gustavofrazao

This article was coproduced with Cappuccino Finance.

As referenced in a recent article, I’m reading “Stocks for the Long Run” (Sixth Edition), and in Chapter 17, Calendar Anomalies, the co-authors explain:

“Although psychologists say that many silently suffer depression around Christmas and New Year’s, stock investors believe the last week of the year ‘tis the season to be jolly.”

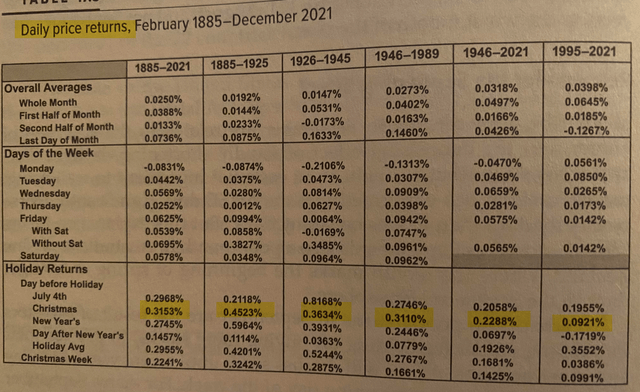

From the book, the snapshot below illustrates the daily price returns, as measured by the DJIA, for various times in the year and in the month.

Over the past 136 years, daily price returns, between Christmas and New Year’s, have averaged nearly 10 times the average return.

As the co-authors continue, “even more striking is the difference between stock returns in the first and second half of the month…

Over the entire 136-year period studied, the percentage change in the DJIA during the first half of the month is almost three times the gain that occurs during the second half, and this outperformance has even increased since 1995.”

The co-authors point out that the more favorable returns in early December could be attributed to

“the inflow of funds into the equity market from workers who automatically have part of their pay invested directly into the market on the first day of the month.

One notices another gain on the sixteenth of the month, where workers who are paid twice per month put funds into stocks and this effect has become larger over time.”

Why Dividend Stocks?

Dividend-paying stocks have a history of outperforming nonpayers, and their high-yielding stocks usually outperform low-yielding ones.

At iREIT on Alpha, one of the best tools for pursuing these objectives has been focusing on the concept of economic moats, which both protect the investor’s dividend income and encourage that income to grow over time.

Paying dividends provides direct and tangible returns to shareholders and they offer these advantages:

- Dividend payments provide investors with valuable signals regarding management’s willingness to reward shareholders.

- Dividends force discipline on management.

- Stocks that consistently offer high dividend yields tend to fluctuate less than the overall market, leading to superior risk-adjusted returns.

When considering a particular dividend-paying stock, ask 3 questions:

- Is the dividend safe?

- Will the dividend grow?

- What level of total return do future dividend prospects suggest?

Now let me provide you with a list of our three top dividend-paying stocks in December…

Broadcom Inc. (AVGO)

Broadcom is a global technology company that designs, develops, and distributes a wide range of semiconductor and infrastructure software solutions.

Broadcom has the long history of innovation in the semiconductor industry and offers thousands of products that are used in data center networking, home connectivity, set-up boxes, broadband access, telecommunication equipment, and smartphones.

Also, their infrastructure software solutions enable customers to plan, develop, automate, manage, and secure applications across mainframe, distributed, mobile, and cloud platforms.

Broadcom has several competitive advantages over their peers. The first is their technological superiority. Their business strategy combines best-of-breed technology leadership in semiconductors with infrastructure software solutions, and the quality of their products is superior.

The second is their unmatched scale. Together with their technological superiority, their scale and administrative platform allows them to deliver a comprehensive suite of technology products to the world’s leading companies and government entities.

The third is their strong liquidity and cash-richness. Broadcom generated $15 B of operating cash flow in the past twelve months, and their current ratio is now 2.42x. This strong cash generating ability and liquidity allows them to invest in new technology and make key acquisitions.

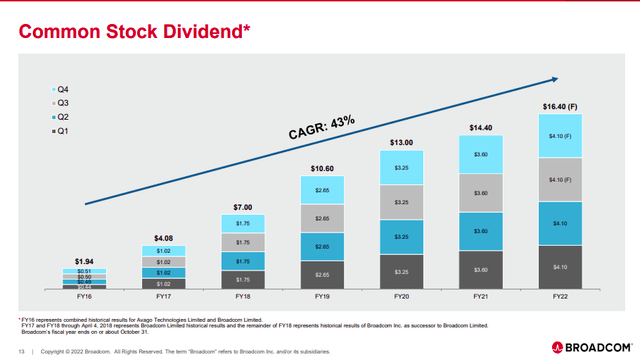

Broadcom has been rewarding their shareholders with a strong dividend for a long time. In the past five years, the dividend growth rate has been 38.1 % (5-year average). Their dividend is relatively safe at this point, shown by the cash dividend payout ratio of 43.7%.

