NicoElNino

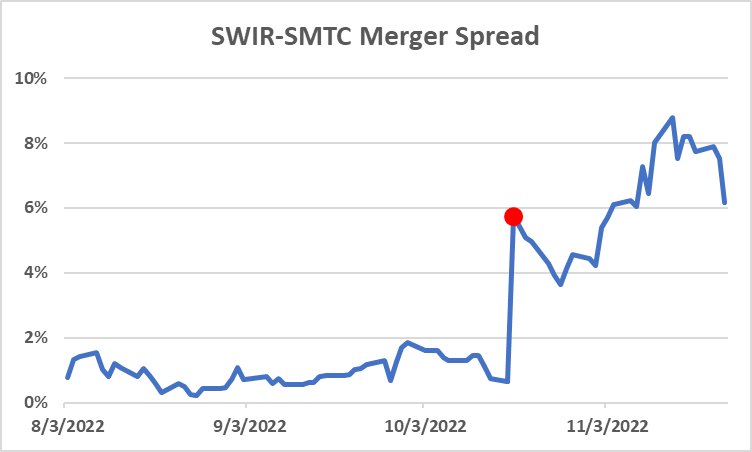

This is a mid-cap merger where the spread has recently widened due to regulatory concerns, however, the merger closing seems highly likely. IoT hardware and software provider Sierra Wireless (NASDAQ:SWIR) is getting acquired by semiconductor supplier Semtech (SMTC). The consideration is $31/share in cash. The transaction has already been approved by SWIR shareholders. Targeted closing is by Mar’23 unless extended by the companies.

The merger has already received regulatory approval from the Canadian Competition Bureau in Oct’22. The only remaining hurdle is antitrust approval in the US. The merger spread used to stand below 2% before spiking on October 18 on the news of a so-called second request from the DOJ. Currently, the spread stands at 8%. The regulator will have to provide a response within 30 days after both companies comply with the regulator’s information requests.

Author’s Calculations. Note: Red dot represents the date when the companies received a second request from the DOJ.

While more details on DOJ’s concerns have not emerged, some points suggest the merger is unlikely to receive regulatory pushback:

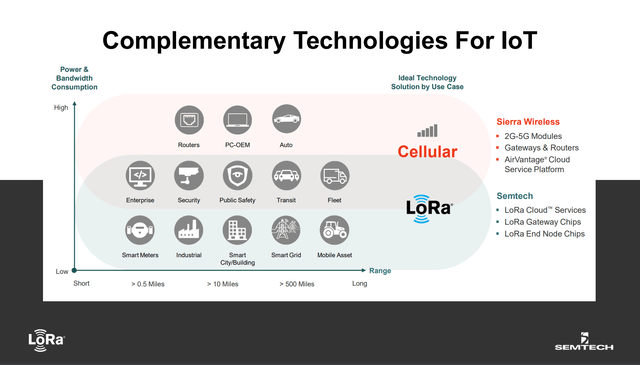

- SWIR and SMTC businesses have limited horizontal overlap. While both companies operate in the IoT wireless connectivity product/service segment, SMTC is a chipset supplier whereas SWIR produces modules and other products which require chipsets as inputs. Moreover, the offerings of both companies rely on different underlying technologies and hence serve different end-markets, suggesting competition is minimal.

- SWIR has a limited market share in both segments it operates in – cellular wireless modules and cellular wireless routers/gateways.

- Numerous transactions involving SWIR’s comparables have closed successfully in recent years.

- While the merger might admittedly involve some supply chain integration, the fact that both company products are based on different technologies suggests that SMTC might not be able to entirely displace SWIR’s current suppliers.

Notably, before agreeing to an acquisition by SMTC, SWIR had attracted company/asset acquisition interests from several PE firms. SWIR’s merger-related proxy (available on SEDAR) mentions two PE firms that reached out to SWIR in May’22 and Jun’22. This suggests the downside might be somewhat protected here in case of a deal break due to regulatory reasons.

Businesses and Horizontal Overlap

SWIR designs and sells hardware and services for wireless connectivity. The company segments its operations into Enterprise Solutions (32% of revenues) and IoT Solutions (68%). Enterprise Solutions primarily involves the production of cellular wireless routers and gateways for end-customers such as utilities and emergency services. The IoT Solutions business comprises sales of cellular wireless modules for industrial solutions and related IoT connectivity services, such as IoT cloud platform.

Meanwhile, SMTC supplies analog and mixed-signal semiconductors. The company splits its operations into Signal Integrity (optical data communications and video transport products, 39% of revenues), Wireless and Sensing (specialized radio frequency products, 33%) as well as Protection (transient voltage suppressors, also known as TVS, 28%).

Horizontal overlap between the companies seems minimal. SMTC produces chipsets used in numerous types of devices whereas SWIR manufactures modules, gateways and routers – all of which require chipsets as production inputs. Moreover, while both companies provide connectivity-focused products and services in the IoT space, the underlying technologies are different – SWIR provides cellular-based connectivity products and services whereas SMTC’s offerings are based on the company’s proprietary LoRa technology. Importantly, the underlying properties of both technologies are different – LoRa is low-power and -bandwith, meanwhile, SWIR’s cellular technology (5G) is low latency and high bandwidth. What this means is that both offerings have different target customers and do not directly compete. Cellular is employed in applications such as emergency services, connected car and entertainment whereas LoRa network solutions occupy market segments where cheap scalability, low power and long life battery take precedence, such as infrastructure, utilities, agriculture and other areas. These arguments suggest that regulatory pushback on horizontal overlap grounds is unlikely.

