cokada/E+ via Getty Images

A bank is a place that will lend you money if you can prove that you don’t need it. – Bob Hope

The iShares US Regional Banks ETF (NYSEARCA:IAT), with over $1bn in AUM, offers focused access to 38 small- and mid-sized traditional banks based in the US. In this article, I will touch upon some of the important narratives that could weigh on the prospects of this sector.

Outlook For Regional Banks

Towards the start of this year, one of the popular trade ideas that were being bandied about was to increase exposure towards regional banks. The argument here was fairly straightforward; structurally, quite unlike other diversified large banking peers that also have strong exposure to the capital markets, most of these regional bank prospects are very balance sheet sensitive. Thus, in an environment where the Fed was looking to raise rates to curtail inflation, these banks were likely to witness a more pronounced expansion in their NIIs (Net interest income).

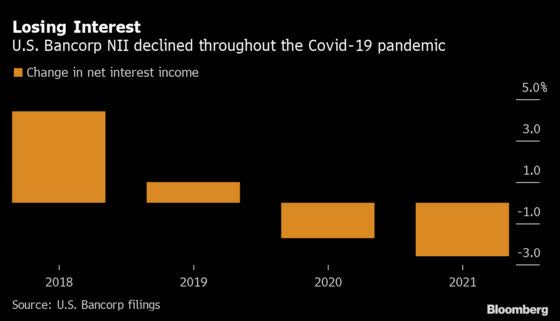

For instance, something like a US Bancorp, which incidentally enjoys the second-largest weight in IAT had stated that they were on course to deliver mid-single-digit growth in the FY22 NII, after a lackluster few years (last year alone, its NII had declined by 2.6%).

Bloomberg

Going gung-ho on regional banks could have been a very fruitful trade idea in a scenario where the Fed was poised to raise rates gradually, and perhaps facilitate a soft landing of the economy. But recent developments have totally upended this narrative. With inflation hovering at levels that have not been witnessed for 40 years, and with no end in sight to this malaise, I think it’s fair to say that we can banish the term “soft landing”. In fact now there’s talk of rates being lifted by as much as 75bps and prospective rate hikes of this ilk could eventually end up damaging the economy.

If you’ve followed developments on the timeline of The Lead-Lag Report, you’d note that I’ve been very vocal in my criticism of the Fed, and this is primarily since much of this is very much self-inflicted. In fact, I recently had a very productive discussion with Lyn Alden on the Lead-Lag Live Twitter Spaces where we debated the leadership deficit at the Fed and how this had adversely impacted the economy.

So as far as regional banks go, the potential to earn higher net interest income is still on course, but you have to ask yourself in a pricier environment such as this, is there going to be ample loan growth momentum on which these higher rates can be levied?

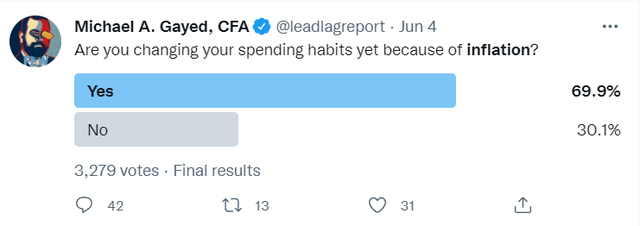

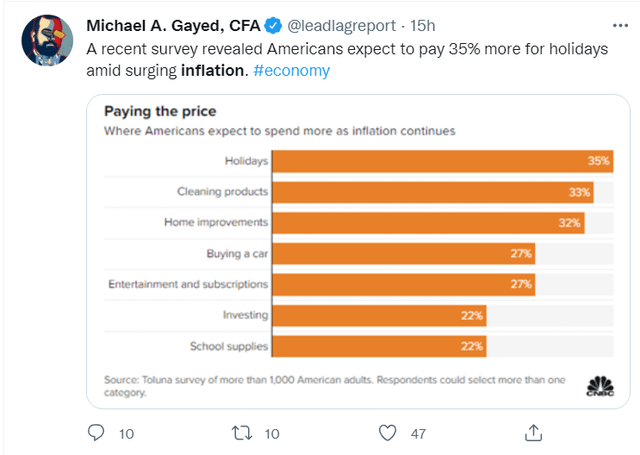

I recently ran a poll asking respondents if they were changing their spending habits; an overwhelming majority voted ‘Yes’. Admittedly, this shouldn’t really come as any great surprise when, spending categories across the board, ranging from leisure to home improvements, have all witnessed heightened pricing pressure.

