Editor’s note: Seeking Alpha is proud to welcome Aidan Schaper as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

stevelenzphoto/iStock via Getty Images

With predictable businesses that are essential to the economy, utilities provide a level of stability that investors cannot find elsewhere. This same stability attracts the attention of retirees and dividend investors alike.

One stock that I have been watching in the utility sector is Idacorp (NYSE:IDA), an Idaho based utility with a customer base of over 600,000. There are several unique aspects to this company that some other utilities simply don’t have. However, its valuation is steep, and in my opinion, Idacorp is just a hold at its current price.

Understanding Idacorp

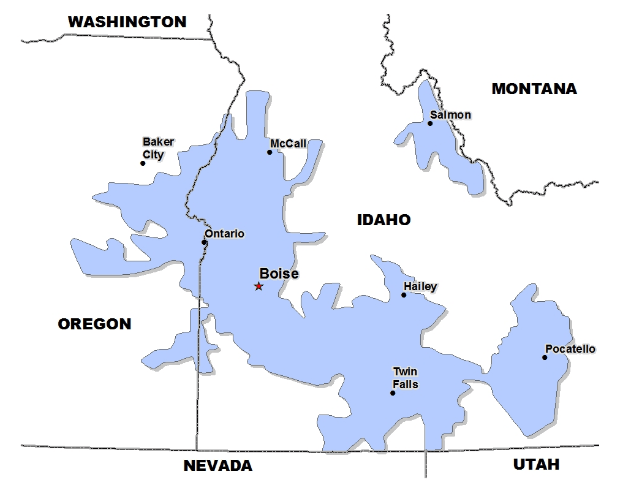

Idacorp is an electric utility that provides power to all of Idaho’s major population centers through its subsidiary, Idaho Power. The company also provides power to some of eastern Oregon. Being an electric only utility is something that might please some investors who feel electric utilities have brighter futures than natural gas utilities. The electrification trend emerging today is causing many consumers to heat their homes with electricity instead of natural gas.

Idacorp Website

The utility services an area of the country whose population is growing rapidly. From 2010 to 2021 Idaho’s population grew by 17.3% making it the fastest growing state in the nation. This trend is projected to continue into the future as low taxes and a growing technology sector draw middle class workers to the state.

More customers means more revenue for Idacorp, but it also densifies the utilities service territory. Let me give you an example. Imagine there are 20 houses on a one mile stretch of road. But then, a developer builds 5 new houses on an empty lot along the road. As a result the utility now has 5 new customers on that road without having to build any new electric poles. So the utility makes more money off of their existing assets.

Besides customer growth, Idacorp is also investing in a number of larger projects. One such project that Idacorp has been investing in is solar micro-grids for specific customers. Recently they built a 40-MW solar micro-grid for Micron Technologies (MU), who is headquartered in Boise, Idaho. Since a lot of big companies have operations in Idaho, this is a lucrative source of future revenue for Idacorp. It also ensures that other micro-grid builders, such as Clearway Energy (CWEN), do not try to poach Idacorp’s large customers. These projects help companies meet their sustainability targets and help Idacorp add more clean energy assets.

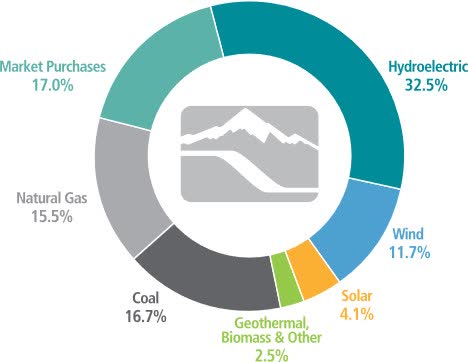

Utilities and governments across the globe are investing billions of dollars into cleaner forms of energy. In the United States alone about 20% of all electricity is being generated through hydroelectric, wind, solar and biomass energy. But Idacorp is well ahead of the national average with 50.8% of its electricity being generated by hydroelectric, wind, solar and biomass. And since Idacorp’s percentage of cleaner energy is already so high, that means the company will have to commit less money to renewable energy projects in the future.

