tiero

The 2022 bear market feels like a time of extreme volatility.

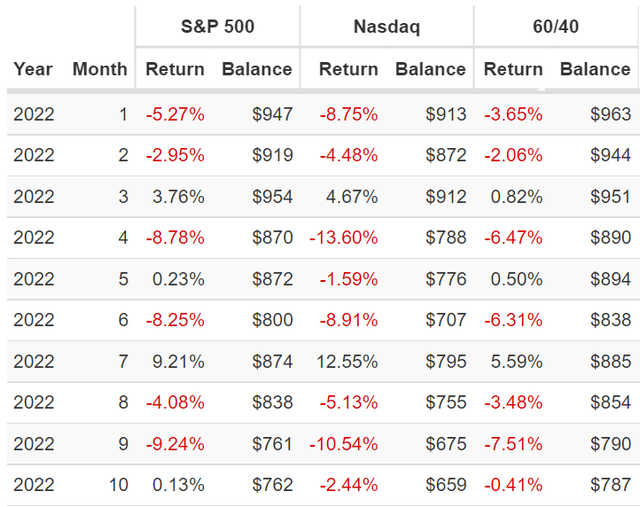

We’ve seen stocks fall 8% to 9% in a single month, no less than three times so far this year. Even the 60/40 retirement portfolio has suffered 6+% declines almost 33% of the time.

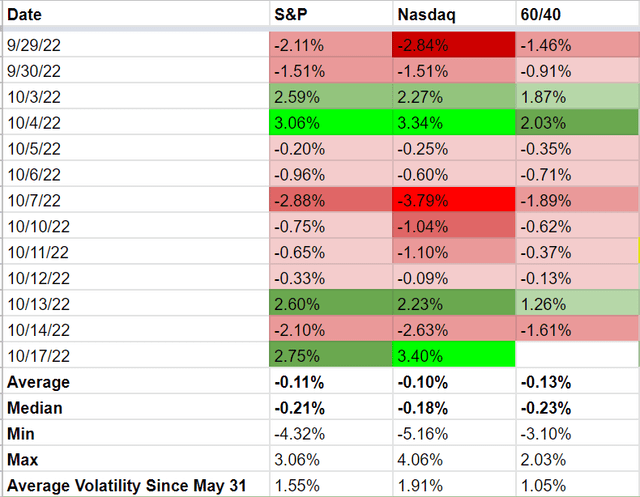

In fact, since the end of May the average daily swings in the market have been 1.6% and almost 2% for the Nasdaq. And from October 13th through the 17th we’ve had three consecutive days of 2+% market swings.

Volatility isn’t risk, it’s just meaningless short-term noise.

Volatility caused by money managers who speculate irrationality with huge sums will offer the true investor more chance to make intelligent investment moves. He can be hurt by such volatility only if he is forced, by either financial or psychological pressures, to sell at untoward times. – Warren Buffett (emphasis added)

Risk is the risk of losing all your money permanently, or suffering a permanent catastrophic decline (as happens with 44% of US companies).

Volatility is the best friend of the smart long-term investor, who knows that when stocks swing the wildest, that’s the time future returns are highest.

To understand just how irrational periods of high volatility are, consider this: According to Ritholtz Wealth Management, for a 1% market move to make sense from a discounted cash flow perspective, the next year’s earnings would have to be impacted 10%.

A 3% move? A 30% swing in the next 12-month’s earnings. A 4% move? A 40% swing in earnings. A 5% move (we’ve seen one this year), a 50% move in earnings.

The same is true for individual stocks. FedEx (FDX) crashed 25%? It requires the next 2.5 years of earnings to be wiped out to justify that single day decline.

Target (TGT) in 1987 fell 35% in a single day. As long as you believe that Target’s next 3.5 years’ worth of earnings will be zero, that made perfect sense.

Do you see why these wild bear market swings are so irrational and potentially lucrative? When even world-class blue-chips can swing 10%, 20%, or 30% in a day, that’s usually a glorious long-term buying opportunity.

But that’s pure math; elegant, emotionless, and logical. Humans are none of these things. The best investing strategy in the world is useless if you can’t stick with it and that’s where ultra-low volatility blue-chips like Johnson & Johnson (NYSE:JNJ) can help you stay safe and safe in crazy markets.

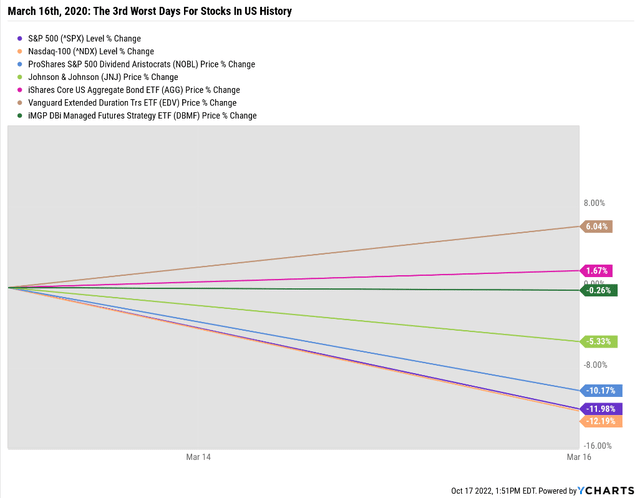

On March 16th, 2020, a global margin call caused the US stock market to fall 12% in a single day.

Aristocrats fell 10%, and even Johnson & Johnson, one of the lowest volatility companies on earth, fell 5%. Mind you by comparison that was a triumph.

