lucky-photographer

Introduction

I own three companies operating in the financial sector. One of them is a regional bank: Huntington Bancshares (HBAN). The other two are part of the financial data & stock exchanges industry: CME Group (CME) and Nasdaq Inc. (NASDAQ:NDAQ). I added Nasdaq to my dividend growth portfolio because it does two things for me. It gives me “technology” exposure, and it is a great dividend growth stock, unlike a lot of companies that people consider to be “tech” stocks.

The company just reported earnings, which came in higher than expected. The business transition away from a traditional transaction-focused company towards an asset-light technology company is going great, and I have little doubt that Nasdaq will continue to outperform both the Nasdaq Index and its industry peers.

In this article, we’re going to discuss all of that and more.

So, let’s get to it!

4 Becomes 3

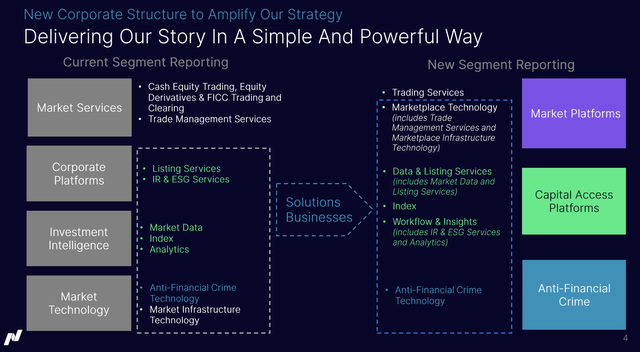

If you’re modeling Nasdaq, it’s time to adjust your models. Starting in the fourth quarter, the company will reduce its complexity as it moves to three reporting segments.

Nasdaq Inc.

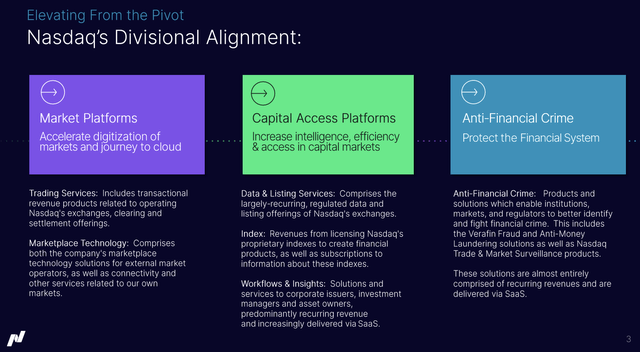

Market platforms will include Nasdaq’s North American and European market services as well as its market infrastructure business. This division will also include its digital assets and carbon market business.

Market platforms will focus on maximizing the liquidity of the capital markets through Nasdaq’s role as a market operator and as a provider of market ecosystems to its technology clients.

According to Nasdaq CEO Adena Friedman:

Nasdaq today serves as a powerful capital markets platform. We are a leading force in the modernization of marketplaces through our world-class technology, including the progress we’re making as we migrate our own markets to our next-gen exchange platform in an edge cloud environment. We are also actively deploying our next-gen market platform to our market technology clients. And through our new structure, we see an opportunity for us to drive a broader strategy as one integrated unit.

This is what was revealed earlier this month, with regard to its push for more crypto exposure:

Nasdaq Inc. will likely wait until there is greater regulatory clarity and institutional adoption around crypto exchanges before debuting plans to launch one of its own, says Tal Cohen, the company’s executive vice president and head of North American markets.

“Those are discussions we are happy to have,” Cohen told Bloomberg TV on Tuesday. “But right now, on the retail side, the market is fairly saturated,” he added. “There’s a number of exchanges servicing the retail customer base.”

Capital Access platforms will combine Nasdaq’s corporate platforms and investment intelligence business.

Anti-financial crime will include Verafin, Nasdaq’s fraud detection, and anti-money laundering solution, as well as its market and trade surveillance business.

This segment is emerging as one of the most exciting segments as it aims to benefit from a new trend of increasing challenges in detecting and preventing financial crime. Nasdaq now offers a world-class platform with holistic solutions and the capabilities to support financial institutions.

Verafin signed 54 new clients in the third quarter. That’s up from 37 in the second quarter.

Nasdaq Inc.

With that in mind, let’s dive into the company’s 3Q22 performance.

What Happened In 3Q22?

In its third quarter, the company behind the NDAQ ticker generated total revenues of $890 million. This is $5.9 million higher than expected and an improvement of 6.2% compared to the prior-year quarter.

Non-GAAP EPS came in at $0.68. That’s $0.03 better than expected.