Idacorp Website

What makes Idacorp a unique utility is that hydroelectric power accounts for 32.5% of the utility’s electricity. This is a good thing because hydroelectricity assets are long lived and cheaper to operate than other forms of energy generation. Solar panels, for example, have a life of around 25 years before they need to be replaced. But a hydroelectric dam can last for anywhere from 50-100 years depending on the design and maintenance. The inexpensive hydropower these dams produce allows Idacorp to charge customers some of the cheapest electric rates in the United States.

| Company | Monthly Residential Cost For 1,000 kWh |

| Florida Power & Light | $103 |

| Idaho Power (Idacorp) | $107 |

| Black Hills Power | $138 |

| Consolidated Edison | $247 |

| Southern California Edison | $323 |

These low rates have helped attract some customers that have a high demand for cheap electricity. A great example of this is Meta (FB), who is building a new 960,000 sq. ft. data center located in Kuna, Idaho. Data storage is an energy intensive business that consumes around 2% of all the electricity in the United States, so new customers like this can be a lucrative source of revenue for Idacorp.

Idacorp’s Real Estate Division

One of Idacorp’s subsidiaries, Idacorp Financial, is an owner of affordable housing projects and other real estate investments. These real estate investments are primarily for tax credit purposes. According to page 20 of their 2021 Annual Report, these investments generated tax credits of $6.2 Million in 2021.

A utility owning a non-utility business is actually more common than some might think. To give a few examples, Otter Tail Corporation (OTTR) has a custom plastic and metal fabrication business. Hawaiian Electric Industries (HE) owns a bank and Portland General Electric Company (POR) has an energy trading business. These are all businesses that the utilities have acquired over the years for various reasons.

Some investors like to avoid utilities that operate non-utility businesses because they take away from the simplicity of owning a utility. These non utility businesses are often more vulnerable to economic downturns as well. I don’t see this real estate segment of Idacorp as necessarily a good or a bad thing. But it is something investors should be mindful of when investing in the company.

Idacorp’s Balance Sheet

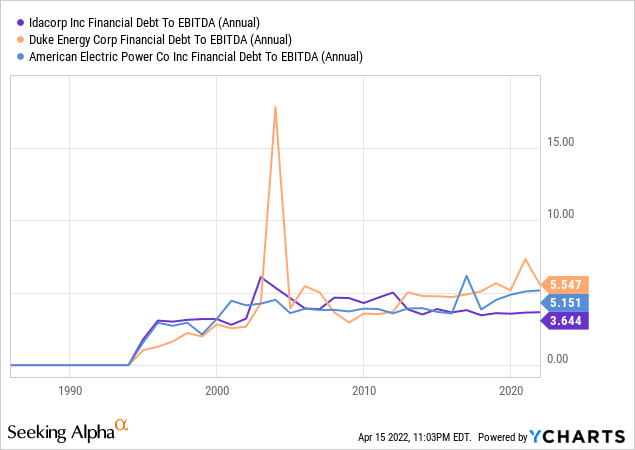

When investing in any company, inspecting the balance sheet is a must. To determine the health of Idacorp’s balance sheet, I first looked at their net debt to EBITDA ratio to determine if the company was in a significant amount of debt.

As of December 31, 2021 Idacorp had net debt of $1.785 billion. If we divide their net debt by the company’s $493.8 million in EBITDA we get a ratio of 3.6. This is an extremely low net debt to EBITDA ratio for a utility company. Duke Energy (DUK) for example, has a net debt to EBITDA of 5.5 and American Electric Power (AEP) has a net debt to EBITDA of 5.1. This low net debt to EBITDA ratio indicates that management has been conservative with the company’s finances.

