buzbuzzer/iStock via Getty Images

Sun Communities, Inc. (NYSE:SUI) is a real estate investment trust (“REIT”) that owns a large portfolio of manufactured housing (“MH”) communities, recreational vehicle (“RV”) resorts, and marinas throughout the United States, Canada, and the United Kingdom (“UK”).

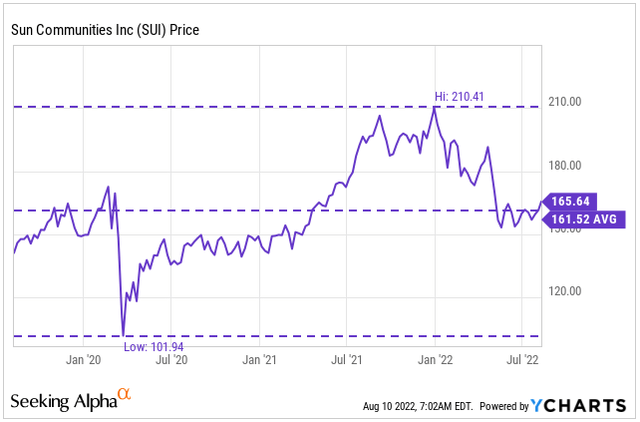

While shares are up about 5% on the month, they are still down about 20% YTD. This is worse than the performance of the broader S&P 500, which is up nearly 11% on the month. And it is worse than a similar peer, Equity LifeStyle Properties, Inc. (ELS), which is down 11.0% YTD.

YCharts – SUI’s Recent Share Price History

The stock briefly came under pressure after issuing softer guidance on their most recent earnings release, but it has since rebounded higher. Still, shares are trading at the lower rung of their 52-week range.

Strong conversion rates of their transient guests, continuing strength in their marinas portfolio, and their recent expansion into the UK are all factors that should support a modestly higher pricing multiple, which is currently lower than their comparative peer set. With earnings out of the way, the current lull presents an attractive entry point for long-term investors seeking to add an affordable housing play into their diversified portfolios.

A Simple Business Model Light On CAPEX

An MH community is a residential subdivision with sites for the placement of manufactured homes, related improvements, and amenities. These properties are detached single-family homes which are produced off-site by manufacturers and installed on site within the community.

Renters at SUI’s communities lease the site where the property is located. This is also the case with the RV resorts and the company’s marinas, which provide wet slip or dry storage space on which the vessel is stored. Typically, SUI owns the underlying land and the surrounding area. In instances where they don’t have an ownership interest, they operate via ground leases. Since they aren’t in the business of actually building out the properties, operations tend to be light on capital expenditures (“CAPEX”). This frees up operating cash for other uses, such as acquisitions and shareholder payouts.

Currently, SUI owns nearly 650 properties containing about 160K MH/RV sites and 45K marinas in 39 states, Canada, and the UK. Almost 50% of total revenues are attributable to MH, while their RV resorts account for the next largest share at 33%.

Strong Conversions of Transient Guests Support Continued Revenue Growth

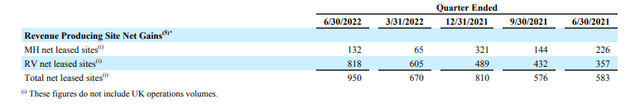

In the current quarter, SUI grew their revenue-producing sites by 950 units, which represented record quarterly growth. Over 85% of the increase came from converting transient RV customers to annual leases. Overall, through the first half of the year, SUI has converted over 1,400 transient guests, which is about 75% of the record number of conversions achieved during all of 2021.

Q2FY22 Earnings Release – Summary of Net Gains in Revenue Producing Sites

Conversion of these customers is a continuing growth opportunity for SUI, as they have historically increased revenue per site by 40-60% for the first full year after conversion. In addition, the average tenure of an RV site at SUI’s resorts is nine years. Therefore, by converting a transient guest to an annual lease, SUI’s rental income stream becomes more uninterrupted.

Demand Remains Robust For SUI’s Available Sites

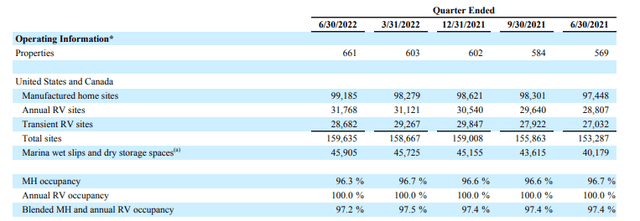

Anchoring revenues are strong occupancy levels, which ended the quarter at 97.2% in their total MH and RV portfolio. While this is down slightly from prior periods, it’s not yet an area of concern due to positive demand indicators, such as applications and forward bookings. YTD, the company has received nearly 30k applications to live in their communities. Forward bookings for the total RV portfolio are also ahead of last year’s record pace.

