ipopba

It has been a challenging year for stocks in general, with the rate-hike cycle leading to a repricing of the broader market. While the S&P 500 index has dropped as much as 17% in 2022, even after the recovery in recent days, shares of Interactive Brokers (NASDAQ:IBKR) have been much more resilient, losing only ~7%. IBKR, along with other brokerage firms, has indeed benefited from rising interest rates that boosted revenue coming from their segregated cash. That is reflected in their quarterly reports and outperformance this year.

In the meantime, IKBR continues to grow its account numbers. This trend is expected to remain strong in large part due to deals with new introducing brokers that should add new accounts as these partnerships ramp up. As valuation multiples are attractive relative to peers and historical standards, shares of IBKR provide a well-balanced risk/reward for investors looking to outperform the industry in the long run, while benefitting from the currently high rates environment.

Rate Hikes Driving Revenue Growth

There is no question the rate-hike cycle that’s under way has benefited IBKR, as interest income captured over first nine months of the year has nearly surged 50% compared to 2021. This has helped IBKR’s net revenue reach $2.1 billion year to date, which was nearly flat compared to 2021, offsetting weaker trading activity in the first half of the year.

On a quarterly basis, net revenue climbed 70% from a year ago, largely due to higher rates as well. Income from commissions remained steady with strong activity in futures and options, despite lower stock volumes given this weak equity market environment. As expected, this strong top-line growth in the quarter also boosted the interest paid to customer credit balances.

Even so, the overall quarterly result was largely positive. The adjusted pretax margin was at 68%, the highest on record. Net income came in at $483 million, 134% higher than last year, despite higher trading costs relative to lower liquidity rebates, higher futures volumes, and SEC fees.

Building a Larger Customer Base

To be sure, the brokerage industry is very competitive, with well-established names increasingly looking to provide better cost-benefit offers to investors of all categories. IBKR remains very well positioned as a low-cost provider, which is clearly a very compelling factor for the individual retail investor. And the wide range of products offered by the IBKR trading platform offers a meaningful added value to the average investor.

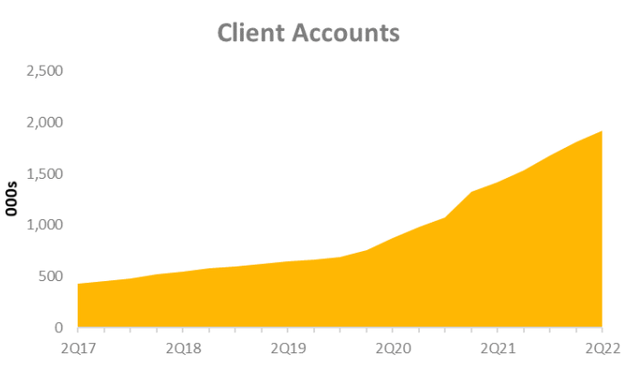

The rapid growth of its customer base over the past few years, as shown below, just confirms the success of the brokerage firm. Interactive Brokers surpassed 2 million accounts at the end of September, after growing 31% over last year. This was largely driven by individual accounts with 38% growth, but also by respectable double-digit growth from other client types – such as proprietary traders, introducing brokers, financial advisors, and hedge funds.

While IBKR has been able to add 90,000 new accounts over the last quarter, representing 5% quarterly growth, the market environment was not that constructive during that time. Still, IBKR seems able to continue along its growth path, as the firm is set to establish a relationship with two new large introducing brokers that are expected to promote the onboarding of new accounts starting in early 2023. While this will be likely a slow process, it should be an additional driver to keep up the pace of growth of its customer base over the coming quarters.

Higher Rates and Growing Balances Underscore a Healthy Outlook

The financial market has been in a turbulent period as inflation expectations are not properly anchored yet, leaving central banks with the tough task of going forward with interest rate hikes. In addition, we don’t have enough visibility in terms of how long it will be before rates finally go down again. For the time being, chances are that rates remain high for an extended period of time. While this should contribute to weak investor sentiment in the short term, brokers like IBKR will continue to benefit as they can generate an outsized revenue from higher interest earned on their segregated cash.

