Nastasic/E+ via Getty Images

Investment Thesis

Despite being concerned about the impending recession, InMode Ltd. (NASDAQ:INMD) proved us wrong in raising its full-year guidance by 6.07% against consensus estimates. So far, the company continues to report exemplary profitability, which is a testament to the management’s ability in adhering to its 80% gross margin.

The upbeat October CPI has also contributed to INMD’s recovery by 32.66% since recent rock bottom levels in September 2022, as the stock rallied by 15.42% in the days after. Assuming that 75.8% of market analysts are right in that the Feds will pivot early with a 50 basis points hike in the December meeting, we expect the tsunami of confidence to lift all boats up moderately, as witnessed with the Bank of Canada’s recent move. Naturally, it is also assuming that these levels of optimism are able to sustain themselves through 2023 with the raised terminal rates to over 6%, against the previous projection of 4.6%.

INMD Continues To Inspire Confidence

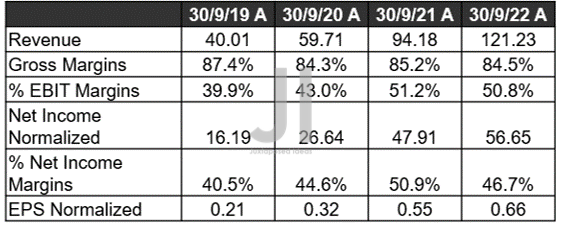

INMD Revenue, Net Income (in million $) %, Gross%, EBIT %, and EPS

S&P Capital IQ

In its recent FQ3’22 earnings call, INMD reported stellar revenues of $121.23M and EPS of $0.66, smashing estimates by 14.47% and 11.86%, respectively. Its profitability remains inspiring, with gross margins of 84.5%, EBIT margins of 50.8%, and net income margins of 46.7%.

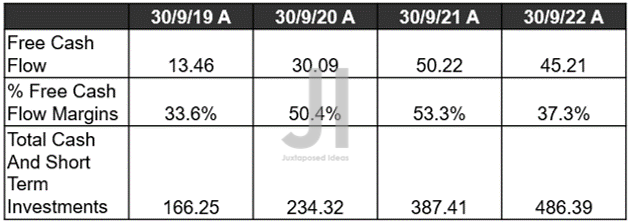

INMD Cash/ Investments and FCF (in million $) %

S&P Capital IQ

Therefore, it is not surprising that INMD has delivered another quarter of improved Free Cash Flow (FCF) generation at $45.21M and FCF margins of 37.3% in FQ3’22. Analysts are also expecting the company to report $69M and 53.3% in the next quarter, given the raised guidance.

The most important point in this whole analysis is the fact that INMD does not rely on any debts whatsoever, despite the painful effects of the pandemic thus far. Though it is also attributed to the asset-light strategy, we have to commend the management’s efficient cost management thus far, despite the elevated stock-based compensation expenses of $20.42M in the last twelve months, rising by 69.17% sequentially. We suppose that the team utterly deserved every reward indeed, since most of its earnings are strategically put into its balance sheet.

By FQ3’22, INMD boasted an eye-popping total cash/ investment value of $486.39M, expanding by 9.63% QoQ, 25.54% YoY, and 292.56% by FQ3’19. The company has also grown its total asset values by 208.77% to $563.98M and market cap by 228.03% to $3B within the most difficult three years in recent history.

Even Pfizer (PFE) has only modestly grown its assets by 214.63% and market cap by 37.09% within the same time period, despite registering a remarkable $65B in COVID-19 vaccine sales between 2021 and 2022 (though we also admit that PFE will face multiple patent cliffs ahead, pointing to more uncertainties ahead). If INMD’s achievement cannot convince anyone, we are not certain what will.