YCharts

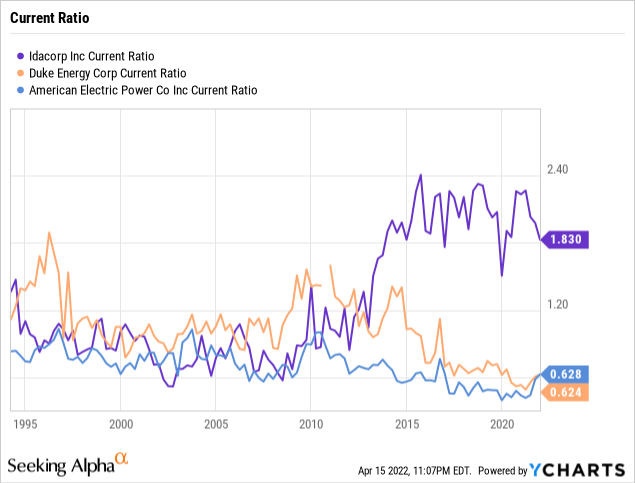

Next I looked at Idacorp’s current ratio. The current ratio is a great way to measure the company’s ability to pay off short term expenses. I look for a current ratio above 1, as this signifies that the company has enough short term assets on its books to cover short-term expenses. A current ratio below 1 shows that a company is paying off short-term expenses by taking out debt.

If we take Idacorp’s December 31, 2021 current assets of $595 million and divide it by current liabilities of $325 million, we get the company’s current ratio of 1.83. This current ratio is well above 1, which means that the company does not need to take out debt to cover its current expenses. If we look at Idacorp’s history we see that the company does a good job at keeping its current ratio above 1.

ycharts

The low level of debt and the ability to pay off its short-term expenses gives Idacorp one of the most robust balance sheets in the utility industry. This gives me confidence that the company will have no problem paying its debts in the future.

Risks

Idacorp’s reliance on hydropower is a double-edged sword. It generates cheap electricity for them, but it also makes them vulnerable to drought. Since Idaho is currently in a severe drought, this adds an element of risk to the company. If their hydroelectric plants become less efficient, Idacorp may have to purchase more power from the market. Purchasing more power from the market might eat into their earnings in the future.

But far more concerning is the fact that this drought increases the risks of wildfires. If one of the company’s power lines were to start a devastating forest fire, it could result in litigation. In 2018 for example, a forest fire caused by PG&E Corporation (PCG) killed 84 people, resulting in the company declaring bankruptcy after a $13.5 billion settlement. The chances of a similar situation happening with Idacorp are rare, but could result in massive destruction of shareholder value if it does happen.

Shareholder value can also be destroyed by regulatory uncertainty. Since utilities need permission from the government to raise rates, this is a risk that is hard to avoid. Relying on the government to do something does not always work out as planned. Idaho has been reasonable with giving the utility rate increases in the past, but there is no guarantee that they will be reasonable going forwards.

Idacorp Valuation

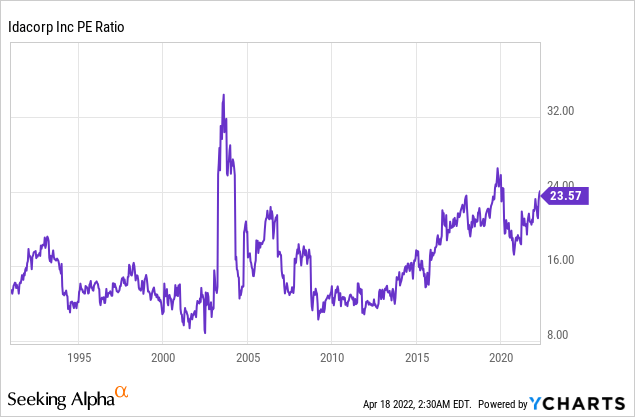

It is always important to not overpay for a stock. Overpaying for a stock might result in the stock underperforming in the short run. When evaluating a utility stock I use the price-to-earnings growth (PEG) ratio to determine the valuation. Because the earnings growth of utilities is more predictable than the earnings growth of other companies, the PEG ratio is often more efficient than a simple price-to-earnings (PE) ratio. To calculate Idacorp’s PEG ratio, we first take the company’s PE ratio of 23.5 and divide it by the expected earnings per share growth, which is 6%. This gives us a PEG ratio of 3.91. Here is how the company’s PEG ratio compares to some of its peers:

| Company | PEG Ratio |

| Idacorp | 3.91 |

| Nextera Energy | 3.22 |

| Duke Energy | 3.39 |

| American Electric Power | 3.54 |

| DTE Energy | 3.55 |

As we can see, Idacorp is valued higher than its peers. This is a sign that Idacorp is potentially overvalued. To confirm our suspicions, we can take a look at the company’s historical PE ratio.

