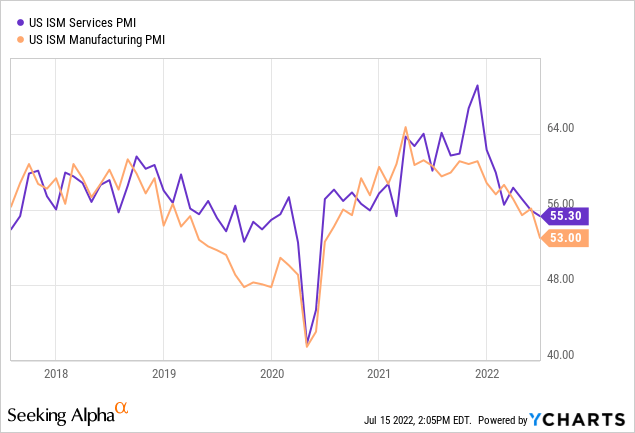

First Guaranty Bancshares’ loan book is heavy on commercial real estate (“CRE”) and commercial and industrial loans (“C&I”). Therefore, the PMI index is also a good gauge of loan demand. As shown below, the indexes are still above 50, which bodes well for loan growth.

However, high interest rates will dampen credit demand, especially for residential mortgages. As of March 2022, residential loans (1-4 family) made up 13% of total loans, according to details given in the 10-Q filing.

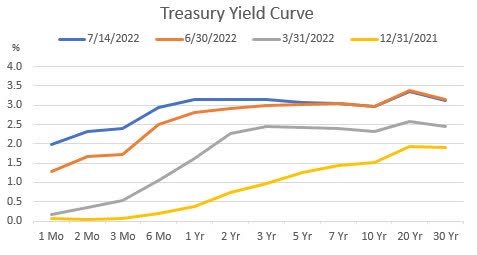

Considering these factors, I’m expecting the loan portfolio to increase by 12.4% by the end of 2022 from the end of 2021. In my last report on First Guaranty Bancshares, I estimated loan growth of 17% for the year. I have reduced my loan growth estimate because I now have a more hawkish stance on interest rates than before. Further, the chances of a recession have increased lately due to the recent inversion of the yield curve (see the middle part of the blue line below).

The U.S. Treasury Department

I’m expecting other balance sheet items to grow mostly in line with loans for the last three quarters of 2022. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Net Loans | 1,140 | 1,214 | 1,515 | 1,820 | 2,135 | 2,400 | |

| Growth of Net Loans | 21.5% | 6.6% | 24.7% | 20.1% | 17.4% | 12.4% | |

| Other Earning Assets | 506 | 406 | 428 | 239 | 364 | 494 | |

| Deposits | 1,549 | 1,630 | 1,853 | 2,166 | 2,596 | 2,853 | |

| Borrowings and Sub-Debt | 53 | 35 | 87 | 117 | 50 | 60 | |

| Common equity | 144 | 147 | 166 | 179 | 191 | 204 | |

| Book Value Per Share ($) | 14.9 | 15.2 | 15.6 | 16.7 | 17.8 | 19.0 | |

| Tangible BVPS ($) | 14.0 | 14.5 | 13.7 | 14.8 | 16.1 | 17.3 | |

|

Source: SEC Filings, Author’s Estimates (In USD million, unless otherwise specified) |

|||||||

Increase in Interest Rates to Barely Affect the Margin

A large part of the deposit book is quick to re-price. Interest-bearing demand and saving accounts made up a sizable 57% of total deposits at the end of March 2022, according to details given in the 10-Q filing. On the other hand, the real-estate-heavy loan portfolio will re-price with a lag. Most real estate loans, especially residential mortgages, carry fixed rates. As mentioned in the 10-Q filing, real estate loans made up 66.6% of total loans at the end of March 2022.

Overall, more liabilities than assets are scheduled to re-price this year. This asset-liability gap was negative 28.7% of total assets at the end of March 2022, according to details given in the 10-Q filing. Although the gap is negative, it does not mean that the balance sheet is liability sensitive. It should be borne in mind that the magnitude of the re-pricing is different for assets and liabilities as they depend on pricing power. Due to the significant liquidity in the industry, banks will have the power to keep deposit costs in check, despite the rising rate environment. In First Guaranty Bancshares’ case, the effect of the re-pricing on both sides of the balance sheet will almost balance each other out, leaving the net interest income barely sensitive to rate hikes.

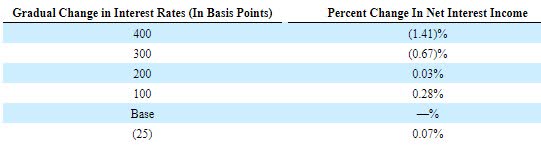

The management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200 basis points hike in interest rates can boost the net interest income by only 0.03% over twelve months.

1Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to remain almost unchanged in the last three quarters of 2022 from 3.59% in the first quarter of the year.

Economic Headwinds to Result in Above Normal Provisioning

First Guaranty Bancshares’ allowances-to-nonperforming loan ratios stood at 150.1% at the end of March 2022. In my opinion, this allowance coverage will be a bit tight given the threats of a recession. Further, higher interest rates can hurt the loan portfolio’s asset quality by pushing more and more borrowers into default. As a result, I believe First Guaranty Bancshares will try to bolster its reserves in the mid of 2022 to prepare for economic headwinds anticipated for the second half of the year.

Overall, I’m expecting the net provision expense to be above normal this year. I’m expecting First Guaranty Bancshares to report a net provision expense of 0.30% of total loans in 2022. In comparison, the net provision expense averaged 0.26% from 2017 to 2019.

Expecting Earnings to Increase by 6%

The significant loan growth will likely be the chief driver of an increase in earnings this year. On the other hand, higher provision expenses will likely restrict earnings growth. Meanwhile, the margin will likely remain somewhat stable for the remainder of the year. Overall, I’m expecting First Guaranty Bancshares to report earnings of $2.58 per share for 2022, up 6% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 53 | 57 | 62 | 75 | 90 | 106 | |

| Provision for loan losses | 4 | 1 | 5 | 15 | 2 | 7 | |

| Non-interest income | 8 | 5 | 8 | 24 | 11 | 8 | |

| Non-interest expense | 39 | 43 | 47 | 58 | 64 | 69 | |

| Net income – Common Sh. | 12 | 14 | 14 | 20 | 26 | 28 | |

| EPS – Diluted ($) | 1.21 | 1.47 | 1.34 | 1.90 | 2.42 | 2.58 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million, unless otherwise specified) |

|||||||

In my last report on First Guaranty Bancshares, I estimated earnings of $2.61 per share for 2022. My updated earnings estimate is barely changed as the downward revision in the loan balance estimate cancels out the commensurate downward revisions in provisions and operating expense estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation. The new Omicron subvariant also bears monitoring.

Maintaining a Buy Rating

First Guaranty Bancshares is offering a dividend yield of 2.7% at the current quarterly dividend rate of $0.16 per share. The earnings and dividend estimates suggest a payout ratio of 25% for 2022, which is below the five-year average of 36%. Although there is room for a dividend hike, I’m not expecting any change in the dividend level because FGBI has maintained its dividend at $0.16 per share since late 2007. In my opinion, a payout ratio that’s 10-11 percentage points below the historical average is not reason enough to break with tradition now.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Guaranty Bancshares. The stock has traded at an average P/TB ratio of 1.22x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 14.0 | 14.5 | 13.7 | 14.8 | 16.1 | |

| Average Market Price ($) | 19.5 | 20.9 | 17.5 | 13.6 | 17.5 | |

| Historical P/TB | 1.39x | 1.44x | 1.28x | 0.91x | 1.09x | 1.22x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $17.3 gives a target price of $21.2 for the end of 2022. This price target implies a 9.6% downside from the July 14 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.02x | 1.12x | 1.22x | 1.32x | 1.42x |

| TBVPS – Dec 2022 ($) | 17.3 | 17.3 | 17.3 | 17.3 | 17.3 |

| Target Price ($) | 17.7 | 19.5 | 21.2 | 22.9 | 24.7 |

| Market Price ($) | 23.5 | 23.5 | 23.5 | 23.5 | 23.5 |

| Upside/(Downside) | (24.4)% | (17.0)% | (9.6)% | (2.2)% | 5.2% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.6x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 1.21 | 1.47 | 1.34 | 1.90 | 2.42 | |

| Average Market Price ($) | 19.5 | 20.9 | 17.5 | 13.6 | 17.5 | |

| Historical P/E | 16.1x | 14.2x | 13.1x | 7.2x | 7.2x | 11.6x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.58 gives a target price of $29.8 for the end of 2022. This price target implies a 27.0% upside from the July 14 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.6x | 10.6x | 11.6x | 12.6x | 13.6x |

| EPS 2022 ($) | 2.58 | 2.58 | 2.58 | 2.58 | 2.58 |

| Target Price ($) | 24.6 | 27.2 | 29.8 | 32.4 | 34.9 |

| Market Price ($) | 23.5 | 23.5 | 23.5 | 23.5 | 23.5 |

| Upside/(Downside) | 5.1% | 16.1% | 27.0% | 38.0% | 49.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $25.5, which implies an 8.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.5%. Hence, I’m maintaining a buy rating on First Guaranty Bancshares.

Be the first to comment