Iryna Dobytchina

A Quick Take On IHS Holding

IHS Holding Limited (NYSE:IHS) went public in October 2021, raising approximately $378 million in gross proceeds from an IPO that priced at $21.00 per share.

The firm owns and operates mobile telecommunications tower facilities in various regions worldwide.

Given the risk of further macroeconomic slowdown, apparent full value of the stock and potential overhang of existing shareholders exiting their locked-up shares, my opinion on IHS is on Hold in the near term.

IHS Holding Overview

London, UK-based IHS was founded to acquire and operate mobile transmission towers to mobile network operators in emerging markets.

Management is headed by Co-Founder, Chairman and CEO Sam Darwish, who has been with the firm since inception and was previously the Deputy Managing Director of CELIA Motophone Ltd., a GSM operator in Nigeria.

The company’s tower holdings by region include:

-

Africa

-

Latin America

-

Middle East

The firm seeks to expand its operations through direct sales and marketing efforts or acquisitions in selected growth markets with what it calls ‘compelling underlying fundamentals.’

IHS Holding’s Market & Competition

According to a 2021 market research report by Verified Market Research, the global market for telecom towers was an estimated $39.5 billion in 2018 and is forecast to reach $114 billion by 2026.

This represents a forecast CAGR of 14.54% from 2019 to 2026.

The main drivers for this expected growth are growing placements in off-grid and rural areas as well as continued smartphone penetration and need for internet and call services.

Also, below is a chart showing the estimated growth trajectory of the global telecom tower market through 2026:

Global Telecom Towers Market (Verified Market Research)

Major competitive or other industry participants include:

-

ATC

-

Helios Towers plc

-

SBA Communications

-

Smaller companies

IHS Holding’s Recent Financial Performance

-

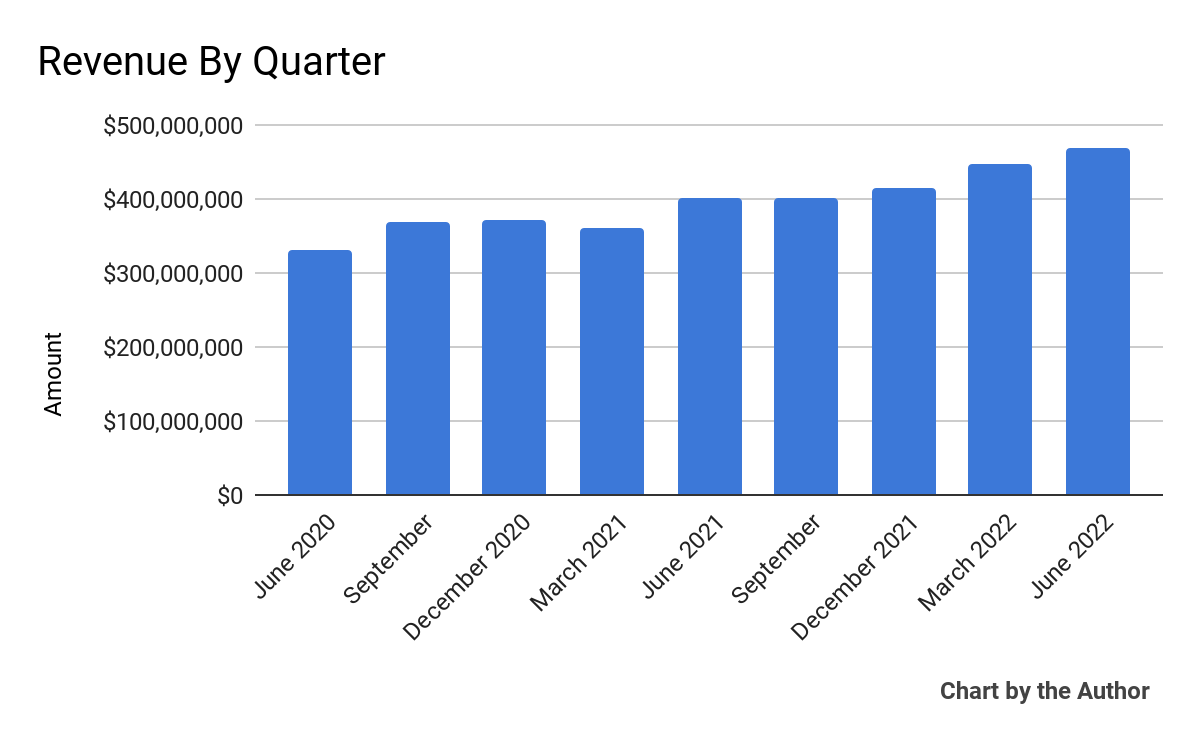

Total revenue by quarter has grown revenue according to the chart below:

9 Quarter Total Revenue (Seeking Alpha)

-

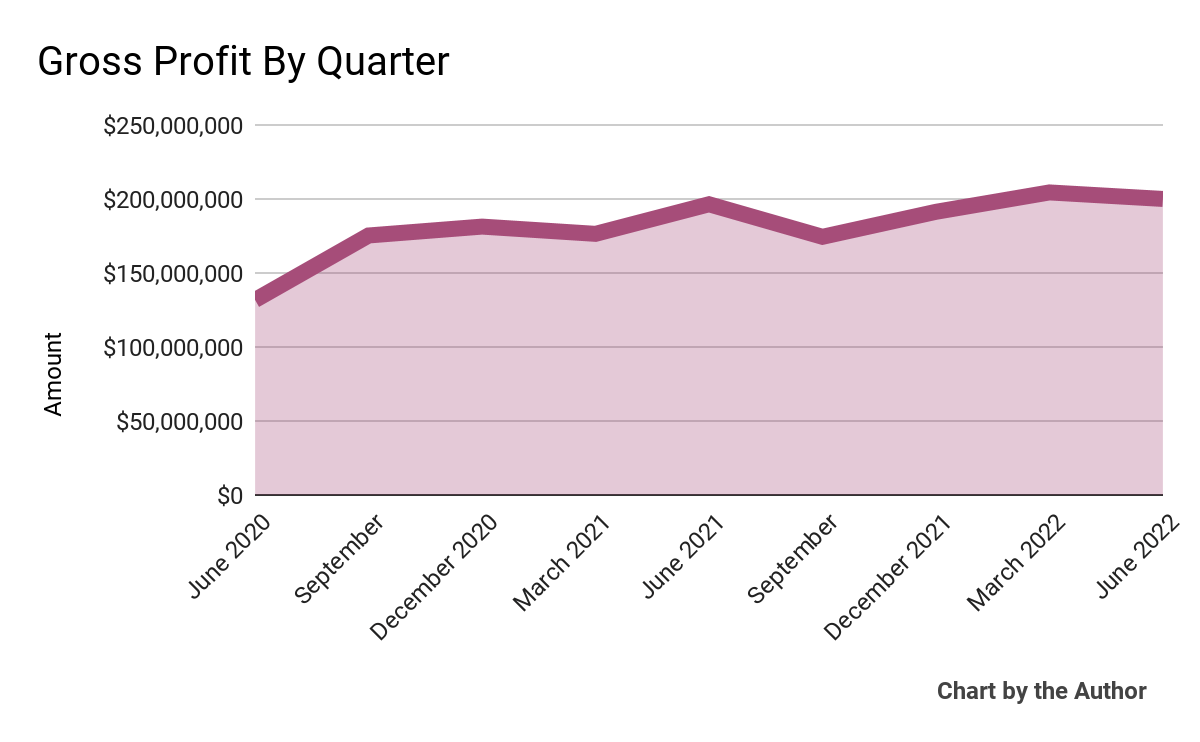

Gross profit by quarter has flattened recently:

