cagkansayin

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 15th, 2022.

The Vanguard Long-Term Corporate Bond Index ETF (NASDAQ:VCLT) is a long-term, investment-grade, corporate bond index ETF.

VCLT’s 4.3% dividend yield is reasonable enough, but not particularly strong under current market conditions. The fund’s long-term holdings have high interest rate risk, a significant drawback in a rising rates environment. Credit risk is quite low, but treasuries are safer, and outperform during downturns and recessions.

In general terms, VCLT offers few important benefits, but several important drawbacks. As such, I see no reason to invest in the fund at the present time.

VCLT – Basics

- Investment Manager: Vanguard

- Underlying Index: Bloomberg U.S. 10+ Year Corporate Bond Index.

- Expense Ratio: 0.04%

- Dividend Yield: 4.36%

- Total Returns CAGR 10Y: 1.37%

VCLT – Overview and Benefits

Diversified Holdings

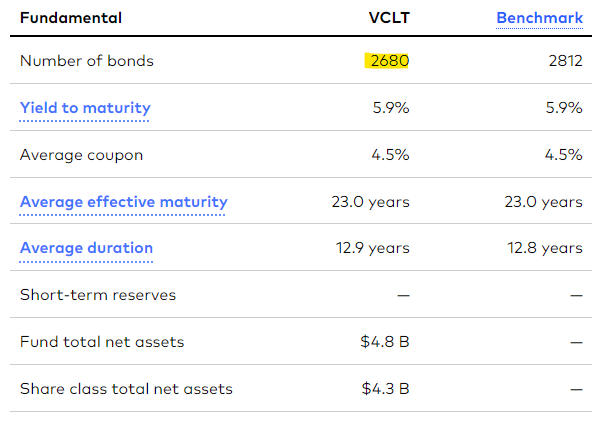

VCLT is a long-term, investment-grade, corporate bond index ETF, tracking the Bloomberg U.S. 10+ Year Corporate Bond Index. It is a relatively simple index, investing in all of the aforementioned securities meeting a basic set of inclusion criteria. As the index is quite broad, the resultant fund portfolio is quite broad as well, with investments in over 2600 securities from several industries.

VCLT

VCLT’s diversified holdings reduce risk, volatility, and potential losses from the default of any specific issuer.

VCLT focuses on investment-grade corporate bonds, so does not provide investors with exposure to other bond sub asset-classes, including treasuries, mortgage-backed securities, and high yield bonds. As such, investors looking for the most diversified bond funds should consider alternative to VCLT.

Low Credit Risk

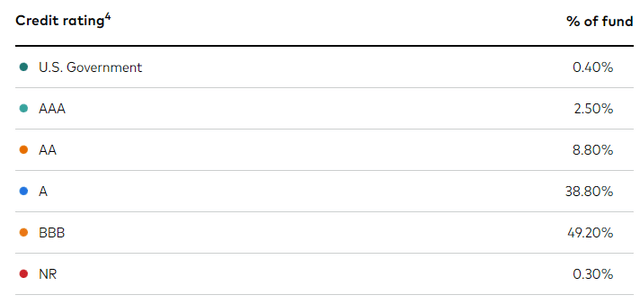

VCLT exclusively invests in investment-grade corporate bonds. These securities invariably carry strong credit ratings, with the vast majority of the fund’s holdings sporting ratings of between BBB and A.

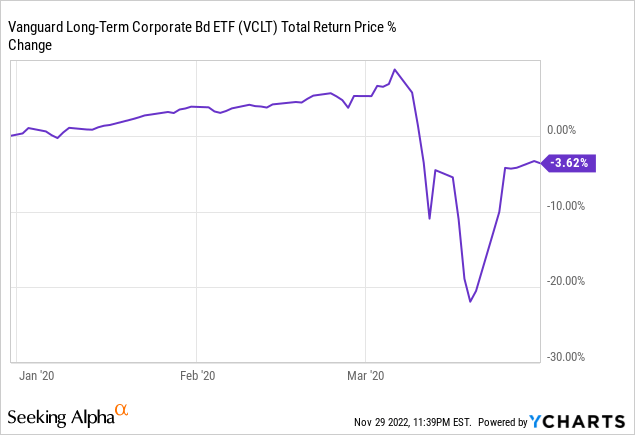

VCLT’s holdings are generally low-risk investments, with low default rates, and with little exposure to / reliance on economic conditions. The fund should suffer minimal losses during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

