HT Ganzo/iStock via Getty Images

Piedmont Lithium Inc. (NASDAQ:PLL) is a money-losing pre-production lithium miner. It has somewhat vague plans to also one day open up a lithium hydroxide processing facility in a location that is yet “to be determined.” The company, which has a market cap of over $1 billion, has some stock holdings in a couple of other small mining companies, and is also trying to start its own mine in the United States; North Carolina to be exact. And that, of course, means that it’ll be stuck in a regulatory and legal purgatory that will last for years to come. Upon seeing all of this, I was tempted to slap a “sell” rating on the stock and be on my way. But fortunately, I decided to dig a little deeper. And what I found, I liked.

A couple of years ago when lithium prices were far lower than where they currently trade at today, Piedmont made a shrewd and well-timed deal to secure concentrate from a Quebec-based mine, and that deal is about to begin paying off. However, the markets don’t seem to be paying very much attention to this part of its business as the focus is almost always on the company’s U.S. operations. But when production starts at the Quebec property, investors will have no choice but to pay attention.

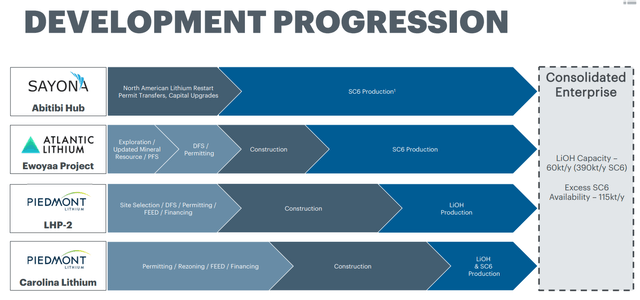

Carolina Lithium

The company is currently working on four projects, but the one that it’s most associated with is Carolina Lithium. That’s the project that is probably furthest from completion and is the aforementioned mine and processing plant in North Carolina. Here, Piedmont plans to extract 242ktpa of spodumene concentrate (“SC6”) from a property that has a total resource size estimated at 44.2Mt @ 1.08% Li2O. The SC6 will eventually serve as feedstock for the lithium processing plant that will produce 30ktpa of lithium hydroxide (“LiOH”). The project’s anticipated capex is rather high at $988 million, but its after-tax NPV8 and IRR are decent, coming in at $2.8 billion and 34% respectively.

Piedmont had initially planned on using the site to supply Tesla (TSLA), with which it has an offtake agreement, beginning sometime between July 2022 and July 2023. But the company has since postponed the start date as it remains stuck in the permitting process; a process that turned out to be much slower than anticipated, and that currently has no clear projected completion date.

The Carolina project is the one that Piedmont is known for, and its stock has risen and fallen along with its fortunes. But to get a better understanding of the stock’s full potential, we need to take a look at one of Piedmont’s often-ignored other projects.

Abitibi Hub

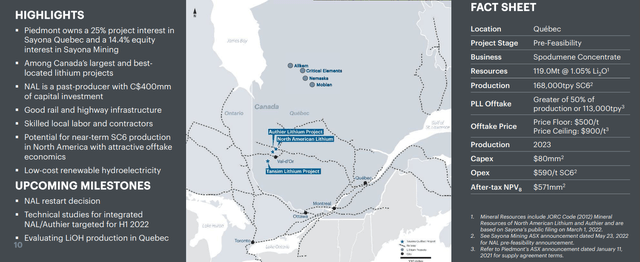

In January 2021, Piedmont purchased a stake in Sayona Mining Limited (OTCQB:SYAXF), an Australian mining company with properties in Australia and the Abitibi region of Quebec, Canada. Piedmont’s equity interest in Sayona now totals about 14%, but of much greater consequence is its 25% stake in Sayona Quebec Inc. (“SQI”) which it purchased for about $5M, Sayona Mining Ltd.’s Canadian subsidiary of which Sayona still owns the other 75%.

SQI holds a 100% interest in the lithium mining operations of North American Lithium (“NAL”). NAL was a Quebec-based lithium miner that shut down in 2019 due to low lithium prices, and in 2021 SQI bought the assets and merged it with Sayona Mining Ltd.’s Authier Lithium Project that’s located just down the road. So what all of this means, is that in addition to owning 100% of Carolina Lithium, a mine that currently produces nothing, Piedmont also owns 25% of SQI/NAL, another mine that currently produces nothing.