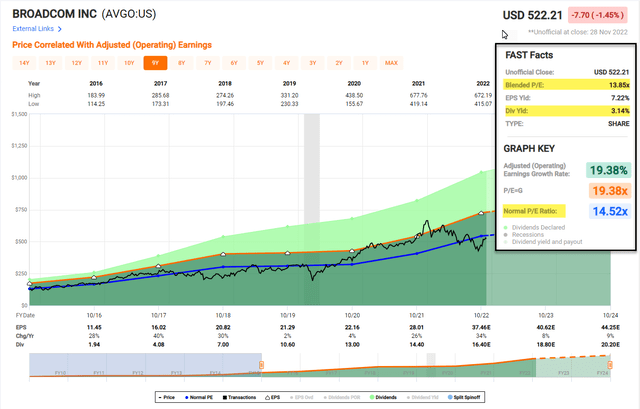

The valuation metrics show that Broadcom is currently undervalued. P/E ratio of 22.86x is far lower than their 5-year average (37.46x), and EV/EBITDA of 13.44x is also lower than 15.37x. The current market volatility is presenting a great opportunity for investors to grab some Broadcom stock at a discount.

Whirlpool Corporation (WHR)

Whirlpool is a leading global kitchen and laundry company. Whirlpool manufactures products in 10 different countries and sells them in nearly every county in the world.

Throughout their long history, they have received global recognition for many different accomplishments – innovative products, leadership, product designs, diversity, and leadership. Whirlpool’s brand portfolio includes KitchenAid, Maytag, Jennair, Amada, and Hotpoint.

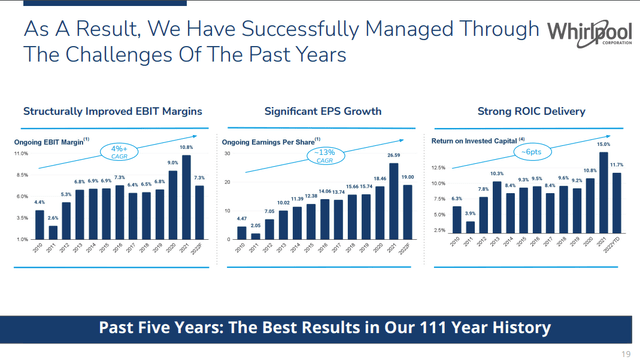

Whirlpool has a long track record of success and has been through several economic cycles. So, they know how to manage tough situations including high-cost environments, recessionary pressure, and market contraction.

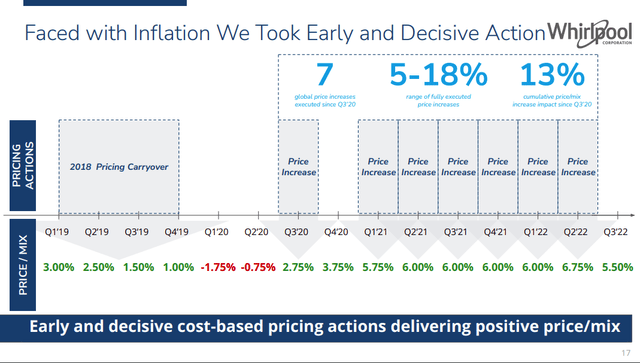

Whirlpool was proactive in facing the high inflation and high cost environment. Their early and decisive cost-based pricing actions are now delivering positive price and product mix results.

Also, they have significantly reduced their fixed cost base to navigate the recessionary environment.

Whirlpool has been increasing their dividend consistently in the past several years (dividend growth rate of 13.35%, 10 year CAGR), and their dividend is relatively safe at this point.

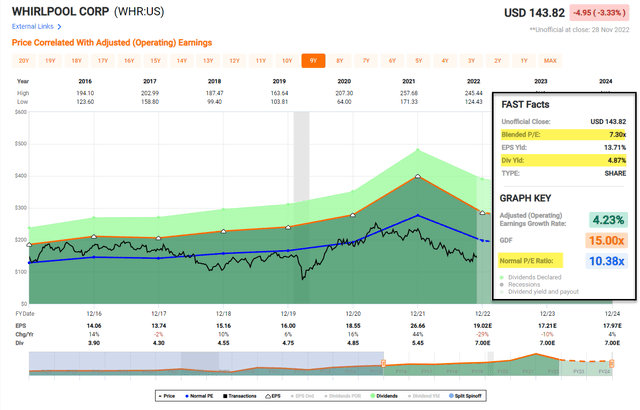

Looking at their valuation metric, Whirlpool is undervalued at this point. P/E ratio of 6.79x and EV/EBITDA ratio of 5.71x are both lower than their 5-year averages.

