yanjf/iStock Editorial via Getty Images

A couple of weeks back, we promised to “share extracts from our weekly reviews.” This article, based on analyses originally published for Wheel of Fortune’s subscribers on Nov. 28 and Dec. 13, is part of that effort.

——————————————————————————–

China is Outperforming Recently, Especially KWEB

This is how we concluded an article about China that we published three weeks ago:

We believe that China is a global force that investors mustn’t ignore, subject to two preliminary conditions/requirements:

- Long-term investment horizon. China is only suitable for those who are willing to adopt a “buy and forget” investment strategy. This is an investment that is likely to run over a course of (at least) 5-10 years, if not more than that, and it requires durability and patience.

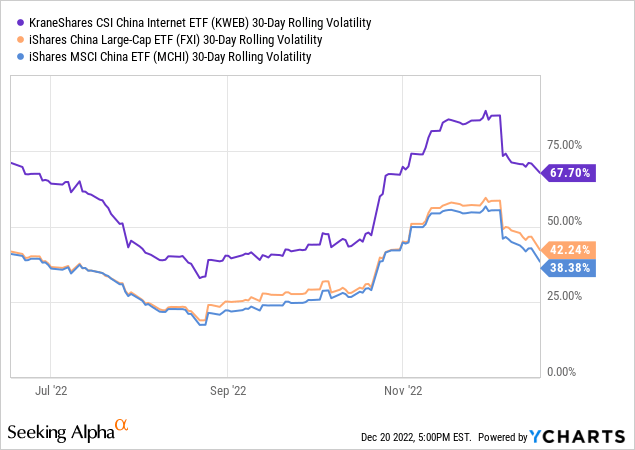

- Low level of risk aversion. If you can’t handle/afford extreme volatility, and/or if you lose sleep over large drawdowns – China isn’t for you. This is an investment for those with a strong stomach and self-restraint.

If you have what it takes to deal with the extreme volatility that Chinese stocks are likely to go through over the next few (not just a couple!) years – we believe that allocating money to China makes sense.

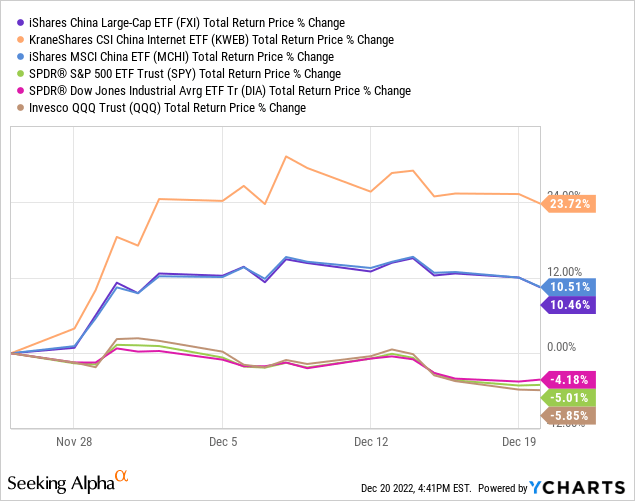

Since then the leading Chinese ETFs have gained nicely. While the broad-based iShares China Large-Cap ETF (FXI) and iShares MSCI China ETF (MCHI) posted low double-digit returns, the tech-oriented KraneShares CSI China Internet ETF (NYSEARCA:KWEB) has gained over 20%.

Double-digit returns over a few weeks is an impressive return no matter what. However, this is even more impressive taking into consideration that during the same period, leading US equity ETFs [SPDR S&P 500 ETF Trust (SPY), SPDR Dow Jones Industrial Average ETF (DIA), Invesco QQQ Trust (QQQ)] have lost about 5% (on average) of their value.

When we compare the two tech-oriented ETFs, KWEB and QQQ, the gap (outperformance) over the past 3 weeks, in favor of the former, is nearly 30% (!) – certainly not something we see too often.

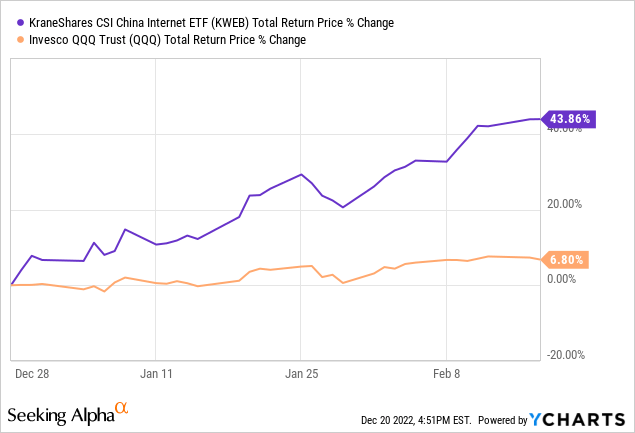

The only other very short-term (=a few weeks) we recall seeing anything like that (in recent years) was the period between Dec. 28, 2020 to Feb. 18, 2021. During that period, KWEB managed to outperform QQQ by no less than 37%. Having said that, this period was twice as long as the period we’re looking at now (=past 3.5 weeks or so).

In this article, we’re taking another look at China (as a whole) following the recent developments with a focus on KWEB, which is the wilder (more volatile) version of the ETFs through which an investor may create a long exposure to China.

China: The Biggest, Perhaps Only, Hope

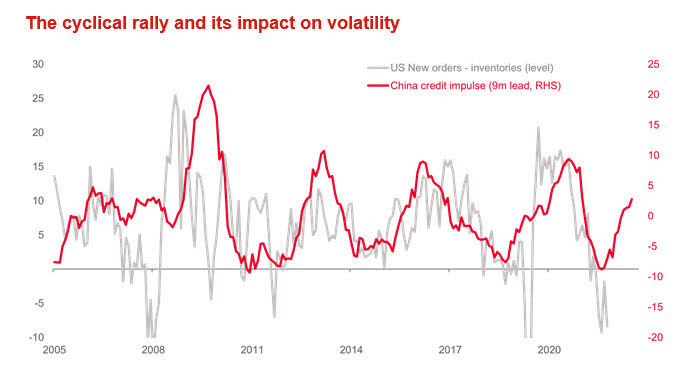

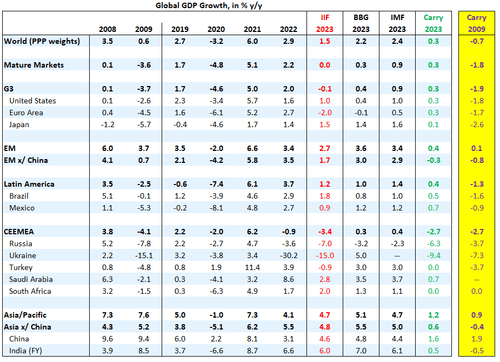

The single biggest driver for the global economy next year will be China, where loosening COVID restrictions are likely, according to the Washington-based Institute of International Finance (“IIF”).

IIF

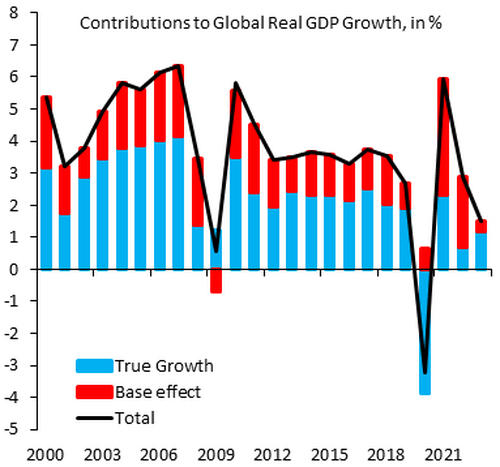

IIF’s chief economist Robin Brooks tweeted that a “global recession in 2023” is the best case scenario investors should prepare themselves for.

“Adjusted for base effects – likely around +0.3% next year (green) – global growth will be only +1.3%. That’s as weak as 2009, when headline growth was lower (+0.6%), but carryover was -0.7% (yellow),” he wrote.

IIF

Brooks goes on to warn that “2023 will be bad” to the degree that another 2008-style “Great Recession” is possibly (let alone likely) upon us.