SMTC Investor Presentation, August 2, 2022

Sierra Wireless Market Shares

SWIR occupies only a limited portion of the market in both segments it operates in:

-

Cellular Wireless Routers and Gateways. Berg Insight has estimated the market size at $1.15bn in 2021. Meanwhile, SWIR’s revenues in the segment reached $150m in 2021, suggesting the company holds a 13% market share. Reportedly, SWIR is among the top five firms in the field, however, the largest player – Cradlepoint which was acquired by Ericsson – has been named the “clear leader in the space” with a 25% market share. Notably, beyond the group of largest companies, the wireless routers and gateways market is quite fragmented with numerous small and medium-sized players.

-

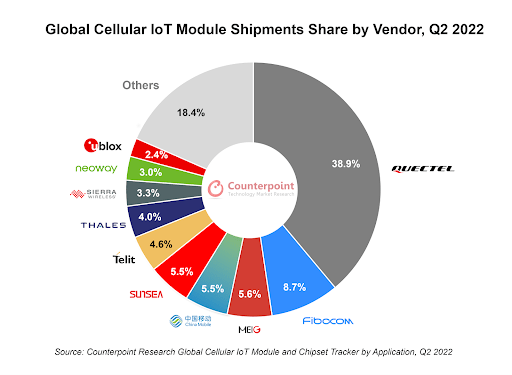

Cellular Wireless Modules. SWIR’s market share in cellular wireless modules industry by shipments volume has been estimated at just 3.3%. Notably, the market has been dominated by companies from China (55% market share and 6 out of 10 top vendors), with Quectel alone capturing 39% of the market by shipment volumes.

Counterpoint Research

Other Industry Transactions

Numerous SWIR’s peers have been successfully acquired in recent years – below are notable industry mergers:

- In Nov’21, Lumentum acquired optical component developer NeoPhotonics for $918m (equity value). Notably, Lumentum has been market leader in chips for 3D sensing, with an estimated 42% market share. The merger did not receive any antitrust pushback from the regulators.

- In Mar’21, Cisco completed the merger with Acacia Communications, a designer and manufacturer of high-speed optical interconnect technologies. The $4.5bn transaction did not receive any concerns from the US antitrust regulators. Acacia was previously one of Cisco suppliers.

- In Nov’20, Ericsson completed its acquisition of wireless router and gateway market leader Cradlepoint for $1bn. Notably, Ericsson already had a significant 4G-5G market presence, IoT platform and relationships with the world’s biggest mobile operators, suggesting the merger involved significant vertical integration. The acquisition closed in two months, after rather swiftly receiving antitrust clearance.

- In Apr’19, Thales acquired digital security software and wireless module provider Gemalto for €4.8bn. The acquisition was completed in 15 months. Thales has since held a 4% global market share in the wireless module segment. Notably, given horizontal overlap, the transaction required divestiture of Thales’s general purpose hardware security modules business.

Another recent industry transaction worth noting is Telit’s acquisition of Thales’ cellular IoT modules assets, which include cellular modules, gateways and data cards. Thales and Telit held a combined 8.6% wireless module market share as of Q2’22. The merger, which was announced in Jul’22, has so far not received any regulatory pushback.

Vertical Integration

The merger is expected to lead to some degree of vertical integration as the combined company will provide an end-to-end IoT solution, spanning from chipset manufacturing and module/gateway production to cloud IoT platform. SWIR currently purchases semiconductors used in manufacturing of modules, routers and other products. Given SMTC’s primary focus on semiconductor manufacturing, the buyer might try to displace some of SWIR’s current suppliers. SMTC has noted plans to include more LoRa chipsets into SWIR products:

Tore Egil Svanberg Stifel, Nicolaus & Company, Incorporated, Research Division – MD

Very good. And as my follow-up question — and Sierra, obviously, they sell systems, and I assume they probably buy semiconductors, right? So is there a role there where you will try and maybe displace some suppliers in the favor of your products? Obviously, LoRa is very different from [cellular], right? But yes, just trying to understand the dynamics there as you become more and more of a vertically integrated company.

Mohan R. Maheswaran Semtech Corporation – President, CEO & Director

Yes, so the initial concept and idea is actually to include more LoRa devices into modules and into systems, whether they be gateways or whether they be — whatever system it is. That’s the initial concept. I think obviously there’s also opportunities in the future to do more different types of technologies, multiple radios and how they work. But I think the priority is going to be on the integration of LoRa and cellular modules and then the cloud services aspect of the business.

Having said that, fundamentally different products of both companies are likely to limit degree of integration.

Another point here is that the merger will allow US-based SMTC to gain scale in the strategically important cellular wireless module market, which is currently dominated by Chinese companies. Given increasing geopolitical competition and data privacy concerns, SMTC’s push to become a more integrated company – which will allow it to better compete against foreign suppliers – seems unlikely to be opposed by US regulators.

Lower risk of antitrust on vertical integration grounds also seems to be supported by FTC and DOJ’s actions since Jan’21. Since early 2021, the regulators have mostly blocked mergers where the buyer and the target possessed significant horizontal overlap. Analysis of FTC’s rulings suggests that the regulator has only successfully blocked two transactions on vertical integration grounds – Lockheed Martin-Aerojet Rocketdyne and Nvidia-Arm. However, both mergers involved much larger buyers than SMTC. Another vertical merger – Illumina-Grail – was litigated by the FTC in court, however, the companies eventually won the case against the regulator. Meanwhile, the DOJ has also recently lost a major merger litigation against UnitedHealth-Change Healthcare – a $13bn transaction which involved two large companies participating in different levels of the supply chain.

Conclusion

With the current spread of 8%, SWIR-SMTC merger arb presents an interesting investment opportunity. The companies have limited horizontal overlap, moreover, SWIR has limited market shares in all the markets it operates in. There is also added confidence from other industry transactions involving SWIR’s peers. With expected closing by Mar’23, the situation might be on track to deliver a solid 25% annualized return.

Be the first to comment