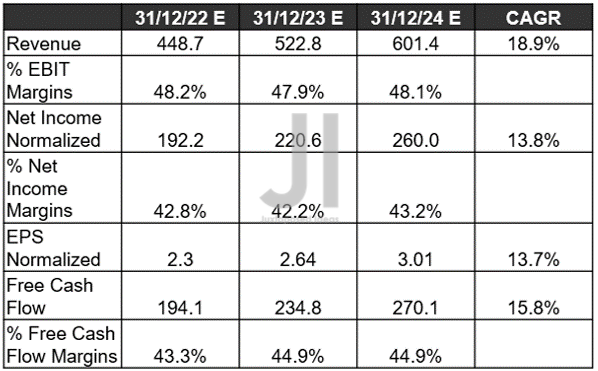

INMD Projected Revenue, Net Income (in million $) %, EBIT %, and EPS, and FCF %

S&P Capital IQ

Over the next three years, INMD is still expected to report impressive revenue and EPS growth at a CAGR of 18.9% and 13.7%, respectively, despite the notable deceleration from hyper-pandemic levels of 51.1% and 60%. It is clear by now, that no company is able to sustain those levels of unsustainable growth, post-reopening cadence.

In the meantime, investors need not worry about the worsening macroeconomics, since Mr. Market expects INMD to boast an exemplary YoY revenue growth of 16.5%, EPS of 14.6%, and FCF of 20.9% in FY2023, despite the tougher YoY comparison. Thereby, aggressively enriching its balance sheet and expanding its book value per share by 35.7% YoY to $9.72 then. Otherwise, by 94.01% against FY2021 levels of $5.01 and 362.68% against FY2019 levels of $2.68. Furthermore, investors that have bought in much earlier are sitting on a gold mine, with a tremendous 5Y total return of 432.8%. It remains a wonder on how we could have missed this excellent stock.

Meanwhile, we encourage you to read our previous article on INMD, which would help you better understand its position and market opportunities.

- InMode: Recession May Kill Consumer Demand

- InMode: Alpha Long-Term Growth – Playing The Insurance Game Next

So, Is INMD Stock A Buy, Sell, or Hold?

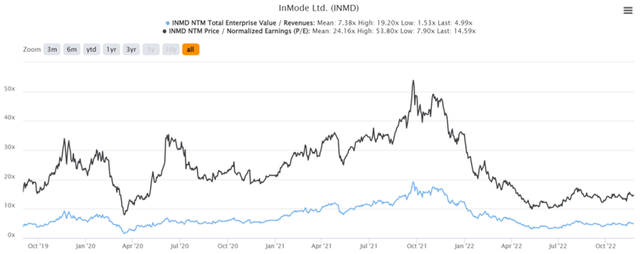

INMD 3Y EV/Revenue and P/E Valuations

INMD is currently trading at an EV/NTM Revenue of 4.99x and NTM P/E of 14.59x, lower than its 3Y mean of 7.38x and 24.16x. Otherwise, nearing its YTD mean of 5.38x and 15.84x, respectively.

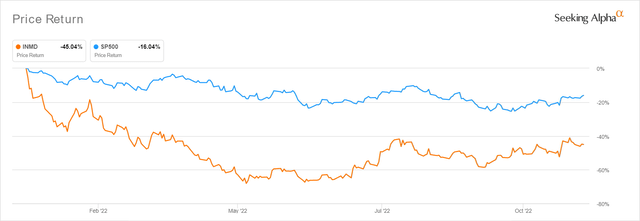

INMD YTD Stock Price

The INMD stock is also trading at $36.15, unfortunately, at a premium of 75.48% from its 52 weeks low of $20.60. It is evident that INMD is led by a stellar management team, which continues to prove the bears tragically wrong. It is no wonder that the stock has also been upgraded multiple times since our first observation, given the consensus estimates’ raised price target of $50.50, from the previous $44 and $48.

Unfortunately, it also means that our short-sightedness has cost us multiple excellent entry points in June and September this year, pointing to INMD’s notable baked-in premium now. Depending on individual investors’ risk tolerance and investing trajectory, the stock has revealed itself as an interesting buy for long-term investing and portfolio growth. Therefore, speculative investors may still nibble at current levels, due to the massive 39.70% upside from current levels. Otherwise, like us, bottom-fishing investors may want to wait for a moderate retracement first before adding, since the Fed’s pivot in December is not written in stone yet. Patience for now.

Be the first to comment