Sundry Photography/iStock Editorial via Getty Images

We monitor dividend announcements for stocks in Dividend Radar, a spreadsheet we update and publish for free every Friday. The spreadsheet provides key data of stocks with dividend streaks of five years or more. The Dividend Radar spreadsheet separates stocks into categories based on the length of the streak: Champions (25+ years), Contenders (10- 24 years), and Challengers (5-9 years).

This past week, eight companies in Dividend Radar declared dividend increases, including one of the stocks I hold in my portfolio. There were no dividend cuts or suspensions announced for Dividend Radar stocks during this period.

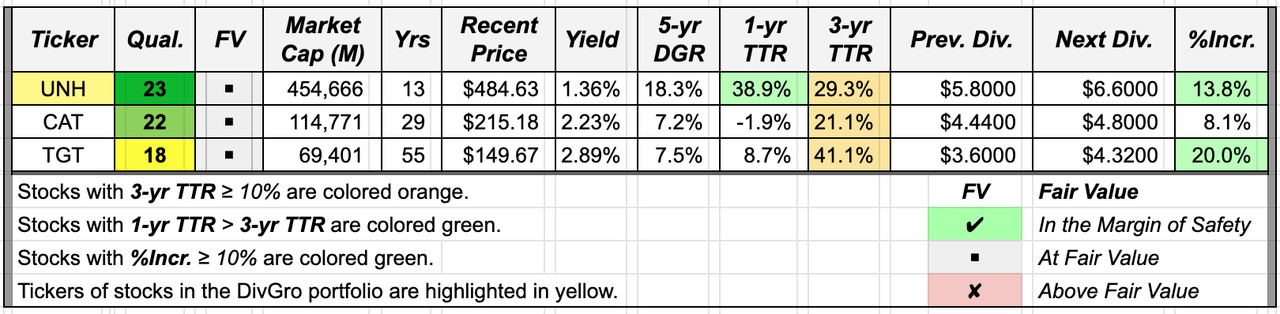

The following table presents a summary of the dividend increases. The table is sorted into sections for Champions, Contenders, and Challengers, and then by the percentage increase, (%Incr). Dividends are annualized and in US$, unless otherwise indicated. Yield is the new dividend yield for a recent price and Yrs are years of consecutive dividend increases.

The following dividend increase data are sorted alphabetically by ticker.

Company descriptions are the author’s summary of company descriptions sourced from Finviz.

BRT Apartments (BRT)

BRT is a real estate investment trust focused on the ownership, operation, and development of multifamily assets primarily in Sun Belt locations. Most of the company’s properties are located in the Southeast United States and Texas. BRT uses its expert real estate and investment experience to maximize risk-adjusted returns for its stockholders.

- On Jun 8, BRT declared a quarterly dividend of 25¢ per share.

- This is an increase of 8.70% from the prior dividend of 23¢.

- Payable Jul 8, to shareholders of record on Jun 30; ex-div: Jun 29.

Casey’s General Stores (CASY)

CASY operates convenience stores under the Casey’s and Casey’s General Store names. The company’s stores offer a selection of food; beverage and tobacco products; health and beauty aids; automotive products; and other nonfood items. Its stores also offer fuel for sale. CASY was founded in 1959 and is headquartered in Ankeny, Iowa.

- On Jun 7, CASY declared a quarterly dividend of 38¢ per share.

- This is an increase of 8.57% from the prior dividend of 35¢.

- Payable Aug 15, to shareholders of record on Aug 1; ex-div: Jul 29.

Caterpillar (CAT)

CAT was founded in 1925 and is headquartered in Deerfield, IL. The company manufactures construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. CAT provides technology for construction, transportation, mining, forestry, energy, logistics, electronics, financing, and electric power generation.

- On Jun 8, CAT declared a quarterly dividend of $1.20 per share.

- This is an increase of 8.11% from the prior dividend of $1.11.

- Payable Aug 19, to shareholders of record on Jul 20; ex-div: Jul 19.

