LilliDay

A surge in inventories during the last six months of 2021, followed by a purge of those inventories during the first six months of this year does not make a recession in my book. If you fall back on the loose definition of a recession being back-to-back quarters of negative GDP growth, then you have your recession. If you wait for the official arbitor (National Bureau of Economic Research) to give us its determination of whether we have had a recession months from now, my suspicion is that this body will say no. Every recession has two consecutive quarters of negative growth, but every two consecutive quarters of negative growth does not necessarily constitute a recession. Either way, when the NBER does make its decision, it will be so far down the road that no one will care. What’s more important is how the market reacted to the negative print of 0.9%, and it was extremely bullish.

Finviz

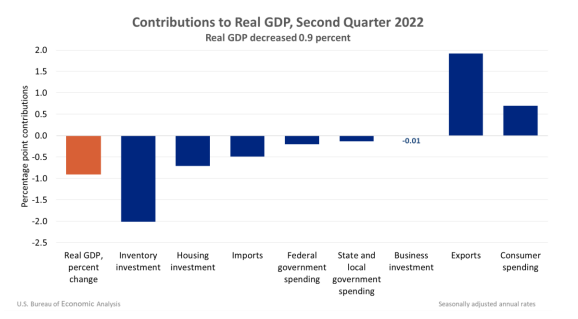

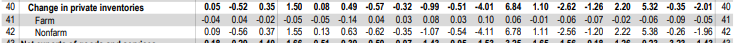

The engine of our economy is the consumer, which accounts for approximately 70% of the rate of economic growth. Despite the horrible sentiment numbers we see, consumers are still spending, the unemployment rate is hovering near an all-time low, the economy added more than 450,000 jobs per month so far this year, and wages are growing better than 5%. That is not consistent with a recession. Consumer spending grew 1% for the quarter, contributing 0.7% to overall growth. Meanwhile, inventories subtracted 2% from overall growth.

Bureau of Economic Analysis

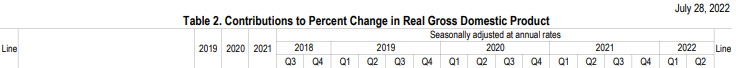

The huge build in inventories by companies like Walmart and Target in the third and fourth quarters of last year contributed 2.2% and 5.3% to overall growth, respectively. That surge in goods came just as consumers were shifting their focus to spending on services, which led to an inventory glut that has still not fully resolved. Hence, the decline in inventory spending that subtracted 0.35% and 2.0% from overall growth in the first and second quarters of this year, respectively.

BEA BEA

Meanwhile, consumer spending (personal consumption expenditures) never lost a beat, contributing to growth in each of the last eight quarters since the recession in 2020 ended. Clearly, the rate of growth in spending is slowing, but that is what the Fed and investors want to see to bring down the rate of inflation. This looks like a soft landing to me.

