Sundry Photography/iStock Editorial via Getty Images

Panasonic’s (OTCPK:PCRFY) latest quarterly results and lowered full-year guidance will disappoint investors, but there were also positive takeaways. For one, the guidance reset embeds a cautious USD/JPY assumption, leaving room for upward revisions from here. Recent price increases for consumer appliances in Japan (Panasonic will hike prices by 3-23%) could also drive upside to near-term earnings growth, along with subsidies from the Inflation Reduction Act (IRA). The latter is key – as Panasonic cements its leadership in battery manufacturing and potentially explores a spinoff, expect a valuation re-rating in line with peers like CATL and LG Energy Solution (both of which command >15x EV/EBITDA valuations). Meanwhile, the long-term optionality from hydrogen is just as attractive, even with earnings contribution only guided to hit the P&L in 2030. Restructuring progress will be the key upside catalyst from here, potentially enabling more high-valuation business listings like Blue Yonder.

Lowering The Guidance Bar

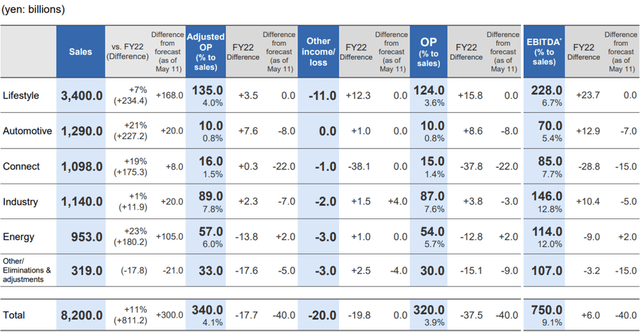

Panasonic missed Street estimates for its latest quarter, although its pricing power did come through, helping it offset higher raw material prices, particularly in the lifestyle business. In line with the miss, management lowered the full-year adj operating profit guidance to JPY340bn (from JPY380bn previously), reflecting the challenging near-term macro outlook. That said, the guidance also embeds potentially conservative FX assumptions at JPY132/USD and JPY134/EUR for the full year (down from JPY115/USD and JPY130/EUR previously). Plus, it accounts for the prospect of consistently high input costs (e.g., lithium, cement, and iron), as well as for slower customer spending at the recently acquired Blue Yonder.

Importantly, the latest guidance update resets the bar lower, and with most of the headwinds now accounted for, there is ample room for earnings upside, in my view. Given the recent industry-wide price hikes for consumer appliances in Japan (Panasonic will hike by 3%-23%), expect pricing power to continue insulating margins into the upcoming quarters. In addition, the batteries business also looks set to contribute strong earnings following the construction of a new US-based automotive battery plant. Yet, the outsized strategic investment required, as well as the lack of clear capex guidance, leaves open the possibility of Panasonic’s balance sheet capacity being constrained in the meantime.

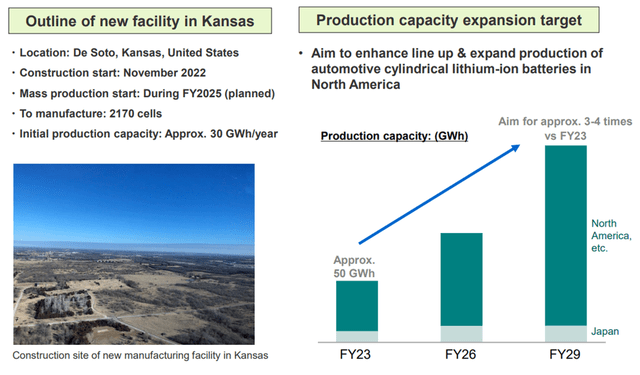

IRA Subsidies To Support The Battery Business

Alongside earnings, Panasonic has officially finalized plans for a new plant in Kansas with an annual production capacity of ~30GWh. Production will cover Panasonic’s 2170 EV batteries (i.e., the lithium-ion cells it produces and supplies to Tesla (TSLA)) but not the new 4680 cylindrical battery cells currently under development. More broadly, this new plant will move Panasonic closer to its targeted annual production capacity ramp-up to 150-200GWh by FY28 (up from the current ~50GWh) but will require a significant capital outlay at >$4bn (assuming no subsidies). As things stand, construction is slated to begin in November 2022, and mass production is targeted for FY24.

