iHeartMedia is no longer just a radio company, but the terrestrial radio segment still drives results and will enable the company to continue to deleverage the balance sheet while simultaneously building a content business for the future. avdyachenko/iStock via Getty Images

As many of our readers know, we have taken a liking to media companies over the last few months. New media companies focused on revenue growth that lack earnings and significant cash flows do not fit our thesis, but content creators who own their content, have good distribution and generate strong cash flows (and in some instances dividends) are of particular interest to us as they fit our current thesis and fit a specific allocation we need in our portfolios.

This brings us to iHeartMedia, Inc. (NASDAQ:IHRT) and their recent quarterly results. We have recently written about Cumulus Media (CMLS) and Townsquare Media (TSQ), both competitors with iHeartMedia’s terrestrial radio segment, and discussed why we liked both of those companies; not necessarily because of the terrestrial radio assets, but because of what those companies are doing to diversify their revenue streams while also deleveraging their balance sheets.

iHeartMedia, Cumulus Media and Townsquare Media are all very different companies pursuing different strategies outside of their core broadcast businesses, but while the focus for each may be somewhat different for their future growth plans, all of these companies are doing a great job of deleveraging their balance sheets and positioning themselves to better withstand the next storm.

iHeart’s Latest Quarter

We thought that iHeartMedia’s latest quarterly results were solid, especially when considering the economic pessimism that has impacted ad sales and advertising in general. Due to the fact that many smaller media companies lack adequate coverage, or even wide coverage, looking at results can be tricky. Since many use consensus estimates, we think that if there are fewer than 5-10 analysts covering a particular stock that investors need to take time to digest results.

That logic would hold true with iHeartMedia, because although some aggregators of data reported that the company missed revenue estimates (Actual $954 million vs. Estimate of $959.4 million), we think that it is much more fair to say that the results were in line with guidance. Adjusted EBITDA was reported as a beat (Actual $237 million vs. Estimate of $229.7 million), and again we think those numbers were in line with management’s guidance. While the quarter may not look exciting (no huge beats, etc.), especially as we just stated that it appeared in line with guidance from our point of view, we think that is exactly why this could be an outperformer in the months ahead.

Media companies have been reporting mixed results this quarter, with many management teams admitting that they are facing headwinds from advertisers while also dealing with inflationary pressures on various costs, including labor. The fact that iHeartMedia was able to deliver a solid quarter in spite of this economic backdrop indicates to us that their focus on top national media markets for the terrestrial radio segment (which gives them a solid national vs local revenue mix), continued growth of the podcasting segment and the decision to pay down debt should all help the company to continue their deleveraging story moving forward; even if the economy weakens a bit.

We thought it was interesting what the company’s CEO, Bob Pittman, had to say about customer behavior regarding their ad spend. Essentially, iHeartMedia is seeing customers cautiously purchase ad inventory in the first month of a quarter, and when everything seems ok in their business, they then spend normally (probably in larger sums, but buying in their traditional patterns) in the second and third month of the quarter. So this is not exactly recession-type spending, but it is also not extremely bullish. The bottom line is that ad buyers are hesitant to commit to spending early in a quarter as they try to get a feel for how everything is going (because iHeartMedia has a lot of larger clients, it certainly seems to fit the idea of large companies managing their earnings to the quarter)