9 Quarter Gross Profit (Seeking Alpha)

-

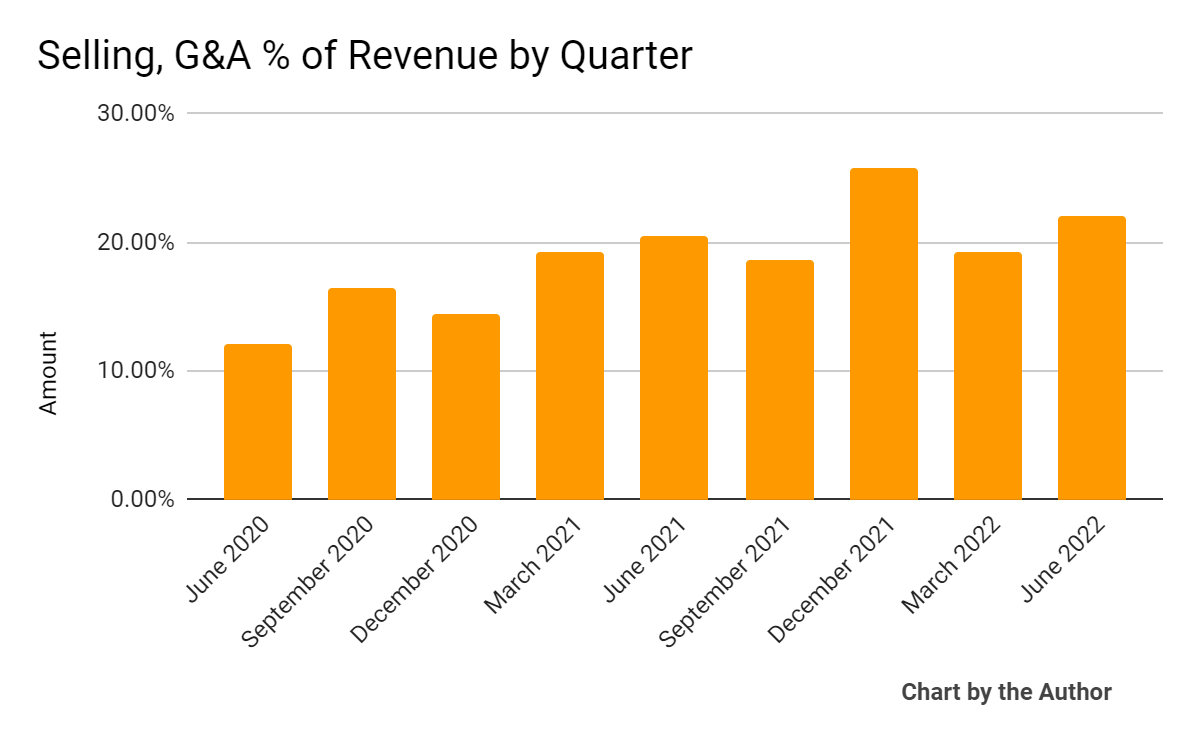

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher as revenue has increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

