AsiaVision

Investment Thesis

I came across IDT Corporation (NYSE:IDT) and thought it was an intriguing company. The company has a low-margin, mature, and declining traditional communication business that is masking the high-growth, high-margin businesses, which are primarily (1) the National Retail Solutions (NRS), its cloud-based POS company, and (2) net2phone, its cloud-based communication business.

As IDT has a few business segments, I aimed to cover only 2 businesses in this article – NRS and net2phone. I’ll be publishing more articles as I dive deeper into the company, but at the moment, I believe these 2 businesses are extremely attractive as they possess industry-leading gross margins. NRS already profitable with an EBITDA margin of over 30%, and with a multiple of 15x to 20x, the business alone is worth more than half of the market cap. Whereas, net2phone is expected to hit profitability soon by FY23.

National Retail Solution (NSR)

Products & Services, and Revenue Model

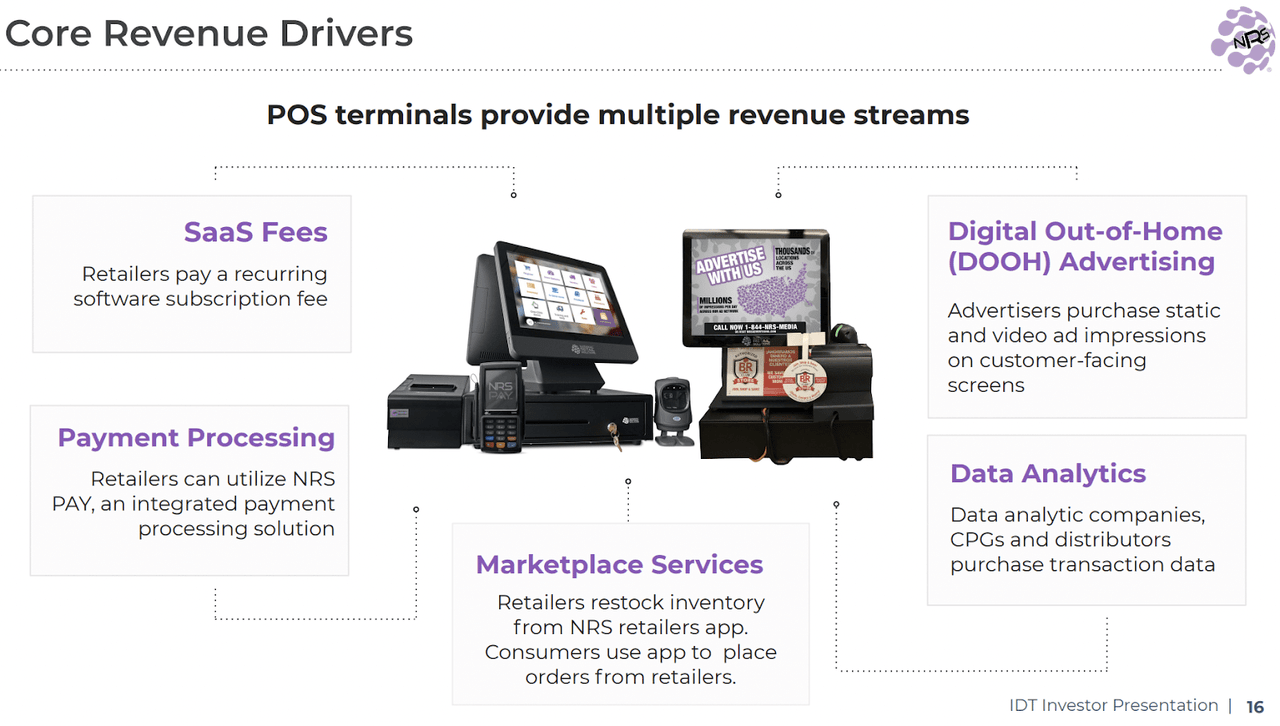

IDT Investor Presentation

NRS was launched in 2015 to provide cloud-based POS services to highly fragmented independent retailers, including convenience stores, tobaccos, and bodegas. It has a mix of hardware and service revenue. Its non-recurring hardware revenue includes sales generated from the sale of POS terminals, and credit card readers, and its high-margin recurring service revenue includes sales from merchant processing (transaction fees from NSR Pay), advertising, and sales of customers’ data to third parties.