Goldman’s Downgrade

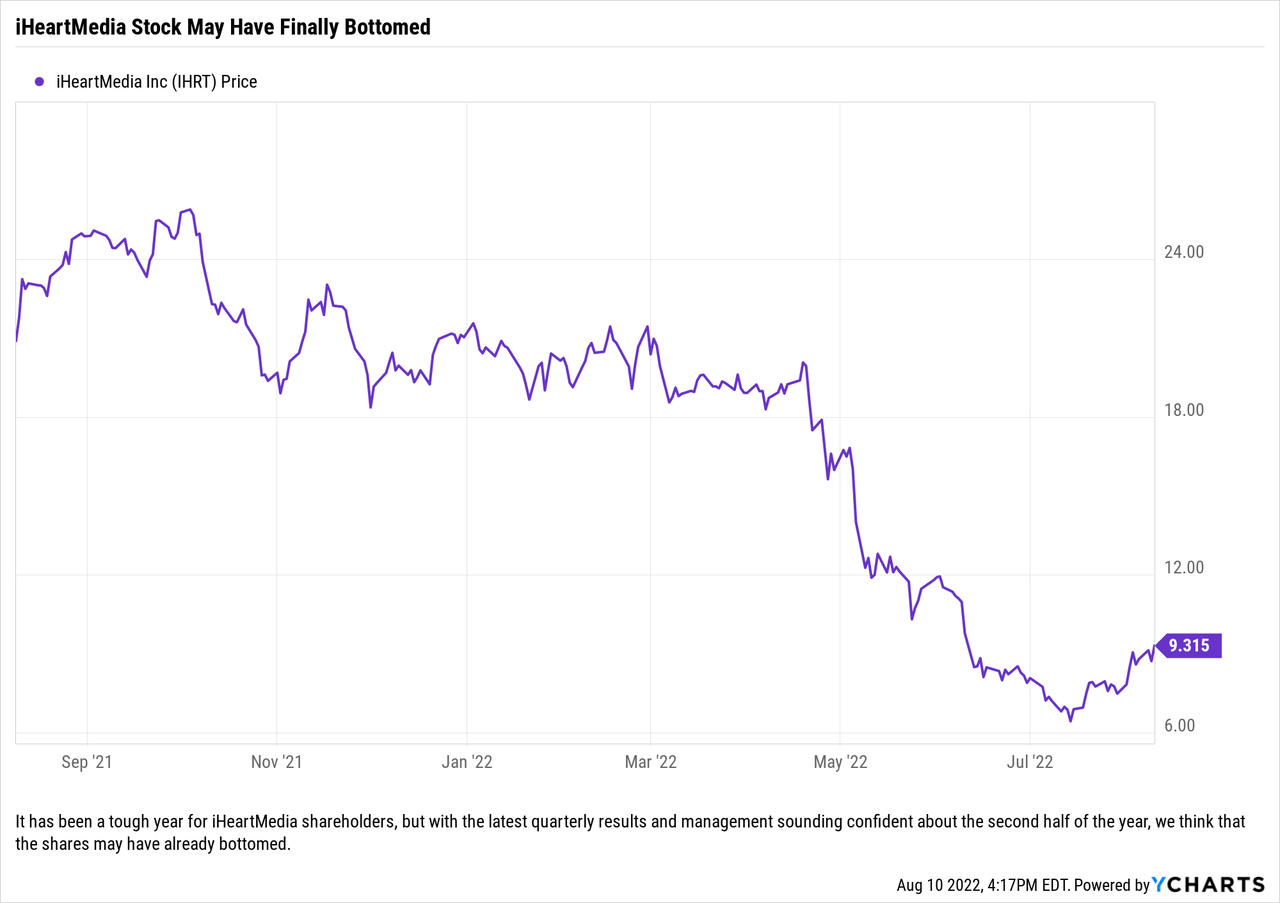

Goldman Sachs (GS) analyst, Stephen Laszczyk moved iHeartMedia to a ‘Neutral’ rating from a ‘Buy’ and set his price target for the company at $9/share today. We think that this is simply “noise” as this analyst has been wrong on every call he has made since initiating coverage on the stock. From our research, Mr. Laszczyk initiated the stock with a ‘Buy’ rating on 7/15/2021 with a target price of $32/share as the stock was trading at $24.49/share. Then on 6/22/2022, nearly a year later, he reiterated the ‘Buy’ along with a new price target of $15/share while the stock was at $7.99/share. Today, Mr. Laszczyk moved his rating to ‘Neutral’ – a downgrade – and lowered the price target to $9/share as the stock has traded above $9/share today on the back of market strength. Yes, the economic outlook has gotten a bit more questionable, but when you are calling for nearly a 90% upside move and then less than two months later, after a $1/share move, declaring no further upside… well that just seems like poor analysis.

To be fair, the Goldman downgrade comes after Morgan Stanley (MS) maintained their ‘Underweight’ rating and lowered their price target to $10/share from $11/share.

Our Take

We will be adding to our iHeartMedia holdings in the coming weeks as we think this name fits perfectly within our thesis of owning companies that generate strong cash flows and have interesting “wild cards” within their portfolios. iHeartMedia is in the enviable position of having their “cash cow” portion of the business built out, which enables them to focus their efforts on building out new growth areas to deploy their content. We think that this company is in a much better position than it was two years ago, and once they have their debt back to a more reasonable level they will be able to engage in more share repurchases and potentially pay a dividend to shareholders. These events could occur sooner than some are anticipating, especially if the company is able to continue to divest real estate assets and transition into an asset-lite model.

While we do not think that iHeartMedia is the best buy in the radio space, we do think that it may be the best buy for investors who are limited by total market-capitalization metrics when investing and could very well be the only viable option if those limitations are $500 million or $1 billion. With the tsunami of political advertising funds hitting in the second half of the year due to the mid-term elections, we believe that all boats will rise with the incoming tide. We also believe that the radio companies are among the best positioned to utilize those additional incoming funds to pay down debt and deleverage their balance sheets, and when it comes to this item alone, iHeartMedia may be the best positioned to grab a large share of those ad dollars based on its dominance in many large markets in states with important U.S. Senate races and House races this year.

Be the first to comment