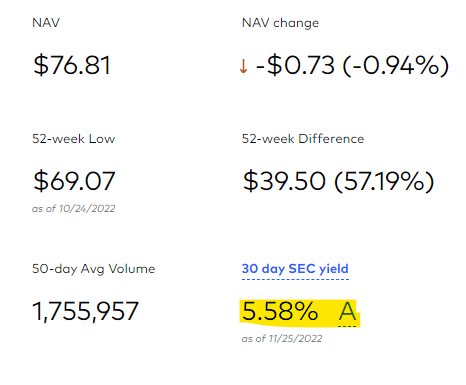

As a final point, VCLT currently yields 4.3%. Yields should increase to around 5.6%, equivalent to the fund’s SEC yield, in the next few months / years. SEC yields measure a fund’s actual generation of income. ETFs almost always distribute any and all income to shareholders as dividends, so if VCLT generates 5.6% in income, it should distribute 5.6% in dividends to shareholders.

VCLT

Although VCLT’s diversified, high-quality holdings are important benefits, the fund’s risks and drawbacks seem to outweigh these. Let’s have a look.

VCLT – Risks and Drawbacks

High Interest Rate Risk

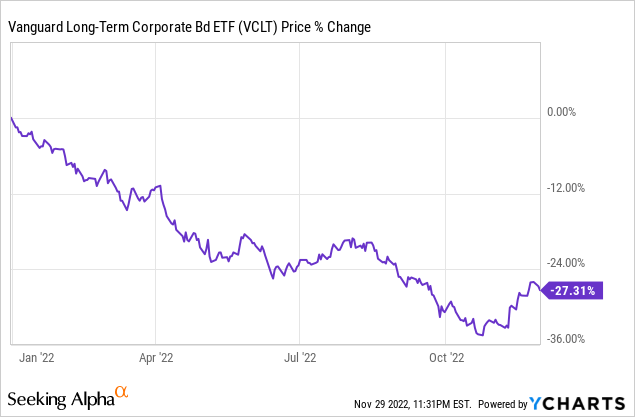

VCLT focuses on long-term bonds, with long remaining maturities, and hence interest rate risk. The fund currently sports a duration of 12.6 years, so investors should expect to see capital losses of around 12.6% for every 1 percentage point increase in interest rates, an incredibly large amount. Even small increases in interest rates lead to significant losses for the fund, a significant negative.

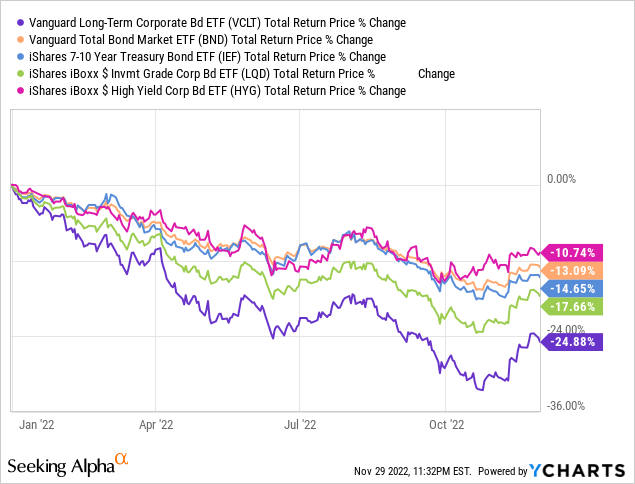

As the fund focuses on long-term bonds, it is long-term interest rates that matter. These tend to be a bit more stable than short-term rates, which should reduce losses somewhat, but these should remain large regardless. As an example, the fund has suffered capital losses of around 27% YTD, during which interest rates have risen 3.5%. Losses were a bit lower than one might expect from changes in short-term rates, but still incredibly large.

VCLT’s duration is quite a bit higher than that of its peers, so the fund should underperform during a rising rates environment. This has been the case YTD, as expected.

VCLT’s excessive duration and interest rate risk is a significant negative for the fund and its shareholders. It is also one which is particularly relevant right now: inflation remains stubbornly high, which could lead to further interest rate hikes.

In my opinion, inflation should normalize in the coming months, as has been the case since around August. So, all remaining interest rate hikes are priced-in already, and the fund should not see continued or further losses. Still, the risk remains.

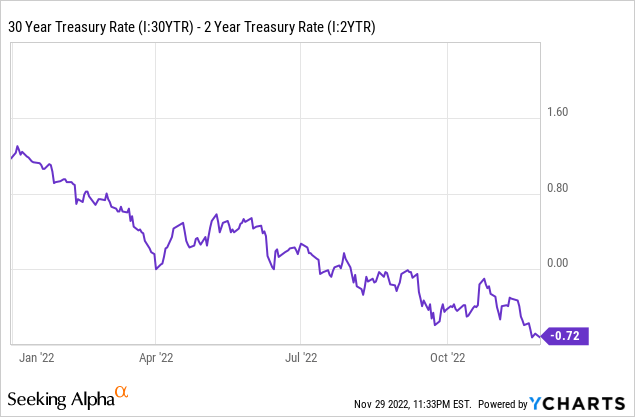

Low Term Premia

VCLT focuses on long-term bonds. These tend to yield quite a bit more than short-term bonds, to compensate investors for their higher interest rate risk, and for tying investor capital for longer. Spreads between these types of bonds tend to be quite wide, but have narrowed since late 2021, and turned negative a couple of months ago. As an example, 30 year treasuries currently yield 0.70% less than 2 year treasuries.