- bonds had a great day

- managed futures were flat or up slightly

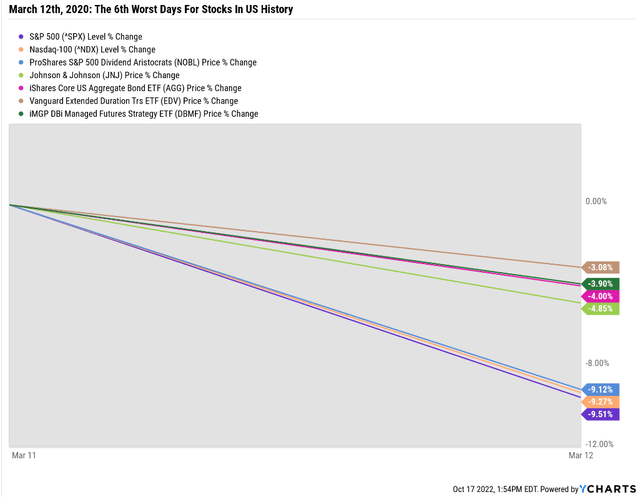

March 12th, 2020 was such a horrific day, that even bonds and managed futures fell, just a lot less than the S&P. JNJ managed to also fall just 5% that day.

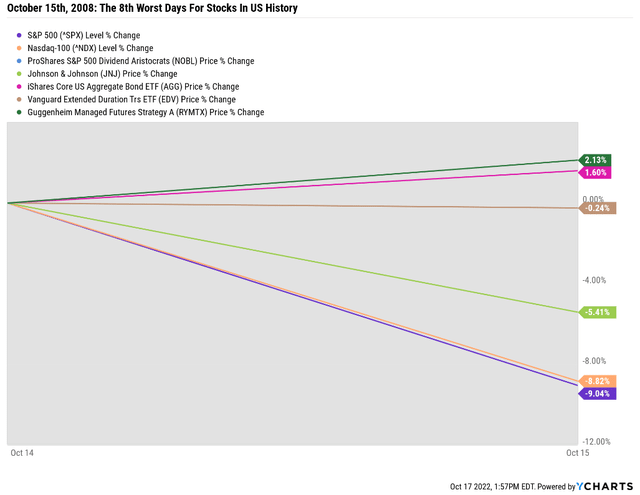

October 15th, 2008, the 8th worst day in US market history, with stocks falling 9% in a day.

- implying either the market was irrational or earnings would fall 90% in the next 12 months

- earnings didn’t fall 90%, the market was just being irrational

JNJ managed to fall 5% that day as well, with bonds and managed futures doing what they were supposed to, staying flat or going up.

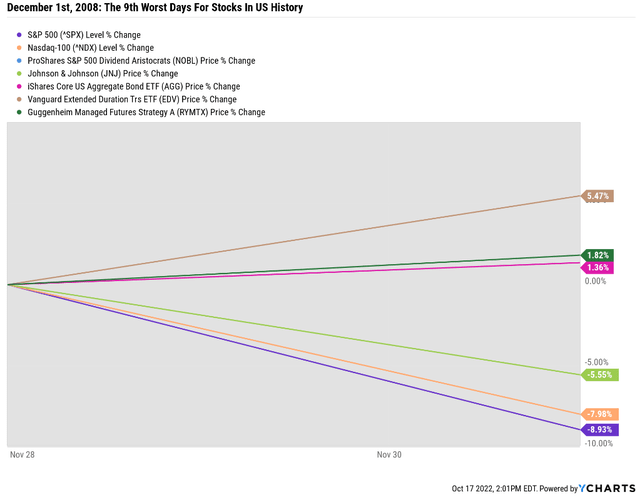

December 1st, 2008, the 9th worst day in market history with stocks falling nearly 9%. JNJ yet again held up relatively well, falling less than 6%.

- bonds and managed futures did their job and went up

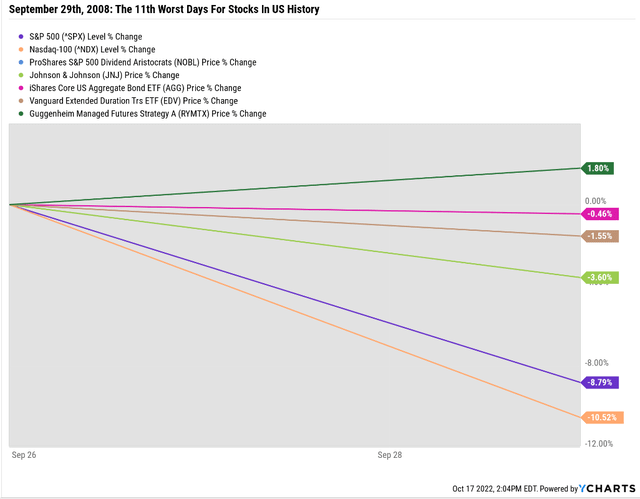

September 29th, 2008, the 11th worst day for stocks, with the S&P down almost 9% and JNJ falling just 3.6%.

- bonds fell slightly while managed futures went up

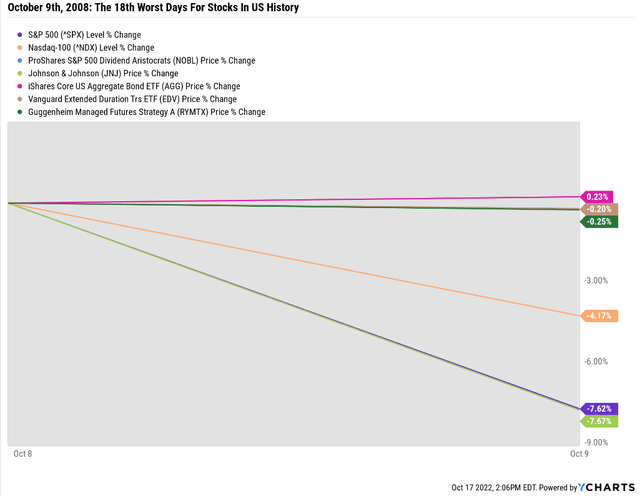

October 9th, 2008, the 18th worst day for US stocks, with the S&P falling nearly 8%. JNJ fell half as much with bonds and managed futures flat.

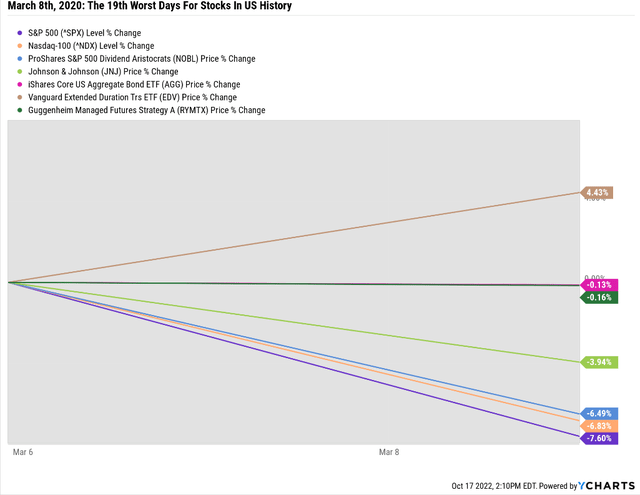

March 8th, 2020, the 19th worst day for stocks, another nearly 8% decline. And again JNJ fell about half as much while bonds and managed futures managed to stay flat or go up.

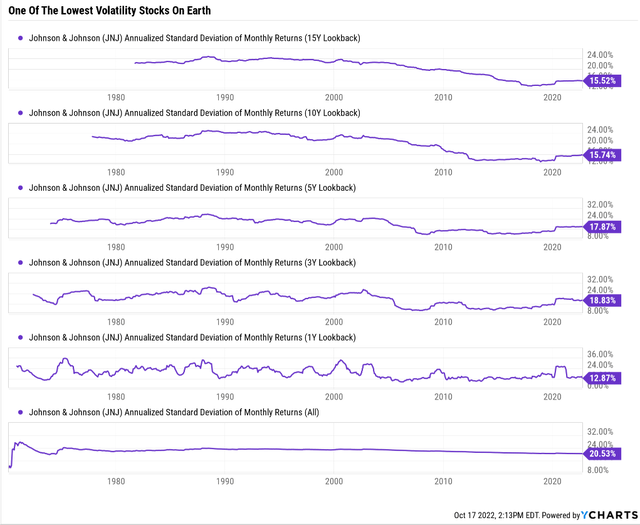

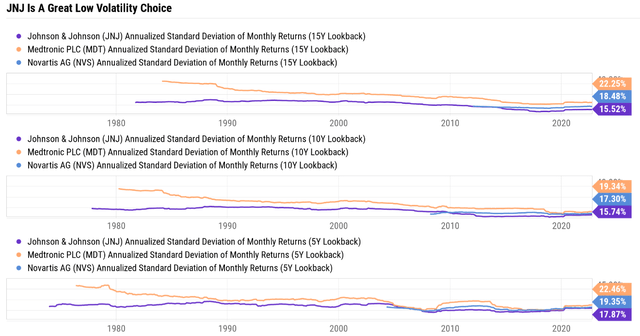

JNJ is so low volatility that it basically matches the annual volatility of the S&P 500 over time. Except that it’s a single company instead of 500.

The point is that as far as individual blue-chips go, those seeking a lower volatility portfolios love JNJ for good reason.

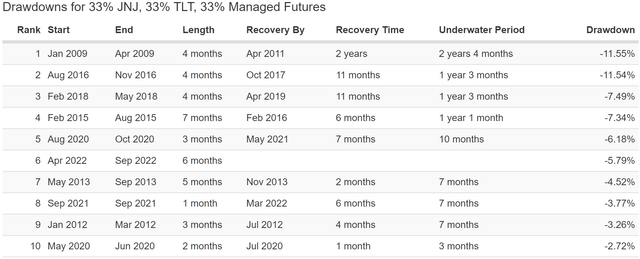

Since March 2007

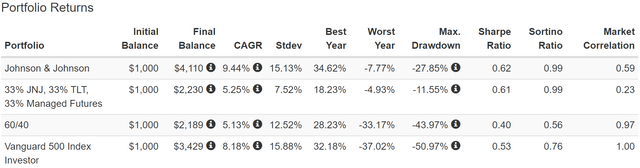

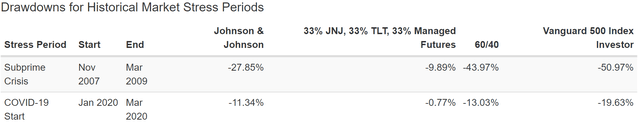

As part of a diversified portfolio JNJ can help you sleep well at night in even the most extreme economic and market crashes.

Flat in the Pandemic? Now that’s low volatility.

Down just 6% in the 2022 stagflation bear market? Now that’s low volatility.

