Joe Raedle/Getty Images News

While long term investors should’ve wanted the Frontier Group Holdings’ (ULCC) buyout of Spirit Airlines (NYSE:SAVE), those investors must now analyze the JetBlue Airways (JBLU) deal. The agreed upon purchase price provides substantial upside to the stock while holding Spirit Airlines offers downside protection on a deal failure. My investment thesis remains ultra Bullish on the stock, though disappointed shareholders didn’t approve the merger with Frontier.

Big Deal Upside

JetBlue agreed to acquire Spirit for $33.50 per share in cash at a value of ~$3.8 billion, including a prepayment of $2.50 per share in cash payable upon Spirit stockholders’ approval of the transaction. In addition, the deal offers a ticking fee of $0.10 per month starting in January 2023 through closing,

Spirit is trading at $22.50 now offering shareholders an incredible $10 upside on deal closure, a 44% gain. The big catch is whether the deal actually gets approved by regulators.

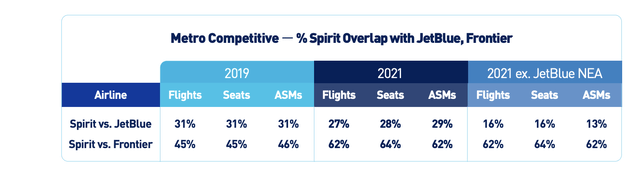

The JetBlue management is comfortable the deal will close, but the market doesn’t agree with this massive discount. The airline suggests the overlap on nonstop routes is only 11%, but JetBlue has a nearly 30% overlap with Spirit Airlines on flights and ASMs.

Source: JetBlue regulatory presentation

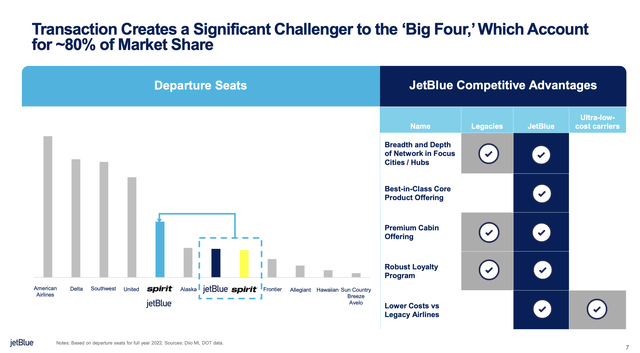

The airline has a plan to divest Spirit assets in NYC and Boston along with growth plans in Fort Lauderdale. JetBlue makes strong points that the combined airline is only 9% of the market share for departure seats in 2022 with 2019 revenues of $11.9 billion.

Source: JetBlue merger presentation

The airline is far smaller than the $45+ billion revenue totals of the legacy airlines. American Airlines (AAL) is forecast to generate 2023 revenues of $53.7 billion while the combined JetBlue is projected to grow revenues to $15.8 billion, as Spirit Airways continues to soar beyond 2019 levels.

Either way, the new JetBlue would be a fraction of the market. The airline has to convince regulators that the removal of an independent ULCC won’t impact the low fares offered to consumers.

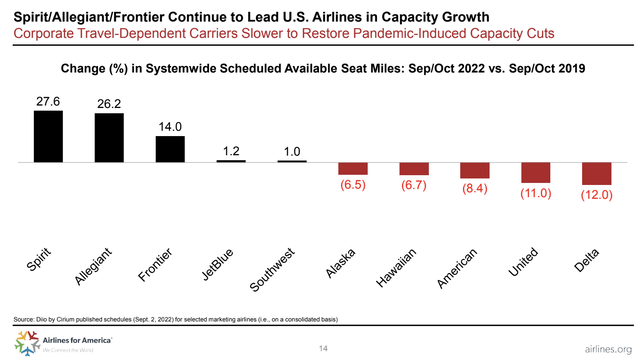

Spirit Airlines has been the aggressive leader in growing capacity while the legacy airlines are still mostly operating at 10% below 2019 capacity levels. Spirit has grown capacity 28% since October 2019, followed by Allegiant Travel (ALGT) at 26% and JetBlue down at 1%.

The biggest fear for regulators is that the combined airline becomes more conservative on capacity expansion with a very large revenue base topping $15 billion and a fleet of 458 aircraft. In the overlap markets, naturally a new airline would have to acquire Spirit assets and aggressively compete on those routes with the new JetBlue to maintain the current fare structures.

Standalone Spirit Is Just Fine

On shareholder approval, Spirit shareholders will obtain a unique cash prepayment of $2.50 per share. The risk to shareholders is the disruption from the deal lingering until 2024 and never obtaining regulatory approval. Some analysts place the regulatory approval at below 50%.

Shareholders will start obtaining the $0.10 ticking fee monthly once approval isn’t obtained by January. The problem is where the stock goes on a regulatory hiccup, though a combined $470 million breakup payment to Spirit and shareholders on a deal blocked due to antitrust groups would be a huge boost for the stock and shareholders.

Shareholders will obtain the $2.50+ cash payment upfront. Spirit could trade lower with any deal cancellation, though Frontier might come calling again on such an occurrence. Shareholders might actually approve the deal no longer having a cash offer from JetBlue on the table.

Based on the United Airlines (UAL) guide up for Q3’22, investors should see the current analyst EPS targets as very solid, if not low. Analysts currently have a 2024 EPS target of $2.23.

Such an EPS target amounts to pretax margins of 4% in 2024. Based on United Airlines target for a 9% pretax margin next year, the analyst community appears far off base with EPS targets on Spirit Airlines.

With 111 million diluted shares, the airline would produce only $250 million in net income to achieve such an EPS target. Revenues are set to approach $6.8 billion in 2024, so similar margins to United Airlines would provide $612 million in pretax profit with nearly $490 million in net income based on a 21% effective tax rate listed for Q3’22.

The numbers continue to support the potential upside from holding onto the stock or merging in a share deal with Frontier, but the only option on the table now is approving the JetBlue deal for 44% upside.

Takeaway

The key investor takeaway is that shareholders should hold onto the stock for either the cash upside from closing the JetBlue deal or general strength in the stock from improving operations in the airline sector. Based on recent sector data, airlines stocks like Spirit Airlines are far too cheap.

Be the first to comment