Long-term bonds are simply not offering competitive spreads relative to short-term bonds right now, a significant negative. In my opinion, under current market conditions, the best course of action is to focus on short-term bonds and bond funds, eschewing longer-term ones. Doing so minimizes interest rate risk with little, even positive, impact on yields. Investors can always pivot to long-term bonds once spreads start to widen later on, without losing out on income.

As a final point, long-term bonds would perform very well if interest rates were to decrease in the coming months. This is obviously a possibility, but not one which seems terribly likely, as it would go against Fed guidance, and I see no catalyst for such a rapid pivot.

Low Flight to Quality Effect

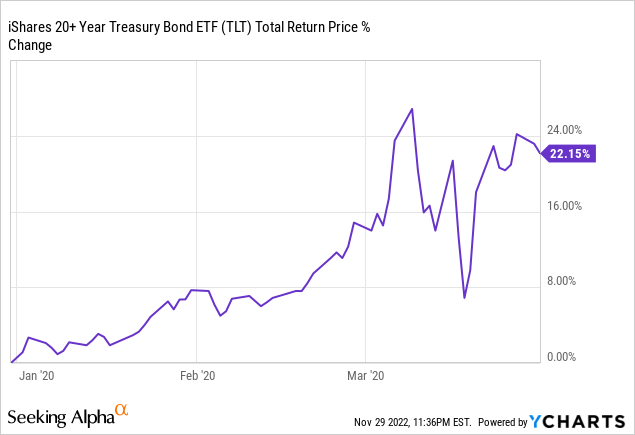

One of the biggest advantages and benefits of long-term treasuries is their outstanding performance during downturns. In most downturns and recessions, these securities see very large gains, due to a flight-to-quality effect: everyone buys treasuries during downturns, as treasuries are the safest asset in the world, so market prices skyrocket. As an example, long-term treasuries saw gains of over 20% in 1Q2020, even as most other asset classes saw significant losses. Very strong gains under very tough economic conditions.

Due to the above, long-term treasuries are sometimes used to hedge a portfolio against downturns. Investors might choose to focus on equities, but have a sizable allocation to treasuries, which help to reduce portfolio losses during downturns, and which can be sold to buy equities during moments of weakness. Said strategy would have worked exceedingly well in early 2020, and during most other downturns as well.

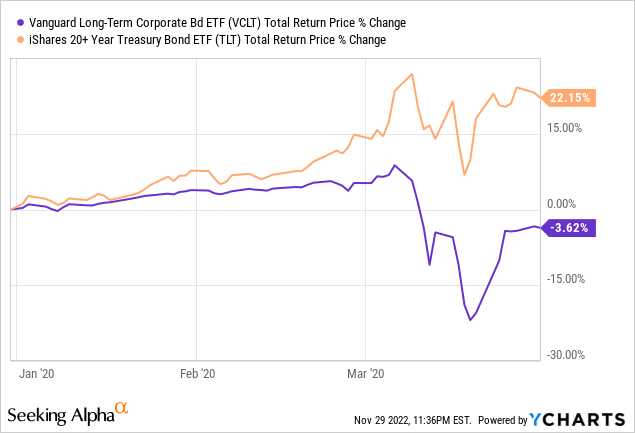

Long-term treasuries tend to see significant gains during downturns, but long-term bonds in general do not, even the safest of these (investment-grade). VCLT, for instance, saw losses of around 3.6% in early 2020, significantly underperforming relative to long-term treasuries.

VCLT’s lack of a flight to quality effect is not a negative per se, but it is definitely an absence of a positive, and an important one at that. Long-term treasuries can be used to hedge an investor’s portfolio, long-term investment-grade corporate bonds can’t, at least not effectively. VCLT’s low yield would be much more palatable if the fund performed very well during downturns, but it does not. I simply see no viable investment thesis, at least under current conditions.

Conclusion

VCLT is a long-term, investment-grade, corporate bond index ETF. VCLT offers investors few important benefits, but suffers from excessively high interest rate risk. As such, I would not be investing in the fund at the present time.

Be the first to comment