imaginima

Published on the Value Lab 27/7/22

Oil definitely has some strong backstops, and indeed refinery capacity is definitely in short supply with hits to western-available refinery capacity over Russia. However, things might start turning over the next couple of months, where markets have been rational in keeping oil multiples still low. Both refiners and crude oil producers could get hit, and a macroeconomic hit like that could dry up demand for exploration. While we still like oil, this is something to look out for, especially for investors in the oil world and in the iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO).

The IEO Breakdown

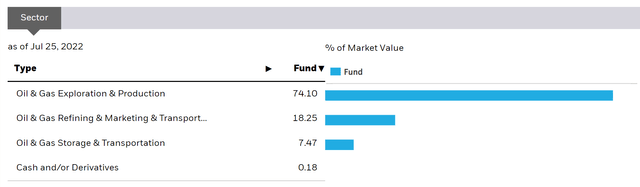

The IEO portfolio is a nice one that gives you exposure to a lot of different parts of the US oil industry. That means a fair bit of exposure goes into refineries, many in the Gulf Coast, but also into logistics players with more margin-defined economics as well as good and true oil companies.

The exposures are still high to the price of oil as well as product crack spreads. These are the two factors that should define your thinking on IEO.

A View On Oil

An interesting piece of news that came out recently ahead of reporting from Asian refiners is that product spreads had started to fall. This has partly to do with the fact that nearer markets like China are in trouble, but the frictions in the oil markets aren’t so much where falling product spreads in Asia will not mean falling spreads in the West.

When product spreads start to fall and output gets cut in order to stay rational on the market, the demand for crude oil inflows falls concurrently. So where cuts to run rate take effect the flows of oil demand will contract and hit crude oil prices. Crude still continues to rise on the spot market, a rationalization in refinery margins is going to start impacting crude prices soon, possibly impacting crude prices globally before falling Asian refining margins become mirrored in the West, where local dynamic markets could maintain spreads and higher refinery complexity could keep more major refiners like Valero (VLO) in the game.

The concern we have is that naturally these falling product spreads are a consequence of slowing macroeconomic factors. In addition to rate hikes in many major western economies, primarily the US which is a large share of corporate wallets, China is struggling too, another large share of wallets. With geopolitical factors responsible for unequivocal value destruction in markets, and with its most rapid transmission into oil prices, we are also getting demand destruction as an additional effect on top of ripples from the credit market. Things look difficult.

Conclusions

Refining capacity, and indeed oil capacity, have both been clearly underinvested in relative to what was needed to take hits from Ukraine on the chin. Refining capacity has fallen both with irreversible decommissioning but also renewable diesel conversions, while oil expansion had been hampered by a host of effects particularly in the US both before, during and after COVID-19. This is a major positive for oil and refining relative to other industries. However, we’re still talking about a commodity, subject to both volatility and cycles. Whether these last 5-6 years have been a downcycle in oil, with now being the up-ramp, remains to be seen. We are inclined to believe that commodities have become permanently more expensive, considering even longer-term trends related to demographic and yield theories from the 60s (think The Population Bomb). Nonetheless, IEO contains a lot of assets that could start seeing hits across the board. At that point we’d rather go with stocks that already have late-cycle multiples within oil, because of the margin of safety that offers when the market decides the cycle is indeed ending. We’d pass on IEO for now and buy a basket of oil companies or just go with a nice diversified oil major.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment