Tomas Ragina

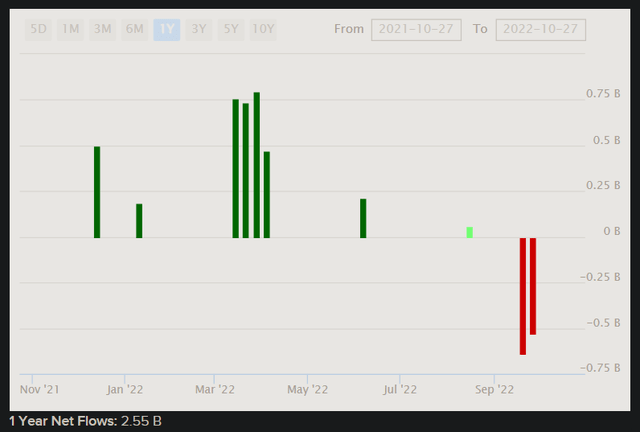

iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG) is an exchange-traded fund that offers exposure to listed emerging market companies. The expense ratio is cheap at just 0.09%, owing greatly to the popularity of the fund. Net assets under management were $56.17 billion as of October 28, 2022. More recently, fund flows have been negative, however, net fund flows have been positive over the past year or so (see chart below) to the tune of $2.55 billion.

I last covered IEMG in my article dated January 17, 2022, in which I was neutral on balance, in spite of strong implied returns. Strong implied returns result from a high implied cost of equity, which often is employed by the market to express a “risk-off” mood. A risk-off mood naturally tends to result from actually high perceived risk. I agreed with the market, with myself being neutral, as IEMG was (and still is) highly exposed to China. China’s business cycle positioning has been recessionary in recent times, making IEMG cyclically unfavorable. Since my article, IEMG has fallen by -28.53% on a total return basis (according to Seeking Alpha), as compared to the S&P 500 U.S. equity index’s index-only change of -15.78%.

Since my last article, and looking at the delta between IEMG’s share price and the S&P 500 index level, the relative drop in IEMG was 1.86x (i.e., 86% worse than the S&P 500). The five-year beta calculated by Yahoo! Finance for IEMG is currently 0.95x (i.e., implicitly 5% less volatile than the S&P 500). So, the recent down-move is characteristic of significant risk aversion. The removal of Hu Jintao at China’s 20th Party Congress recently was also not favorable. The country has seemed to become increasingly communistic and dictatorial in recent times, which is practically only perceived as being adverse to the local investment profile (at least, for foreign investors). That means higher equity risk premiums, and thus lower valuations (prices).

However, I would not entirely write off investing in China just yet, only we should probably accept that risk premiums will remain elevated as compared to the past, for the foreseeable future. It becomes somewhat philosophical at this juncture as to what a “fair” risk premium is for a country with elevated political risk.

Political risk is driven by various factors. The “directional change” in political risk is perhaps important. Factors include military involvement in politics; democratic accountability; government stability; internal and external conflicts and tensions; government effectiveness (quality); regulatory quality; rule of law (or lack thereof); and control of corruption. Those are the main factors; other factors could include expropriation risk; political violence; terrorism risk; exchange transfer and trade sanction risk; and sovereign default risk.

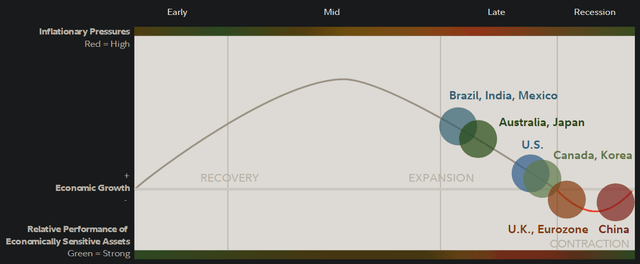

For China, the principal risks are in my view related to a lack of accountability, the potential for conflict with Taiwan/U.S., COVID-19 lockdowns, and an uncertain future as to law and regulation. It is possible that China becomes even more authoritarian, while I think the risk of war with Taiwan is probably weaker now than before (given the struggles of Russia vis-à-vis Ukraine). A more cyclical risk is the business cycle, but soon this will provide China with a tailwind, and indeed political risk may abate somewhat once the world business cycle moves in a more favorable direction (based on Fidelity research as illustrated below, China remains ahead in its business cycle).

As you can see, China is in contraction (based on factors such as falling economic activity, credit creation, negative/weaker earnings growth, monetary easing, and worsening inventory/sales ratios). However, that would make a recovery phase the next phase, within time, and markets are forward-looking. It is therefore political risk that is most likely holding Chinese equities back.

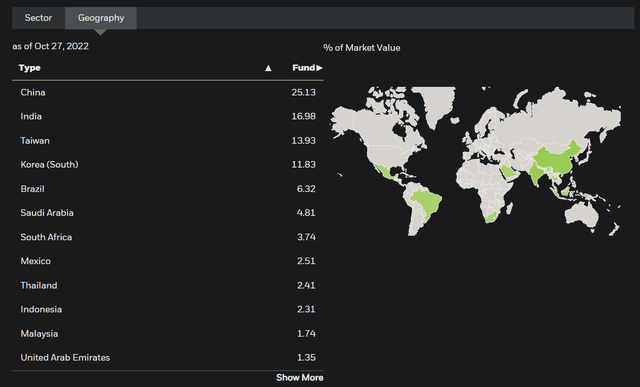

I discuss China at length, as IEMG’s main geographical exposure is China, at 25.13% (as of October 27, 2022). However, the ultimate exposure is greater given the significance of China for plenty of other emerging markets. Other key exposures include India (16.98%), Taiwan (13.93%), South Korea (11.83%), and Brazil (6.32%), among others.