Oil-Dri Corporation of America (ODC)

ODC develops, manufactures, and markets sorbent products in the United States and internationally. The company provides agricultural and horticultural products, animal health and nutrition products, bleaching clay and purification aid products, cat litter products, industrial and automotive sorbent products, and sports products. ODC was founded in 1941 and is based in Chicago, Illinois.

- On Jun 9, ODC declared a quarterly dividend of 28¢ per share.

- This is an increase of 3.70% from the prior dividend of 27¢.

- Payable Aug 26, to shareholders of record on Aug 12; ex-div: Aug 11.

Omega Flex (OFLX)

Incorporated in 1975 and based in Exton, Pennsylvania, OFLX manufactures and sells flexible metal hoses and accessories in North America and internationally. OFLX was formerly known as Tofle America, Inc. and changed its name to Omega Flex, Inc. in 1996. Omega Flex, Inc. was incorporated in 1975 and is based in Exton, Pennsylvania.

- On Jun 10, OFLX declared a quarterly dividend of 32¢ per share.

- This is an increase of 6.67% from the prior dividend of 30¢.

- Payable Jul 5, to shareholders of record on Jun 24; ex-div: Jun 23.

Target (TGT)

Founded in 1902 and headquartered in Minneapolis, Minnesota, TGT sells a range of general merchandise and discount food products in about 1,800 stores in the United States. The company offers everyday essentials and fashionable, differentiated merchandise at discount prices. TGT operates as a single business segment and has a fully integrated online business, Target.com.

- On Jun 9, TGT declared a quarterly dividend of $1.08 per share.

- This is an increase of 20.00% from the prior dividend of 90¢.

- Payable Sep 10, to shareholders of record on Aug 17; ex-div: Aug 16.

Universal Health Realty (UHT)

UHT is a real estate investment trust. The company invests in healthcare and human service-related facilities in the United States, including acute care hospitals, behavioral healthcare facilities, rehabilitation hospitals, sub-acute care facilities, surgery centers, childcare centers, and medical office buildings. UHT was founded in 1986 and is based in King of Prussia, Pennsylvania.

- On Jun 9, UHT declared a quarterly dividend of 71¢ per share.

- This is an increase of 0.71% from the prior dividend of 70.5¢.

- Payable Jun 30, to shareholders of record on Jun 20; ex-div: Jun 16.

UnitedHealth (UNH)

Founded in 1974 and based in Minnetonka, Minnesota, UNH is a diversified health and well-being company with core capabilities in clinical expertise, advanced technology, and data and health information. The company provides medical benefits to customers in the United States and in more than 125 other countries.

- On Jun 8, UNH declared a quarterly dividend of $1.65 per share.

- This is an increase of 13.79% from the prior dividend of $1.45.

- Payable Jun 28, to shareholders of record on Jun 20; ex-div: Jun 16.

Please note that we’re not recommending any of these stocks. Readers should do their own research on these companies before buying shares.

Dividend Cuts and Suspensions

Following requests from readers, we’ve added this section to our weekly article series. Please note that we’re only covering dividend cuts and suspensions announced by companies in Dividend Radar’s spreadsheet.

There were no dividend cuts or suspensions announced for stocks in Dividend Radar during this period.

An Interesting Candidate

In this section, we highlight one of the stocks that announced a dividend increase. We provide a quality assessment and present performance, earnings, and valuation charts.

Our objective is to identify high-quality dividend growth [DG] stocks trading at reasonable valuations. That’s a tough task, though, as high-quality DG stocks often trade at premium valuations. If we can’t find a worthy candidate, we’ll suggest a stock to add to your watchlist and a suitable target price.

To start, we use DVK Quality Snapshots to do a quick quality assessment, screening our list of DG stocks based on quality scores. Below is a shortlist of stocks with quality scores in the range 18-25:

Created by the authors from data in Dividend Radar

We’ve focused on all three stocks in this article series, but let’s revisit Dividend King, Dividend Aristocrat, and Dividend Champion, Target (TGT).