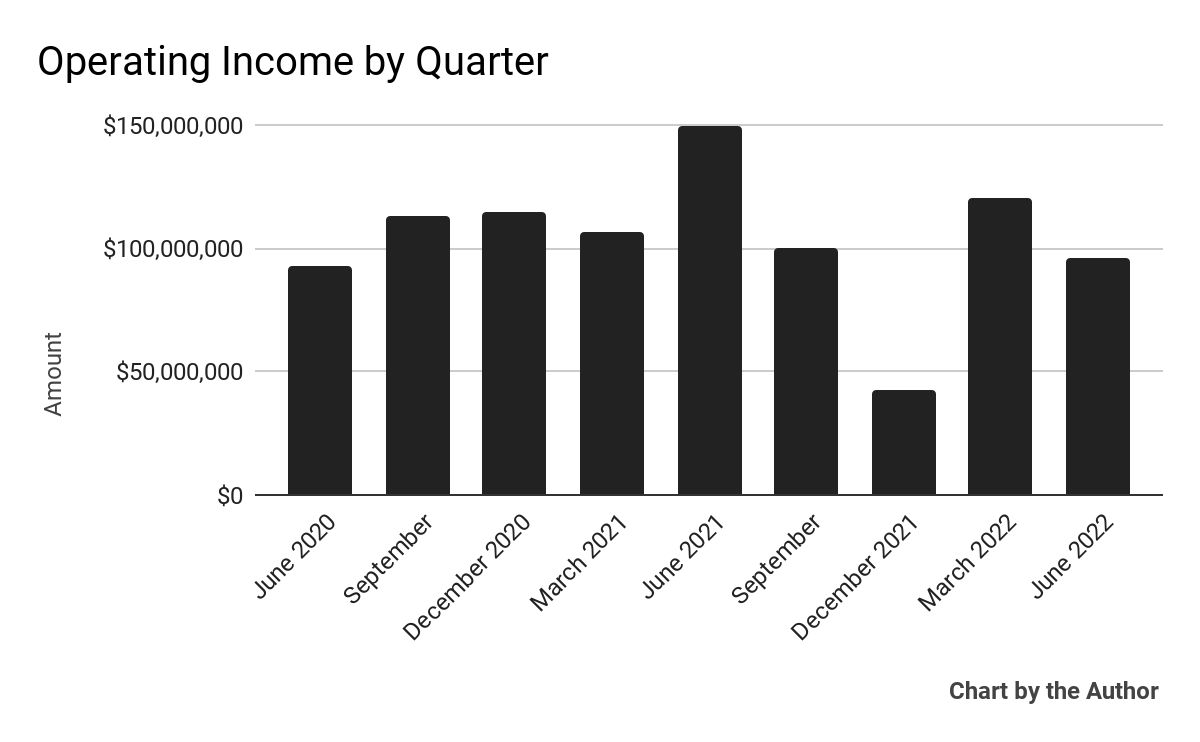

Operating income by quarter has fluctuated significantly over the past several quarters:

9 Quarter Operating Income (Seeking Alpha)

-

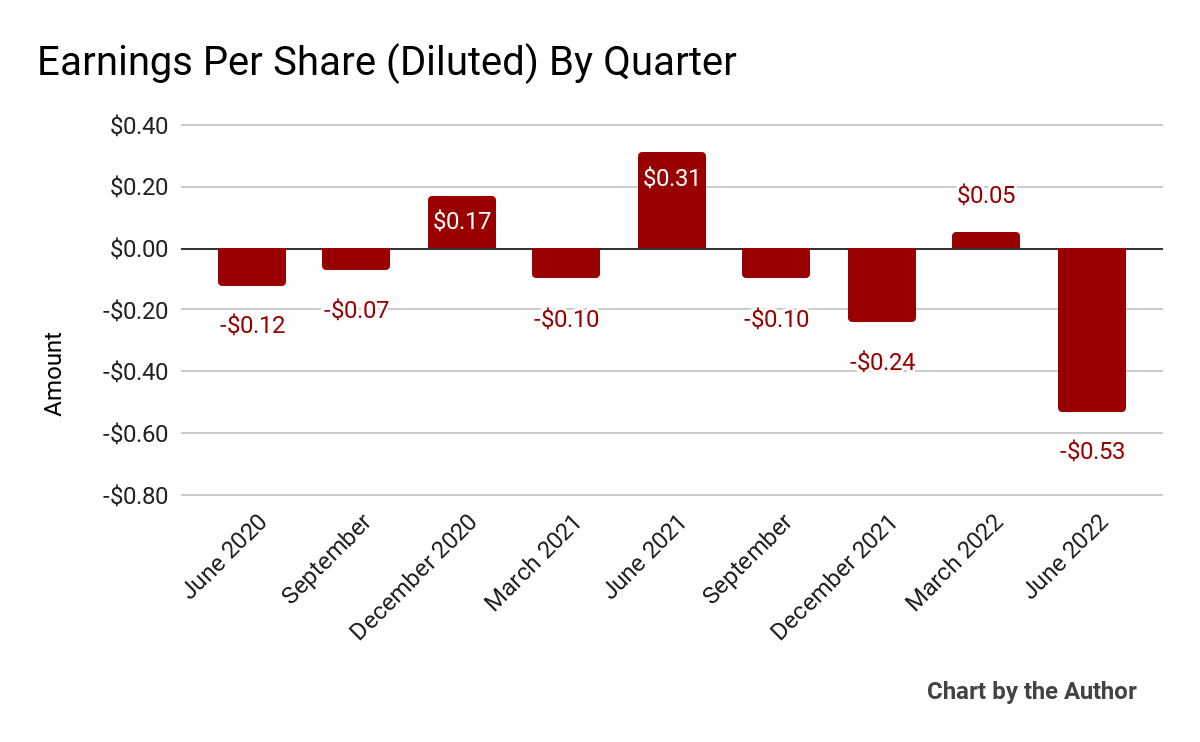

Earnings per share (Diluted) have also fluctuated, through even more so due to several quarters of negative earnings:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

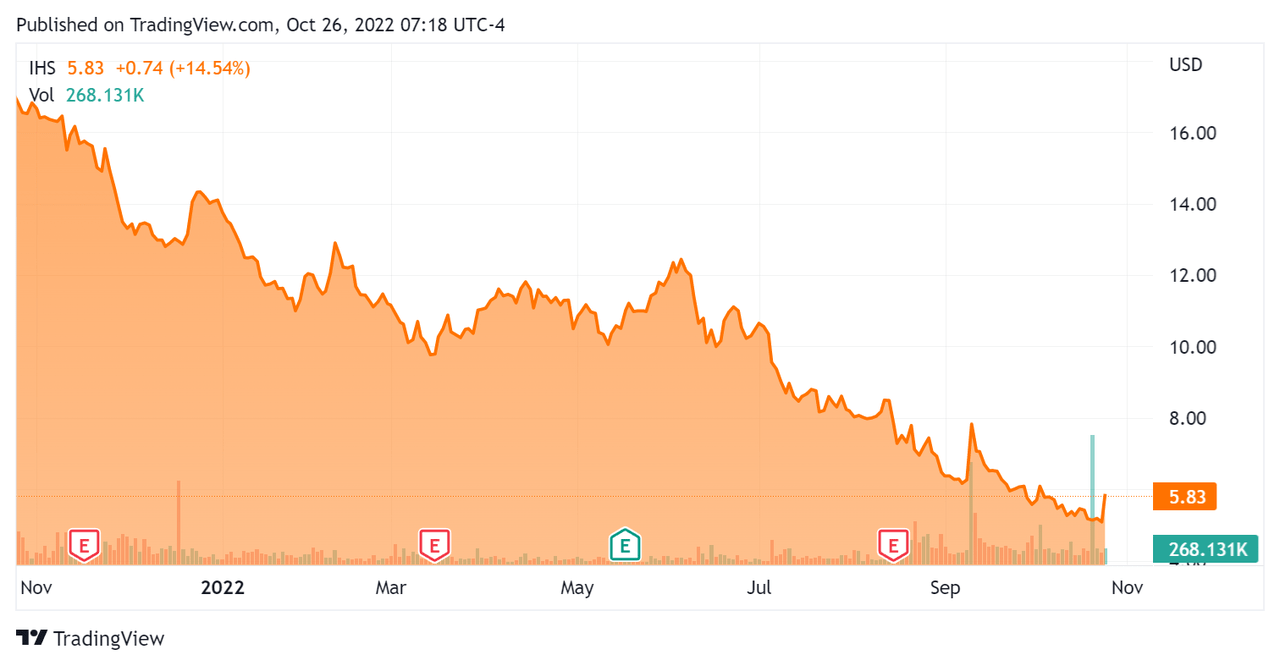

Since its IPO, IHS’ stock price has dropped 65.8% vs. the U.S. S&P 500 index’s drop of around 15.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For IHS Holding

