fstop123/E+ via Getty Images

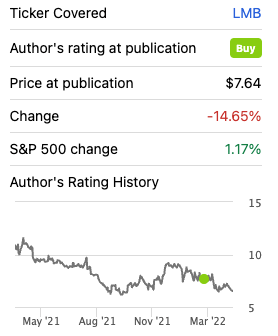

Since my last article, Limbach Holdings (NASDAQ:LMB) stock is down almost 15%. In this article I will go over the 2021 results, the outlook for LMB and an update on valuation.

Seeking Alpha

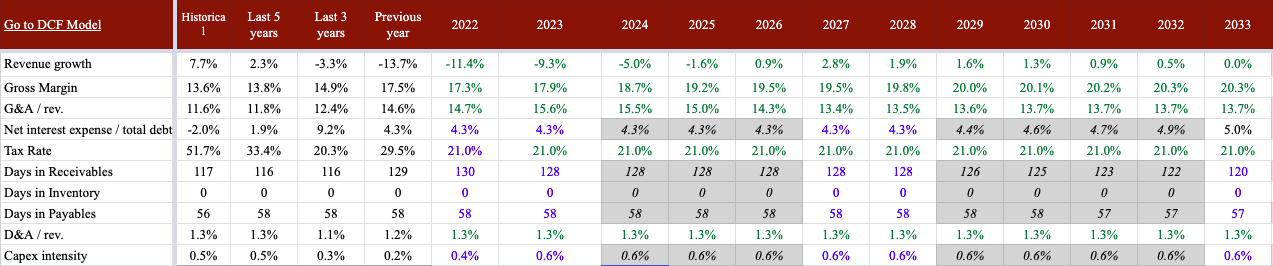

2021 results – revenue in line with expectation but gross margin better than expected

Earnings were released on March 16. As expected, revenues decreased by 13.7%. As LMB continued to focus on smaller and more profitable GCR projects, GCR revenues declined 20.6% to 350.1M USD. What is interesting is that while revenues declined by 90M USD, gross profit stayed constant at 45M USD. As a consequence, gross margin improved from 10.2% to 13.0%.

ODR revenues increased 10.3% to 140.3M USD. The gross margin of this segment was 28.9%, higher than the higher bound of management’s long-term expectation of 25% to 28%. As a result of better margins in both segments and an improvement in the mix, gross margin improved from 14.3% to 17.5%.

However, the improvement in gross margin was fully offset by higher SG&A expenses. The increase was due to professional fees related to the recent acquisition and costs of normal business that were not incurred in 2020 due to the pandemic.

Also on the good side, interest expenses were lowered from 8.6M USD to 2.6M USD driven by the refinancing of debt at a lower interest rate.

The ODR segment can be a hedge to the supply chain issues

Experts expect the supply chain issues to continue in 2022 and even into 2023. Some of the issues are not so easily fixed and need time such as the chip shortage. While all the large players such as Intel (INTC) have announced building new plants, these won’t be ready anytime soon. However, LMB may benefit from this supply shortage or at least mitigate its impact. The shortage of new equipment is leading customers to squeeze the most of their current assets. Extending the life of equipment entails more frequent maintenance – one of the ODR services. But also running older equipment for longer than recommended causes it to break down more frequently leading to more emergency repairs – another ODR service. During the earnings call, Mike McCann elaborated on this.

One interesting benefit we’ve realized from the supply chain issues is that our time and material services have experienced a 44% increase year-over-year. That trend seems to be continuing to Q1 of 2022.

Because new equipment isn’t immediately available, owners are investing in their existing older equipment, but that’s not always a long-term solution. Old equipment ultimately fails and that supports emergency repair and unplanned work. 2021 was our best year yet for preventative maintenance contract sales. We added sales resources after backing off investments in 2020. These resources tend to take a year to produce, and we are now seeing those investments pay off.

Outlook improvement thanks to management delivering on their promises

Note that revenue will continue to shrink until 2025 at which point the size of the ODR segment will contribute to net growth for LMB. As per gross margin, there will be gradual margin improvement thanks to mixing improvements and integration of acquired businesses and capturing synergies. Gross margin in 2022 may slightly decrease as I expect gross margin to retract to the guided band.

Author estimates

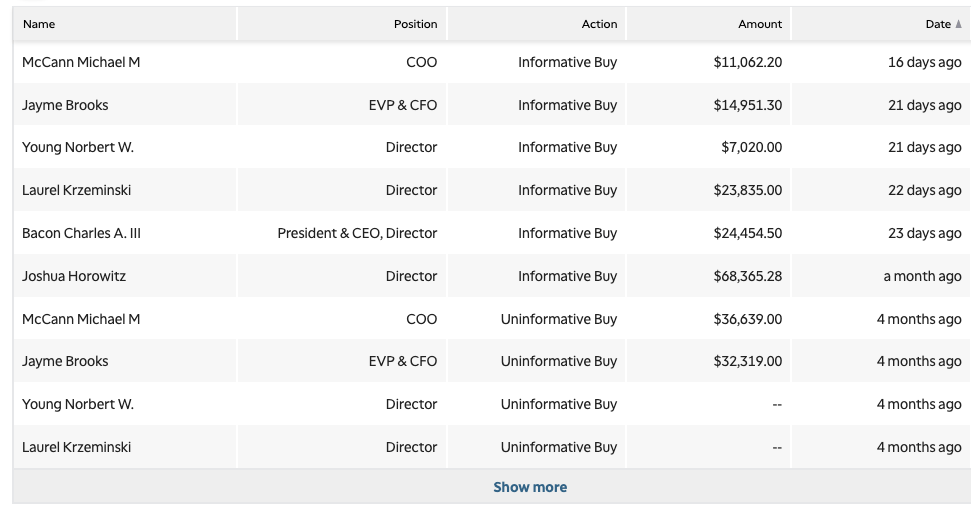

Insiders continue buying shares

In the first quarter of 2022, management and directors bought more shares, those are informative buys.

TipRanks

Valuation

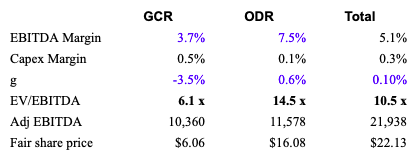

Updating the model for 2021 results, the target price improved from $21 to $22 per share. At the current share price, you are paying for the GDR business and only 60 cents for a business worth $16.

Author estimates

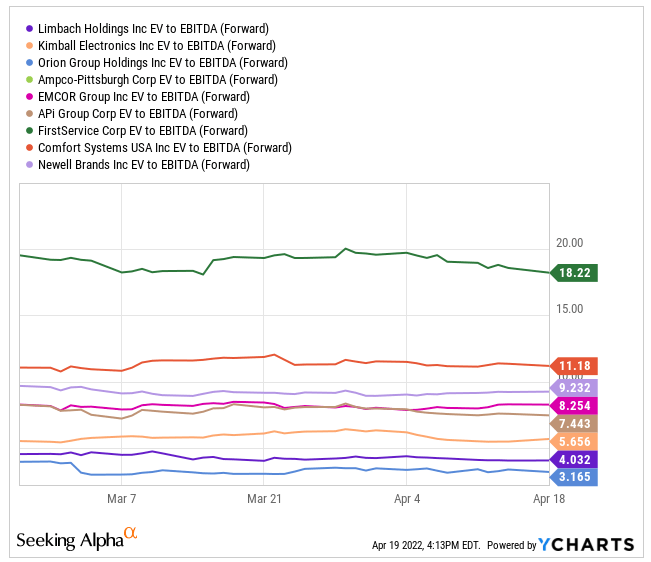

The target price implies an EV/EBITDA multiple of 10.5x which is significantly higher than the current 4x multiple. However, as ODR contributes more to LMB’s EBITDA, I expect the multiple to expand closer to more ODR peers are shown in the graph below.

Ycharts

Conclusion

The investment thesis has not changed since our previous article. On the other hand, LMB shares are more attractive as the share price has dropped 15% while the financial results met or surpassed our expectations.

Be the first to comment