RoschetzkyIstockPhoto/iStock Editorial via Getty Images

Here at the Lab, we recently analyzed Bridgestone and Continental Aktiengesellschaft, providing a neutral rating target for the two companies. We see the Japanese tire manufacturer as ‘a show me story’, whereas we expect Continental to continue to suffer at profitability level. In addition, Continental’s management is always too optimistic and thanks to our recent Autoliv analysis, we are more cautious. Within the tire sector, our preference has always been Michelin (OTCPK:MGDDF;OTCPK:MGDDY). This year, we commented about the company twice already and we analyzed its Russian exit implication and also the latest monthly data improvements. Today, we provide an analysis of the just-released Q3 numbers.

Q3 Results

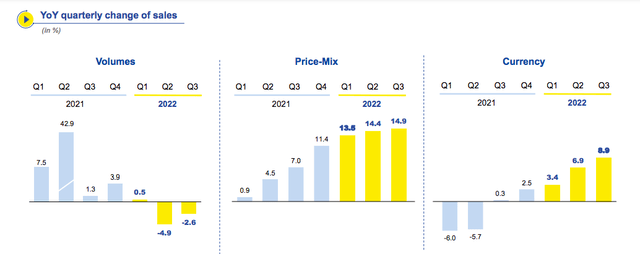

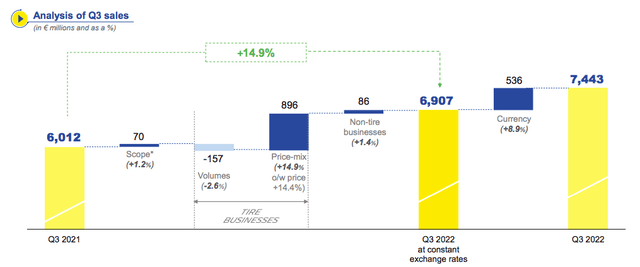

As is customary, there is no disclosure of the company’s profitability. With €7.4 billion in top-line sales recorded in Q3, this was up by +23.8% on a yearly basis. In detail, the group’s sales reached €20.7 billion at the end of September, an increase of 20.5% compared to the same 9 months period in 2021, accelerating its revenue growth trajectory on a quarterly basis. This was supported by a higher price mix as well as a positive evolution of FX currency (sustained by an additional plus 8.9%).

Source: Michelin Q3 result presentation

However, tire volumes fell by 2.4% over one year mainly due to the Russian market exit and Chinese health restrictions.

Michelin volumes, price mix and FX evolutions

Despite that, Michelin is currently outperforming the tire markets and is supportive of Mare Evidence Lab’s thesis, confirmed even in our last publication called: Tire Market Improvement Continues. As already mentioned, “We should keep in mind that new commercial vehicle and car registrations were down by -14% and -20.3% in the EU“.

Conclusion and Valuation

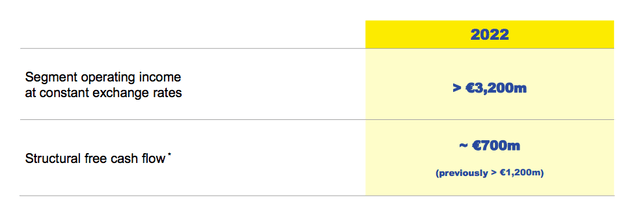

In this complex scenario, the company tire manufacturer confirms its 2022 guidance for annual EBIT profit at the CET level and revises its outlook for structural FCF to €0.7 billion (from a previous estimate of €1.2 billion). Michelin is adjusting free cash flow for higher working capital requirements due to raw material inflationary pressure and inventories. Energy costs are expected to account for approximately 4% of the company’s total turnover in 2022, versus the 2.5% recorded in 2021. Here at the Lab, we believe that we are almost at the inflation peak, and working capital will soon revert its trajectory. The company forecasts a flat projection in the Passenger Car and Light truck market, whereas it estimates a single-digit increase in the Truck & Specialty tire divisions.

Concerning the valuation, Michelin is still trading at a higher discount on EV/EBITDA (4.5x versus 5.5x). Valuing the entity in line with its historical average, we derive a buy rating target of €33 per share, confirming our outperforming view on the company.

Be the first to comment