TGT yields 2.89% at $149.67 per share and has a 5-year dividend growth rate [DGR] of 7.5%.

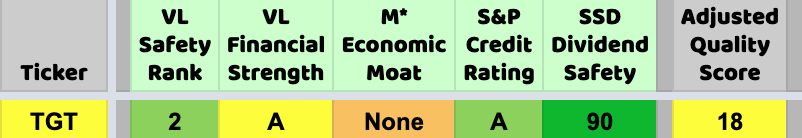

TGT is rated Decent (quality score: 15-18):

Created by the author from a personal spreadsheet

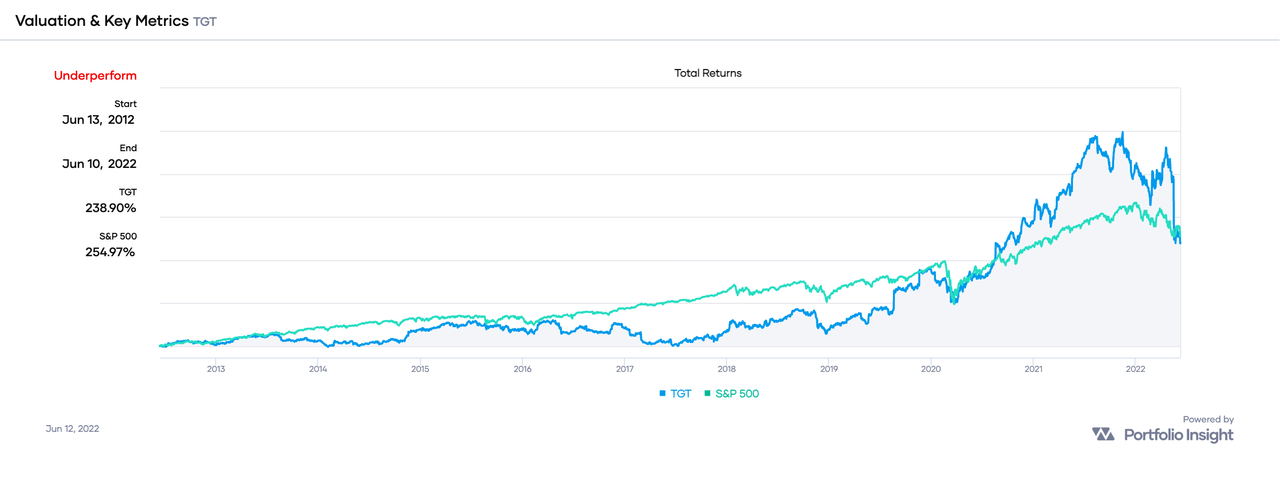

Over the past ten years, TGT underperformed the SPDR S&P 500 ETF (SPY), an ETF designed to track the 500 companies in the S&P 500 index:

Portfolio-Insight.com

Over this time frame, TGT delivered total returns of 239% versus SPY’s 255%, a margin of 0.94-to-1.

If we extend the period of comparison to the past twenty years, TGT essentially matched the performance of SPY, with total returns of 453% versus SPY’s 458%. That’s a margin of 0.99-to-1.

