francescoch/iStock via Getty Images

The FDA has been brutal to small companies which go through the full process of clinical trials, file their approval application, and get their filing approved. Then POW, the FDA issues a dreaded CRL.

In 07/2022 the FDA accepted ImmunityBio’s (NASDAQ:IBRX) N-803 (anktiva) bladder cancer therapy BLA for filing; it set a target PDUFA of 05/23/2023. This article addresses the prospects for ImmunityBio’s application and for its shareholders as this drama unfolds.

The company plays its cards close to its vest however it is interesting on closer look

This is my first take on ImmunityBio. I noted before I decided to write this article that it provides no quarterly earnings calls. This is an annoyance but not uncommon for development stage biotechs. I figured at least I would be able to check out its quarterly progress by reviewing its quarterly earnings press release.

No such luck. ImmunityBio does not issue a quarterly earnings press release. Now this is a first in my experience. It does issue a less useful and more ponderous filing which will have to suffice for purposes of this article. I will refer to its Q2, 2022 10-Q for the balance of this article as the “10-Q”. If I refer to any earlier 10-Q’s I will so identify them.

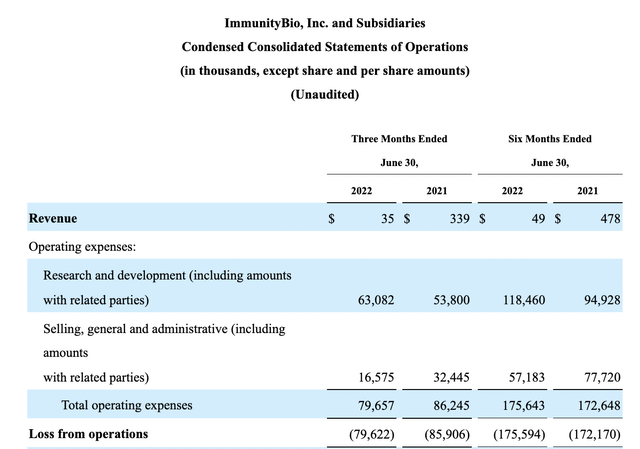

ImmunityBio’s 10-Q statement of operations lists the following revenue and expenses:

10-Q excerpt (seekingalpha.com)

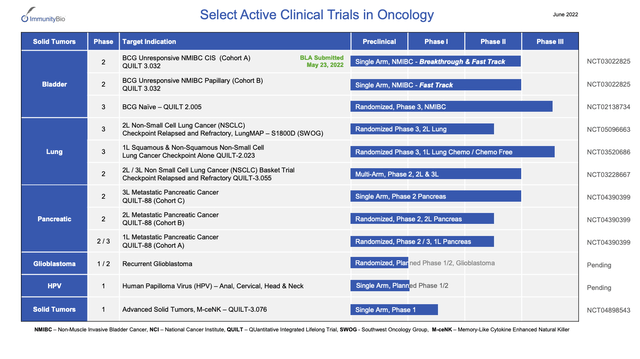

Its income is nominal as is common for development stage biotechs. Its expenses are significant. Its R&D expenses outstrip its SG&A by a factor of ~3.8. Turning to its oncology pipeline from its 06/2022 overview presentation, we find an extensive listing of late and intermediate stage candidate therapies:

Notably it has already submitted a BLA for its lead candidate therapy as is discussed in more detail below.

