Morsa Images/DigitalVision via Getty Images

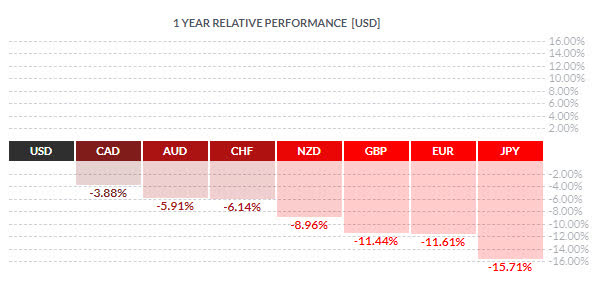

“A hawkish Federal Reserve and heightened geopolitical tensions have driven a 14% gain in the U.S. dollar against a basket of currencies over the last year, forcing companies such as Coca-Cola Co. (KO) and Procter & Gamble (PG) to temper expectations for the rest of the year.”

Microsoft is one of the latest companies to warn of a fourth-quarter currency headwind.

The following was reported by Reuters on June 2, 2022: “Microsoft warns of forex hit; cuts forecast”

“Microsoft Corp. (MSFT) on Thursday cut its fourth-quarter forecast for profit and revenue, making it the latest U.S. company to warn of a hit from a stronger greenback.”

Source: Finviz

U.S. DOLLAR PAIRS • FOREX.COM • DAILY

USD ETF Up +16.31%

Over the course of the last year, the U.S. dollar Bullish ETF (UUP) has gained +$3.94 or +16.31%. This is at a time when the U.S. stock indices have a current year-to-date loss of DJIA 30 -9.46%, S&P 500 -13.80%, and Nasdaq 100 -23.11%.

Since the U.S. Dollar was put at a major low on January 6, 2021, the trend has been solidly up.

INVESCO DB USD INDEX BULLISH FUND ETF • UUP • ARCA • DAILY

USD Retracements Are In The 2-4% Range

As professional traders who study prices, we see that the maximum pullback in the U.S. dollar has been 57 days and -4.4%. The recent pullback in the UUP (US Dollar Bullish ETF) has only been 15 days, or -3.24%. This 3-week pullback or more importantly the retracement of -3.24% is safely within the previous retracement data sets.

UUP (USD) remains in an uptrend and until the price confirms otherwise we should consider this trend will continue. There are significant headwinds ahead for stocks and especially multinational companies whose revenues and earnings are being diminished by the strong USD.

INVESCO DB USD INDEX BULLISH FUND ETF • UUP • ARCA • DAILY

USD Headwinds Causing Problems For Nasdaq Companies

The NASDAQ QQQ ETF remains solidly in a bear market as the U.S. dollar continues to batter revenue and earnings for these global companies.

It should come as no surprise that the recent bounce in the QQQ occurred at 50% of the post-Covid bull market rally. This bull rally was +$235.83 and 50% of this is $117.91. The QQQ found temporary support about -$1.00 below the 50% level with its drop of -$118.90.

Due to globalization, most if not all of the NASDAQ 100 QQQ companies will feel the effect of the USD headwinds. Most of the group is a true multinational, but for those whose business solely focuses on the U.S. market, their revenues and earnings will still be impacted by the non-USD origin of their products and or support services (manufacturing, cost of goods, etc.).

Note: Inflation is causing increases in company product/service increased pricing, resulting in consumer cutbacks that may cause “The Perfect Storm” in the fourth quarter.

INVESCO QQQ TRUST ETF • QQQ • NASDAQ • DAILY

In today’s market environment, it’s imperative to assess your trading plan, portfolio holdings, and cash reserves. Experienced traders know what their downside risk is and adapt as necessary. Successful traders manage risk by utilizing stop-loss orders, rebalancing existing positions, reducing portfolio holdings, liquidating investments, and moving into cash.

Successfully managing our drawdown ensures our trading success. The larger the loss, the more difficult it will be to make up. Consider the following:

- A loss of 10% requires an 11% gain to recover.

- A 50% loss requires a 100% gain to recover.

- A 60% loss requires an even more daunting 150% gain to simply break even.

Recovery time also varies significantly depending upon the magnitude of the drawdown:

- A 10% drawdown can typically be recovered in weeks to a few months.

- A 50% drawdown may take many years to recover.

Depending on a trader’s age, they may not have the time to wait nor the patience for a market recovery. Successful traders know it’s critical to keep drawdown with reason, as most have learned this principle the hard way.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment