Douglas Rissing

The BTAL ETF provides exposure to the spread between low beta and high beta stocks. This spread is essentially a measure of risk appetite, which is highly correlated to financial conditions. As financial conditions are expected to remain tight in the near term, BTAL should continue to generate positive returns.

Fund Overview

The AGFiQ U.S. Market Neutral Anti-Beta Fund (NYSEARCA:BTAL) is an actively managed ETF that provides exposure to the spread return between low and high beta stocks. The BTAL ETF has the potential to generate positive returns so long as low beta stocks outperform high beta stocks.

Strategy

To achieve its investment objective, the BTAL ETF tracks the Dow Jones U.S. Thematic Market Neutral Low Beta Index (“Index”). The index is designed to measure the performance of a long/short strategy with long positions in low beta companies and short positions in high beta companies.

Beta is calculated using weekly returns for the previous 52 weeks relative to the S&P 500 Index. The index is dollar neutral (long and short the same dollar amount) within each sector by identifying the 20% of securities with the lowest betas as equal-weight longs and the 20% of securities with the highest betas as equal-weight shorts.

Portfolio Holdings

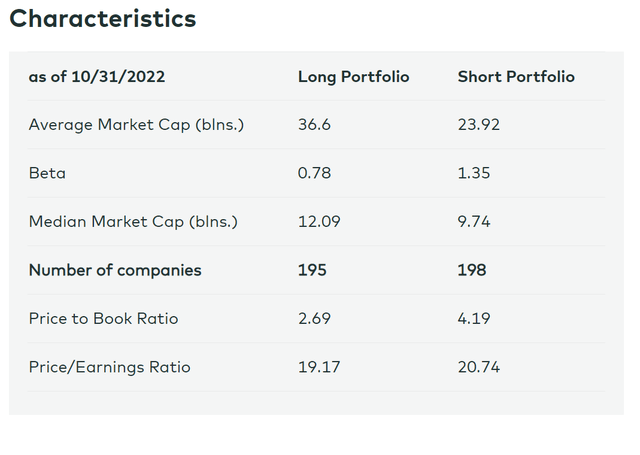

As of October 31, 2022, the BTAL ETF portfolio is long 195 companies with an average beta of 0.78 and short 198 companies with an average beta of 1.35 (Figure 1).

Figure 1 – BTAL portfolio characteristics (agf.com)

Returns

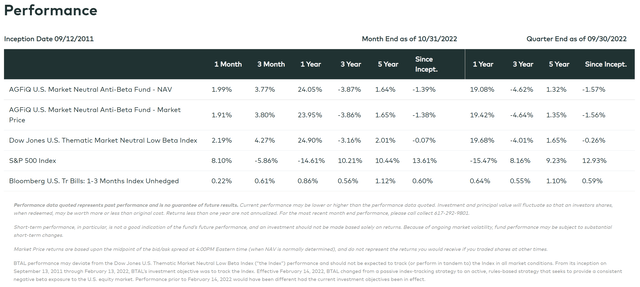

In the short-term, BTAL has performed very well, with 1Yr returns of 24.1% to October 31, 2022 vs. -14.6% for the S&P 500 Index (Figure 2). However, on longer-term time horizons, BTAL has performed poorly, with 3Yr and 5Yr average annual total returns of -3.9% and 1.6% respectively vs. 10.2% and 10.4% for the S&P 500.

Figure 2 – BTAL returns (agf.com)

Distribution & Yield

The BTAL ETF does not pay a distribution.

Fees

The BTAL ETF charges a net expense ratio of 1.54% after fee waivers from the manager. Gross expense ratio is 2.06%.

Low Beta/High Beta Spread Works When Financial Conditions Are Tightening

The basic idea behind the BTAL ETF is to play the spread between low beta and high beta stocks. This spread is similar to the concept of ‘risk appetite’ that I have written about previously, when discussing the Renaissance IPO ETF (IPO). Intuitively, when risk appetite is low, investors prefer low beta defensive securities and shun high beta ‘risky’ securities.

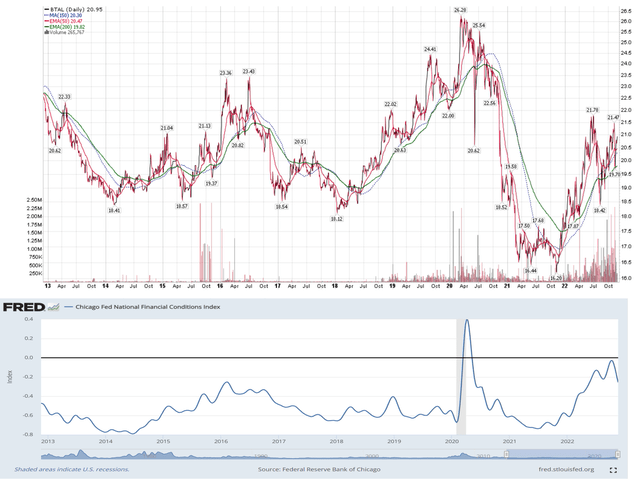

Broadly speaking, risk appetite is strongly influenced by financial conditions. When financial conditions are ‘loose’ or ‘easy’, risk appetite increases, and high beta stocks outperform. Figure 3 overlays the BTAL ETF vs. the Chicago Fed National Financial Conditions Index. We can see the peaks and troughs between the two series are highly correlated.

Figure 3 – BTAL vs. Financial Conditions (Author created with price chart from stockcharts.com and financial conditions from St. Louis Fed)

Looking forward, as the Federal Reserve remains keen on tightening financial conditions to fight inflation, we should expect the low beta / high beta spread to continue to generate positive returns for BTAL.

Risks To BTAL

The key risk to BTAL, if we observe from Figure 3, is a loosening of financial conditions. For example, if the economy enters a recession in the coming months and the Federal Reserve is forced to reverse course and lower Fed Funds rate to stimulate economic growth, then we can expect low beta/high beta spread to generate negative returns for BTAL.

Conclusion

The BTAL ETF provides exposure to the spread between low beta and high beta stocks. This spread is essentially a measure of risk appetite, which is highly correlated to financial conditions. As financial conditions are expected to remain tight in the near term, we should expect BTAL to continue to generate positive returns.

Be the first to comment