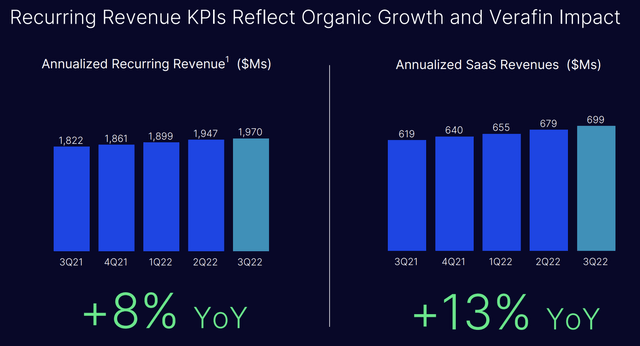

What’s interesting is that organic sales growth was much stronger. Organic revenue growth was 9%, adjusted for acquisitions and divestitures. Total annualized recurring revenue (“ARR”) improved by 8% to $1.97 billion.

Annualized SaaS (software as a service) revenues came in at $699 million, growing at a faster rate of 13%. Nasdaq is excited that recurring growth is outperforming as the company aims to move towards SaaS and ARR-related services.

Nasdaq Inc.

Market technology revenues increased by $18 million, or 16%. $7 million of this increase came from the deferred revenue write-down on Verafin in the prior-year period.

Organic growth in this segment was 18%, driven by strong anti-financial crime and market infrastructure technologies. The market infrastructure technology business grew 6% compared to the prior-year period with 8% organic growth, excluding forex.

According to the company:

ARR for market technology totaled $456 million, an increase of 7% compared to the prior year period. The Market Technology segment operating margin was 15% in the period and increased 6 percentage points compared to the prior year period. Investment Intelligence revenue increased $12 million or 4%, reflecting organic revenue growth of $16 million or 6%.

AUM and exchange-traded products linked to Nasdaq indexes totaled $311 billion, a decline of 14% from 3Q21, which is a result of market troubles. However, ARR totaled $583 million, an increase of 5% compared to the same quarter.

Corporate platforms revenues improved by 8%, including 11% organic growth. This segment benefited from higher US listing service revenues and higher adoption of investor relations, ESG, and advisory and reporting offerings. ARR in this segment was $589 million, an 11% improvement.

Market Services net revenues increased by 4%. The organic revenue increase was $24 million or 8%, including an $11 million negative impact from changes in FX rates. The organic increase reflects growth across trade management services, U.S. cash equity, equity derivatives, and fixed rates.

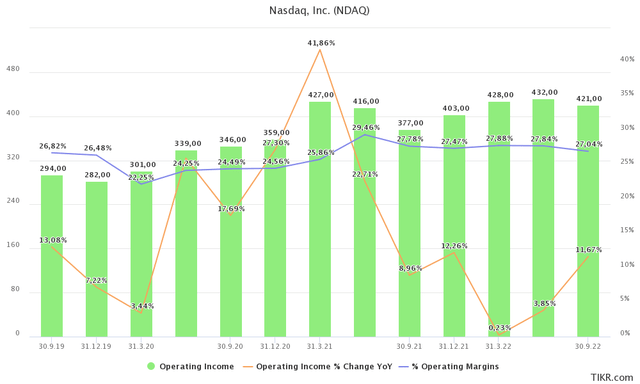

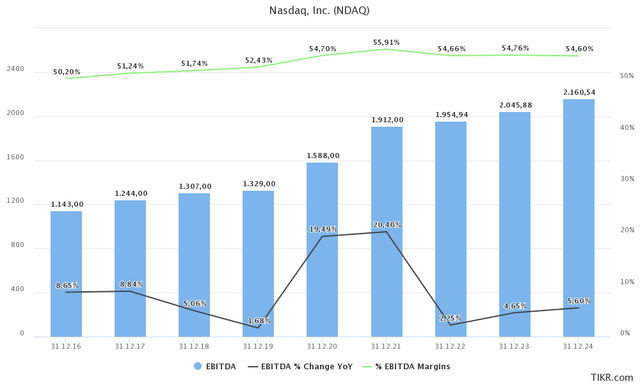

At this point, it is important to take a step back as I just bombed you with a lot of numbers. Essentially, what we are dealing with here is a company that continues to improve its business despite economic headwinds. Total operating income in 3Q22 improved by 11.8%, one of the best growth rates in recent years. It’s up from almost zero growth earlier this year when the company was up against tough comparison quarters. However, the company continues to manage costs very well, resulting in steady margins.

TIKR.com

On top of that, SaaS revenues continue to improve, rising to 35% of ARR. Company listings are healthy, and new business endeavors like ESG and financial crime protection are doing better than I expected.

The same goes for analytics, which is turning the company into more than a traditional exchange company. It’s one of the reasons I bought the company. So far, I have not been disappointed.