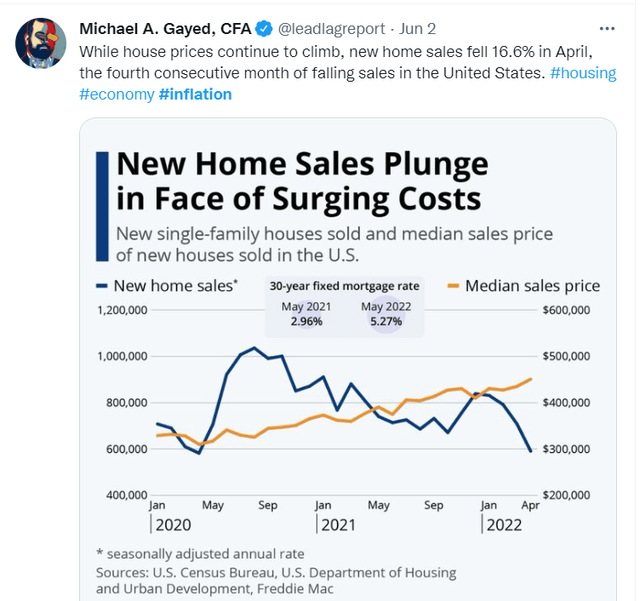

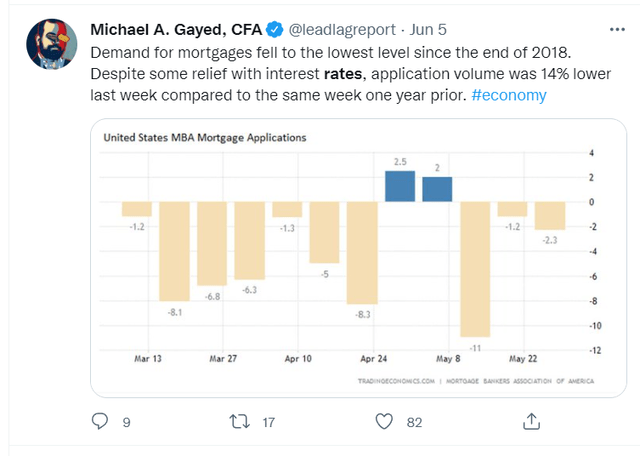

The other thing to note is that the loan books of these regional banks are heavily exposed to the housing market, but as noted in our service, a number of metrics are pointing to a slowdown in this market; new home sales have been sliding for four straight months, even as demand for mortgages have dropped to their lowest level in four years.

During the housing boom of 2020 and 2021, these regional banks saw their non-interest income component benefit from fees linked to higher quantum of originations, as well gain-on-sale margins. This component of the non-interest income is unlikely to serve as a tailwind in 2022.

Another thing to note is that the credit quality metrics have so far surprisingly held up pretty well, so much so that in FY21, net charge-offs for mid-tier regional banks only accounted for 0.11% of average loans, a sharp fall from the long-term charge-off rate of 0.21%. With rates now rising, I don’t imagine these numbers will sustain, and you will likely see higher charge-offs and more significant provisioning. This could, of course, also weigh on the ability of these banks to boost the level of distributions to their shareholders.

Separately, also do consider that in an unremarkable loan growth environment, some of these regional banks could perhaps extract better value by engaging in M&A and consolidating the industry as a whole, but recent reports suggest that the US regulators are likely to make this harder to close; this is in stark contrast to what we saw last year, where over $60bn of bank-related M&A was completed, the highest since 2007.

Conclusion

As mentioned in this week’s edition of The Lead-Lag Report, the market narrative will continue to be largely dictated by developments on the inflation front and the longer-term trend suggests that equities could face another lower leg. Under conditions such as this, it would be foolhardy to wedge yourself to a high-beta play such as IAT (3-year beta of 1.26x). Besides, as far as valuations go, it does not appear that regional banks offer much of an edge relative to the broader financial sector. Currently, IAT trades at a forward P/E of 11.5x, not far away from the multiple of the broader Vanguard Financials ETF (12x).

Be the first to comment