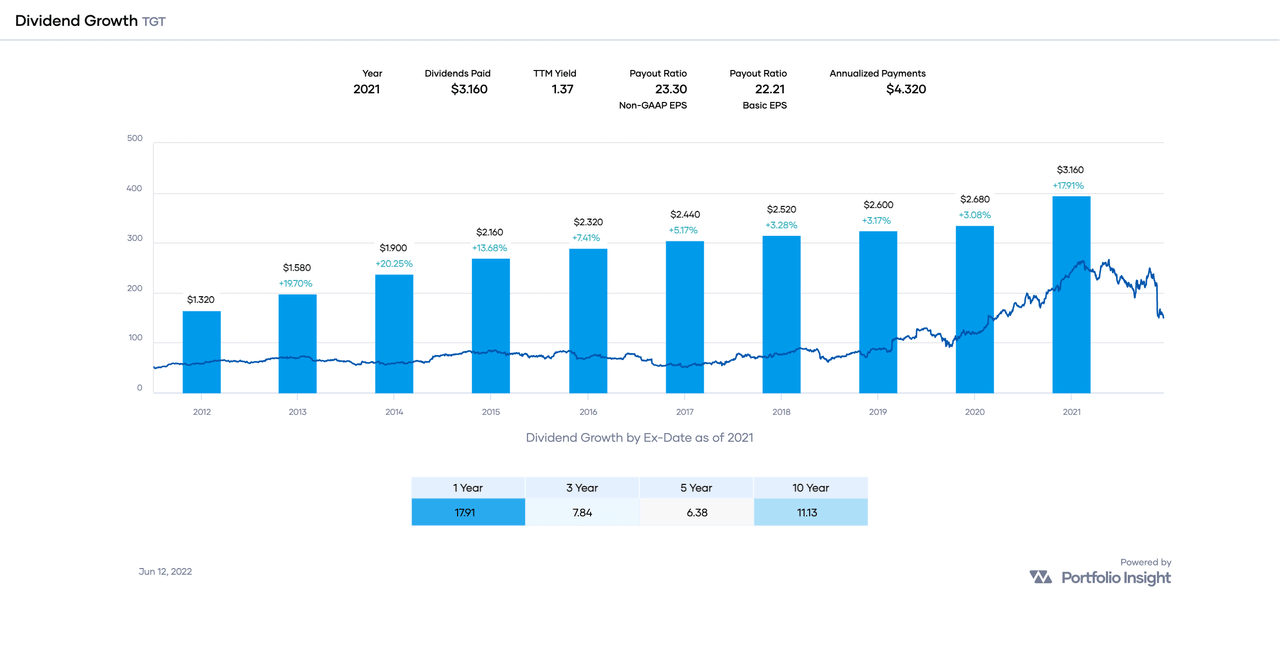

TGT has grown its dividend for 55 years, but here are the dividend payouts of the last decade:

Portfolio-Insight.com

For several years until 2020, TGT’s dividend growth rate [DGR] decelerated, though the increases have been quite generous (17.91% and now 20%)!