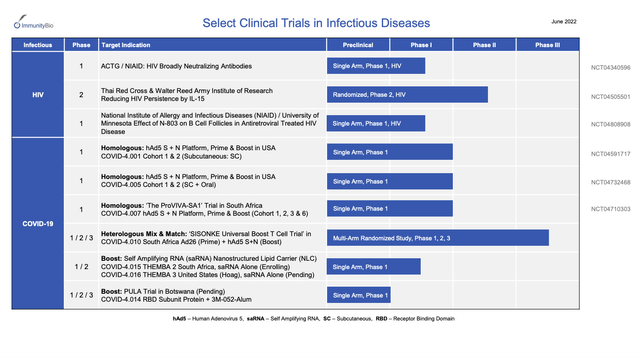

In addition to this nice oncology pipeline, its overview presentation includes the following pipeline of infectious disease therapies:

As I write in 10/2022, I consider both COVID-19 and HIV to be crowded-full with therapies that are adequate for current needs. Accordingly this branch of ImmunityBio’s pipeline strikes me as more of a diversion and expense than an asset for the foreseeable future. On the other hand, its oncology pipeline provides encouragement that it is getting a solid return for its R&D expenditures.

The FDA dispenses its largesse liberally until the very end

As noted above the company has filed its BLA for its lead therapy. It references NCT03022825 in connection with this. The brief description of this trial on clinicaltrials.gov reads:

This is a Phase II/III, open-label, single-arm, multicenter study of intravesical BCG plus N-803 or N-803 only in patients with BCG unresponsive high grade non-muscle invasive bladder cancer (NMIBC). All patients treated in the study will receive via a urinary catheter in the bladder, BCG plus N-803 or N-803 only weekly for 6 consecutive weeks (initial induction treatment period). After the first disease assessment, eligible patients will receive either a 3-week maintenance course or a 6-week re-induction course (second treatment period) at Month 3. Eligible patients will continue to receive maintenance treatment in the third treatment period at Months 6, 9, 12, and 18. Eligible patients have the option to receive maintenance treatment in the fourth treatment period at Months 24, 30, and 36. The study duration is 60 months.

The study’s estimated primary completion date is January 2023. This raises the question, how can it be filing its BLA before the study’s estimated completion date? At page 8 of its 10-Q it discusses this BLA filing and the FDA’s subsequent acceptance of the filing. It also advises that the FDA has awarded it therapy Breakthrough Therapy and Fast Track designations in this indication.

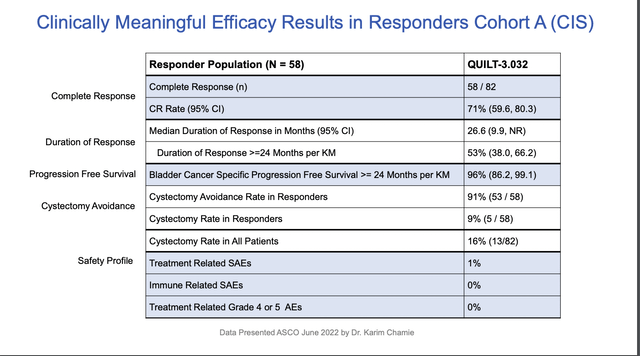

The company’s above referenced overview presentation includes slides 8-16 focusing on this treatment in this indication. Without directly saying so one can imply that it has brought its BLA forward because of the strong data generated to date. Slides 12-16 contain data presented at ASCO in 06/2022 by Dr. Karim Chamie.

Slide 12 below provides a nice summary of key data from these slides:

The safety profile coupled with cystectomy (bladder removal) avoidance are particularly notable. With this level of data it is easy to see why there would be urgency to get approval for this therapy.

Complete response letters are the FDA’s way to sidetrack NDA’s and BLA’s where it is dissatisfied with the underlying data supporting the application. They can pop up unexpectedly at the last minute on applications that have been accepted for filing in due course. Their timing tends to be right before or on the PDUFA date.

In two cases I followed extensively and painfully, the FDA issued CRL’s for therapies which it had previously designated as breakthrough therapies. I refer to:

- Omeros’ (OMER) BLA for narsoplimab in treatment of HSCT-TMA and

- Acadia’s (ACAD) sNDA for pimavanserin in the treatment of hallucinations and delusions associated with dementia-related psychosis.

According to an 04/2021 article which includes a comprehensive overview of applications with breakthrough designations, my concern may be overstated. However citing the Acadia example and a Merck (MRK) application, it noted that the situation seems to be tightening up with CRL risk existing despite breakthrough designation.

Its near term investment prospects are fair to partly cloudy

As I write in mid-October 2022, the environment for development stage biotechs that I follow has been nothing but tough. I think of Athersys (ATHX), Ultragenyx Pharmaceutical (RARE) and Inovio Pharmaceuticals (INO) among others. So many have been brought to their knees by a tough operational environment for all companies coupled with a tough FDA.

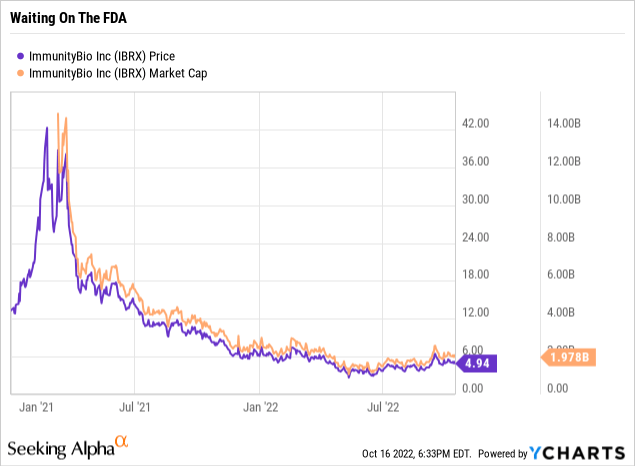

ImmunityBio does not appear to be in a tough position compared to any of the companies I have named. It still maintains a reasonable market cap as shown by its price chart below although it is undergoing a current downdraft:

Today’s ImmunityBio is the result of a 12/2020 merger of then privately held ImmunityBio with publicly traded NantKwest (NK). The deal closed on 03/09/2021. Both companies are affiliated with billionaire serial biotech entrepreneur and medical theorist Dr. Patrick Soon-Shiong. ImmunityBio’s oncology therapeutics including N-803 represent a culmination of Soon-Shiong’s decades long work to generate a therapeutic that:

…activates and proliferates NK cells and T cells and drives memory T cells for your innate immune system to treat cancer and infectious diseases…

Investors who choose to tag along for the ride will be treated with proper respect but must realize that there are pluses and minuses at to living in the shadow of Big Daddy.. In response to a reporter noting that ImmunityBio dropped 90% in a few months, Soon-Shiong pointed to his prior track record. He is confident that despite prices dropping steeply they will ultimately recover in recognition of science underlying N-803.

Consider how ImmunityBio is responding to its cash needs. According to its 10-Q, its cash balance took a hit from Q4, 2021 to Q2, 2022; it dropped from ~$181 million to ~$61 million. Mind you, there is no earnings call or earnings press release to elucidate the situation.

No worries. On 09/02/2022, ImmunityBio filed an 8-F advising that it had received $124.4 million from a financing funded by a Soon-Shiong affiliated company. That is the good news. Reality check; the note bears interest at a floating rate plus 8%. Additionally the company refinanced an outstanding $300 million loan to the same affiliate at the same rate, adding a convertible feature permitting the holder in case of default:

…to convert the outstanding principal amount and accrued and unpaid interest due under this note into shares of the company’s common stock at price of $5.67 per share.

Additionally, it extended the maturity of the $300 million loan by a year to 12/31/2023 and increased the spread from 5.4% to 8%.

Conclusion

I am optimistic that the FDA will evaluate ImmunityBio’s BLA favorably. If it has any reservations on this important therapy with its solid safety record, it should resolve them in favor of approval to give patients a chance to access this important life altering therapy.

I have noticed an aura of mistrust on comment streams addressing FDA decisions. I have never given the suspicions much credence. Here we have a therapy where the little guy, ImmunityBio’s anktiva, is set to challenge Merck’s (MRK) KEYTRUDA (pembrolizumab) after having bested it in clinical trials. It will be interesting to see how it unfolds.

Be the first to comment