blackdovfx

Kimball Electronics, Inc. (NASDAQ:KE) got my attention because its quant rating is particularly high at 149 out of 4766. Therefore, it was worth taking a look at the stock.

The company is a small business with revenues of $1.35B as of June 2022, and its market capitalization is only $566M. The company provides contract electronics manufacturing services and diversified manufacturing services for the automotive, industrial, medical, and public safety markets.

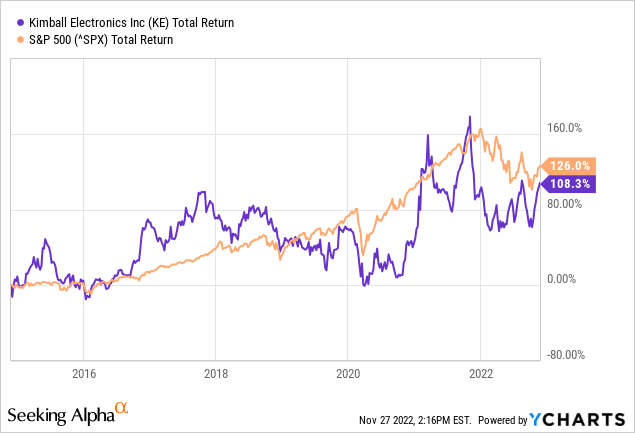

Although the stock offers plenty of volatility, its share price still rose 108% from 2014 to the present, compared with the 135% return of the S&P500. Kimball Electronics stock represents a good return, but it comes with high volatility.

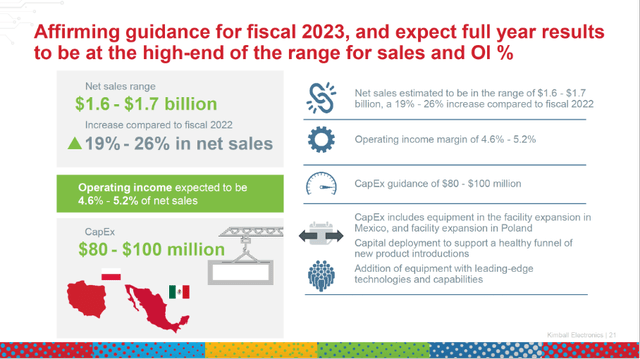

Sales are expected to grow 19% to 26% from fiscal year 2022, keeping sales and operating margin at the upper end of the range.

Kimball Electronics benefits from strong demand for automotive microchips. Their strong growth prospects and favorable stock valuation make the stock a buy.

Company Overview

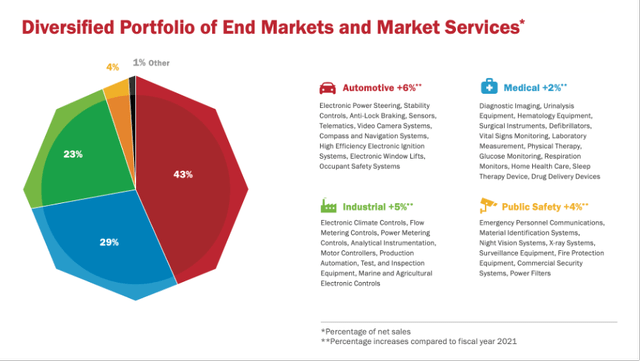

Kimball Electronics is a provider of contractual electronics manufacturing services (“EMS”) and diversified manufacturing services to customers in the automotive, medical, industrial and public safety markets. Their core competency is the production of durable electronics, but they also provide services in disposable medical supplies, drug delivery solutions, precision molded plastics and manufacturing automation, testing and inspection equipment.

The image shows their portfolio breakdown for fiscal 2022, but in the current quarter the company consolidated the industrial segment and the public safety segment.

Diversified Portfolio of End Markets and Market Services (Fiscal 2022 Annual Report)

Automotive Market Is Booming And Kimball Electronics Expects Strong Growth

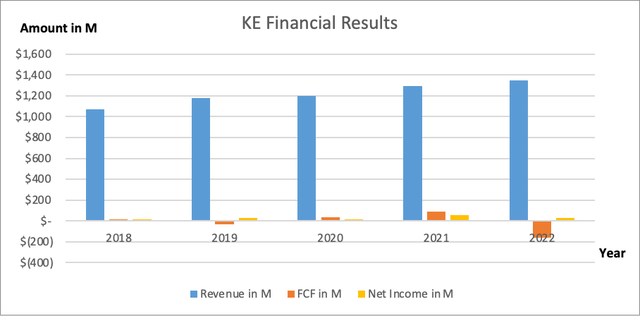

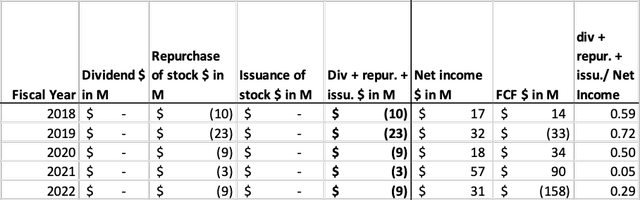

Kimball Electronics has managed to grow its sales strongly in recent years. From fiscal 2018 to fiscal 2022, sales grew an average of 6% per year. Net income grew an average of 18% per year. Free cash flow was negative due to capital expenditures related to equipment in facility expansion.

Kimball Electronics Financial Highlights (SEC and Author’s own graphical visualization)

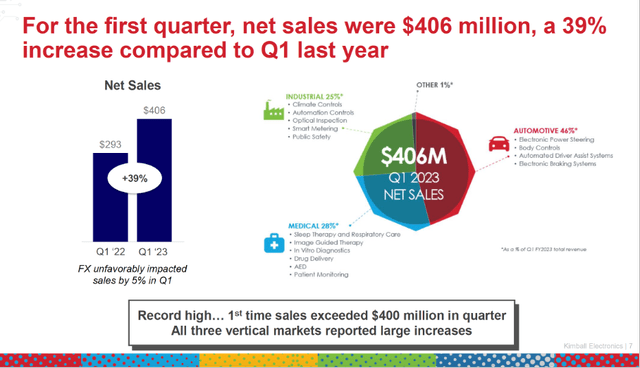

In the first quarter of fiscal 2023, sales increased sharply by 39% year-on-year. Gross margin was significantly higher (7.2%) than in the same period last year (5.3%). However, production was more severely constrained by a shortage of parts. Adjusted selling and administrative expenses were 3.9% of revenues, up from 4.2% in the same period last year. Cumulatively, the figure was higher due to higher salaries and related payroll costs, share-based compensation, factoring costs and travel expenses. Adjusted operating income came in at 3.3% of revenues, up from 1.1% in the same period last year.

Sales growth 1QFY22 (1Q22 Investor Presentation)

The automotive end market was the best performing vertical and experienced strong growth, with 43% year-on-year revenue growth. As a result, the automotive segment now accounts for 46% of total sales. Kimball Electronics provides products such as electronic power steering, automatic driver assistance, electronic braking, and redundant braking systems in self-driving applications. Advanced Driver Assistance Systems is a growing business within this sector. CEO Don Charron expects robust continued growth in this industry megatrend they call “electrification” of vehicles. Electronic components are being added to these smart vehicles at an increasing rate. There are increasingly stringent production standards for both electric and internal combustion engines. Rapid adoption of electric vehicles (EVs), expansion of autonomous driving, and improved connectivity are strong growth engines in this industry megatrend.

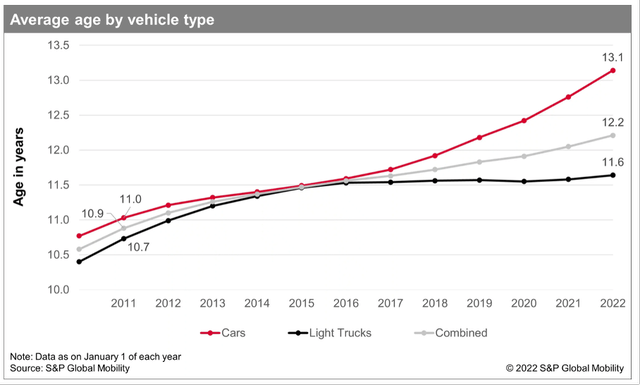

This growth trend is reinforced by the fact that the average age of cars has risen to 13 years. This is the fifth year in which the average age of cars has risen sharply. The cause can be found in the ongoing shortage of microchips, coupled with related supply chain and inventory challenges. Car manufacturers cannot deliver their cars if the chips are not delivered on time. Lagging delivery slows car sales and causes users to extend use of their cars. This increases the average age of cars.

Average age by vehicle type (S&P Global Mobility)

S&P Global expects the shortage of microchips to continue through 2023. The increasing use of the latest technology requires a greater supply of microchips. The ongoing crisis between Russia and Ukraine remains a potential impact on the supply chain of new vehicles in the coming year. Quoted from S&P Global website:

“While some of the new vehicle demand has been destroyed, as supply chain challenges ease, some pent-up demand for new vehicles is expected to be realized through the middle of the decade. At that time, scrappage rates could increase, creating the climate for average age to moderate or even reduce slightly,” said Campau.

The automotive market is a strong growth market for Kimball Electronics.

Looking beyond the automotive end segment, the Medical segment also showed strong sales growth last quarter.

The medical segment accounts for about 28% of total sales and sales increased 35% year-on-year. The corona crisis had a strong impact on the medical sector with a significant decline in elective procedures during the crisis. The growth of products with applications such as sleep and respiratory therapy, image-guided therapy, in vitro diagnostics, drug delivery systems, AED and patient monitoring equipment shows that the medical industry is recovering rapidly. The aging population, improved and cheaper access to healthcare and increasingly sophisticated medical equipment are growth drivers for this end market.

Finally, Kimball Electronics experienced strong growth in the Industrial end markets. The Industrial segment also consolidates the Public Safety end segment and represents 25% of company sales. This segment saw year-over-year sales growth of 35%. Kimball Electronics manufactures products that contribute to smart cities, energy efficiency and energy management. They call this segment “Green and Clean.” As well as industrial devices and applications focused on public safety.

Kimball Electronics expects momentum to continue in fiscal 2023. Sales are expected to increase 19% to 26% over fiscal 2022, putting them at the upper end of the range for sales and operating margin. The $2B sales milestone is in sight, and production capacity is being carefully evaluated at each location to support the higher level of production needed to reach the $2B milestone.

Guidance FY23 (1Q22 Investor Presentation)

Share Repurchases

Although Kimball Electronics does not pay a dividend, they repurchase shares. In fiscal 2022, the company repurchased $9 million worth of shares, representing a repurchase yield of nearly 2%.

Share repurchases are a tax-efficient way to return cash to shareholders. When the company repurchases shares in the open market, demand increases while supply decreases.

Because Kimball Electronics is a small company, free cash flow is unstable over the years. Share repurchases represent only a small amount compared to their net income. No shares were repurchased in the first quarter of fiscal year 2023, but there is $11 million remaining on their program.

Share repurchases (SEC and Author’s own calculations)

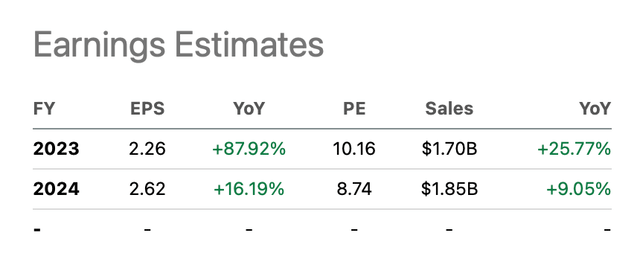

Earnings Outlook Is Great, Share Valuation Metrics Look Favorable

Analysts reported on the Seeking Alpha KE ticker page that they see strong growth in earnings per share for the next few years. The P/E ratio for fiscal year 2024 is expected to be 8.7, very attractive compared to the S&P500’s P/E ratio of 21.

Earnings estimates (Seeking Alpha KE ticker page)

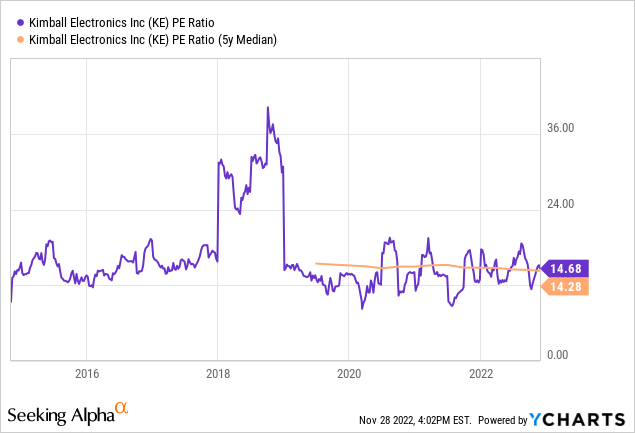

Looking at the average P/E ratio for the past 5 years, we see that the P/E ratio is about 14, in line with the average number. To get an estimate of the average share price at the end of fiscal year 2024, we multiply the expected earnings per share of $2.62 times the average P/E ratio of 14 to arrive at the share price of $36.70. As of November, the share price of $22 provides a margin of safety for estimated value in fiscal year 2024.

The estimated share price offers an expected return of 28% per year on average. It should be noted that this is an estimated value, and the car manufacturing market tends to be highly volatile. Although many analysts are positive about the secular EV trend, a recession is looming because the yield spread is deep in the red. Investors should be cautious when investing in the car manufacturing market or end markets in this sector.

Key Takeaways

- Kimball Electronics: their core competency is the production of durable electronics, but they also provide services in disposable medical supplies, drug delivery solutions, precision molded plastics and manufacturing automation, testing and inspection equipment.

- Kimball Electronics got my attention because its quant rating is particularly high at 149 out of 4766.

- In the first quarter of fiscal 2023, sales increased sharply by 39% year-on-year. Adjusted operating income came in at 3.3% of revenues, up from 1.1% in the same period last year.

- The automotive end market was the best performing vertical and experienced strong growth with 43% year-on-year revenue growth.

- CEO Don Charron expects robust continued growth in this industry megatrend they call “electrification” of vehicles. This growth trend is reinforced by the fact that the average age of cars has risen to 13 years. The cause can be found in the ongoing shortage of microchips, coupled with related supply chain and inventory challenges.

- Kimball Electronics expects momentum to continue in fiscal 2023. Sales are expected to increase 19% to 26% over fiscal 2022, putting them at the upper end of the range for sales and operating margin.

- In fiscal 2022, the company repurchased $9 million worth of shares, representing a repurchase yield of nearly 2%.

- Share repurchases are a tax-efficient way to return cash to shareholders. When the company repurchases shares in the open market, demand increases while supply decreases.

- The estimated share price offers an expected return of 28% per year on average.

- Although many analysts are positive about the secular EV trend, a recession is looming because the yield spread is deep in the red. Investors should be cautious when investing in the car manufacturing market or end markets in this sector.

Be the first to comment