Gabe Ginsberg/Getty Images Entertainment

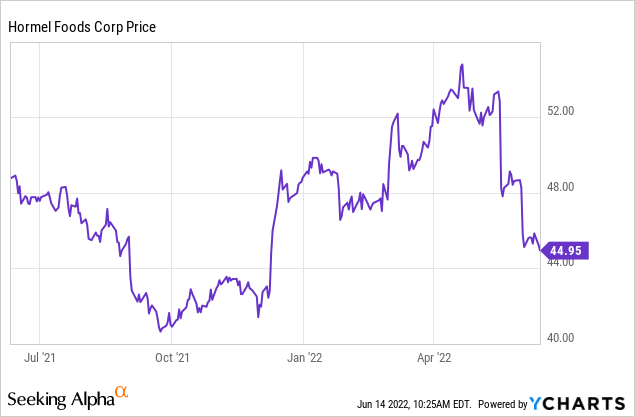

Hormel Foods (NYSE:HRL) reported earnings on June 2nd. Despite a strong report with earnings and revenues beating estimates, shares fell 5% on the results. Since then, shares have roughly traded flat, which isn’t too bad in light of the rest of the stock market. Still, for a defensive recession-resistant holding such as Hormel, recent stock price action hasn’t been that great.

In December of last year, I predicted that Hormel shares would hit new all-time highs in 2022. This was achieved in April; however, now shares have given back all their recent gains. As such, it’s worth asking if Hormel stock is undervalued once again. And the answer is yes.

Hormel’s Q2 Earnings

Hormel’s Q2 earnings came in at 48 cents per share, which was a penny ahead of estimates. It also topped Q2 of both 2020 and 2021, where it earned 42 cents per share and 42 cents per share, respectively. The company has reached a new record in terms of its overall size, and earnings are rising significantly in accordance with that fact.

To that point, in Q2, Hormel grew revenues at a sizzling 18.8% rate, and also topped Wall Street’s expectations on that front. The company is benefitting from several positive factors including sizable price hikes, its acquisition of Planters, and disciplined efforts in cost control.

To highlight that, Hormel’s profit margins have almost fully recovered to pre-inflationary shock levels. They’re just 30 bps lower now than they were a year ago. That’s incredibly strong performance in a time when many consumer staples companies such as Clorox (CLX) have seen their profit margins completely implode. Hormel, by contrast, has almost fully passed along higher costs to consumers and is earning record revenues and profits as a result.

Regardless, traders are still nervous, judging from the soft post-earnings report stock price action. The supply chain situation and commodity meat price shocks remain potentially troubling for Hormel’s short-term outlook. It’s understandable why management didn’t raise guidance for the back half of 2022 yet, as there are a lot of moving pieces which can impact results for the rest of the year.

As things stand, Hormel delivered both record profits and earnings this quarter, with revenues in particular soaring 19% year-over-year. That’s a lot more than just inflation driving the big move on the top line.

HRL Stock Key Metrics

Hormel guided to a midpoint $1.92 of earnings for this year, putting HRL stock at 23x this year’s earnings. Going forward, based on my analysis, Hormel should earn roughly $2.15 in 2023 and $2.35 in 2024, putting it at 21x and 19x those forward earnings.

While Hormel has already gotten its profit margins back to pre-pandemic levels, I expect further gains to profit margins going forward. This is because Hormel had been previously structurally underearning due to problems with pricing for certain meats such as turkey, along with a prolonged avocado production problem in Mexico which has hampered profitability of Hormel’s Mexican foods division. As a result, Hormel’s “new normal” profit margins should be higher than they were in, say, 2019.

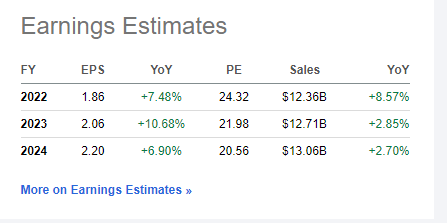

While I believe Hormel will be able to grow its profit margins, Wall Street analysts disagree. They are predicting that Hormel will miss its own 2022 guidance announced earlier this month and that it will also grow earnings more slowly than the company’s 10% threshold over the next two years:

HRL earnings estimates (Seeking Alpha)

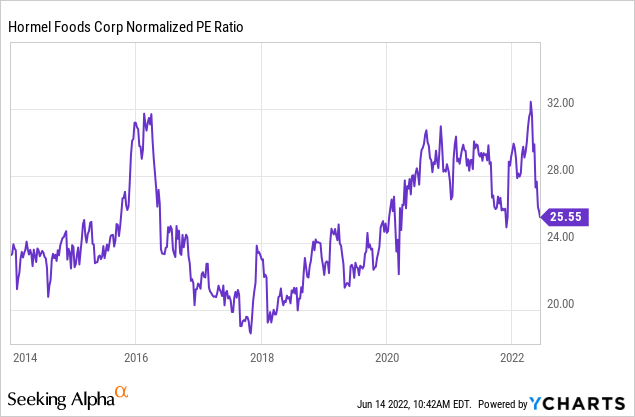

Even using this more bearish set of analyst estimates, Hormel stock is still attractively valued at today’s prices. Historically, Hormel trades around a 25x P/E on average, so we’re back at the midpoint of the company’s typical valuation range:

At this point, however, Hormel should arguably be getting a slight premium to normal since it is enjoying unusually fast growth at the moment and defensive stocks such as Hormel tend to attract a safe haven bid during uncertain times. Also, I’d note, in executing the Planters acquisition, Hormel flexed its previously unused balance sheet capacity, and by adding some leverage onto the firm’s conservative business, it should earn higher returns on equity “ROE” and thus garner a higher valuation multiple going forward.

What Is Hormel Food Stock’s Target Price?

Over the next 12 months, I see Hormel being worth $54 per share, which is a 25x multiple of the $2.15 per share of earnings I project for the company in 2023.

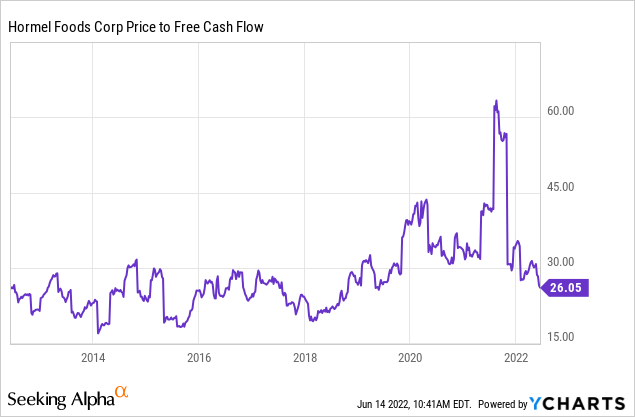

A couple of other metrics point to Hormel being undervalued at the present time as well. For one, the company is back to 26x free cash flow, which is its lowest point since 2018:

At a 25x free cash flow multiple, which is just one turn down from here, Hormel would be yielding 4% on a free cash flow basis. That’s a generous offer from one of the nation’s best-run consumer staples companies.

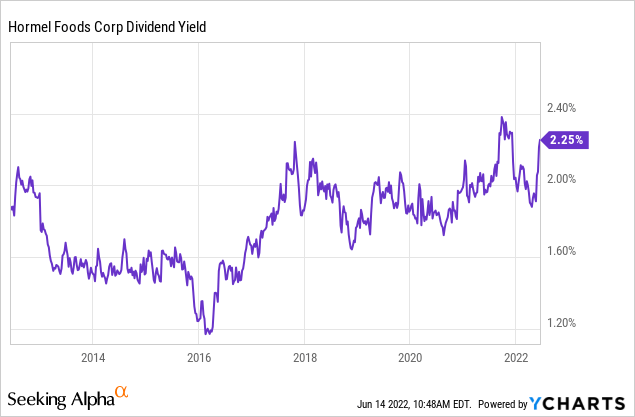

And, as you know, free cash flow has a way of turning itself into dividends. Hormel’s dividend yield has been becoming increasingly attractive lately as the stock price has slipped:

Hormel’s dividend yield is up to 2.25% now, and is only 15 basis points below its peak yield that it has offered at any point over the past 10 years. Meanwhile, the company is a Dividend King which has increased its dividend for 56 consecutive years in a row. These aren’t just token dividend hikes, either – Hormel has grown its dividend at a 9.9% compounded rate over the past five years.

A similar-sized hike this year would lift Hormel’s annual payout to $1.14. At a 2.0% dividend yield, which is in-line with Hormel’s past five years of valuation, this would suggest a price target of $57 per share versus the current $45 market price. Either on earnings or based on its dividend, Hormel has a comfortable margin of safety.

Is HRL Stock A Buy, Sell, Or Hold?

Hormel stock is attractively priced for a consumer staples company that grows earnings at 10%/year over the long term, has a conservative balance sheet, and superior management team.

Though the stock is currently in a bit of a downtrend, the company has posted record revenues six quarters in a row and is now generating record earnings as well. The market’s sentiment can do whatever it wants in the short term; however, Hormel, the business, is larger and more profitable than ever. And management is executing on its plan to keep growing revenues at least 5% and earnings 10%/year for the foreseeable future.

As Hormel’s earnings, cash flows, and dividend will continue to inexorably grow at a favorable rate over the next decade, it’s hard to experience much of a drawdown on the stock if bought at a reasonable price — such as the current one.

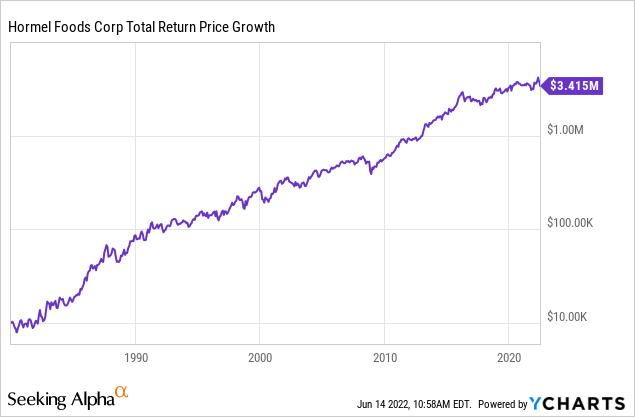

Hormel is my largest position not because it has the most upside (it doesn’t) but that the downside risk is so minimal. I’m highly confident that the stock will produce 11-12% annualized long-term returns while the odds of permanent capital impairment are exceptionally low:

To prove that point, $10,000 invested in Hormel stock in 1980 would be worth $3.4 million today. That’s impressive by itself.

What’s particularly compelling, however, is that Hormel stock barely ever draws down. Indeed, dating back to 1980, shares have never dropped more than 40% from prior highs. That’s a stark contrast to companies like Amazon (AMZN) which have posted tremendous long-term gains but have also had periods of mind-boggling volatility along the way.

Hormel, by contrast, is a recession-resistant well-run business with a conservative balance sheet and products that are immune to technological change. Hormel is rarely going to deliver strong short-term gains, but over time, it inevitably keeps climbing up and to the right on the chart. Pullbacks are usually good buying opportunities, and that’s especially true now as Hormel stock is slipping even as the company posts record earnings and revenues. This divergence won’t last for long.

Be the first to comment