Bear in mind that the U.S. dollar has strengthened materially this year as well, which has not only increased the sovereign default risk of certain emerging markets with U.S.-dollar (external) debt exposures, but also reduced the values of shareholdings denominated in non-U.S. currencies (that naturally includes IEMG’s portfolio).

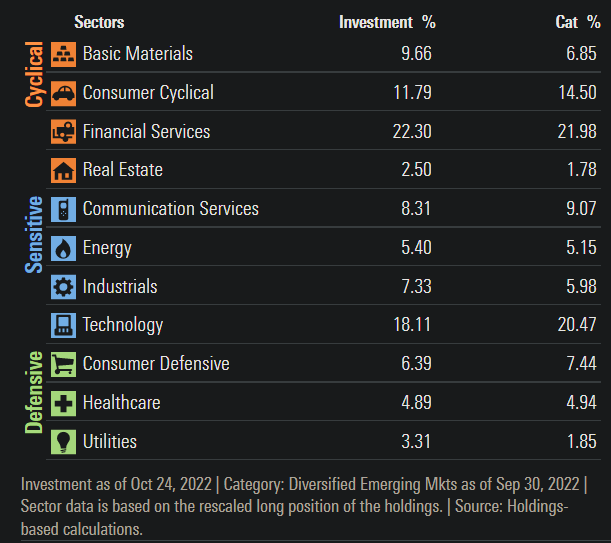

In terms of sector exposures, which has application to IEMG’s relative performance in light of the business cycle: IEMG is fairly balanced. The largest exposures are Financial Services (22.30%, Cyclical) and Technology (18.11%, Sensitive [to the business cycle]). All considered though, IEMG’s portfolio is more aggressive, with a clear bias toward Cyclical and Sensitive sectors.

Morningstar

That means that, at the end of China’s business cycle, it makes sense that IEMG has suffered from elevated “downside beta” (beyond political risks mentioned earlier). Having said that, the fund is also exposed to countries that are still in their expansionary phases (such as India, Brazil, and Mexico). So, I would still place IEMG’s adverse volatility down to political risk primarily.

We can make some basic assumptions about IEMG’s portfolio. The portfolio is constructed so as to track the performance of its chosen benchmark index, the MSCI Emerging Markets IMI. As of September 30, 2022, the index’s forward price/earnings ratio was 10.22x. The price/book ratio was 1.49x. Dividing the latter into the former, gives us an implied 14.58% forward return on equity, which is pretty good. The forward earnings yield is implied at 9.78%. The midpoint of these two numbers often provides a reasonably good implicit forward return profile (over the long run). In this case, the range is fairly tight between 10-15%.

Total forward return is closely linked to the implied cost of equity. The cost of equity has two core components: the risk-free rate, and the equity risk premium.

Stable and mature markets might command equity risk premiums of 4.2-5.5% as a general rule, or as little as 3.2% globally if we account for survivorship bias (the U.S. market has performed very well over time). It makes sense that IEMG would be at least twice as risky to invest in (perceptually and intuitively) than the United States. That is, especially with the fund’s relative downside variance at almost 2x recently (as discussed earlier; since my last article). So, an equity risk premium of circa 6.4-11.0% is actually likely fair.

Bond yields (local risk-free rates) across IEMG’s top country exposures (i.e., emerging markets) are mixed relative to the United States. The 10-year yield for China is admittedly lower at circa 2.69%, but India‘s 10-year yield offers 7.42%. Taiwan’s is sub-2% at the time of writing. Together these are IEMG’s top three exposures (56% of the fund). Based on my own calculations, the weighted risk-free rate (10-year yield) for IEMG’s portfolio is about 5% at present.

So, adding 5% to our range of around 6% to 11% gives us a cost of equity range of around 11% to 16%. Assuming nominal earnings growth of at least 2% into perpetuity, would give us a growth-adjusted cost of equity of 9% to 14%. I would say that range is quite conservative. Morningstar currently estimates three- to five-year earnings growth for IEMG at 12.17%. Our cost of equity would imply a minimum fair forward price/earnings ratio of 7.14x to 11.11x. Per Morningstar, the current multiple is about 9.85x (or per MSCI’s index at the end of September 2022 as mentioned earlier: 10.22x).

In summary, I would argue that IEMG is probably priced conservatively, but within the realms of expectation for an elevated (and country-weighted) equity risk premium. IEMG is not likely so cheap that upside is imminent; rather it will likely remain sensitive to both the global business cycle and more importantly political risk.

Another factor is simple market beta relative to the most dominant equity market: the U.S. market (to which almost all other equity markets show some degree of positive correlation with). The U.S. market has sold off this year; a gradual turn toward risk would likely support IEMG. However, political risk (arguably still the most important factor here) remains, and therefore I would have to continue to remain neutral on IEMG.

Be the first to comment