brightstars

Published on the Value Lab 28/10/22

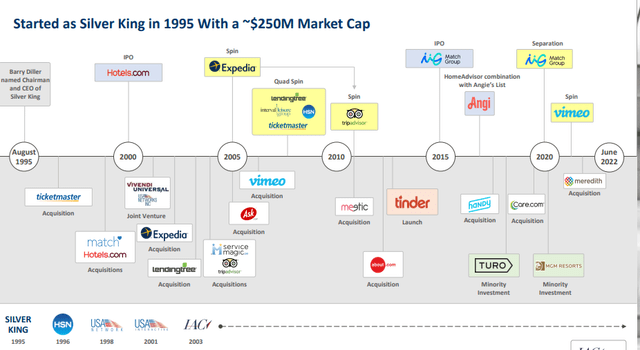

IAC (NASDAQ:IAC) is a company that has been buying and selling interests in major internet media company for years. The pedigree of its track record is that of a top-tier VC. The only difference is that a lot of the businesses it buys it also operates and are later stage than typical VC, such as with the properties that eventually became Expedia (EXPE) after it was spun off, as well as the Vimeo (VMEO) property which also now exists as its own entity as of last year. In both its history but also its current strategy, companies with valuable network economics have been the targets, which makes the current IAC valuation all the more easy to overcome with high order compounding growth.

The IAC Pedigree (June 2022 Investor Pres)

We believe that IAC is a very strong buy for the investor who doesn’t believe that capital markets have become fundamentally ruined forever (IAC does ultimately rely on markets to realise the value of their progressive portfolio) but it also offers downside protection in case the venture space never looks the same as it did these last decades again – which would be a pessimistic assumption. The reason is that much of IAC’s current valuation can be explained by non-operating positions it has in solid, profitable and mature stocks, as well as other companies which have stock market valuations that still shore up the current valuation despite heavy discounts in tech and media stocks. With a certain valuation guaranteed by major ownership in some publicly listed equities, including MGM Resorts (MGM), the upside comes from the non-public holdings, i.e., the venture portfolio of media internet stocks, some more profitable than others, but all growing quickly. Even with very conservative valuations for all of them, including valuing some at the cost of when they were acquired by IAC, an almost 2x upside could be estimated from the current IAC price which has come down very substantially upon the discounting of tech stocks.

While there could be some volatility ahead, we are beginning to worry about peak inflation coming while we’re still rather on the sidelines. As opposed to most tech companies that would require hope that tech valuations return to normal, which they may not if interest rates go higher and stay high for a long period of time, there is a high degree of downside protection with IAC in more definitely valued exposures in public markets that have already been discounted by the market rout and account for most of the current valuation. The mitigation of speculative elements in this stock, as well as the exceptionally low cash burn for a VC style exposure, makes IAC a high conviction buy.

The Breakdown of IAC

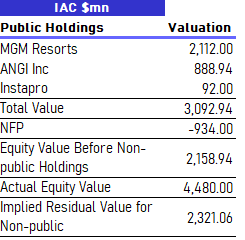

Let’s start with a discussion of IAC’s holdings which trade on public markets and are therefore given valued determined by public markets rather than our own, more subjective determinations.

Public Holdings

The holdings that currently trade publicly are one operating and the other non-operating.

Public Holdings (VTS)

Angi Inc.

The operating holding is Angi (ANGI) once called Angie’s List, of which IAC has an 85% economic interest, and an almost 100% voting interest.

At December 31, 2021, IAC held all Class B shares of Angi Inc., which represent 84.5% of the economic interest and 98.2% of the voting interest of the Company.

The current market cap of Angi is just above $1 billion, and we scale down the market value of the Angi ownership of IAC by the 85% factor giving us a $889 million valuation.

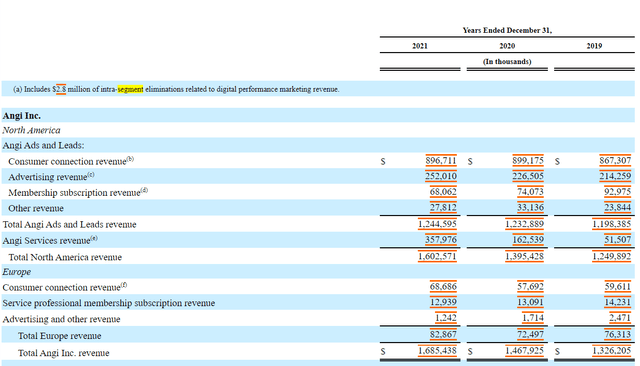

What does Angi do? It has two websites, Angie’s List and Homeadvisor that are marketplaces/directories for people to find home service professionals, people like remodelers, cleaners and landscapers. The company makes money in two ways. The first is that it sells its own priced services directly to the consumers and then uses one of the home service people from the platform to conduct the service, obviously charging higher than the cost of engaging the professional(s) which goes into COGS. The other way they make money is by charging home service professionals and businesses to be present on their directory, effectively being an advertising medium for them to generate business. They have both a directory and automated matching system and they charge for these leads or the ad space on their platform. Angi also provides service professionals tools for invoicing, quoting and a suite of other things for individuals to be able to run their business substantially on their platform. There’s also a membership tier that creates subscription revenue from both the consumer and the home service professionals side which gives access to savings and is beneficial to anyone buying or selling at a larger scale.

Ultimately this is a business with demand side economics that makes fee income upon matching customers with home service professionals, making money primarily charging the affiliated home service professionals primarily for the lead generation (50% of revenue), and hosting ads for businesses on the website (16% of revenue). The rest is mostly (20%) the selling of subcontracted home services that are billed directly to Angi, or the provision of Roofing services that Angi does comprehensively in house. Overall, the selling of subcontracted services has seen a doubling in revenue (roofing has been on the decline however), but it has introduced gross margin compression into the business due to higher labour and material costs and a larger portion of the sales being material intensive. Still, the majority is a pretty lovely platform economics business, and has grown phenomenally with all the home improvement people have been up to during the pandemic and still now despite macro pressure. Macro will put more pressure on this company’s growth prospects over the next year as the recession takes hold, but the markets have already shown their ire with substantial YTD selling with forecasts still showing growth, so we are happy with the current market cap as a conservative baseline where it trades at 0.67x sales, which is probably low considering companies like Udemy (UDMY) with similar platform economics trade at 2.4x sales, more than 4x the multiple. Angi could probably be more expensive than it is to be fairly valued.

ANGI Stock Price (Seeking Alpha)

We should also mention that Angi is operating cash flow positive even as they have grown the services revenue in their mix which increases working capital burden and compresses some of the gross margin. Therefore, there is no reflexivity risk. From a historical price analysis, the fact that the declines in Angi mirror that of a pre-revenue deSPAC, the lack of reflexivity from stock prices mattering for financial conditions doesn’t seem to be taken into consideration. We also note that there is a deceleration in the ad and lead-based earnings for Angi, growing about 10% this quarter YoY, with last year seeing about 17% YoY growth. This deceleration is consistent with what we’re seeing in the latest ad-based tech revenues too from the current earnings season. This deceleration is certainly part of the large discount being taken on the company, although we note that Angi is managing to create new lines of business to accelerate growth overall, outside of just the ads and leads-based businesses.

MGM Resorts

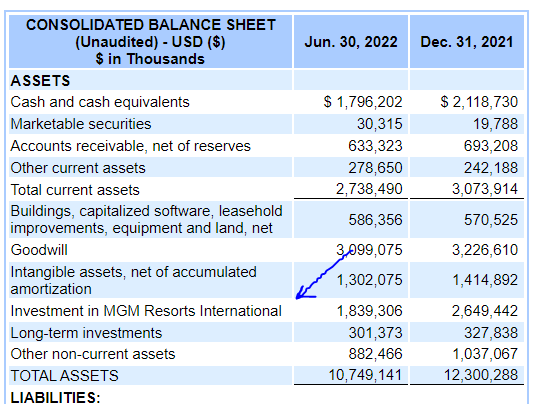

The other publicly traded holding is MGM Resorts. Unlike Angi this is of course not a controlling stake and they have enough ownership, 16.5%, in order for them to account for it as an equity-accounted holdings. It is accounted for separately than the other marketable securities.

IAC Balance Sheet (sec.gov) 10-Q)

We have a more updated market cap at around $2.1 billion for their stake. Could that hold? We cover MGM and in our last article we discuss that MGM is in the process of going asset lite, and selling its super valuable properties, like the Bellagio that it once owned, to real estate investors who they will then pay rent to as operators. There’s still a lot of hard assets in this business, and the calming down of the reaction to COVID-19 is a good thing for gaming. In particular we also pointed out that unlike some of the other operators on the Strip, MGM also had a pretty large regional gaming portfolio, where regulation and general economics tend to be better from a cash flow perspective and the perspective of recurring revenue. There is less dependence on tourism and corporate convention revenue.

The big catalyst for MGM is BetMGM which is the online betting platform it launched with Entain (OTCPK:GMVHF). This is a J.V at the moment that is still unprofitable but is dominating the open sea of the legalising online betting landscape in the US. When it scales it could add 20% to the EBITDA of MGM, so a really big mover. We think the chances this bears fruit as expected are quite high since no one else managed to move into this market at the same scale of BetMGM as the different states legalise and regulate online betting. We cover Betsson (OTC:BTSBF) on the Value Lab which is a formidable competitor and they haven’t been able to get commercialised yet.

China is a much smaller part of MGM compared to the other Strip players which a good thing considering how tough operating in Macau has become. With smaller China exposure, good amount of regional gaming exposure, and a good catalyst with BetMGM, things honestly look pretty good for MGM at a 7.4x forward PE and a relatively resilient portfolio. We’re pretty confident we can put the $2.1 billion they’re worth in our SoTP valuation later without that value tanking too much from here.

Non-Public Holdings – The VC-like Portfolio

We’ve discussed in detail the public holdings which should either be resilient or have already been substantially discounted and can have their market values comfortable used in the SoTP. Let’s discuss Dotdash Meredith which is 100% controlled and their main and profitable consolidated operation.

Dotdash Meredith

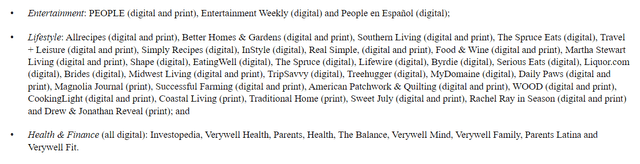

You’ve probably not heard of Dotdash Meredith, but you’ve certainly heard of its brands. It has dozens of publishing brands that are read by hundreds of millions of people. The vaunted list contains the following:

Dotdash Meredith Brands (2021 10-K)

Its brands are some both in print and digital, others are just digital. You’ll surely recognise the names Investopedia, The Balance, PEOPLE Magazine and Martha Stewart Living. Dotdash Meredith, which became so at the end of last year when it merged with Meredith, is a very valuable property, and it capably producing revenue growth and also has been profitable. IAC bought it into the fold for quite cheap, at around 7.5x trailing EV/EBITDA, despite the fact that its digital media is growing pretty fast at a 15% annual historical rate. Dotdash was a digital portfolio until the Meredith acquisition which introduced some print elements, and in doing so major impairments of intangibles occurred due to the fact that a lot of book value that went into Meredith, a 120 year old company, doesn’t have market value where print media has taken a secular dive. The vast majority of the revenue and adjusted EBITDA, which accounts for these impairments, is firmly in digital media. Digital to print is about 9:1 in ratio.

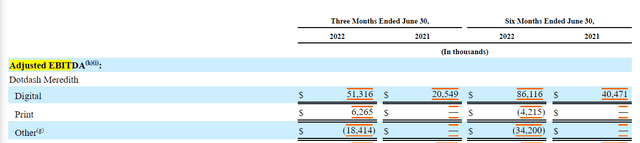

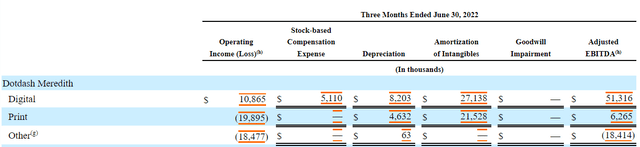

Print/Digital Split Dotdash Meredith (Q2 2022 10-Q) Adjusted EBITDA Reconciliation (Q2 2022 10-Q)

Other is just expenses that are overhead across the businesses and not clearly allocated to one segment or the other.

Looking at the revenue figures from print, we can see sequential growth comparing the 3 month and 6 month trailing data. Naturally, due to consolidation effects digital grew massively. If print media saw sequential improvement, the digital segment likely produced sequential improvement too, although we note that pressures may start to mount now since it’s becoming evident that even the highest value platforms for ads like Google (GOOG) are beginning to see some pressures in terms of ad spend. For now there is still growth. Dotdash digital should be up about 15-20% by the end of the year according to management forecasts, and print media up 3% YoY. The 15-20% is believed to be maintainable in 2023 as well as of the August earnings call. The tune might change slightly in the next earnings call, but the recession risks we already very talked about by August so it should have been at least partially considered. There is substantial synergy in the driving of digital traffic for brands that typically worked on a hybrid basis – around 30% on an annualised basis. Deceleration might come but much like Angi, there is enough latent space for growth that declines are unlikely.

Nonetheless, markets understand that advertising is going to be under pressure from macroeconomic forces. For Future Plc (OTCPK:FRNWF) the markets have seen fit to discount the stock YTD by 70% reflecting the macroeconomic risks. As of now the company has a positive net margin and no reflexivity risks in a downturn. It is also not very levered with a leverage ratio less than 2x net debt on EBITDA. It also has a wide portfolio of digital media publications including Guitar World, TechRadar and CinemaBlend. Markets are valuing it at 1.8x P/S, so let’s apply the same multiple to the largely digital Dotdash Meredith business.

Search

The search business is comprised for the Ask Media Group. You probably know Ask.com as that unwanted search engine you sometimes get on your browser when you forget to opt out downloading it at some point in your internet travels. The business model is the same as other search engines except of course the quality of the indexing isn’t as good as Google’s. Customers pay for getting their listings presented with other relevant materials to the engine users’ queries. A lot of people end up using Ask.com but we don’t consider it quality. A good comp would be Baidu (BIDU). There is no question Baidu is in a better market position, but concerns around China and a moment in time where geopolitical discounts are their harshest on top of negative macro forecasts makes the comparison likely reasonable or even conservative on balance. We take the 1.62x P/S.

Care.com

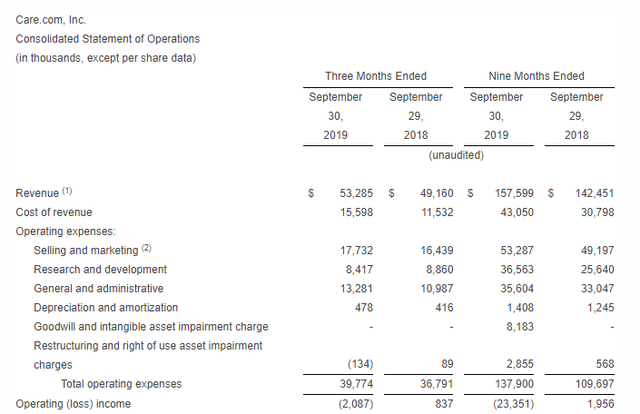

We can start by implying information from when it was taken private by IAC in late 2019 at a valuation of $500 million in EV, and therefore about $600 million in equity value given cash and cash equivalents at the time. Its operating losses were very narrow at the time, and it would fluctuate between negative and positive profits. In other words, the company likely did not burn excessive amounts of cash in the meantime. It would be trading at about 3x P/S given 2019 sales and the valuation. It being semi-profitable probably would categorise it as non-venture – this is important because late-stage venture would be getting destroyed right now as the IPO exit becomes a pretty weak option for realising value for VCs. This isn’t a company that would be down-rounding. In fact it is unlikely to have needed any capital market interaction, at least not with the equity markets.

Income Statement (Q3 2019 PR for Care.com)

What does Care.com actually do? it provides a marketplace for customers to find caregivers of various kinds. It also now has an enterprise segment which has been growing strongly that gives a portal to employers to find caregivers for employees as part of the employee benefits. The company works on a subscription and fee based model, fundamentally on a freemium model where subscription gives you better access to caregivers, and the value proposition is that it makes it easier to find trusted people to take care of your children, your elderly or you house. For the caregivers it is a platform to find business where working through word of mouth may be tough. This business has been growing throughout the pandemic, and continues to post 10% growth YoY with higher results not possible due to very strong early 2021 comps, and this growth is in both enterprise and in direct to consumer business. This is another one of IAC’s businesses that benefits from network effects and therefore first-mover advantages, and open seas in terms of TAM.

Mosaic Group and Other

The Mosaic Group is a company that owns quite a few famous language apps but also phone security apps. Their apps have 3.8 million subscribers and we estimate the average subscription to be a couple of dollars a month. The miscellaneous businesses are nothing to scoff at. Some of them I recognised immediately, although their commercial scope was previously unknown to me, including brands in digital media such as the The Daily Beast. Others are new VC style exposures that have a chance at developing platform economics. With assumptions about revenue from Mosaic and Care.com, where we use the 2019 figures for Care.com, on top of the given information on Dotdash, we can estimate some of the revenue figures. Still, because they are marginal, we value them at 0x since it doesn’t matter for the overall valuation.

Turo

Finally there’s Turo, which is virtually the AirBnB (ABNB) of cars. This is a unicorn that was valued at $1.2 billion in 2019, which is when the last funding round appears to have happened. The company had at some point started exploring the possibility of an IPO, but the state of public markets does not lend itself to following it through. It’s impossible to know exactly how the private markets would value this company. Klarna has reportedly gone into a down round that has slashed its valuation by more than 80%. SoftBank (OTCPK:SFTBY) screws up again apparently. This is consistent with how SPACs have fallen, which are a pretty good barometer of how private market ideas would be valued if a liquid markets were speculating on their shares. Klarna had a valuation of a little less than that in 2019, so we assume that Turo’s valuation wouldn’t have fallen since 2019 and use that valuation. IAC owns 25% of Turo, so that’s the number that makes it into the valuation. This is probably conservative because relative to other businesses in venture, Turo has likely become a lot more attractive on the basis that the situation with used cars remains tight, and therefore a platform to rent out cars would similarly do well with used car fleets having become extremely valuable. Also note Turo is another business with very clear and strong network effects.

Bottom Line

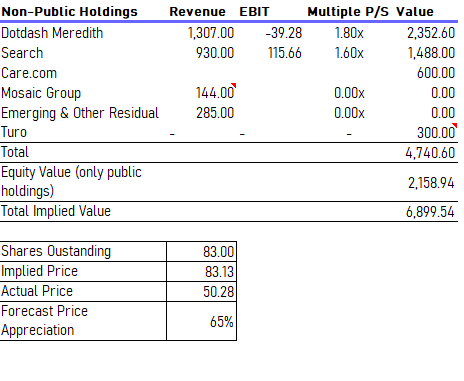

Here is the sum-of-the-parts (SoTP) valuation, considering all the valuations we’ve just gone through.

Valuation (The Value Lab)

Financial Safety from Reflexivity

Before we wrap up, we want to clarify by this is much like a long duration call option on these progressive venture stocks. We don’t even begin to calculate the option value embedded in this, and just focus straight on the SoTP, but IAC is cash generative without any issues, and there’s no dilution risk in the consolidated operating businesses. The only companies that have dilution risk are in the Mosaic Group and the other emerging investments along with Turo. These together are less than 5% of the total value of the SoTP.

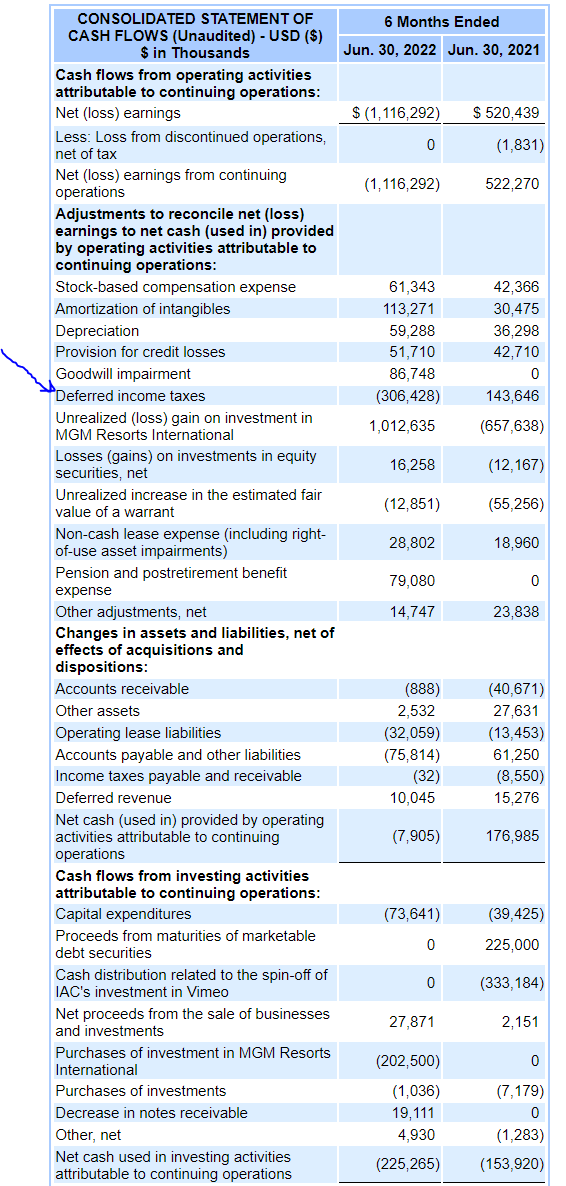

Cash Flow Statement (10-Q Q2 2022)

There is no reflexivity risks here. The falling stock price doesn’t go into a death spiral with the company’s financial condition. The main reason why cash flows are so poor right now of course has to do with declines in net earnings, driven about 10% by impairment costs and otherwise almost completely by the unrealised losses in MGM, with more cash flow pressure coming from a sudden need to pay deferred income taxes. Taking back these effects the company is operating cash flow neutral, and the FCF is negative $74 million for 6 months, annualising at $148 million. The company has $1.79 billion in cash assets, plus almost $2 billion in MGM stock, covering the debt load twice over too. Years of cash burn could happen before there’s an issue, and markets will eventually recover and scale up costs should graduate some of the emerging businesses into some degree of profitability over the next few years. The vast majority of the debt matures in 2028, so there’s really no pressure from there either.

Final Valuation and Conclusions

When you invest in a VC fund, the horizon is about 7 years. Not only does it take years for businesses to scale up and reach critical masses, especially true of platform economic businesses like those in IAC, but the right moment needs to be chosen for the companies’ values to be realised in capital markets. Otherwise, even if they decide to hold onto some of their properties, it could take some years for the network effects to take effect and create profitable businesses.

There is also the matter of peak inflation. Many key bottlenecks in the economy are loosening. Semiconductor inventories are rising, charter rates are beginning to fall for both commodities but also containership goods. Flatbeds should start coming onto the market faster, and in general logistics should be less of a problem. Fuel costs are still high but that’s just what happens when economic cooperation is permanently destroyed. When peak inflation comes the market will already jump to expecting a Fed pivot and markets will recovery harshly, because people have already been speculating on this moment, with the trades for now going the wrong way. Real wages are falling, so no wage-price spiral yet, so the unwinding of cost-push inflation may begin to be noticeable in the inflation figures to catalyse a market recovery.

Macro is a real risk to the business. Not only does it affect the pretty important ad based income that the company generates, which accounts for the majority of the Dotdash and Angi revenue, which is the lion’s share of the company’s business, but it affects the ability for the company to realise value with its holdings.

Nonetheless, it’s not bad enough where rampant cash burn will be a devastating problem to the going concern. Moreover, the upside is massive at 65% with very conservative assumptions across the SoTP. So overall, IAC is a clear buy into progressive, flywheel businesses.

Be the first to comment