BEA

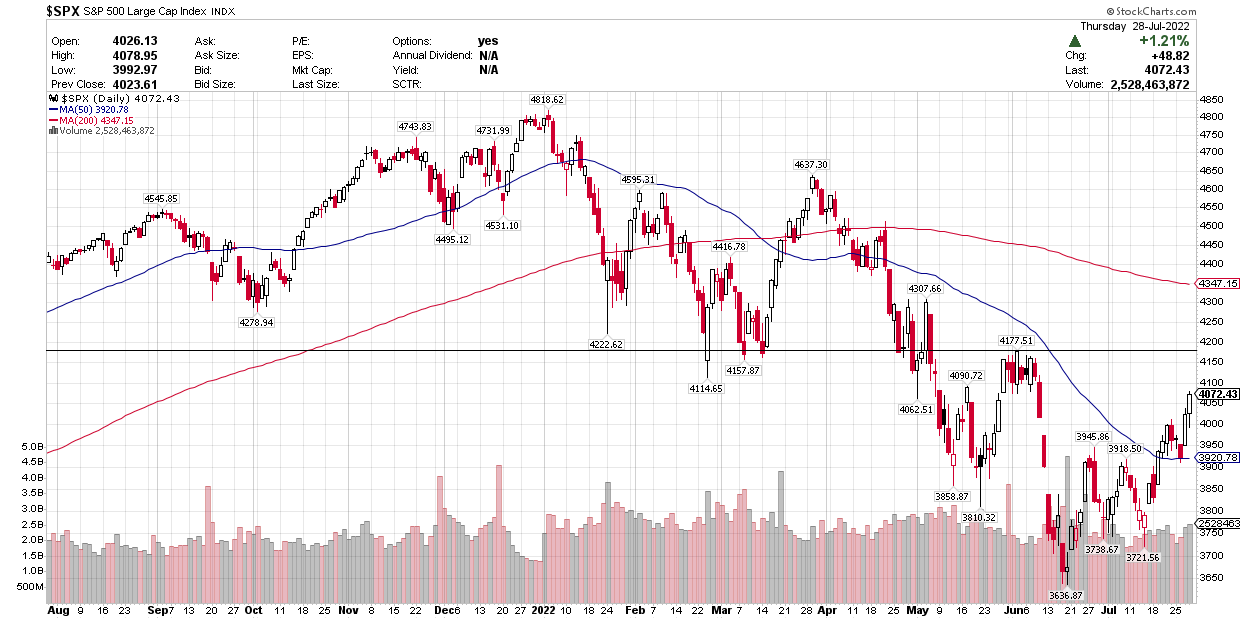

I think too many investors are operating under the assumption that this bear market will be associated with a recession, and if it is not official over the past six months then it will happen over the coming year. That means investors may be waiting for a new low in the S&P 500 before deploying capital. The problem with that outlook is that the average bear-market decline not associated with a recession is approximately 22% and lasts an average of four months. We have already declined 25% over six months. If the recession does not happen, then we may already be halfway to a new bull market. That is my outlook, because corporate earnings have continued to grow this year as valuations have come down measurably.