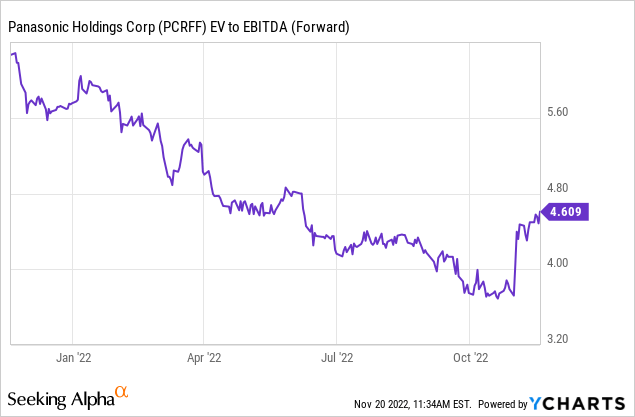

The key for the near-term economics is the passing of the Inflation Reduction Act (IRA), which will offer advanced manufacturing production credits worth $35/KWh for automotive batteries from 2023 before phasing out fully by end-2032. Per management, IRA subsidies will boost profits in the energy segment by ~JPY40bn in Q4, although this likely moves much higher as production ramps up. Perhaps more importantly, the IRA subsidies validate the firm’s battery leadership and future growth potential, which could have important implications for the valuation. Given battery manufacturing comps such as China’s CATL and LGES in South Korea typically command significantly higher EV/EBITDA valuations (note Panasonic trades at 4-5x EBITDA), progress here paves the way for a separate listing or spinoff down the line.

Long-Term Optionality From The Hydrogen Business

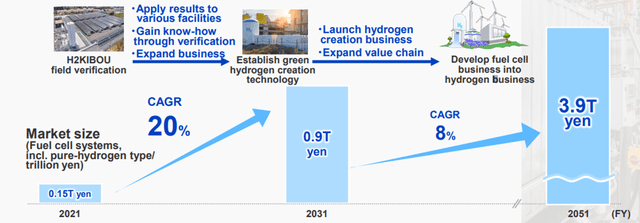

Panasonic’s hydrogen ambitions make sense given the global market potential – by 2030, the company guides to JPY6tn of hydrogen-related demand, including ~JPY900 bn for installed fuel-cell systems (implied 20% CAGR). While the company is targeting Japan and Europe initially, China could also be an addressable market opportunity should subsidies extend beyond large-scale installations. The capex commitment is currently sized at JPY10bn/year over the next few years, although larger investment plans are being actively considered, presenting upside to these estimates.

Still, growth in this business could open up an attractive new recurring earnings stream via external sales of energy management systems. Further, government support could significantly alleviate the initial capex burden, given hydrogen’s role in guaranteeing energy security for Japan over the long run. For now, though, hydrogen-driven growth is purely option value, given there will be limited earnings contribution until 2030 or so. Pending tangible results here, a future listing remains off the table, so I do not see hydrogen alleviating the conglomerate discount/overhang on Panasonic stock anytime soon.

Long-Term Upside Potential Outweighs Near-Term Headwinds

Panasonic’s decision to revise its guidance lower may have disappointed investors, but the long-term growth story remains intact. Progress in the battery business, in particular, has been positive, as the company’s new battery plant and IRA subsidies should boost the earnings growth trajectory. Given its Asian battery manufacturing peers command significantly higher valuation multiples as well, the Panasonic battery business could unlock significant value in a future spinoff. Over the long run, the hydrogen opportunity presents massive upside as well, even with earnings visibility limited for now. The stock currently trades at an undemanding 4-5x EV/EBITDA, presenting compelling value to patient, long-term investors.

Be the first to comment