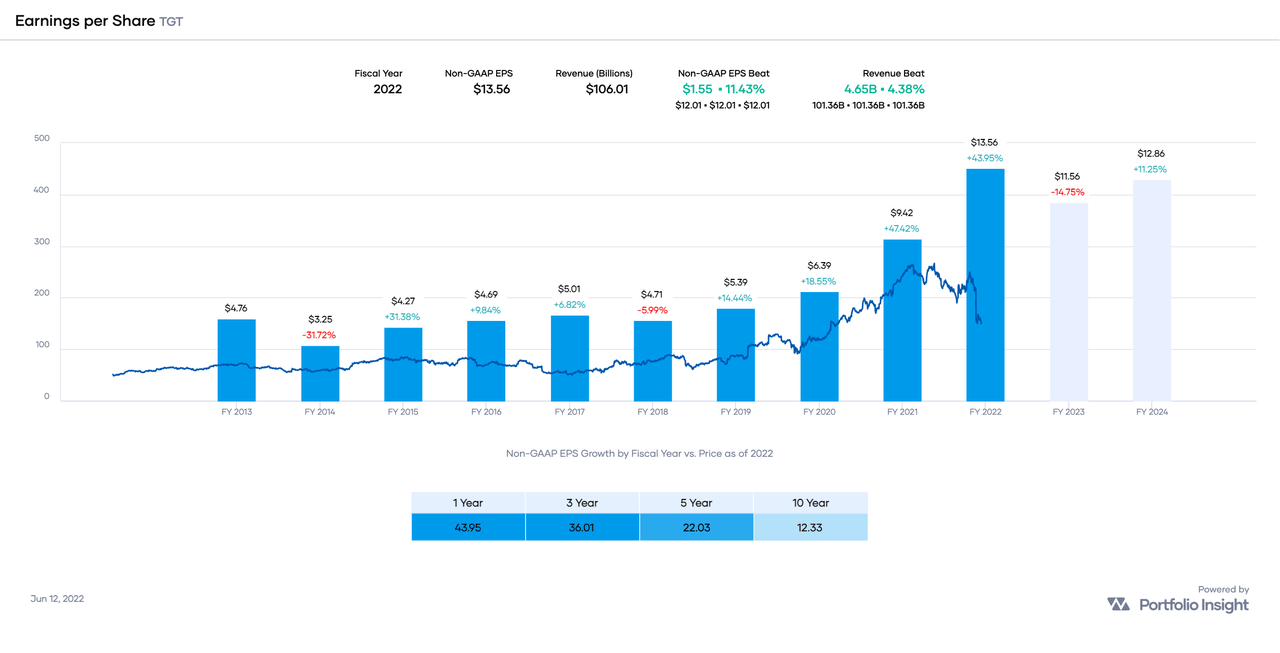

Looking at TGT’s earnings and how they are growing, perhaps the generous recent dividend increases are not so surprising:

Portfolio-Insight.com

While the earnings estimates for FY 2023 and FY 2024 do not match or exceed the FY 2022 earnings, nevertheless, TGT seems to be running on all cylinders!

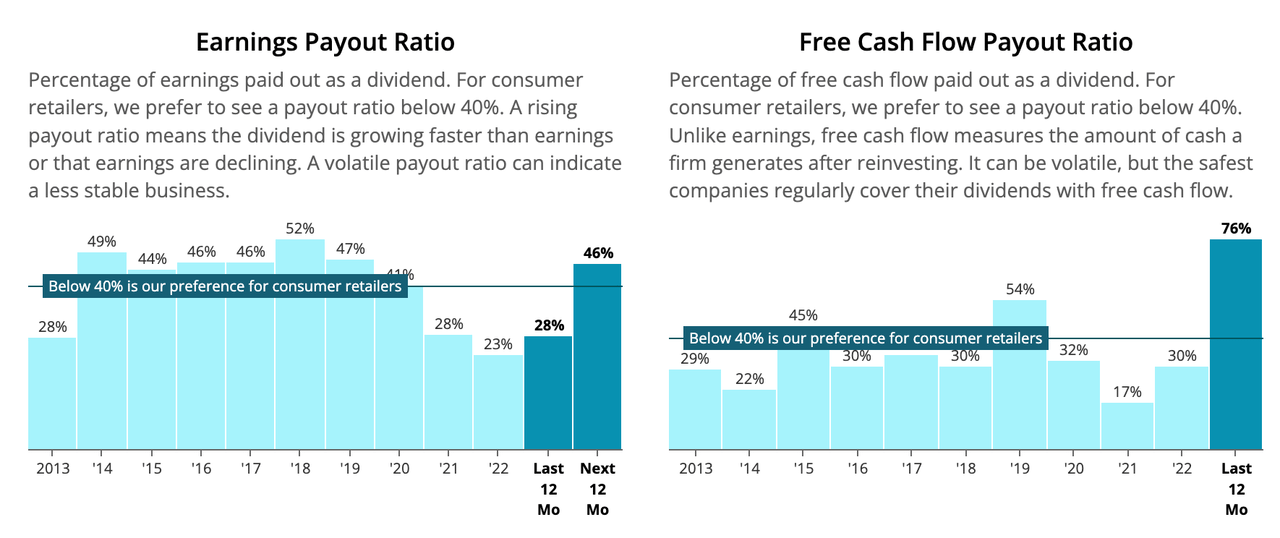

At 28%, TGT’s earnings payout ratio is “low for consumer retailers,” according to Simply Safe Dividends:

Simply Safe Dividends

TGT has plenty of room to continue paying and growing its dividend. Simply Safe Dividends considers TGT’s dividend Very Safe, with a Dividend Safety Score of 90.