Nasdaq Stock Performance & Valuation

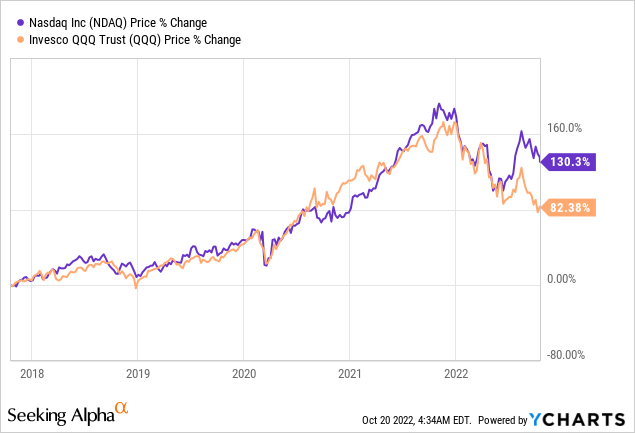

The beauty of Nasdaq is that it combines quality and growth. Over the past five years, the stock has risen by 130%, outperforming the tech-heavy ETF (QQQ) by almost 50 points. Year-to-date, the stock is down 20%. QQQ is down 32%. Yet, even between 2018 and the stock market peak of 2021, NDAQ was able to keep up with QQQ. On a long-term basis, “nothing” beats owning companies that do well in bull markets and outperform their benchmarks during downturns.

Going forward, EBITDA growth is expected to gradually improve after two stellar years in 2020 and 2021, caused by the QE-fueled tech boom. EBITDA margins are expected to remain close to 55%.

TIKR.com

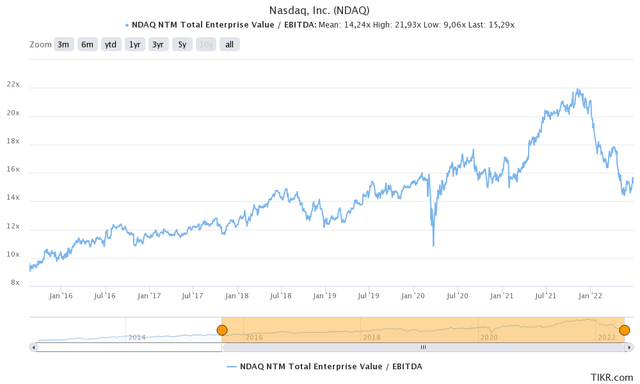

With that said, investors are currently paying 15.8x 2023E EBITDA of $2.1 billion. That is based on the company’s $32.3 billion enterprise value, consisting of its $27.5 billion market cap and $4.8 billion in 2023E net debt.

As I said in my prior article (back in August, the multiple was 16.7x):

I believe this valuation is fair, but it’s not great for new (large) entries. I think new investors should start small and add on weakness whenever it occurs, or wait for weakness and start a larger position.

TIKR.com

While I remain very bullish on a long-term basis, I am more comfortable adding more NDAQ shares at a valuation closer to 13-14x EBITDA.

Economic conditions remain challenging, especially for “growth” stocks. While NDAQ is a growth/value hybrid with an implied free cash flow yield of 5.2%, it is prone to weakness in that sector.

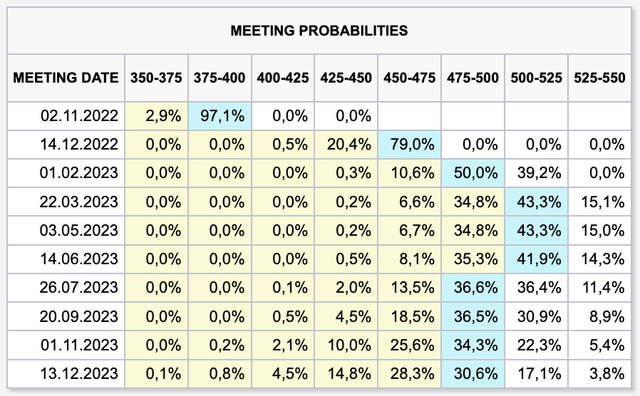

The Fed is now expected to hike rates to at least 500 basis points, which is not expected to change unless the economy runs into some serious trouble. At that point, the Fed will have to prioritize financial stability over fighting inflation (more details in this article).

CME Group

My personal opinion – as an NDAQ shareholder – is that I would be more comfortable adding a significant amount of shares at a 13-14x EBITDA valuation.

Now, regardless of whether you agree with me or not on the valuation, I recommend people start small when buying. Add gradually over time. This makes sense in times of high economic uncertainty. If stocks continue to drop, investors can average down. If stocks suddenly take off, buyers have a foot in the door.

Takeaway

NDAQ’s earnings were good, but not spectacular. If anything, they confirmed that the company is on track to transform its business into a more diverse tech-focused financial services provider. The company is seeing strong organic growth and improvements in recurring revenues. It is also restructuring its business segments to better utilize its new “niches” like financial crime.

The company is growing quite significantly in these areas, which I expect to last for many years to come. On top of that, the business is managing expenses quite efficiently, maintaining strong margins in times of high inflation and slowing economic growth.

Moreover, the company is outperforming the stock market by a rather wide margin this year, which I believe is a sign of high quality.

Unfortunately, the company hasn’t reached a point where I would be comfortable buying more shares. However, I believe that we will get to a more favorable point due to economic uncertainties and the fact that the Fed will soon be backed into a corner.

Long story short, if you’re looking for exposure in “tech” or finance, I think NDAQ is a terrific stock to own on a long-term basis.

However, due to the aforementioned macro challenges, I remain “neutral” for the time being.

(Dis)agree? Let me know in the comments!

Be the first to comment