Growing Number of Terminals

NRS Pay Website

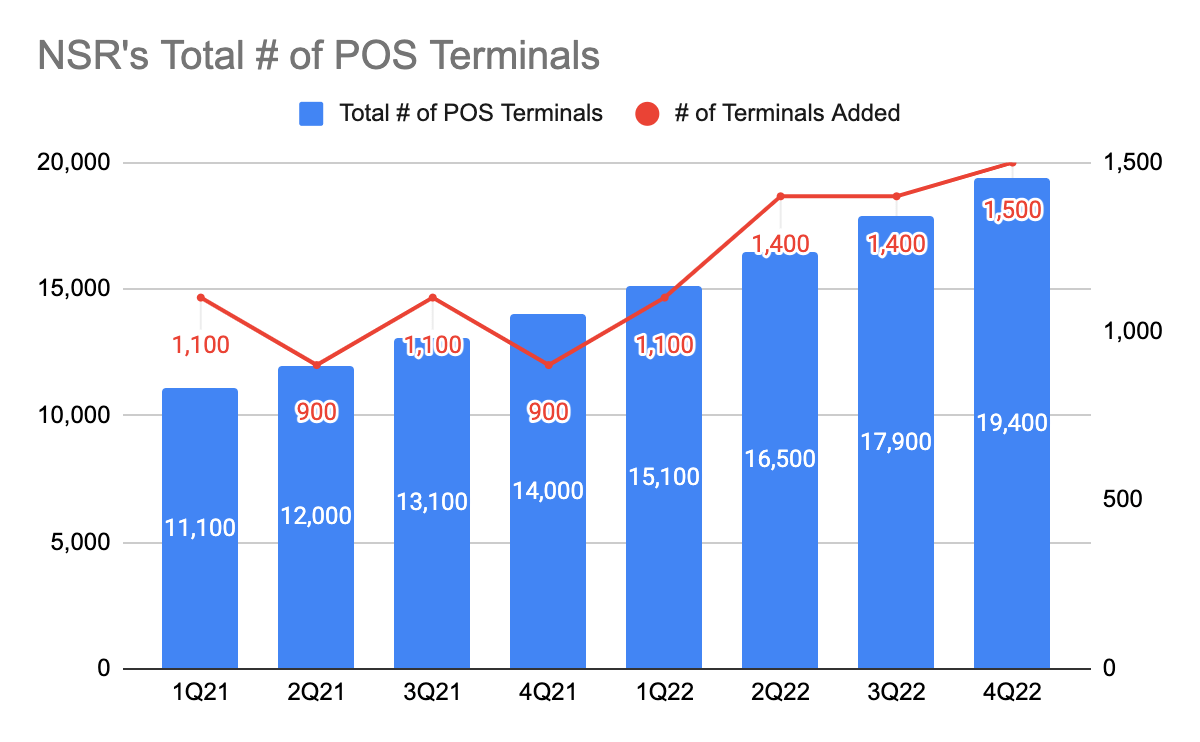

Typically, a company has to spend huge sales and marketing (“S&M”) dollars to acquire customers. However, NSR can tap into BOSS Revolution’s existing relationships with over 35,000 retailers to reduce customer acquisition costs. Today, NSR has over 19,400 POS terminals deployed, and they have been accelerating the number of new terminals over the past few quarters with 4Q22 being the largest addition in a quarter. During the 3Q22 earnings call, the management stated that they can grow above 1,400 new units per quarter as they solved the inventory shortages. Given this, we can assume that they will reach 25,400 terminals (1,500 per quarter) by the end of FY23.

As NRS serves independent retailers, I believe that the sales cycle is shorter than companies that serve multi-chain operators or tier-1 operators with over 1,000 stores for various reasons. I’d think that it is easier to onboard a single operator in comparison to onboarding a merchant with multiple stores. And, independent retailers are likely to be less rigorous in choosing POS so long as basic needs are met and costs are low. This means that they are much easier to convince, and once onboarded, they tend to be very sticky as POS makes up a core operation of an operator. Without a POS, a business cannot function.

NRS Pay

NRS Pay Website

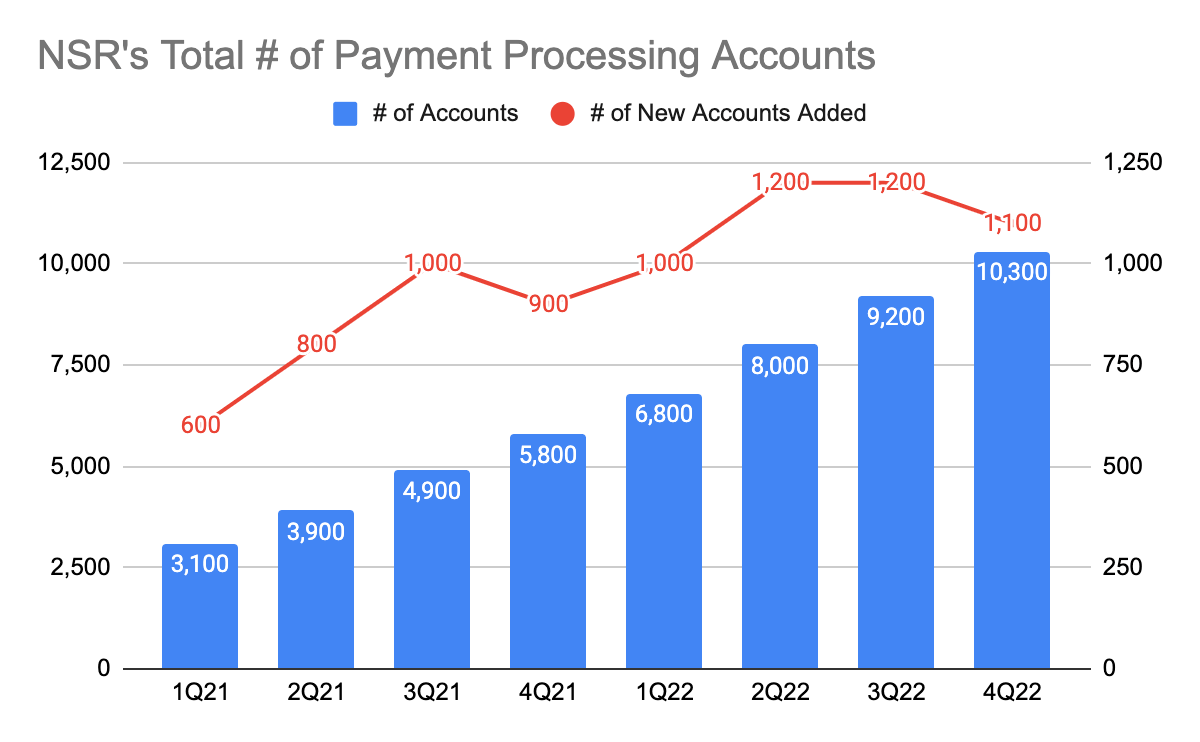

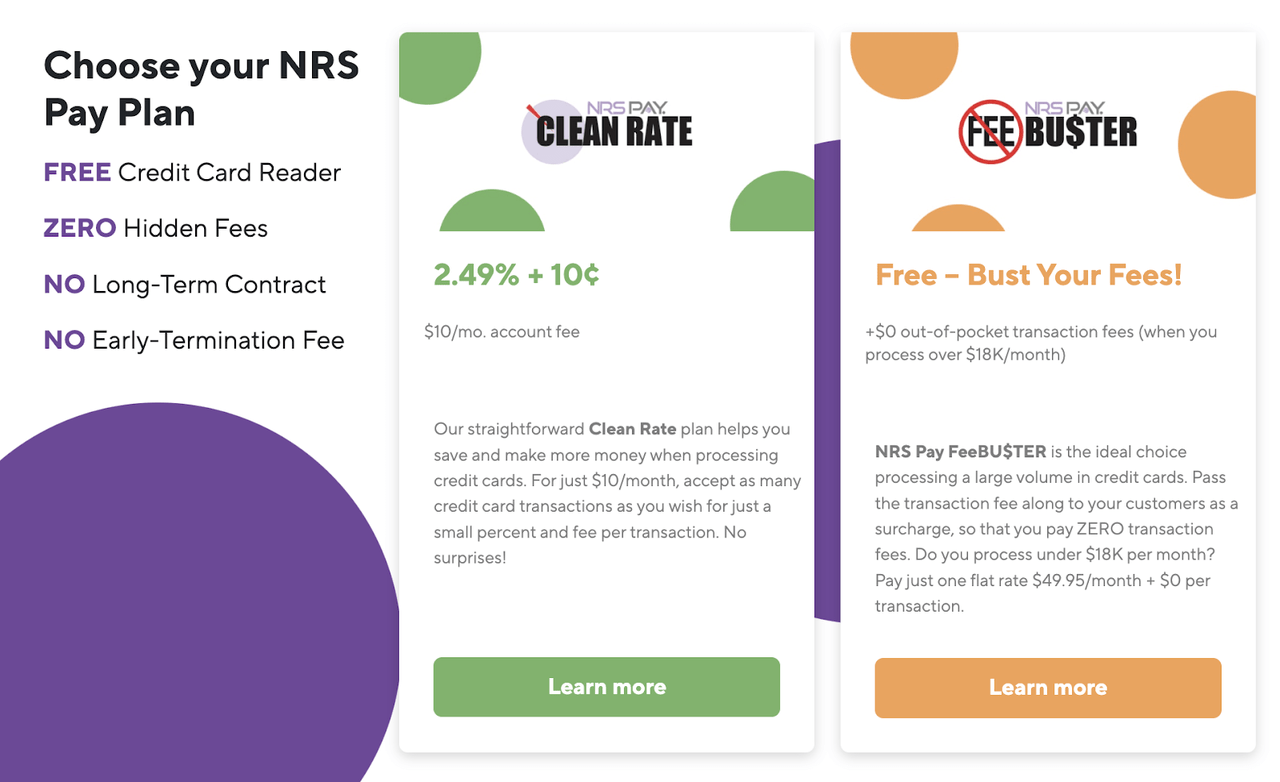

NRS Pay, NSR’s payment processing solution, allows merchants to accept card payments and is also accelerating the number of accounts. In NRS FY21 annual report, the company pride itself to deliver a payment processing solution that is cheaper than its competitors:

“For NRS PAY, simplified, transparent pricing with free card readers, no hidden fees and lower total cost to operate than most competitors”

NRS Pay Website

Unlike tier-1 operators, independent retailers do not have pricing power; therefore, providers control the processing fees that they charge to merchants. NRS Pay charges a (1) 2.49% + $0.10 fee, and a $10 monthly fee, or (2) a flat $49.90 monthly fee with unlimited transactions for free. This is in direct comparison to Lightspeed (LSPD) which charges a 2.6% + $0.10/$0.30 fee, and Toast (TOST), which is charging a 2.7% fee on a $75 check (higher for a smaller check). According to ReformingRetail, Toast is charging a ridiculous fee to its merchants. Here, NRS Pay does not look to be profiting from merchants and it is congruent to what they said in providing a transparent and lower cost than its competitors.

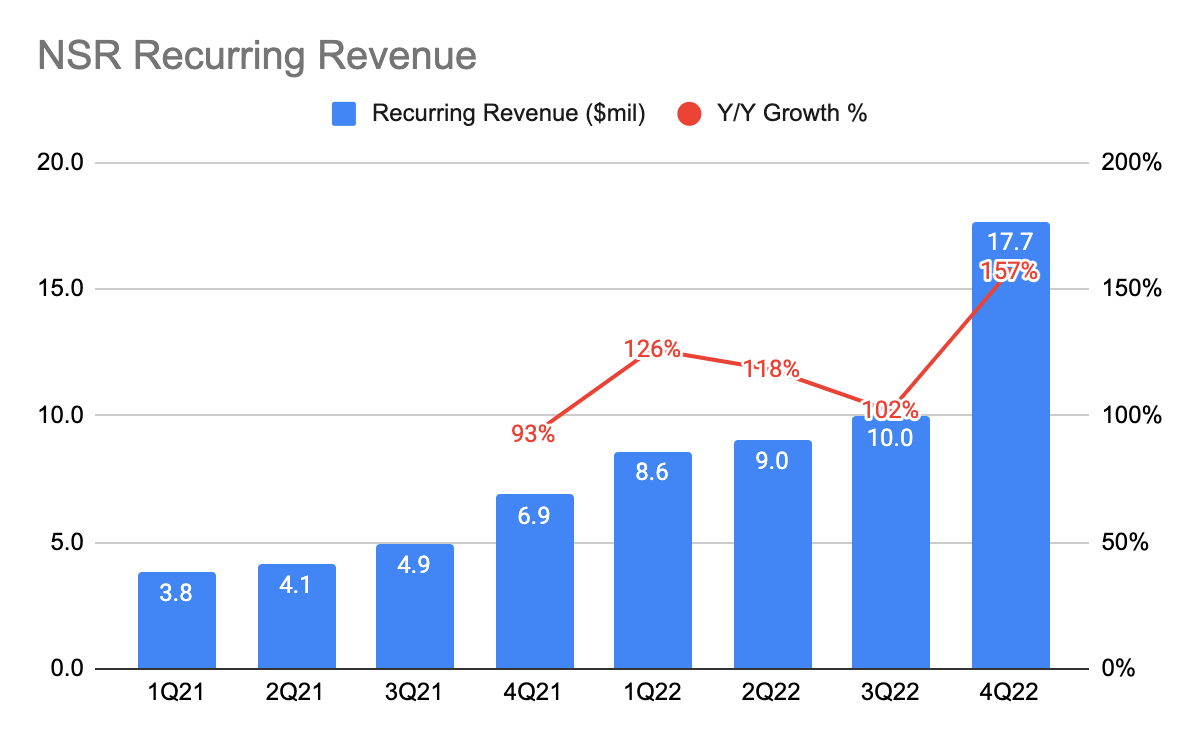

Rapidly Growing Recurring Revenue

IDT 10-Q IDT 10-Q

NRS has been growing really quickly with its most recent 4Q22 recurring revenue growing at 157% Y/Y. This is primarily driven by (1) its land-and-expand strategy whereby NRS introduces more features and merchants adopt more features, and (2) the growing number of independent retailers, which has been accelerating as mentioned earlier on.

In 2 years, its recurring revenue has grown close to 5 times from 1Q21 to 4Q22, making it one of the fastest-growing companies among its peers. Furthermore, with over 200,000 independent retailers in the U.S, there is a massive runway for NRS to grow.

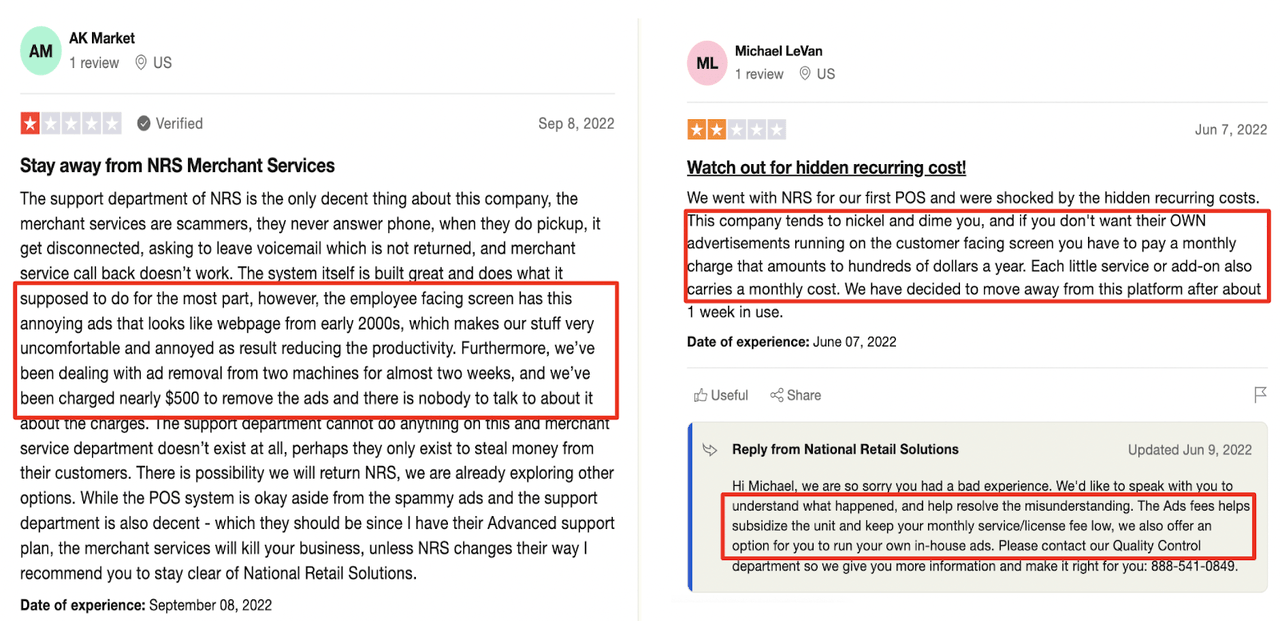

Trustpilot: Intrusive ads and Additional Fees For Removal of Ads

Trustpilot

On Trustpilot, customers reviewed that NRS advertisements, shown on the POS terminals’ screen, are intrusive. And merchants who wish to remove the ads are required to pay additional fees. And it seems that NRS is charging a low monthly fee in exchange for ads to be shown, although this is a trade-off that I believe will continue to entice merchants to use NRS Pay to keep their cost low.

However, as POS makes up the core of a merchant’s operation, these intrusive ads may destroy the merchant’s experience, which is something to look into in the long run. After all, ads make up a meaningful portion of its recurring revenue.

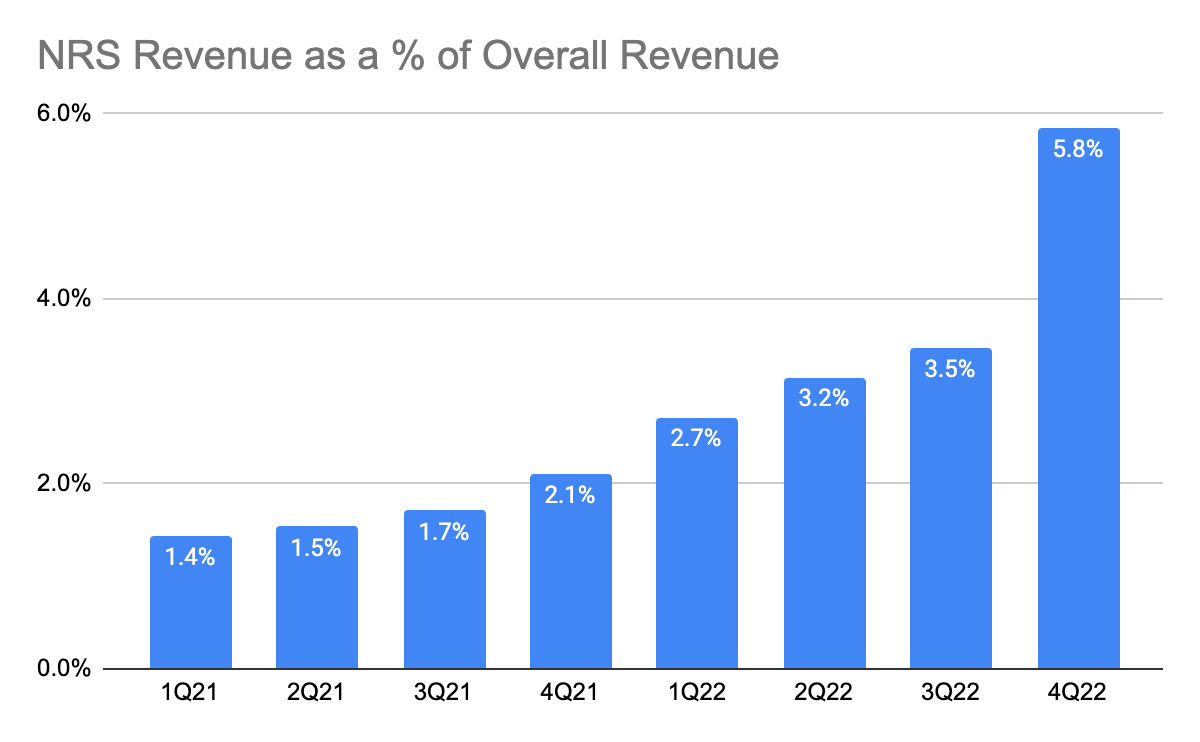

Leading Industry Margin and Back-of-the-Envelope Valuation

I believe NRS is one of the few cloud-based POS companies that possess a leading industry gross margin of 90% as of 4Q22 and is already profitable. During the 2Q22 earnings call, the management stated that NRS’s recurring revenue margin is close to 100% and the POS terminal has a gross margin of 10% to 20%. Since NRS recurring revenue is $17.7 million and POS terminal revenue is $1.6 million in 4Q22, this gives us a blended gross margin of 92%.