The point is that JNJ is NOT a bond alternative, it never was. But combined with low volatility blue-chips, bonds, and managed futures, it can create portfolios that can deliver 60/40 beating returns along with volatility that’s so low, it’s like rolling over even the largest market potholes in a Rolls Royce.

But I am not here to just praise JNJ for its low volatility. There are three reasons to love JNJ and potentially own it forever, or until the world, ends, whichever comes first.

But I also want to highlight why anyone who loves JNJ for its quality, safety, and dependability should consider Medtronic (MDT) and Novartis (NVS), as great dividend aristocrat alternatives.

3 Reasons To Love JNJ

Why is JNJ such a low volatility stock? Because it’s as close to a perfect recession-resistant choice for income investors as you can find.

- recession-resistant business model

- AAA credit rating

- dividend king (59-year dividend growth streak)

Let’s start with that business model, which is now focused on medical devices and patented drugs.

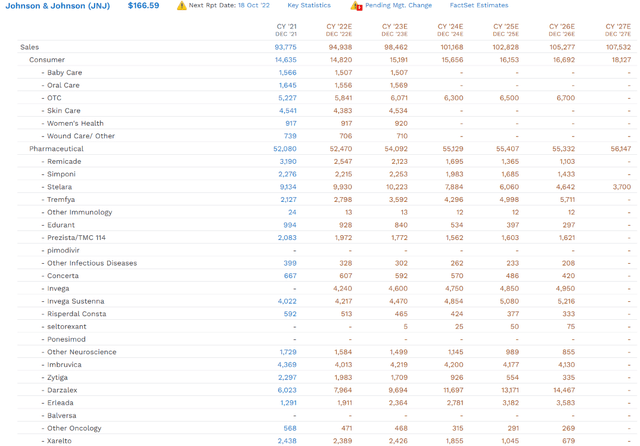

With JNJ spinning off its consumer business to focus on higher margin medical devices and patented drugs, the drug portfolio is more important than ever.

- 16% of 2021 sales were from consumer products

JNJ has a highly diversified portfolio of blockbusters with well-spaced patent expirations which is expected to result in slow but steady drug sales.

JNJ has 18 $1+ billion blockbusters currently and 99 new drugs and indications currently in development and trials.

It’s medical device business is generating $28 billion in annual sales which is expected to grow to $33.3 billion by 2027.

The upside to spinning off consumer products is that margins will improve, which management believes will result in a higher P/E over time.

- though it might not since consumer health has no patent expirations

- and is a source of very stable cash flow

The downside to the spin-off is that JNJ’s patented businesses are slow growing and that means the growth outlook has fallen significantly compared to 6% to 7% expected growth pre-spin-off announcement.

Drugs are a hamster wheel that requires constant R&D and new drug launches to overcome patent cliffs. That’s why Moody’s estimates the long-term growth rate of the industry at 4% over time, and JNJ’s growth outlook is now similar to the industry norm.

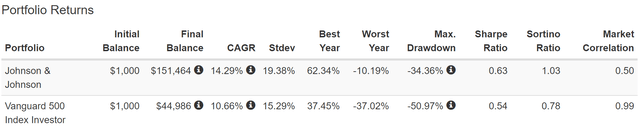

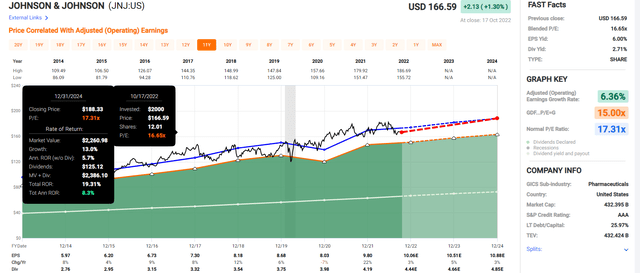

JNJ Historical Returns Since 1985

(Source: Portfolio Visualizer Premium)

The days of JNJ beating the market are likely gone for good, with the new business model.

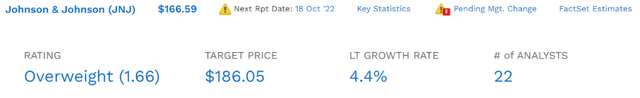

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Schwab US Dividend Equity ETF | 3.8% | 8.50% | 12.3% | 8.6% | 6.3% | 11.4 | 1.85 |

| Nasdaq | 0.8% | 11.5% | 12.3% | 8.6% | 6.3% | 11.4 | 1.85 |

| Dividend Aristocrats | 2.8% | 8.7% | 11.5% | 8.1% | 5.8% | 12.5 | 1.75 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.6 | 1.62 |

| Johnson & Johnson | 2.7% | 4.4% | 7.1% | 5.0% | 2.7% | 26.7 | 1.31 |

(Sources: DK Research Terminal, FactSet, Morningstar, YCharts)

What About New Regulations?

After taking a closer look at what we consider the three key elements of the Inflation Reduction Act that will affect the biopharma industry over the next decade, we’re reducing our fair value estimates for 17 of the biggest biopharma names in Morningstar’s coverage by an average of 2%. – Morningstar

The reason to buy large drug makers is they have diversified businesses that can handle changes in US regulations with a minimal impact to cash flows.

We think the step-down in U.S. branded drug sales from capping Medicare price increases to inflation (fully rolled out in 2023), redesigning Medicare Part D (beginning in 2025), and Medicare negotiation (beginning in 2026 for small molecules) will result in a 3% reduction in total sales for these firms by 2031, with firm-level reductions depending on the firm’s reliance on the U.S. market, proportion of the portfolio targeting seniors, history of price increases, and relative size of its small molecule and biologics portfolios (as biologics are immune from Medicare negotiation for 13 years instead of nine). – Morningstar

The impact on big drug companies will likely be minimal because it will be several years before the regulations take effect, and drug companies are free to raise prices ahead of the price caps.

Our estimates factor in some ability for the industry to either benefit from certain changes (like potential increased prescription fill rates in Part D with lower out-of-pocket costs) or compensate for headwinds (like responding to inflation caps on price increases with higher launch prices). Overall, we think the effect of the Inflation Reduction Act is manageable for the industry, and we see the competitive advantages and economic moats of these firms remaining intact.

Turning to the effects on individual firms, we think firms with higher exposure to these policy changes include AstraZeneca (oncology negotiation), Bristol (expensive oncology drugs), Gilead (HIV negotiation), and Novo Nordisk (Ozempic negotiation and list price increases). Factors reducing exposure include low Medicare exposure (Biogen and BioMarin), global diversification (BioMarin, Pfizer, and Roche), and biologics focus (BioMarin and Roche). – Morningstar

The IRA impact on JNJ will likely be middle of the road, because it’s diversified into medical devices, as well as overseas sales.

- 50% of sales are international and not affected by the new regulations

The good news is that the other two reasons to love JNJ are not likely to be affected by the consumer health spin-off (which is expected in 2023 or 2024) or new regulations.

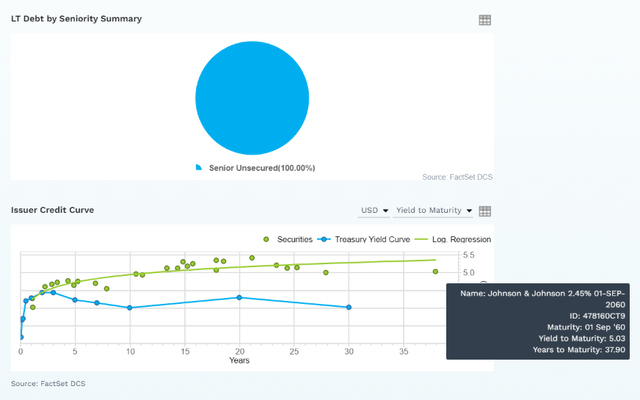

JNJ Credit Ratings

| Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

| S&P | AAA Stable Outlook | 0.07% | 1428.6 |

| Moody’s | Aaa (AAA equivalent) Stable | 0.07% | 1428.6 |

| Consensus | AAA Stable Outlook | 0.07% | 1428.6 |

(Sources: S&P, Moody’s)

Along with MSFT, JNJ is the only AAA-rated company in America, as close to a risk-free stock investment as exists.

Rating agencies estimate a 1 in 1,429 chance of losing all your money over the next 30 years, buying these shares today.

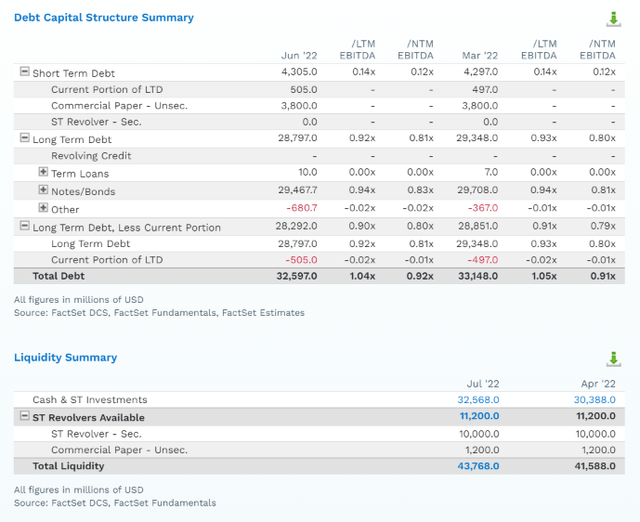

JNJ has debt/EBITDA of 1.0X, and that’s expected to trend a bit lower over time.

Credit Rating Leverage Guidelines

| Credit Rating | Safe Net Debt/EBITDA For Most Companies | 30-Year Default/Bankruptcy Risk |

| BBB | 3.0 or less | 7.50% |

| A- | 2.5 or less | 2.50% |

| A | 2.0 or less | 0.66% |

| A+ | 1.8 or less | 0.60% |

| AA | 1.5 or less | 0.51% |

| AAA | 1.1 or less | 0.07% |

(Source: S&P)

The company’s short-term liquidity is $44 billion, more than enough to cushion any unexpected blows from things like lawsuits.

- talcum powder lawsuit liabilities are being handled with a Texas Two-step

- a subsidiary has been formed to absorb all those liabilities and has declared bankruptcy

- JNJ is now immune to those lawsuits from a legal perspective

JNJ’s bonds are well staggered, 100% unsecured, and the bond market is so confident in its survival that it’s willing to lend to the company for nearly four decades at a reasonable 5% interest rate.

- 2.45% originally before interest rates soared

What this means is that JNJ has all the financial flexibility it needs to maintain its wide moat through massive R&D spending.

- $14.6 billion in 2021

- rising to $16.3 billion in 2027

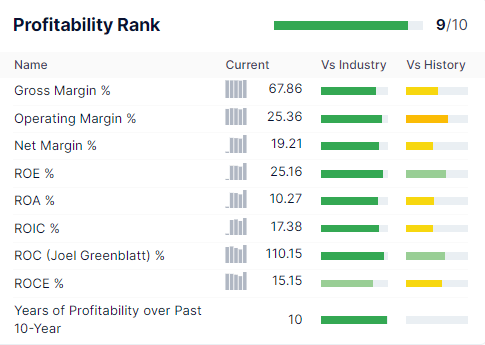

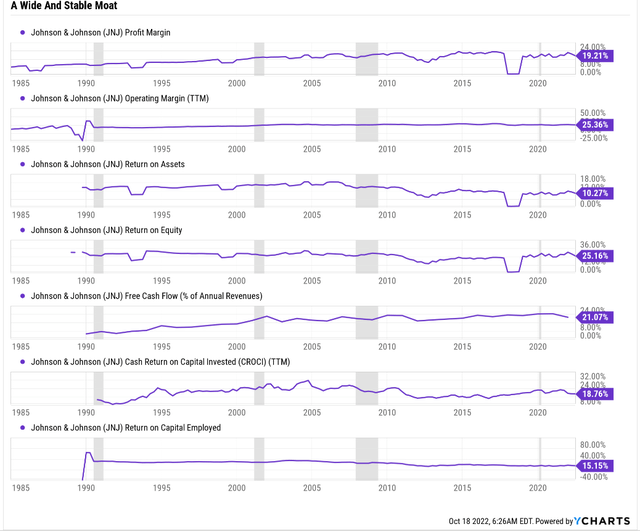

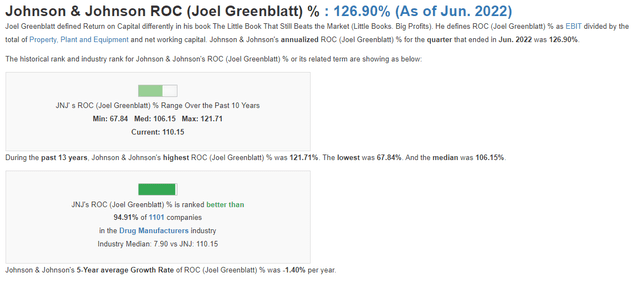

GuruFocus Premium

JNJ’s historical profitability is in the 90th percentile of drug makers, and that might now increase to 95th in the coming years.

JNJ’s free cash flow margins are 21%, on par with Apple’s (AAPL). Those are likely to increase a bit in the future.

- 2024 FCF margin consensus: 29%

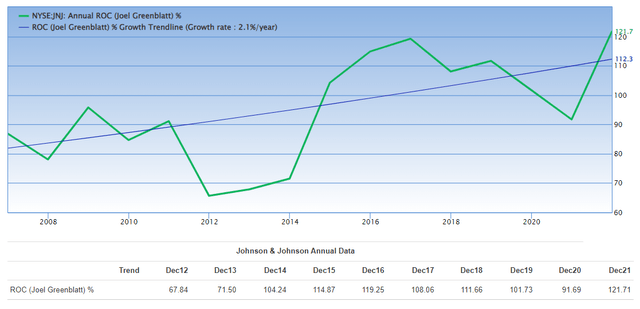

JNJ’s return on capital, or annual pre-tax profit/the cost of running the business was 127% in the most recent quarter, in the 95th percentile of the industry.

JNJ’s ROC has been trending higher at a 2.2% rate for 14 years, confirming its wide and stable moat.

All of which means the very safe dividend, confirmed by a 59 year dividend growth streak, is likely to persist for decades to come.

- annual dividend increases since 1963

For context, JNJ has been raising its dividend every year through:

- nine recessions

- 14 bear markets

- dozens of corrections

- inflation as high as 15%

- interest rates as high as 16%

- Fed fund rate as high as 20%

JNJ was founded in 1886 and will likely outlive us all.

Does that mean that it’s a reasonable buy today? Not necessarily.

JNJ 2024 Consensus Total Return Potential

JNJ is basically fairly valued and is a slow growing company, meaning around 20% total return potential over the next two years.

- about 8% annual return potential

- half that of the S&P 500

For anyone comfortable with a modest 7% return potential in the coming decades, it’s a fine low volatility choice, but there are superior A-rated defensive dividend aristocrat options.

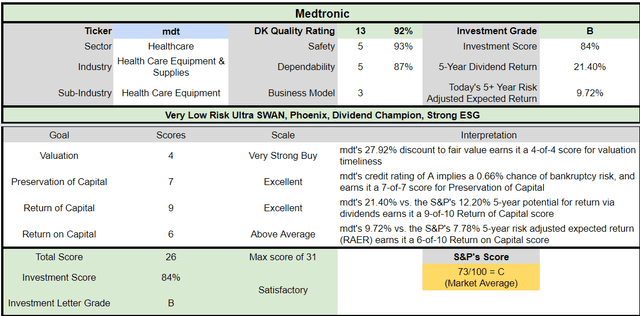

Why Medtronic Is A Potentially Great JNJ Alternative

Reasons To Potentially Buy Medtronic Today

| Metric | Medtronic |

| Quality | 92% 13/13 Quality Ultra SWAN (Sleep Well At Night) Dividend Aristocrat |

| Risk Rating | Very Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 72 |

| Quality Percentile | 86% |

| Dividend Growth Streak (Years) | 45 |

| Dividend Yield | 3.3% |

| Dividend Safety Score | 93% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.35% |

| S&P Credit Rating | A Stable |

| 30-Year Bankruptcy Risk | 0.66% |

| LT S&P Risk-Management Global Percentile |

93% Exceptional |

| Fair Value | $114.71 |

| Current Price | $82.76 |

| Discount To Fair Value | 28% |

| DK Rating |

Potentially Very Strong Buy |

| P/E | 14.4 |

| Cash-Adjusted P/E | 12.9 |

| Historical P/E | 18 to 19 |

| LT Growth Consensus/Management Guidance | 8.4% vs 4.4% JNJ |

| 5-year consensus total return potential |

13% to 15% CAGR |

| Base Case 5-year consensus return potential |

13% CAGR (2X the S&P 500) |

| Consensus 12-month total return forecast | 26% |

| Fundamentally Justified 12-Month Return Potential | 41% |

| LT Consensus Total Return Potential | 11.7% |

| Inflation-Adjusted Consensus LT Return Potential | 9.4% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.46 |

| LT Risk-Adjusted Expected Return | 8.14% |

| LT Risk-And Inflation-Adjusted Return Potential | 5.85% |

| Conservative Years To Double | 12.32 |

(Source: Dividend Kings Zen Research Terminal)

Medtronic is an A-rated aristocrat like JNJ, but is growing about 2X as fast. It’s also far more undervalued, creating superior medium-term total return potential.

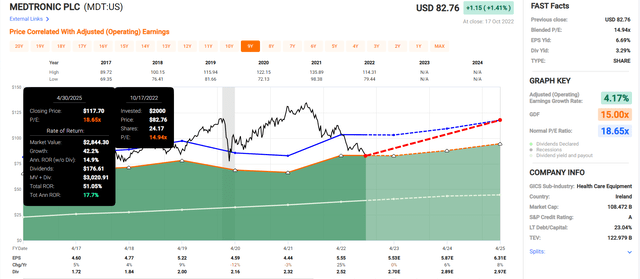

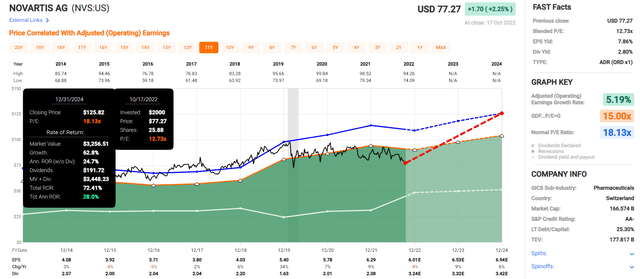

Medtronic 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

- 2.5X the consensus return potential of JNJ

- 18% annual return potential through April 2025

If MDT grows as expected and returns to historical fair value, investors could make 2.5X as much as if they bought JNJ today.

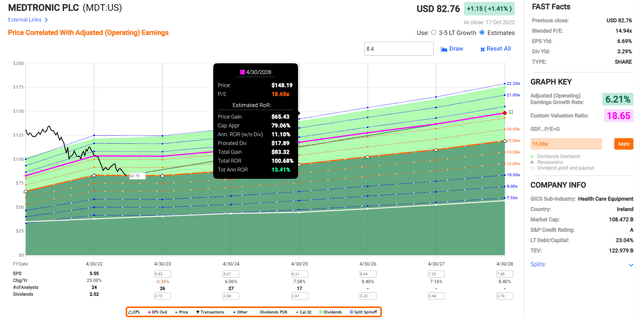

Medtronic 2028 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If MDT grows as expected and returns to fair value by April 2028, it could double, generating solid 13% annual returns.

- about 2X that of the S&P 500

- about 3X more than JNJ

And let’s not forget that long-term MDT, which yields more than JNJ and is growing much faster, could deliver far more income and inflation-adjusted wealth.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Medtronic | 3.3% | 8.4% | 11.7% | 8.2% | 5.9% | 12.2 | 1.78 |

| Novartis | 4.4% | 5.8% | 10.2% | 7.1% | 4.9% | 14.8 | 1.61 |

| Johnson & Johnson | 2.7% | 4.4% | 7.1% | 5.0% | 2.7% | 26.7 | 1.31 |

(Sources: DK Research Terminal, FactSet, YCharts)

In other words, MDT is likely to be a far better investment than JNJ long-term. And compared to the S&P 500 it’s a potentially excellent investment today.

MDT Corp Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

MDT is a potentially excellent JNJ alternative for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 28% discount to fair value vs. 7% S&P = 21% better valuation

- 3.4% very safe yield vs. 1.8% S&P (2X the yield and much safer)

- 15% higher annual long-term return potential

- about 20% higher risk-adjusted expected returns

- almost 2X the consensus 5-year income

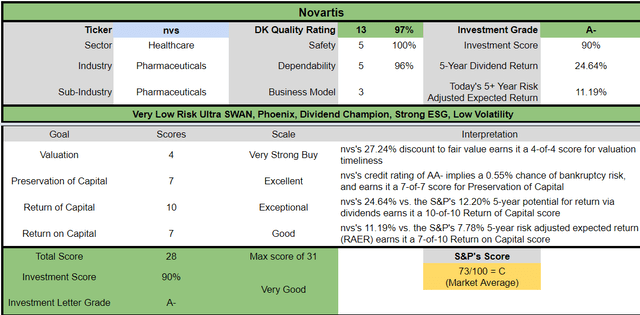

Why Novartis Is A Potentially Great JNJ Alternative

Further Reading

- Novartis Is One Of The Best High-Yield Dividend Aristocrats You Can Buy In 2022

- a full deep dive on NVS’s growth prospects, investment thesis, and risk profile

Here is the bottom line up front about NVS.

- NVS is a Swiss company

- 15% dividend tax withholding thanks to a tax treaty with the US

- What You Need To Know About Foreign Dividend Withholding Taxes

- US investors get a tax credit that recoups the tax withholding for most investors

- though for larger accounts some more complex paperwork is required

- and you have to tell your broker to file with Switzerland to get the lower rate (35% default rate) or else you won’t get it

Reasons To Potentially Buy Novartis Today

| Metric | Novartis |

| Quality | 97% 13/13 Quality Ultra SWAN (Sleep Well At Night) Global Aristocrat |

| Risk Rating | Very Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 21 |

| Quality Percentile | 96% |

| Dividend Growth Streak (Years) | 25 |

| Dividend Yield | 4.4% |

| Dividend Safety Score | 100% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.00% |

| S&P Credit Rating | AA- Stable |

| 30-Year Bankruptcy Risk | 0.51% |

| LT S&P Risk-Management Global Percentile |

97% Exceptional |

| Fair Value | $106.20 |

| Current Price | $77.27 |

| Discount To Fair Value | 27% |

| DK Rating |

Potentially Very Strong Buy |

| P/E | 11.8 |

| Cash-Adjusted P/E | 9.9 |

| Historical P/E | 15 to 17 |

| LT Growth Consensus/Management Guidance | 5.8% |

| 5-year consensus total return potential |

15% to 20% CAGR |

| Base Case 5-year consensus return potential |

14% CAGR (2X the S&P 500) |

| Consensus 12-month total return forecast | 21% |

| Fundamentally Justified 12-Month Return Potential | 42% |

| LT Consensus Total Return Potential | 10.2% |

| Inflation-Adjusted Consensus LT Return Potential | 7.9% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.14 |

| LT Risk-Adjusted Expected Return | 7.10% |

| LT Risk-And Inflation-Adjusted Return Potential | 4.81% |

| Conservative Years To Double | 14.96 |

(Source: Dividend Kings Zen Research Terminal)

NVS is growing slightly faster than JNJ but offers a yield that’s nearly 2X as high.

- assuming you fill out the paperwork to get the tax credits and reduced dividend tax withholdings

NVS’s AA-credit rating is almost as good as JNJ’s and its 97th global long-term risk-management rating from S&P is actually far superior.

S&P Long-Term Risk-Management Global Percentile Ratings (8,000 Rated Companies)

- NVS: 97th percentile = exceptional

- MDT: 93rd percentile = exceptional

- JNJ: 77th percentile = good

And just like MDT, NVS is so undervalued that even modest growth can deliver far better medium-term return potential.

Novartis 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If NVS grows as expected and returns to historical mid-range fair value, it could deliver 72% total returns by 2024, 28% annual returns, and 3.5X more than JNJ.

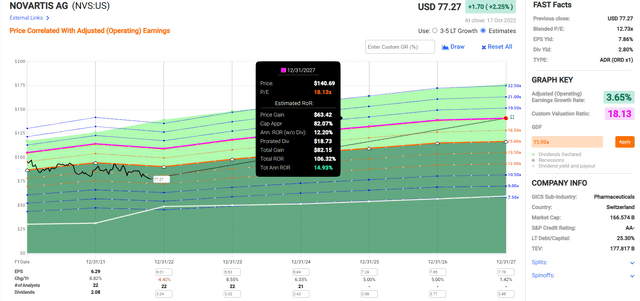

Novartis 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If NVS grows as expected and returns to historical fair value it could more than double, delivering 15% annual returns over the next five years.

- about 2X the S&P 500

- about 3X JNJ

NVS Corp Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

(Source: Dividend Kings Automated Investment Decision Tool)

NVS is a potentially excellent high-yield JNJ alternative for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 27% discount to fair value vs. 7% S&P = 20% better valuation

- 4.4% very safe yield vs. 1.8% S&P (almost 3X higher and much safer yield)

- 10% higher annual long-term return potential

- over 50% higher risk-adjusted expected returns

- 2X the consensus 5-year income

Bottom Line: If You Like JNJ, You’ll Love Medtronic And Novartis

JNJ is a great buy and hold forever low volatility dividend king for anyone who has realistic expectations for what it’s new slower growth and higher margin business model likely means for the future.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Medtronic | 3.3% | 8.4% | 11.7% | 8.2% | 5.9% | 12.2 | 1.78 |

| Novartis | 4.4% | 5.8% | 10.2% | 7.1% | 4.9% | 14.8 | 1.61 |

| Johnson & Johnson | 2.7% | 4.4% | 7.1% | 5.0% | 2.7% | 26.7 | 1.31 |

(Sources: DK Research Terminal, FactSet, YCharts)

The days of people getting rich from JNJ are likely over. Doubling your money in risk and inflation-adjusted terms is likely to take a quarter century.

- JNJ can help you stay rich but won’t make you rich

In contrast, MDT represents a higher-yielding and much faster growing A-rated defensive aristocrat alternative.

For those seeking even higher yield, NVS offers almost 2X more yield than JNJ and solid market-matching long-term return potential.

- with an AA-credit rating and 97th percentile global long-term risk management

JNJ is one of the lowest volatility stocks on earth, but NVS and MDT aren’t far behind, thanks to supreme quality, fortress balance sheets, and exceptional long-term risk management.

I own all three, and am giving JNJ some time to get its growth outlook up. But for new money today I would go with MDT as my #1 pick because:

- it’s growth prospects are the most predictable (medical devices are easier to model than drug sales)

- it’s total return potential is by far the best

- its discount to fair value is highly attractive

- it could double in the next five years (3X better returns than JNJ)

Be the first to comment