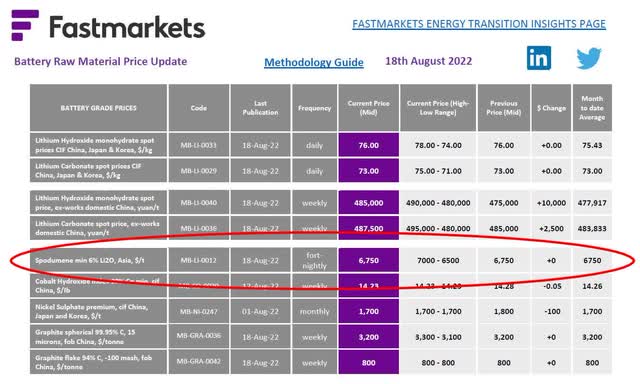

But as they say, the devil is in the details and so is the value embedded in a long-term contract. That’s because, when Piedmont was negotiating the deal with Sayona, it secured an offtake agreement that allowed it to purchase the greater of 113ktpa of SC6 or 50% of NAL’s production for between $500 and $900 per metric ton. Those were the prevailing prices when the deal was struck, but they’re not the prevailing prices today. Today, SC6 trades for about $6,750/t, which would give Piedmont a $661 million yearly gross profit if the mine were currently in operation. That’s using the $900 price ceiling, assuming purchase of the minimum 113k tonnes and doesn’t factor in shipping costs which would reduce that gross number.

Now granted, lithium prices have recently been on quite a run due to production shutdowns in Sichuan, China and booming electric vehicle (“EV”) sales. The Sichuan situation will probably resolve itself in the weeks to come, and EV sales may cool due to a slowing economy by the time the mine begins production. It’s also highly likely that the mine will take time to ramp to full production, meaning that Piedmont may not get its full allocation in 2023.

So, to take all of these factors into account, we’ll be very conservative and assume that Piedmont gets a 60k tonne allocation in 2023 and nets $3,000 per ton, a price similar to what lithium was trading at a year ago. Even in that case, the miner would make $180 million, or $10/share. Then, using Albemarle Corporation’s (ALB) P/E of 13.7 as a benchmark, we can derive a share value of $137 per share for Piedmont.

And just to be clear, those terms will last for the life of the mine and a Pre-Feasibility Study released this May indicated that the mine will be viable for 27 years. The two companies have also expressed an interest in one day jointly building and operating a lithium conversion plant. In such a case, the preferential terms enjoyed by Piedmont would carry-over to the new arrangement.

The project is also located in a mining-friendly region which has all of the necessary road and rail infrastructure and is home to many mining projects, including Glencore plc’s (OTCPK:GLCNF) gigantic Horne Smelter in the nearby town of Rouyn-Noranda. So, I don’t anticipate any regulatory issues such as the ones impeding the company’s Carolina project.

Ewoyaa & LHP-2

Piedmont’s other two projects are a mine in Ghana and a U.S.-Based lithium hydroxide plant that will be built to refine that mine’s SC6. While interesting, and in spite of the fact that the company’s most recent 10-Q says that a feasibility study for LHP-2 will be published within the next four months, I believe that these projects will not have a meaningful impact on the stock’s performance for some time.

The timelines for the projects seem a little ambitious, given where things currently stand. A feasibility study for LHP-2 will be difficult to complete within the given timeframe when a location for the plant has not even been selected yet. I’m not bringing this up to single out Piedmont, as hopeful projections are extremely common in the industry. Miners are an optimistic bunch, and they have to be given all the obstacles they face.

Catalyst

But what I think will really get the stock moving will be a restart of production at the Abitibi project. And that project does appear to be right on schedule. In June 2022, Piedmont and Sayona formalized restart plans for the NAL/SQI site, agreeing to commit $80 million towards that end on a pro rata basis. Then on August 4, Sayona issued a press release explaining that construction work continues to ramp up as 30% of the plant upgrades are complete, and the project is on track to deliver its first SC6 in Q1 2023. So, investors can look for the market to begin taking notice of the stock this fall as the production start date approaches.

Risk

The risk to this thesis is a deep and persistent fall in the price of lithium. The NAL mine closed once in 2019 due to low lithium prices and if the price of SC6 were to drop back to those levels, the mine would again be in danger of closing.

The second risk is operational in nature. Breakdowns, slowdowns, and accidents frequently occur on mine sites and these can sometimes prove to be very costly both in money and time lost. Although production is currently slated to begin in Q 1 2023, any number of operational mishaps could easily push that date back several quarters into the future.

Be the first to comment