This is substantially higher than Toast and Lightspeed’s gross margins of 16% and 44%, respectively. And during the 4Q22 earnings call, management disclosed that NRS achieved a $7 million EBITDA, thus translating to an EBITDA margin of 36%. This $7 million EBITDA alone makes up 29% of IDT’s overall EBITDA, and by the end of FY23, NRS is expected to generate $30 million of EBITDA.

For a business that is generating $30 million of EBITDA and with a best-in-class EBITDA margin of over 30%, I believe an appropriate multiple is in the range of 15x to 20x. This gives us a value of $450 million to $600 million, for which the company’s current market cap is $652 million. Keep in mind that net2phone is only one of the few businesses in the company, and this makes me wonder why is the market mispricing it.

Net2phone

Secular Tailwind

Net2phone, IDT’s unified cloud communication business, is one of the high-margin and high-growth businesses. This business is growing as there is an increasing shift from legacy PBX systems to cloud-based PBX systems. Legacy PBX systems are extremely inefficient, non-scalable, and expensive as it involves hardware deployments, and enterprises looking to transition into the remote workforce are adopting cloud-based PBX systems, which are far less capital-intensive. Net2phone offers a suite of services including web conferencing, domestic and international calling to over 40 countries, and text messaging.

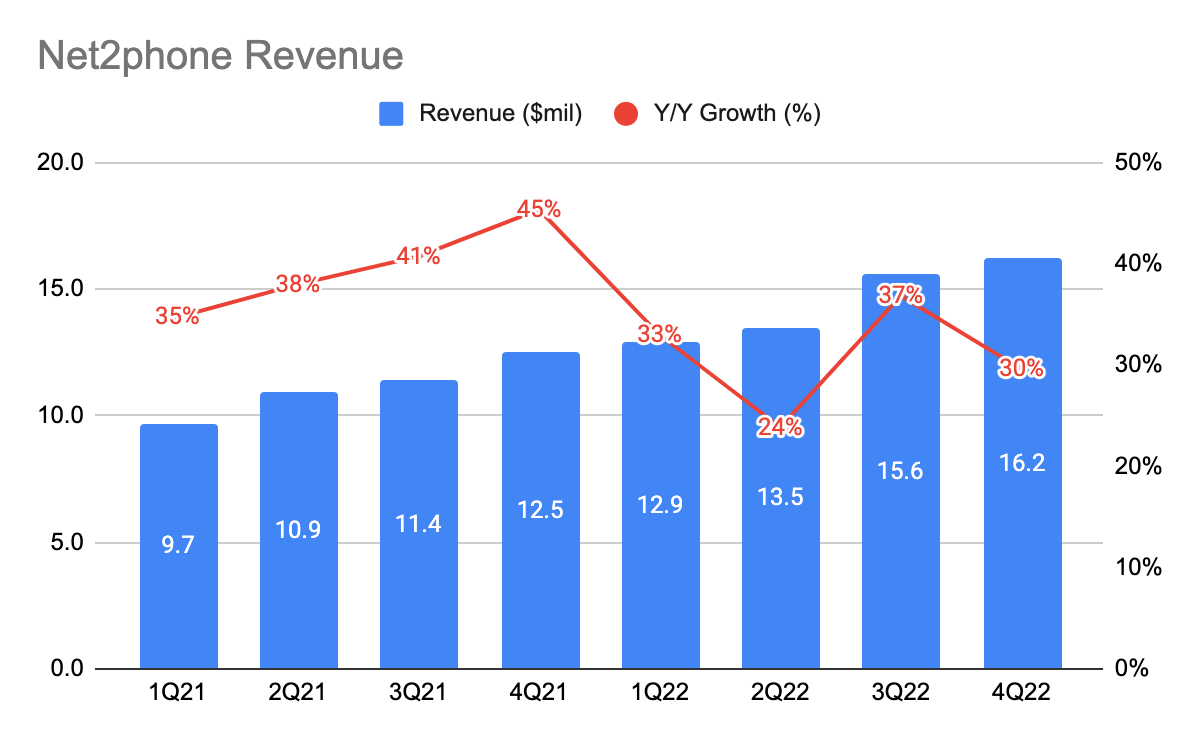

Increasing Revenue Growth

IDT 10-Q IDT 10-Q

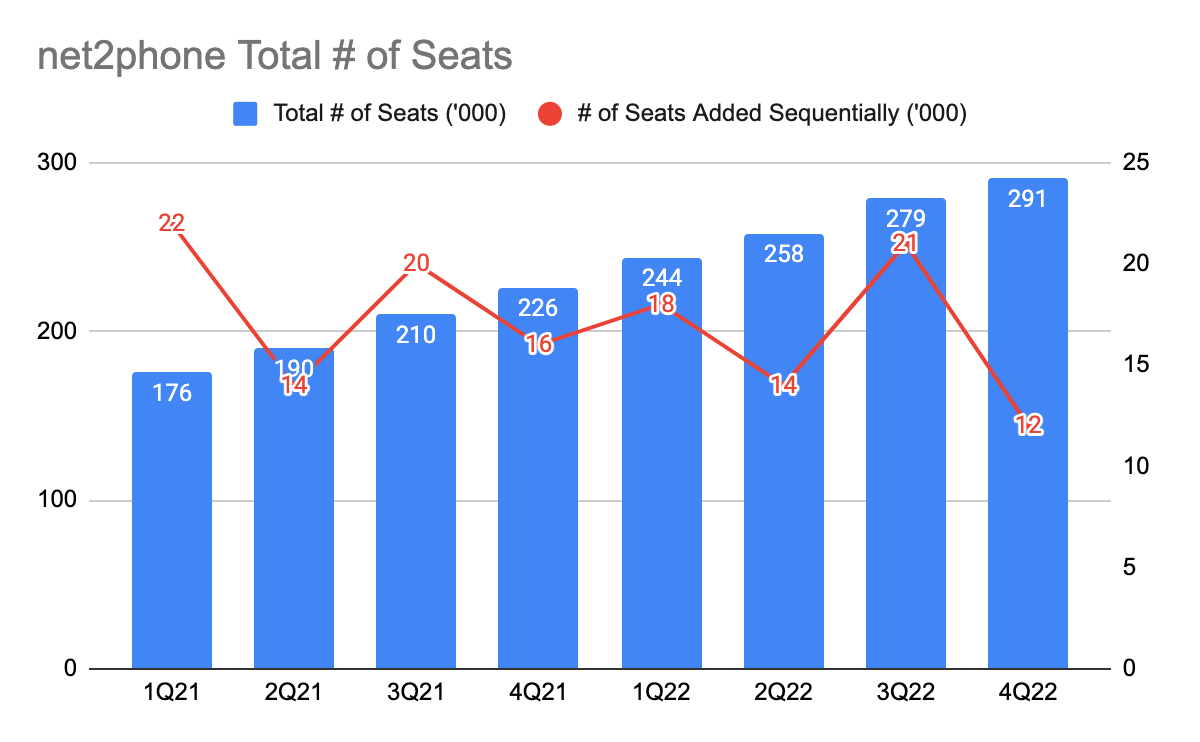

Net2phone revenue has been growing strongly over the quarters, which is primarily driven by the number of seats (or the number of employees), and each seat is charged a monthly subscription fee. The number of seats has also been consistently growing, indicating that net2phone is onboarding more organizations and more employees within existing and new organizations. It operates primarily in Latin America, and in particular, the U.S. which they are experiencing higher growth from. In FY22, U.S. revenue grew 48% Y/Y and Latin America grew 27% Y/Y.