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.94 |

|

Revenue Growth Rate |

15.2% |

|

Net Income Margin |

-15.2% |

|

GAAP EBITDA % |

41.4% |

|

Market Capitalization |

$1,690,000,000 |

|

Enterprise Value |

$5,090,000,000 |

|

Operating Cash Flow |

$720,210,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.82 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Helios Towers plc (OTCPK:HTWSF); shown below is a comparison of their primary valuation metrics:

|

Metric |

Helios Towers plc |

IHS Holding |

Variance |

|

Enterprise Value / Sales |

4.64 |

2.94 |

-36.6% |

|

Revenue Growth Rate |

18.9% |

15.2% |

-19.7% |

|

Net Income Margin |

-45.7% |

-15.2% |

-66.8% |

|

Operating Cash Flow |

$76,100,000 |

$720,210,000 |

846.4% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On IHS Holding

In its last earnings release (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the completion of its acquisition of Mobile Telephone Networks Proprietary Limited in South Africa, which added 5,691 towers to its portfolio.

Leadership noted that demand for access by telecom service providers continued to ‘track expectations’ and that its diversified portfolio helps to reduce country- or region-specific volatility to macroeconomic or other events.

The board waived the registered offering requirement for the first block of shares subject to lock-up arrangements, so up to 78.2 million shares will become available to be sold by locked-up shareholders, increasing liquidity by putting downward pressure on the stock price as more shares come onto the market.

As to its financial results, topline revenue rose 16.4% year-over-year and 9.9% represented organic growth.

Gross profit stagnated while higher diesel costs negatively impacted EBITDA as many tower sites are not (yet) connected to the electrical grid and require diesel to run their operations.

For the balance sheet, the firm finished the quarter with $567.3 million in cash and equivalents and $2.66 billion in long-term debt and $595.3 million in the current portion of long-term debt.

Over the trailing twelve months, free cash flow was $241.7 million and the firm spent $478.5 million in capital expenditures.

Looking ahead, management raised its forward revenue guidance by a slight $10 million at the midpoint of the range for the full year of 2022 and reiterated adjusted EBITDA, RLFCF and CapEx guidance.

Regarding valuation, the market is valuing IHS at a lower EV/Revenue multiple versus Helios Towers.

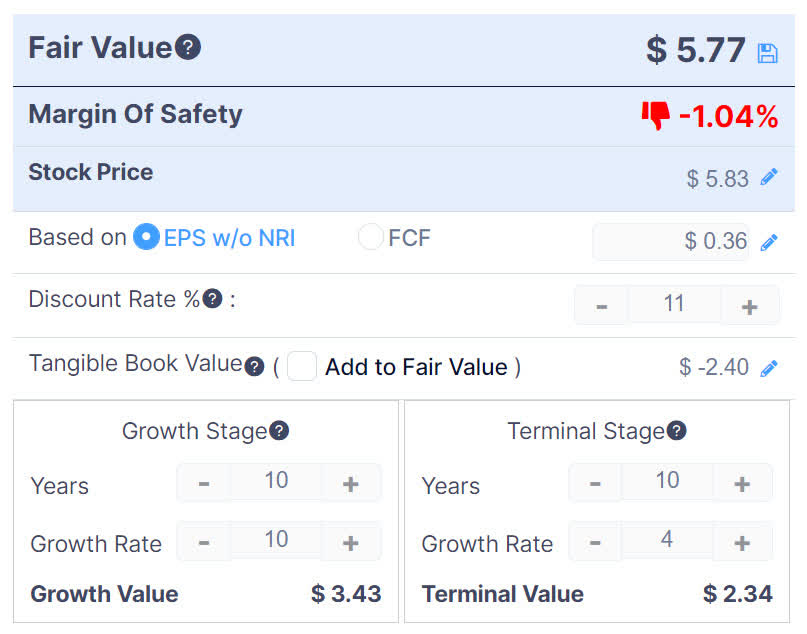

Even with generous assumptions as to organic growth, my discounted cash flow analysis indicates that IHS may be fully valued at its current stock price of $5.83, as the summary chart shows below:

IHS Discounted Cash Flow (GuruFocus)

The primary risk to the company’s outlook is the potential for further macroeconomic slowdown and high diesel prices, reducing organic revenue growth and raising operating costs.

Given these risks, apparent full value of the stock and potential overhang of existing shareholders exiting their locked-up shares, my opinion on IHS is on Hold in the near term.

Be the first to comment