Bradley Caslin

Shares of easyJet (OTCQX:EJTTF) declined by over 5% since I covered the airline’s earnings back in June. The broader markets gained nearly 4%, so I would say that putting a Hold rating instead of a buy rating has been the right decision. In this report, I will have a look at the FY2022 results and compared them to FY2021 results but more importantly to FY2019 and I will analyze the guidance provided for 2023.

Limited Strength Visible In Base Fares

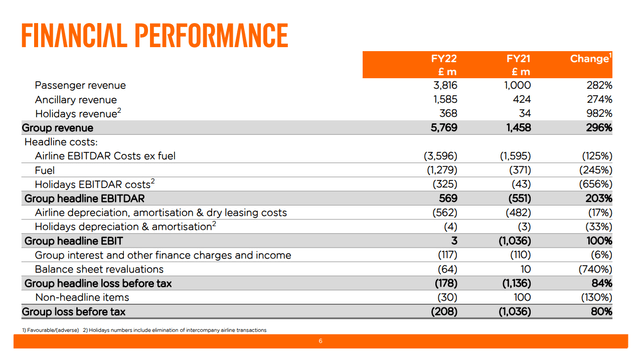

On the revenue side, we saw easyJet doing a 3x. Passenger revenue and ancillary revenue also did a 2.7x-2.8x and somewhat obvious year-over-year the growth in holidays revenues was even stronger do a 10x. For easyJet’s Holidays business, we don’t have a meaningful comparison available. The business was launched in 2019 and should have seen full year contributions in 2020 with a break-even target. Obviously with the pandemic kicking in 2020 as well as 2021 numbers and to some extent 2022 numbers are not fully reflective of the business potential making comparison pointless. We can, however, assess how the business is performing with regard to its break-even target and what we see is that both on pre-tax and after-tax level there was a 8% margin. So, driven by strong demand for holidays easyJet saw a strong year for its Holidays segment.

Year-over-year seats flown increased from 28.2 million to 81.5 million marking an 189% increase. Passengers flown increased 242%, meaning that the remainder in growth was driven by stronger unit revenues which stood at £66.23 compared to £60.81 per seat in 2019. So, pricing environment is better than last year but also better than in 2019. However, this is driven by ancillary revenues. Compared to 2019, passenger revenues are down 24% and ancillary revenues are up 15% on capacity being down 24%. So, what we’re seeing is that passenger revenue is down in line with the capacity and the positive offset on revenues is really only provided by ancillary revenues. Even though year-over-three, the passenger revenues per seat excluding ancillary revenues are down compared to 2019, I do believe that overall results are good. We see stronger revenue generation in ancillary and easyJet had some challenges during the summer with its Gatwick and Amsterdam operations which pressured revenues.

Year-over-year, revenue per seat improved 31% and 8% compared to 2019 while headline costs per seat went from £56.74 in 2019 to £68.88 in 2022. Excluding fuel that would be an increase from £43.26 to £65.28. So, on a unit basis we see 8% higher revenue but 50% higher costs excluding fuel. This is driven by higher crew costs, maintenance and overhead costs and less seats to amortize these costs over.

Liquidity And Debt

For FY2022, cash flow from operating activities was £776 million with cash and cash equivalents being stable at £3.64 billion. In 2019, we saw operating cash at £761 million and cash and cash equivalent sup £260 million up to £1.285 billion. Net debt stood at £670 million compared to £326 million in 2019. So, I would say that while base fares have not exploded as we see in other parts of the world, at least not for easyJet, they also are not in a position of high net debt as we do see with other airlines.

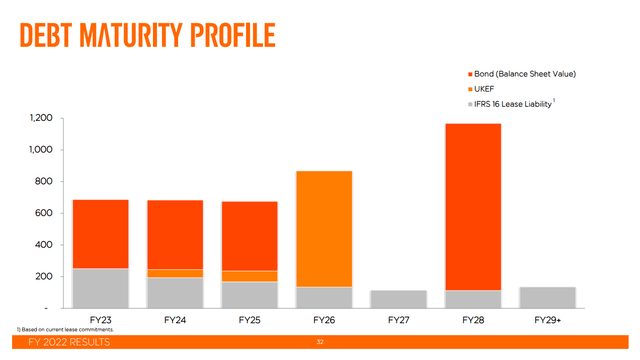

Looking at maturing debt, we see that there is debt maturing in the coming years. Ideally, I would like to see up to 36 months of debt-free runway. EasyJet does not have that, but with their cash and cash equivalents they can easily surface that debt. Essentially, they’re able to get to the 36 month debt free runway if they burn off their cash liquidity to 2019 levels. So, I’m not concerned regarding upcoming debt maturities.

Risks And Opportunities

When it comes to risk, the obvious risk we’re seeing is with regard to the British economy. The British economy is not in good shape and that could backfire on easyJet even though holiday demand is likely to remain strong. However, I could see significant pressure on fares. Those fares already were not extremely impressive compared to 2019 and I do believe it reflects the competitive environment for easyJet.

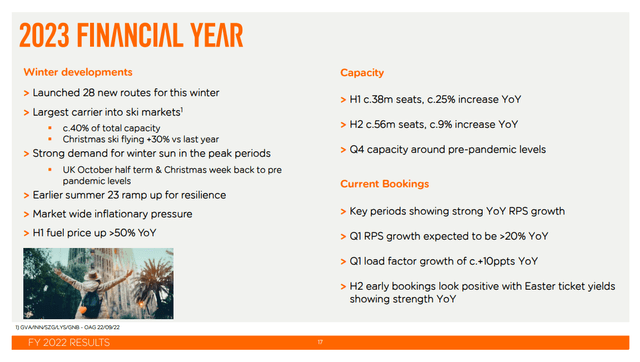

On a capacity level, easyJet expects to be up 25% year over year in the first half of the year and 9% in the second half with 94 million seats expected to be flown up 15% year-over-year but down 10% compared to 2019. So, what we see at easyJet is somewhat mixed. Easter ticket yields are stronger year-over-year, but at the same time they’re cautious on revenue strength and that is really a view diverging from other airline comments.

Conclusion: No Positive Surprise, easyJet Stock Down

I would consider shares of easyJet a hold given their manageable debt and relatively small growth in net debt position compared to pre-pandemic levels. Capacity is expected to grow which should bring per seat costs down, but we’re seeing that on base fares. The company is not seeing the big boom that other airlines saw and the company has warned on softening in fares, and while the Holidays segment is expected to see 30% year-over-year growth I do not see big reasons to buy easyJet shares at this point and given that shares are trading down 2.6% I don’t think that anyone has been particularly impressed with results or the 2023 guidance.

Be the first to comment