High Gross Margin and Breakeven in FY23

IDT 10-Q IDT 10-Q

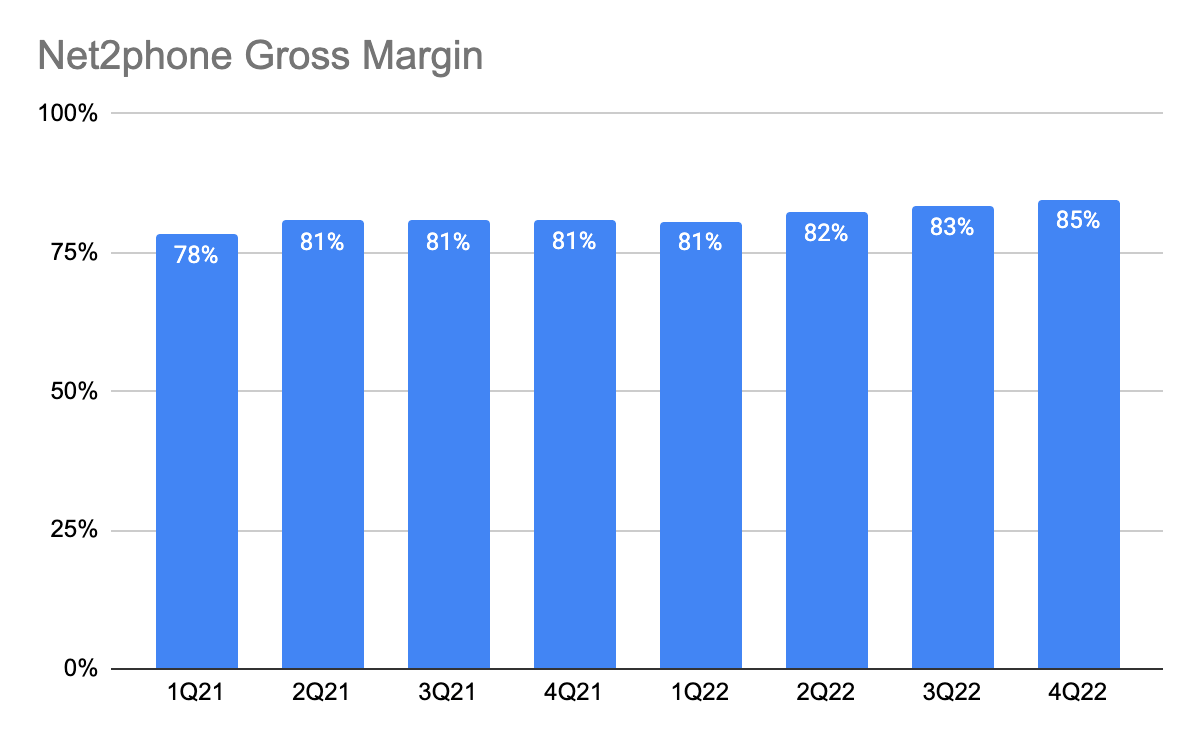

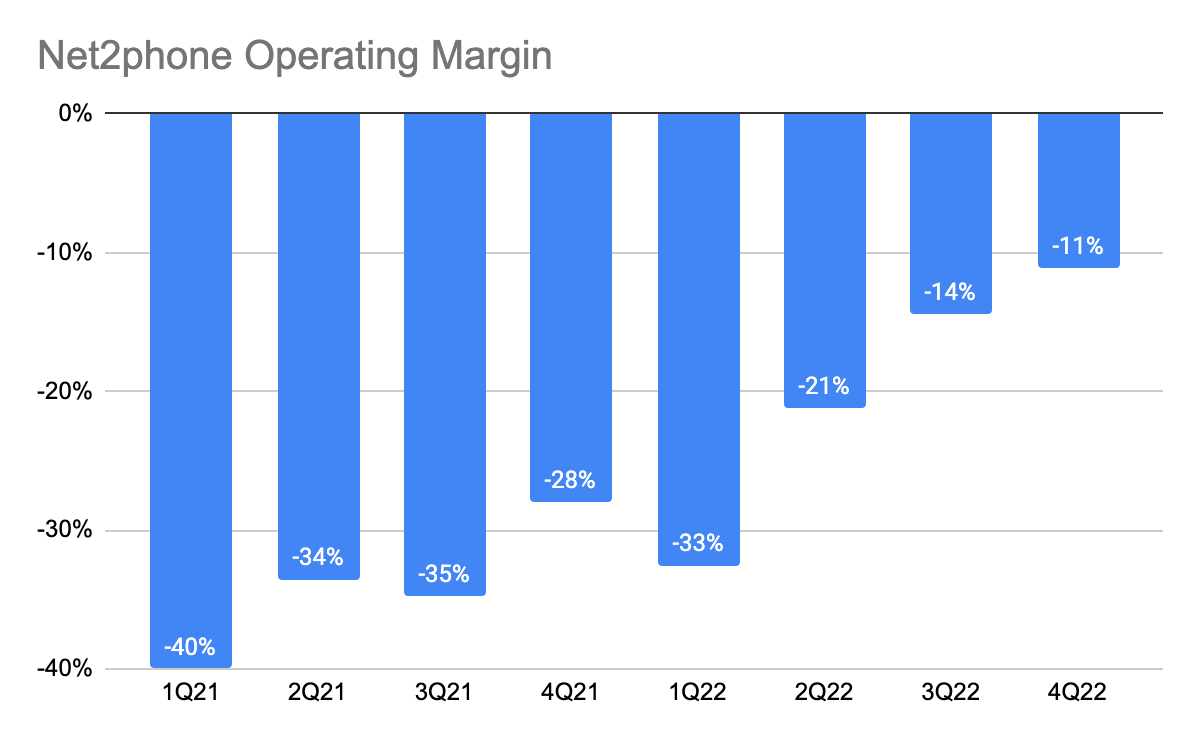

Like NRS, net2phone also has an industry-leading gross margin of 85% compared to peers including RingCentral (RNG), 8×8 (EGHT), and Five9 (FIVN). While it is still currently unprofitable, the management has been accelerating its path to profitability with its operating margin improving from -40% in 1Q21 to -11% in 4Q22. By the end of FY23, they are expected to break even, and it could be one of the few companies in the industry to hit profitability.

Conclusion

These are 2 businesses in particular that caught my attention when I first studied the company. I do think IDT is attractive given that both NRS and net2phone possess industry-leading gross margins, and are growing strongly. I believe NRS, which has an EBITDA margin of over 30%, should be worth a multiple of 15x to 20x, and this means NRS alone makes up more than half of the company’s market cap. Currently, I do think this is an attractive investment and I intend to dive deeper into the next couple of weeks.

In the meantime, if you have any great resources to point me to, I would appreciate it if you would do so in the comments section below.

Be the first to comment