In 2016, Idacorp traded at only a 16x PE ratio. But Idacorp’s PE ratio has trended upwards over the last 6 years and now sits at around 23.5 x. A PE ratio this high is expensive for a company that is projected to grow earnings at only 6% annually. Idacorp trading at a historically high multiple is a clear sign of overvaluation, in my view.

YCharts

Given this overvaluation, I believe Idacorp is just not an attractive investment right now. The good news though is that there is a near-term catalyst that may cause the stock to dip in the coming months.

As I mentioned earlier, Idacorp is operating in an area that is in a significant drought. This means that when summer comes, the chances of a wildfire will rise. Investors are aware of this wildfire threat, so we may see Idacorp trend downwards in the coming summer months. I am willing to accept the risk of a wildfire because the odds of a catastrophic one happening are rare. So there is a chance that, come summer, we may see a chance to buy Idacorp at a lower valuation.

Dividend

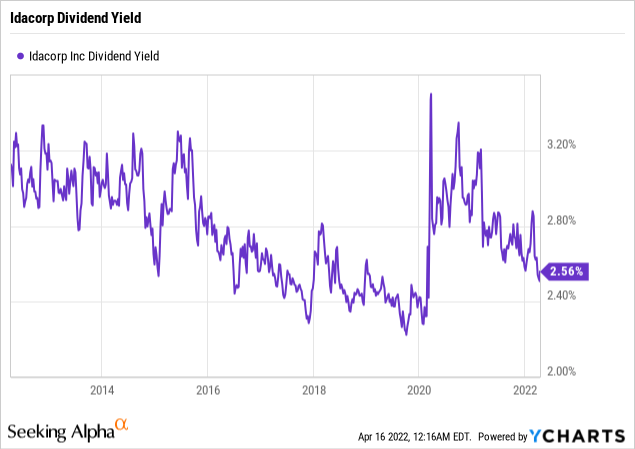

Utility companies often take out debt and issue equity to cover expenses, and use money directly from their operating cash flow to pay dividends to shareholders. This allows them to normally pay higher dividends than the market average. And with a current dividend yield of 2.56%, Idacorp almost doubles the market average of 1.33%.

ycharts

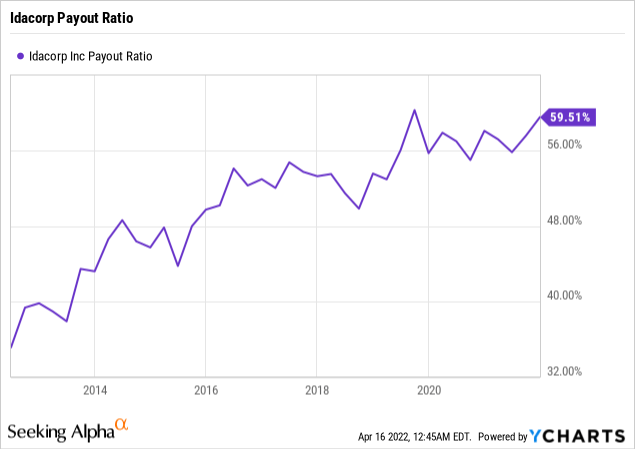

But with a 2.63% dividend yield comes a rising payout ratio. Idacorp’s payout ratio has been steadily rising since 2012 and now sits at around 60%. This rising payout ratio might slow dividend growth in the future, so I would prefer to see a higher dividend yield to compensate for the potential slowdown in dividend growth. Given the near-term wildfire threat and the rising payout ratio, I think it is reasonable for investors to wait for a higher dividend yield before purchasing the stock.

ycharts

Conclusion

Idacorp is a strong utility company in a growing area of the country. The company has a bulletproof balance sheet and a high amount of renewables in its generation portfolio. But with such a high valuation, I believe it is just a hold at its current price. The company has a few risks that may drive the stock price down in the summer months. But for now, I will wait on the sidelines for a lower valuation to offer a better buying opportunity.

Be the first to comment