IIF

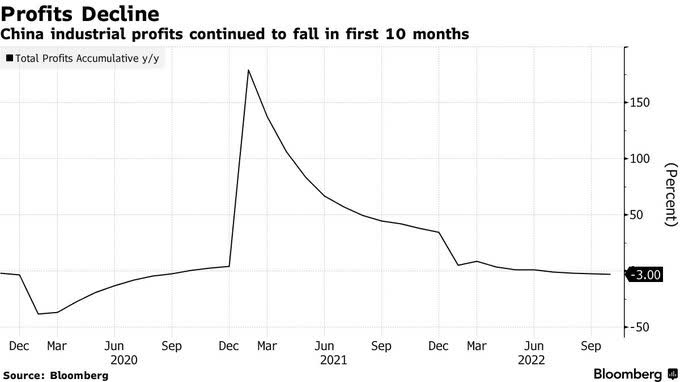

January-October Chinese industrial profits fell 3.0% Y/Y, worse than the 2.3% Y/Y decline during the first nine months.

Bloomberg

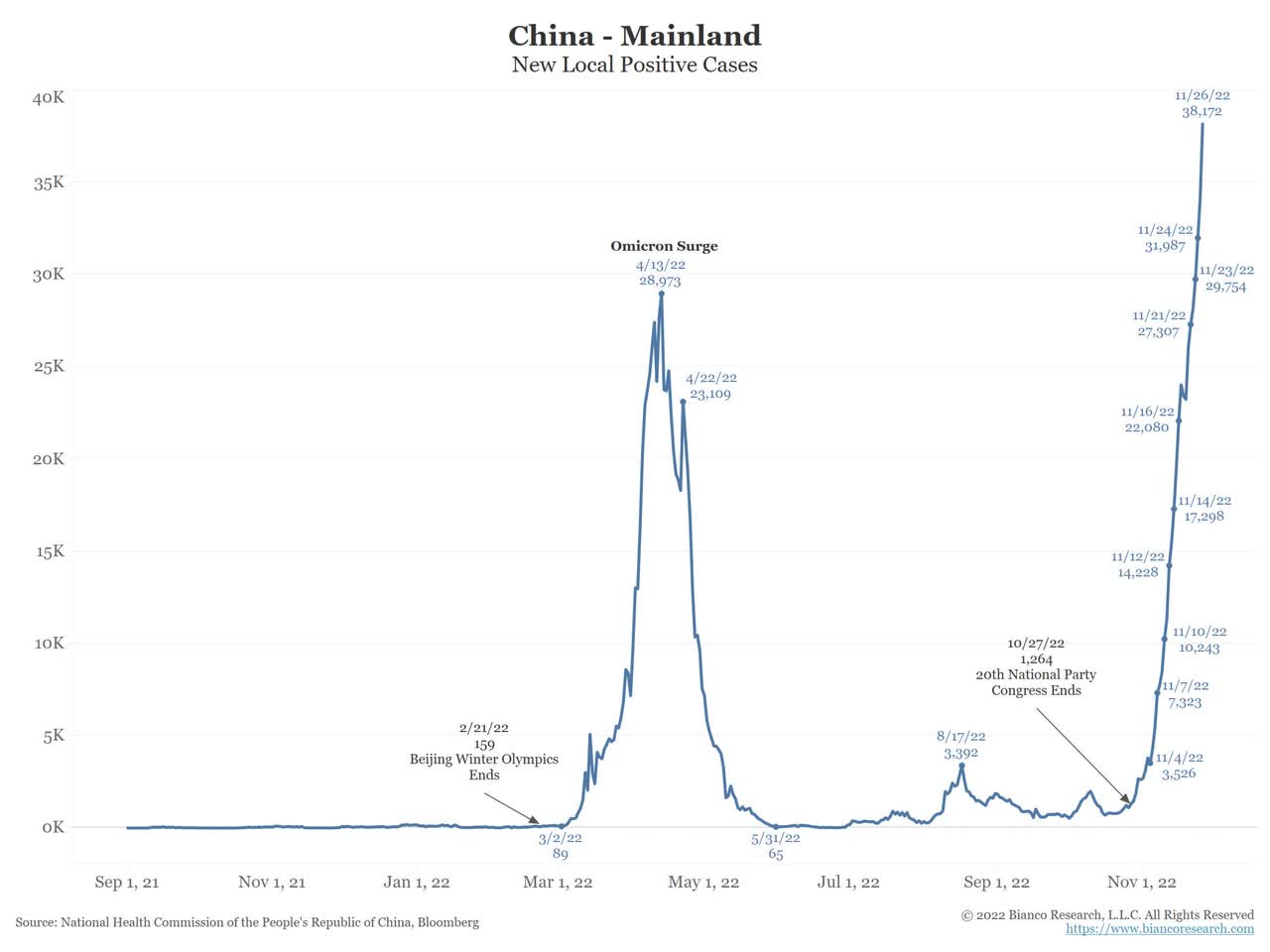

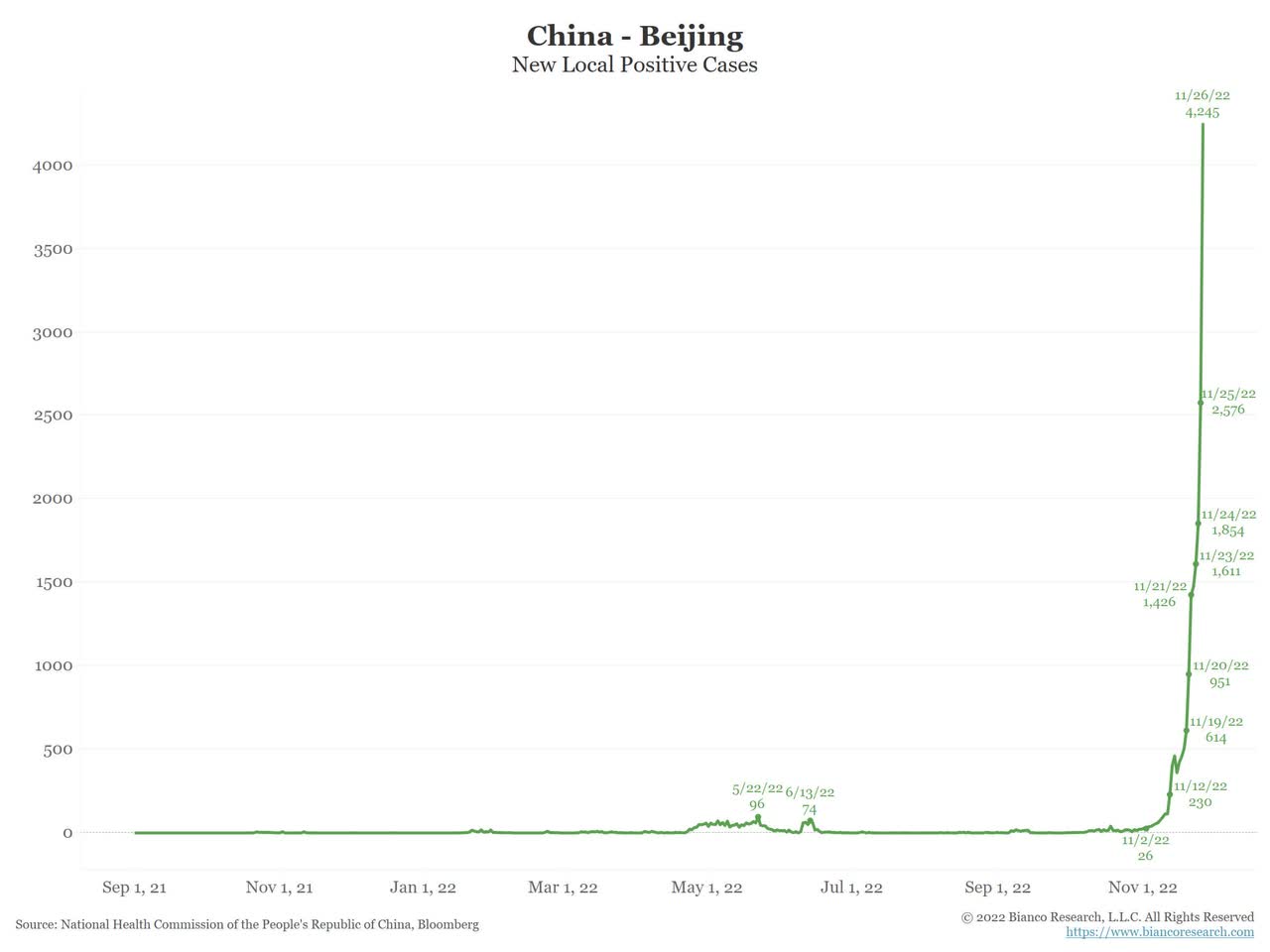

The chart/s everybody is now re-focusing on (as if we’re back in time) is/are new COVID cases in China.

Although this isn’t going to happen soon (surely not during winter time), China’s zero-COVID policy will probably ease sometime in (spring, perhaps summer) 2023.

Nonetheless, before that, we’re due for several months of crushing lockdowns, production problems, and (apparently) massive protests that impact everyone – in and out of China.

Bianco Research

Bianco Research

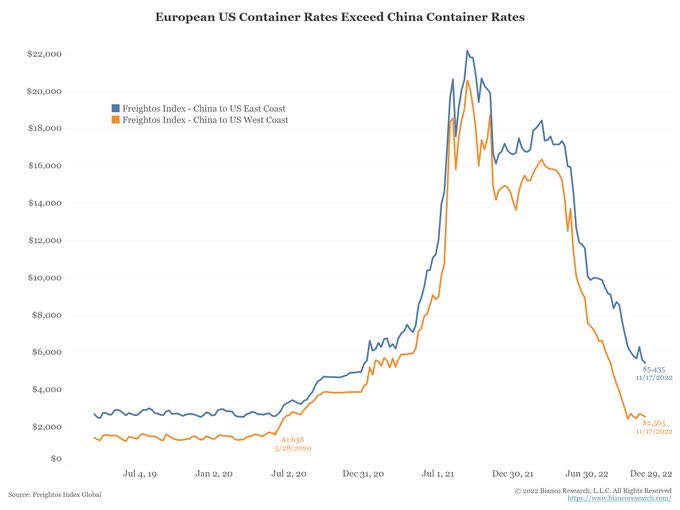

Many people claim/assume that the supply-chain, one of the main characteristics of 1H/2022, is already fixed (therefore, the risk of rising inflation is also contained). Thing is, this is only a result of China’s ongoing lockdowns and/or (artificially) slowing global demand/trade.

Chinese exports are collapsing only because the Chinese authorities are beating up and locking down their workforce.

Bianco Research

What will happen when China does finally reopen fully?

Will the supply chain still be viewed as “fixed” when the world’s second largest economy is back to full economic activity?

Current Bad Economic Data + Gradual Reopening = Better Outlook for 2023

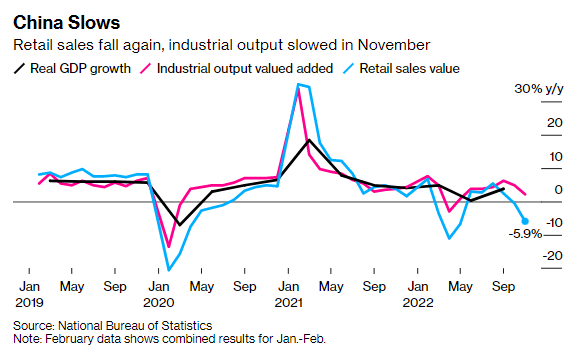

China’s economic activity keeps falling.

Bloomberg

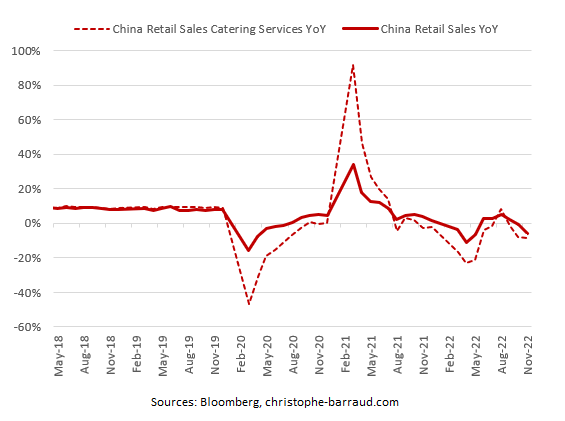

Chinese retail sales contracted in November at the fastest pace since April 2020, and there’s no better category than “Catering Services” to reflect this.

This category, which includes dining out, plunged 8.4% Y/Y, suggesting that there’s a long way to go (out of “zero COVID” policy) before China’s economy may start showing signs of life.

Bloomberg

The good news is there are already signs suggesting that economic activity is rebounding in December thanks to Chinese authorities taking steps (early in the month) towards easing the COVID restrictions.

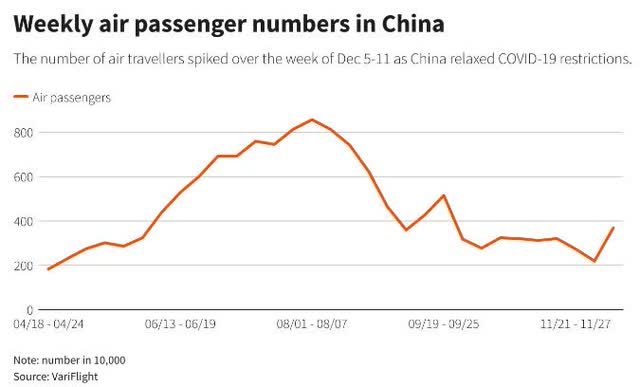

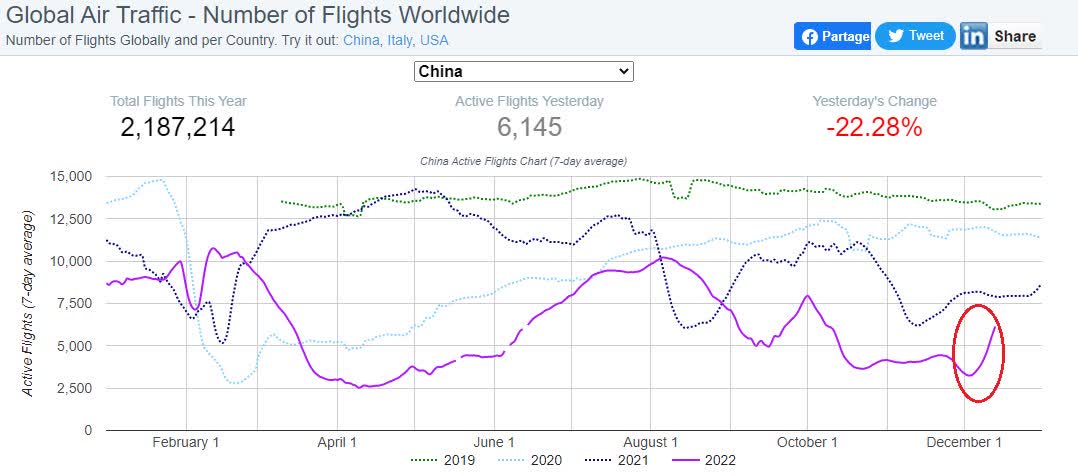

Based on both Variflight and Airportia data, Chinese road and air traffic has rebounded sharply over the last couple of weeks.

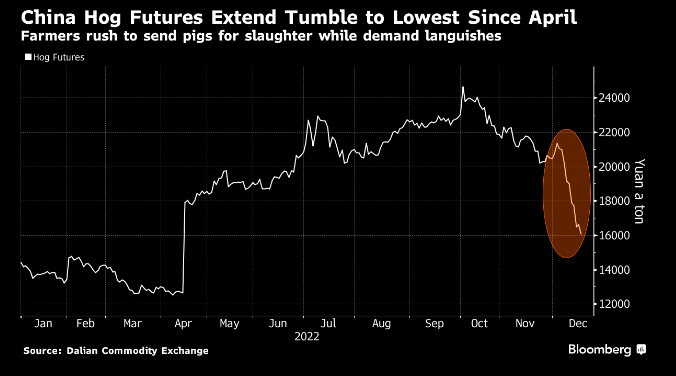

China’s hog futures have tumbled almost 25% over the past two weeks with supply overwhelming demand, seeing farmers rushing to send their pigs for slaughter.

This development (and similar ones) will add further downward pressure on Chinese CPI headline while core CPI remains contained at or below 1% for the eighth straight month.

That, in turn, is leaving the People’s Bank of China with more/enough room to ease its policy in the coming weeks/months.

Bloomberg

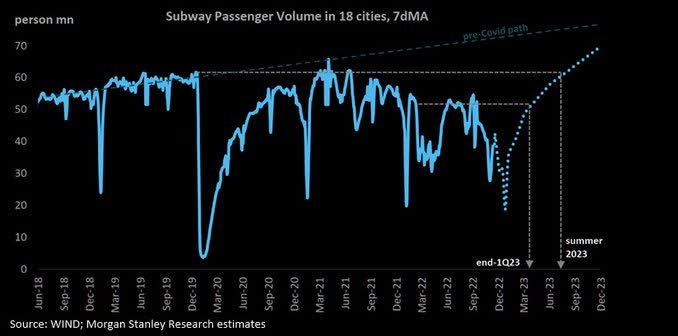

Morgan Stanley: “We expect mobility to return to pre-Omicron (February 2022) level by end-1Q, followed by further recovery for the remainder of 2023 that surpasses the pre-Covid (December 2019) high”

Morgan Stanley

KWEB: Cautious Optimism for the Long-Run

You already know why we like China generally speaking.

Here’s why we like KWEB particularly:

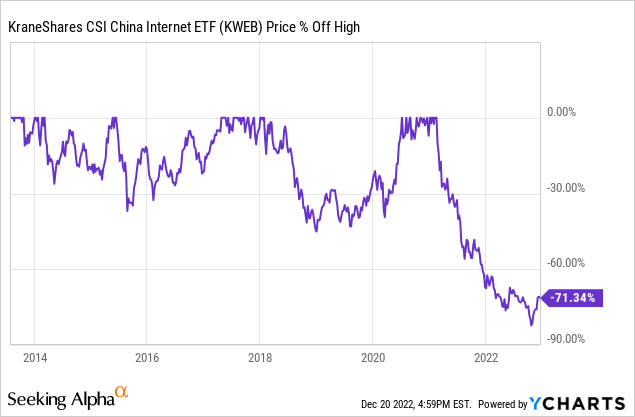

1) Never in its near-decade-long history has KWEB suffered anything like the drawdown it went (or still going) through this year.

Losing 80% (at the worst point; now closer to 70%) from peak is a deep/good-enough drawdown for most stocks, surely for an ETF, even if the focus is on volatile Chinese tech/growth stocks.

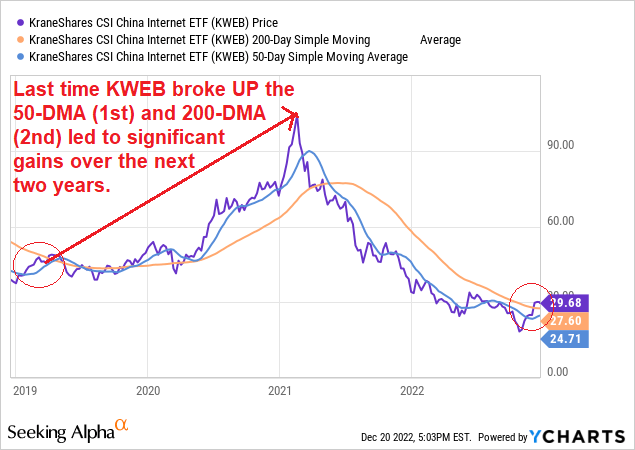

2) KWEB has just been able to move past both the 50-DMA (first) and 200-DMA (then after).

Not only is this a bullish technical sign for itself, but the last time this break-up happened (early 2019), KWEB doubled in value over the following two years.

Y-Charts, Author

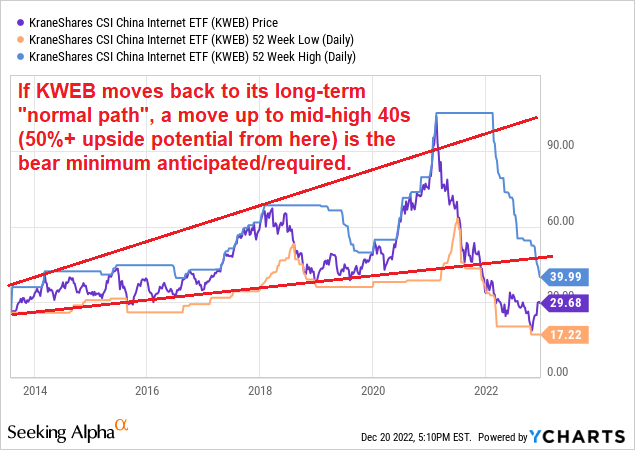

3) Using the below chart as a reference, the long-term “normal path” for KWEB is the channel between the two red lines.

A 50% spike is needed from current levels in order for KWEB to move back into this channel, recapturing the long-term, uptrend, path.

Y-Charts, Author

Nobody is guaranteeing us that this will be the case, and nobody is promising us that (even if this is the case) it would be an easy, or quick, task.

Nevertheless, if history is any guide, KWEB has good chances of making it (happen) at some point.

Moreover, when we analyze what the future holds for the global economy – the last thing we wish to do is to ignore, let alone bet against, China.

Once it’s clear (to you as it’s to us) that being long China makes sense, there’s no better Chinese ETF to implement that strategic exposure through than KWEB.

Be the first to comment