Longer term, central banks will eventually cut rates. While this could cause a drop in IBKR’s interest-related revenue, financial markets are expected to become much more buoyant. That, in turn, will boost trading volume, as investors deploy cash into stocks again and generate higher commissions for IBKR.

IBKR Trading at Discount Vs. Its Peers

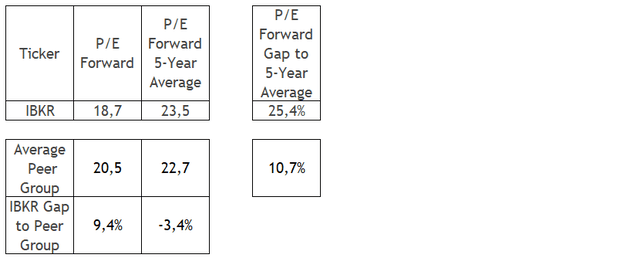

Despite the fact that IBKR has outperformed the broader market so far this year, with a 7% loss vs. a drop of roughly 17% seen in the S&P 500, shares are offering some relative value at the moment. With a forward P/E of 18.7, IBKR is trading at a 9.4% discount compared to the peer group. That group is defined here as the following stocks: CME Group (CME), MarketAxess (MKTX), Intercontinental Exchange (ICE), LPL Financial (LPLA), Stifel Financial (SF), Cboe Global Markets (CBOE), Nasdaq (NDAQ), and The Charles Schwab Corp. (SCHW). The forward P/E of IBKR’s peer group is 20.5 on average.

That compares with a 3.5% premium for IBKR relative to the peer group from a historical perspective, using as reference the forward P/E five-year average. This alone gives IBKR an upside of nearly 12.9% if the company multiples eventually catch up with the average premium. Furthermore, IBKR is trading at 25.4% discount on a forward P/E basis, compared to its five-year average of 23.5. This suggests that IBKR has juicy double-digit upside that can materialize as the stock price moves higher, once the macroeconomic environment normalizes in the coming years.

Data from Seeking Alpha, consolidated by the author

Macroeconomic Uncertainties Still Justify a Conservative Strategy

The broader market has been hit by ongoing tightening policies from central banks worldwide to tame inflation. As there is no obvious consensus regarding the extension of this process, this lack of visibility should keep the stock market weak and volatile for at least a few quarters ahead. Meanwhile, IBKR continues to deliver growth on the back of the account growth and the rate hike cycle tailwinds. On top of that, its valuation looks attractive over the long run relative to its peers and on a historical basis as well.

For investors who might be reluctant to increase their exposure to the stock market at the moment, instead of adding shares of IBKR outright, we can outline two scenarios using options that offer appealing income over the coming months.

Start a new position with covered call options

- Buy 100 shares of IBKR (trading at $76.23 at the time this article was written)

- Sell one call option for $1.25 with a strike price of $85, expiring on Jan. 20, 2023

The premium would be 1.6% over a nearly two-month period if holding until expiration. The upside would be 11.5% if the strike price is reached.

Sell a covered-cash put

- Sell one put option for $1.00 with a strike price of $65, expiring on Jan. 20, 2023

- The premium would be 1.3% over a nearly two-month period if holding until expiration

The first scenario offers a premium of 1.6% for holding shares for two months. If the strike price is hit, the upside is 11.5%. In this case, the stock will be sold at a forward P/E of 20.9, roughly at the current peer group average of 20.5.

On the other hand, the second scenario provides a premium of 1.3% for holding shares for two months. If the strike price is hit, shares of IBKR would be purchased at the price of $65, which is 14.7% below the current price and at a forward P/E of 15.9.

Of course, an investor’s choice would depend on his or her bullishness regarding the stock and his or her risk appetite. Either way, the premium collected will provide reasonable income and decent upside in case of the first scenario or, for the second scenario, the opportunity to buy shares at an additional double-digit discount, if the strike price is hit.

Be the first to comment