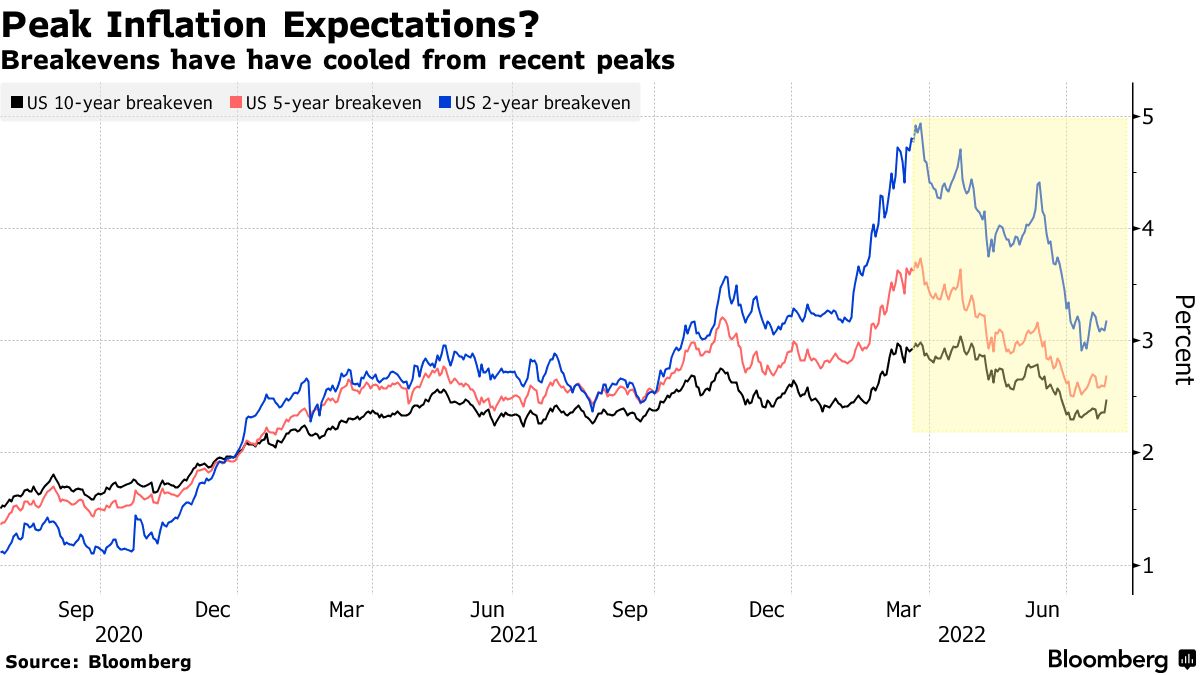

Most importantly, inflation expectations have fallen back to the levels we saw at the beginning of this year, which makes the Fed’s job a lot easier. In turn, this has reduced expectations for rate hikes later this year, which is an extremely bullish development for the stock market.

Bloomberg

The Technical Picture

The S&P 500 is approaching my near-term target of the 4150-4200 level, which would be a 12% rally off the lows and probably see some overhead resistance that requires another pullback before working higher

StockCharts

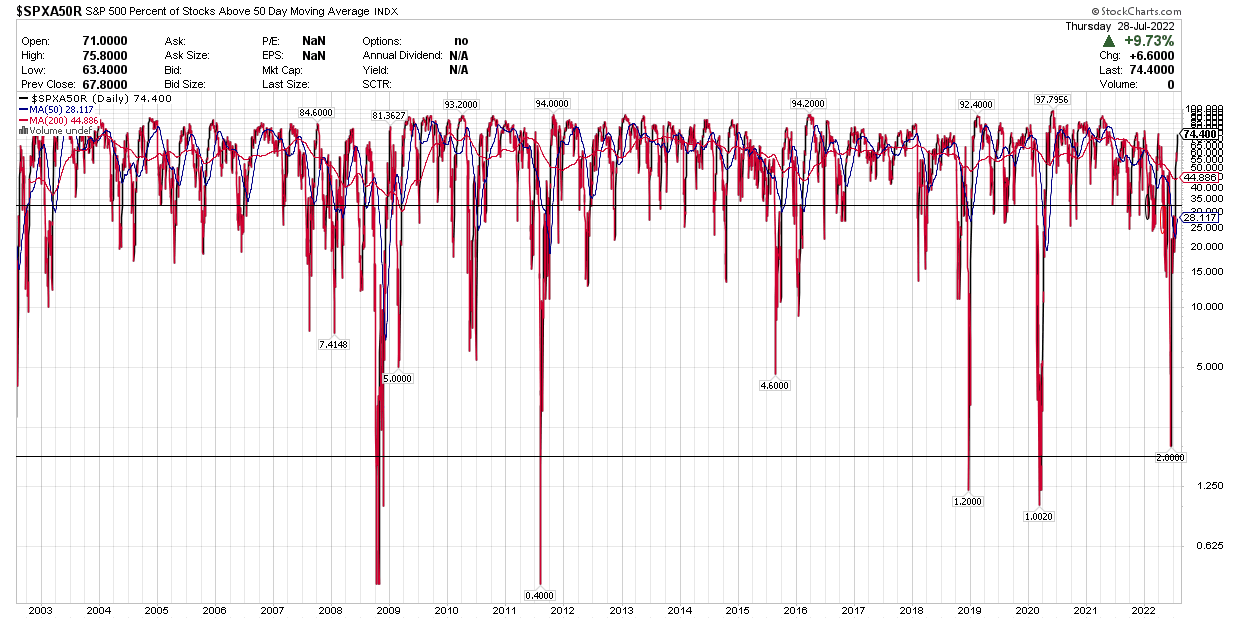

Along those same lines, the percentage of stocks in the S&P 500 trading above their 50-day moving average is at 74% and approaching overbought territory.

StockCharts

Be the first to comment