Carl Kauffman/iStock via Getty Images

Introduction

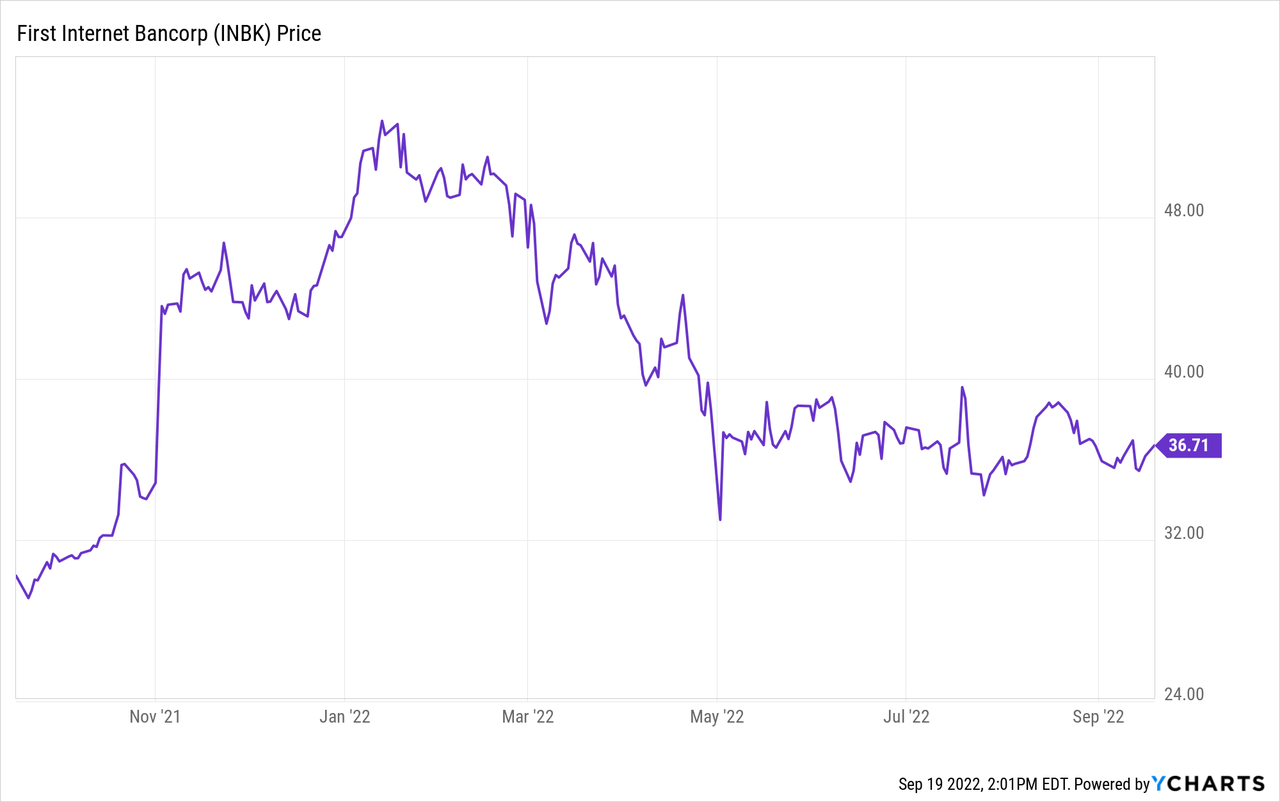

First Internet Bancorp (NASDAQ:INBK) is an Indiana-based online-only financial institution which does not operate any traditional branches. The bank’s financial performance is pretty strong, and although it barely pays any dividends on its common shares, the 2029 subordinated notes trading as (NASDAQ:INBKZ) offer good value for income-oriented investors.

The banking activities are performing well

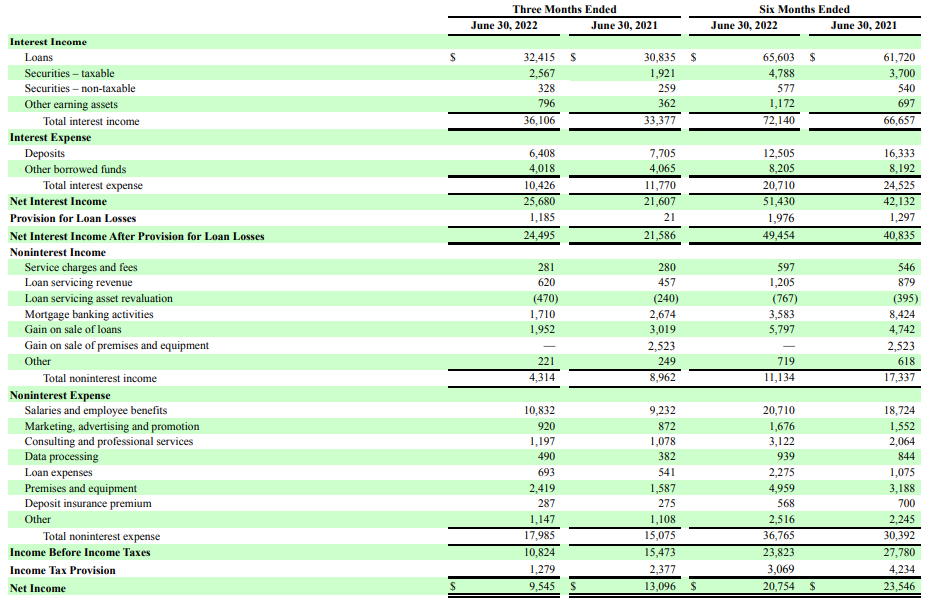

During the second quarter of the year, First Internet saw its interest income increase by about 10% compared to the Q2 2021 interest income while its interest expenses decreased from $11.8M to $10.4M. This caused the net interest income to increase by approximately 20% to just under $25.7M.

INBK Investor Relations

As the bank operates as a digital bank the operating expenses are relatively low but this also means the non-interest income also is pretty low. The $4.3M in non-interest income was mainly fueled by the gain on the sale of loans and generating additional gains in the future also will depend on the interest rate trajectory.

The bank also recorded about $1.2M in loan loss provisions, and this resulted in a pre-tax income of $10.8M and a net income of $9.5M for an EPS of $0.99. As First Internet is currently paying a quarterly dividend of $0.06/share, that dividend is obviously extremely well covered. It also means the vast majority of the earnings are retained on the balance sheet which should help INBK to continue to grow.

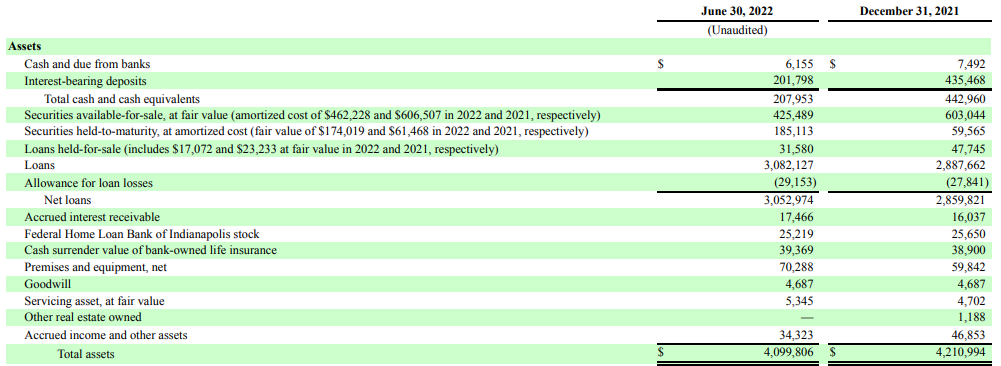

Looking at the asset side of the balance sheet, INBK’s balance sheet shrunk a little bit, mainly because it was hit by the value decrease in the securities available for sale segment. As of the end of June, the bank had just under $208M in cash and just over $610M in securities, which means about 20% of its assets were invested in liquid or very liquid assets.

INBK Investor Relations

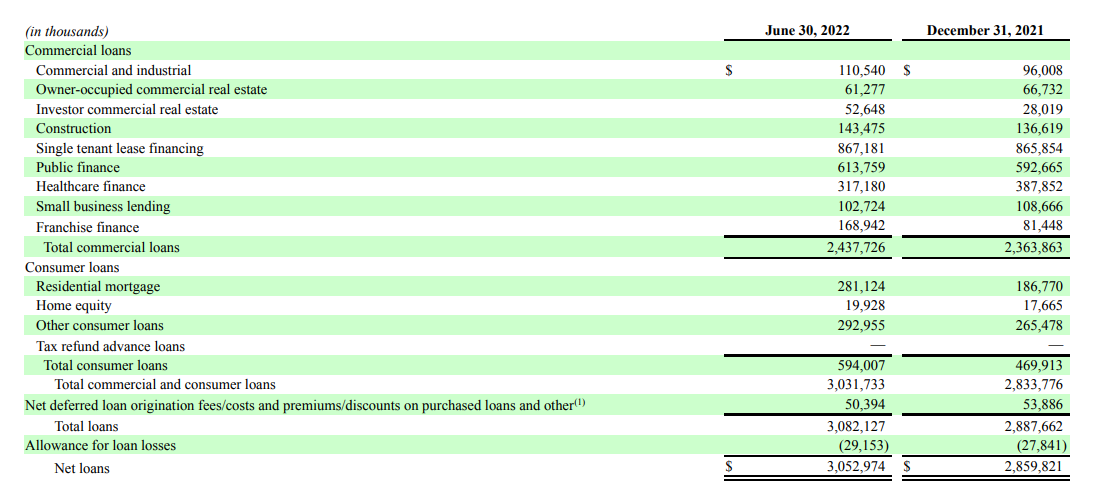

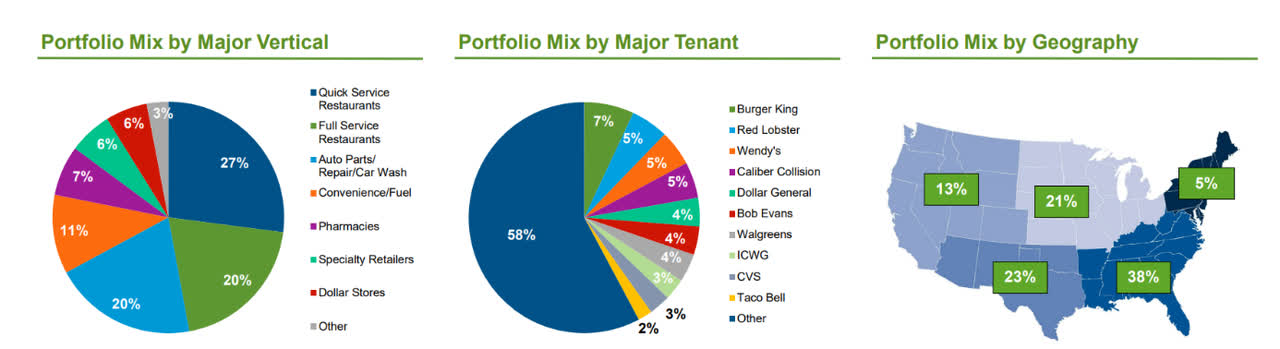

Looking at the breakdown of the loan book (below), we see INBK is a pretty large financier of public institutions as that represents in excess of 20% of the total loan book. But the largest portion of the loan book with almost 30% of the loans, is the single tenant lease financing.

INBK Investor Relations

The single tenant lease portfolio has an average LTV ratio of 47% which is pretty low.

INBK Investor Relations

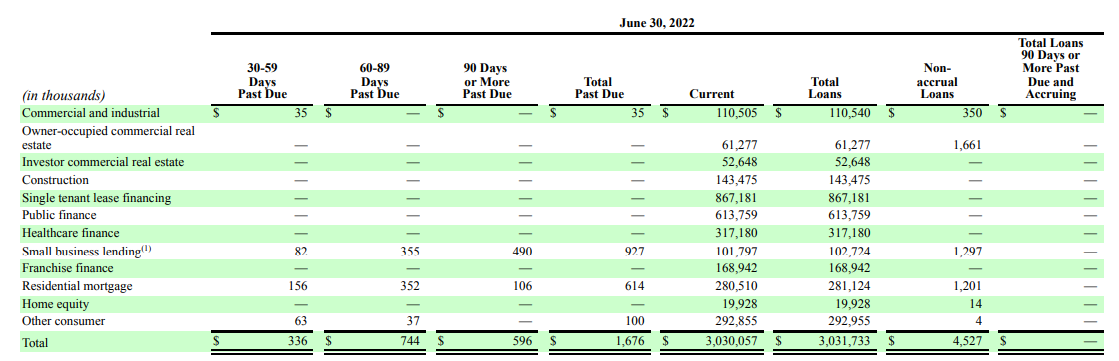

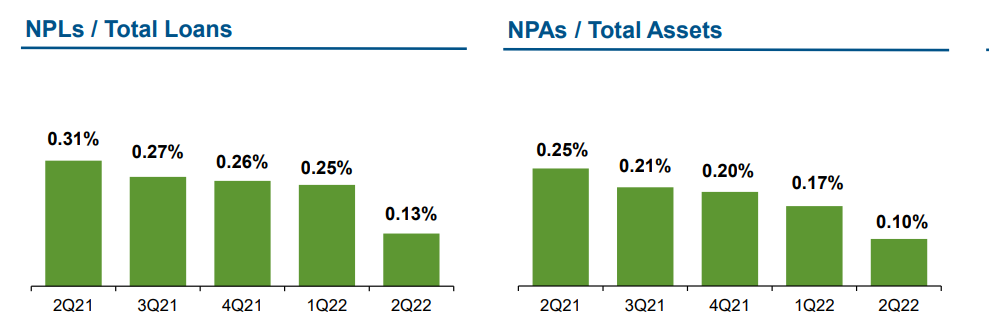

I was surprised to see the quality of the loan book. As of the end of June, less than $5M of the loans are on a “non-accrual basis” while just under $1.7M has a past due status. This means that 99.8% of the total loan book is classified as “current.”

INBK Investor Relations

A very strong performance indeed, and that explains why the bank is able to keep the loan loss provisions relatively low and this obviously helps to boost the net income profile.

INBK Investor Relations

I’m intrigued by the 2029 notes

First Internet Bancorp also has a debt security listed on the exchange with INBKZ as ticker symbol. This is a fixed to floating (‘FtF’) debt security and although it’s a subordinated security, it obviously still ranks senior to the common shares and is part of the regulatory Tier 2 capital.

The total size of the offering is just $37 which means it should be very easy for First Internet to simply repay these notes upon reaching the maturity date. At this moment, the notes have a 6% yield with the $1.50 in interest payments payable in four equal quarterly tranches of $0.375. From June 2024 on, the securities will move to a floating interest rate with a three-month LIBOR + 411 bp interest rate (the LIBOR has a floor of 0% but that doesn’t really matter in the current interest environment). The three-month SOFR currently stands at 3.471% which means that at the current SOFR rate, the interest rate will increase to 7.58% based on the $25 principal.

INBK also has the right to call INBKZ in June 2024 and given the most recent share price of $24.7, the yield to call is approximately 6.7% which I think offers a good risk/reward ratio for this bank.

Investment thesis

As of the end of the second quarter, INK had a tangible book value per share of $38.35. That’s slightly lower than the $38.51/share it reported as of the end of 2021, but the increasing interest rates in the first half of this year had a negative impact on the value of the assets in the portfolio of securities available for sale (which had a net impact of approximately $25M) but the worst should be behind us and I wouldn’t be surprised to see the tangible book value exceed $40/share again by the end of this year as an expanding net interest margin also should have a positive contribution to the financial performance.

This means INBK offers the best of both worlds: Investors that look at the bigger picture will appreciate the high earnings retention rate on the common shares as only tiny fraction of the earnings are paid out as a dividend. And investors looking for an income security could very well enjoy INBK’s Fixed-to-Float note maturing in 2029.

I currently have no position in either, but I will likely try to get my hands on some of the INBKZ securities below par.

Be the first to comment