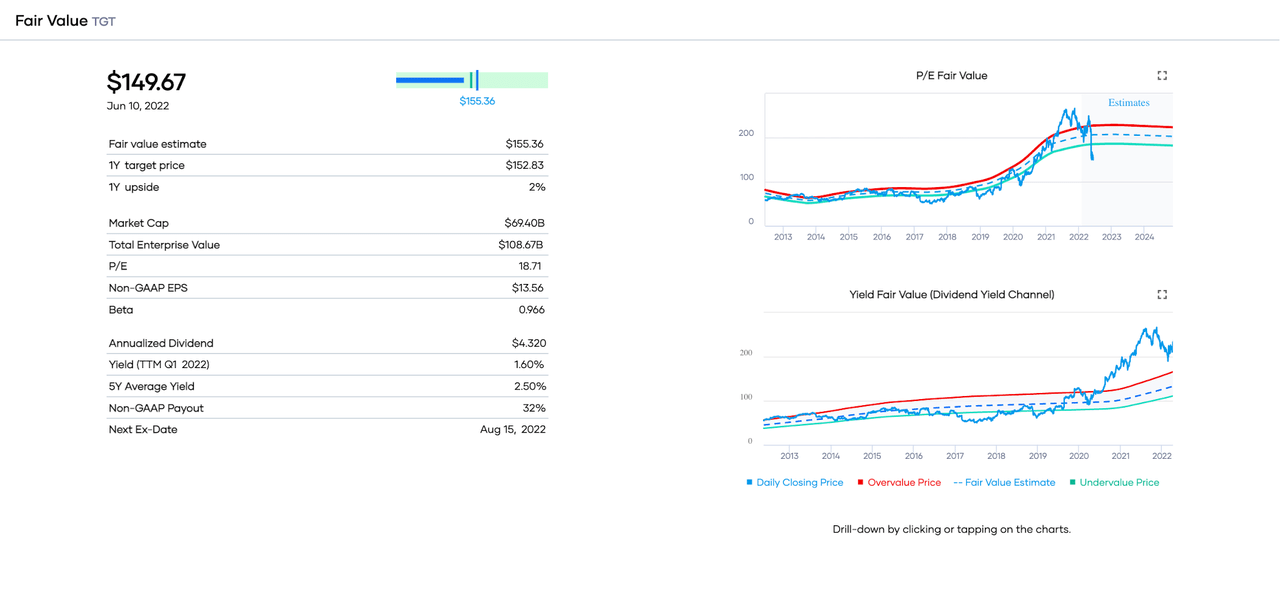

Next, let’s now consider TGT’s valuation.

We could estimate fair value by dividing the stock’s annualized dividend ($4.32) by its 5-year average yield (2.50%). This results in a fair value [FV] estimate of $173. Given TGT’s current price of $149.67, the stock is trading at a discounted valuation relative to its past dividend yield history.

For reference, CFRA’s FV is $152, Portfolio Insight’s FV is $155, Morningstar’s FV is $171, and Finbox.com’s FV is $209.The average of these fair value estimates is $172, also indicating that TGT may be trading at a discounted valuation.

My own FV estimate of TGT is $170, so I believe the stock is trading at a discount of about 12%.

Here are the most recent Seeking Alpha articles covering TGT:

- Hold: Target: Too Much Inventory, Stay On The Sidelines, by Albert Lin, CFA

- Hold: Why Did Target Stock Crash In May; Is It A Buy Now?, by The Value Pendulum

- Hold: Why Did Target Stock Drop And Where Is It Headed?, by Chuck Walston

Conclusion

TGT is a quality DG stock rated Decent. For stocks rated Decent, I require a 10% discount to my fair value estimate. Therefore, my Buy Below price is $153.

Please note that I’m not recommending TGT or any of the stocks listed in this article. Readers should do their own research on these companies before buying shares.

Thanks for reading, and happy investing!

Be the first to comment