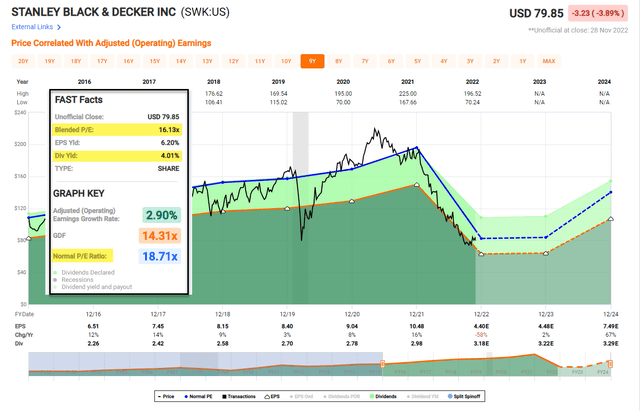

Stanley Black & Decker, Inc. (SWK)

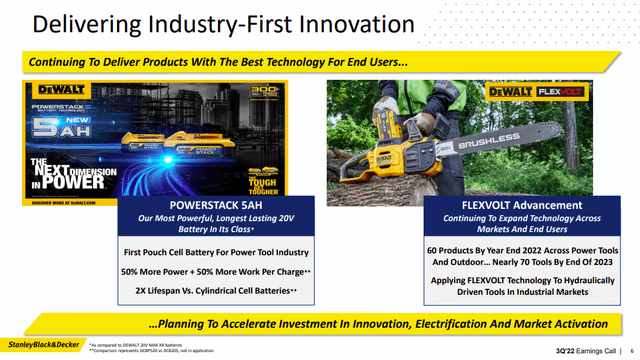

Stanley Black & Decker is a diversified global provider of hand tools, power tools, outdoor products, and related accessories. They are the industry leader, and their products are known for quality and innovative features.

They continue to invest in innovation, electrification, and market activation, so I expect them to remain the leader in the industry for the coming years.

During the pandemic-induced supply chain issues, Stanley Black & Decker focused on supply chain optimization and simplifying the organization. They delivered $65 M 3Q savings in SG&A, and they are on track to deliver $150-200 M in 2022. This will result in margin improvement and larger cash flow in the future.

Stanley Black & Decker has been a stellar dividend growth company throughout their history. They have paid dividend for the past 145 years and have increased their dividend for the past 54 years. Given their improving margins and solid performance, I expect them to continue this streak in the future.

Looking at their valuation metrics (P/E ratio and EV/EBITDA ratio), they are undervalued at this point. The current P/E ratio of 22.16x is lower than the 5-year average (23.36x), and the current EV/EBITDA of 11.05x is lower than the 5-year average (12.65x).

Consider The Risks

During the past couple of years of the pandemic, we have been repeatedly confronted with new Covid-19 variants, countries renewing their restrictions, and a volatile stock market.

Recently, there was a new twist. The Chinese government tried to impose restrictions and lockdowns, and this caused civil unrest. It’s nearly impossible to gauge exactly how this will impact the stock market, but it’s likely to add to market volatility.

All three companies listed here have been impacted by the high cost and high inflation environment. Even though I have great confidence in their ability to navigate the challenging environment, it is uncertain when inflation will ease significantly. Therefore, their stock prices are likely to struggle until the inflation starts to clearly show a downtrend.

Conclusion

Dividend growth stocks have always been my favorite type of stocks. Typically, these are blue chip companies that can point to a long track record of success. They have weathered many different economic cycles, and they know how to navigate tough times.

The three companies in this article are great examples of such companies. While we get through the volatility, we can collect the dividend. And when inflation starts tracking down and the Fed softens its stance on interest rates, a returning bull market will cause these stocks to appreciate substantially.

Best of both worlds!

Happy Holidays from iREIT on Alpha

Factoid: ’Tis, as in ’tis the season, is an old—very old—contraction of it is. The apostrophe replaces the i in the word it to create ’tis. Because it is a contraction, ’tis needs an apostrophe. Saying ’tis the season is the same as saying it is the season.

According to Google’s Ngram Viewer, the contraction ’tis was a fan favorite in the early 1700s. At this time, it was likely used more often than it’s.

www.thesaurus.com/e/grammar/tis-the-season/

Be the first to comment