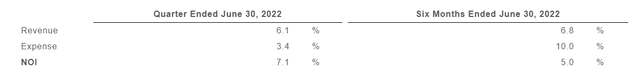

Q2FY22 Form 10-Q – Summary of Quarterly Operating Results

Though forward bookings remain strong, moderation in growth was noted on the Q2 earnings call. While this factored into tempered guidance, full-year growth in same-property net operating income (“NOI”) for both their MH/RV and marina portfolio is still expected to be at a strong 6.4% at the midpoint. This is down just 50 and 30 basis points (“bps”), respectively, from prior guidance. This includes respective third quarter growth of 6.8% and 8.6% at the midpoint.

In contrast to NOI, estimates for funds from operations (“FFO”) were increased by $0.02/share at the low end of guidance, creating a new midpoint of $7.27/share, which would be a penny/share over last quarter and 11.7% greater than 2021.

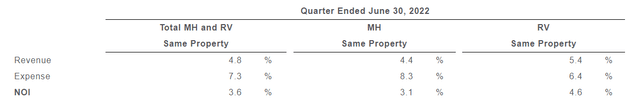

The projected growth rate for the remainder of the year would build on a strong Q2 that included core FFO/share growth of 13% compared to last year and same-property NOI growth in their MH/RV and marina portfolio of 3.6% and 7.1%, respectively.

Contractual Rental Increases Tied To CPI

In the MH/RV portfolio, expenses were up 7.3% during the quarter. While this weighed on NOI, it’s worth noting that the company was able to increase annual rents by CPI or greater in 90% of their MH portfolio. But due to the timing of the increases and the rapid acceleration of inflation to 9.1%, the company was largely left in a holding pattern later in the quarter. At the next round of increases, management is expecting to fully adjust their rental increases to match their expenses with their costs.

Q2FY22 Earnings Release – NOI Summary of MH/RV Portfolio Q2FY22 Earnings Release – NOI Summary of Marina Portfolio

Revenue growth continues to be favorably impacted by higher rates, a high volume of transient conversions, and robust demand. Additionally, even though SUI had 1,500 fewer transient RV sites due to conversions, same-property transient RV revenue was up 60bps from last year, driven by higher rates and an occupancy gain of 170bps.

Growth Through Strategic Acquisitions Supported By Strength of Cash Flows

Aside from higher rates on existing sites, SUI also benefits from external growth through the acquisition of additional sites. In the current quarter, they were particularly active, closing on +$1.8B in assets, +$1.2B of which was related to Park Holiday’s portfolio of 40 properties in the UK.

The inclusion of these assets into SUI’s current portfolio is expected to contribute meaningfully to future revenue growth, supported in part by the lengthy tenure of the individual customers, not unlike SUI’s domestically based MH portfolio, and structural shifts in the UK towards domestic holidays.

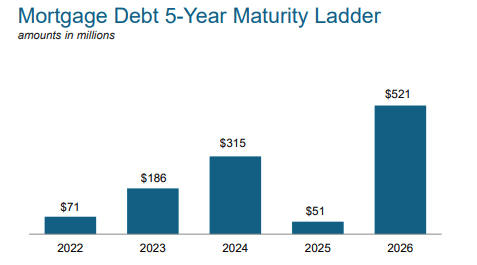

The ability to engage in strategic activity is supported by SUI’s strong investment-grade balance sheet that includes limited near-term debt maturities and exposure to variable-rate debt. In addition, net debt levels in relation to EBITDA remain within their desired range, and the overall debt load represents less than a quarter of the company’s capitalization.

June 2022 Investor Presentation – Debt Maturity Schedule

Limited CAPEX requirements also enable SUI to devote a greater portion of operating cash to acquisitions and shareholder payouts. Regarding the payout, the company currently pays a quarterly dividend of $0.88/share, which represents a yield of 2% at current pricing. At a payout ratio of around 50%, coverage is strong with ample room for growth. Most recently, the payout was increased 6% to its current level. Backed by a strong track record of continuous growth, further hikes are likely in future periods.

A Dependable Market-Beating, Long-Term Holding

SUI is a dependable long-term portfolio holding that operates in an industry that is of a particular draw in the current market environment. The affordability of manufactured housing compared to other options and the value proposition in SUI’s RV resorts provide financially stretched households a viable alternative to their needs and wants for shelter and recreation.

Continued conversion strength of their transient guests will support long-term earnings growth, as most permanent residents have long tenures at SUI’s communities, 14 years on average for their MH residents. Favorable supply dynamics, especially in their marinas portfolio, and high barriers to entry into the overall industry are limiting SUI’s competition to two other notable names, both of whom have underperformed SUI over the long term.

The current pullback into a relative lull following their earnings release presents an attractive opportunity for long-term investors seeking to add a quality REIT to their diversified portfolios. In addition to share price upside, SUI offers a steadily growing dividend payout that is currently yielding 2% and is growing at a five-year compound annual growth rate of 5%.

Applying a 20x multiple on expected future FFO of approximately $10/share would yield an estimated share price of $200. Recent expansion into the UK and strong momentum in their portfolio of marinas are two factors that would support this level of growth in FFO in future periods.

Over the past 10 years, SUI has handily outperformed the broader S&P and the MSCI U.S. REIT index, returning over 400% over that time frame. Though shares are currently stumbling, there is little to suggest an end to their reign of dominance.

Be the first to comment